Virgin Islands Sample FCRA Letter to Applicant

Description

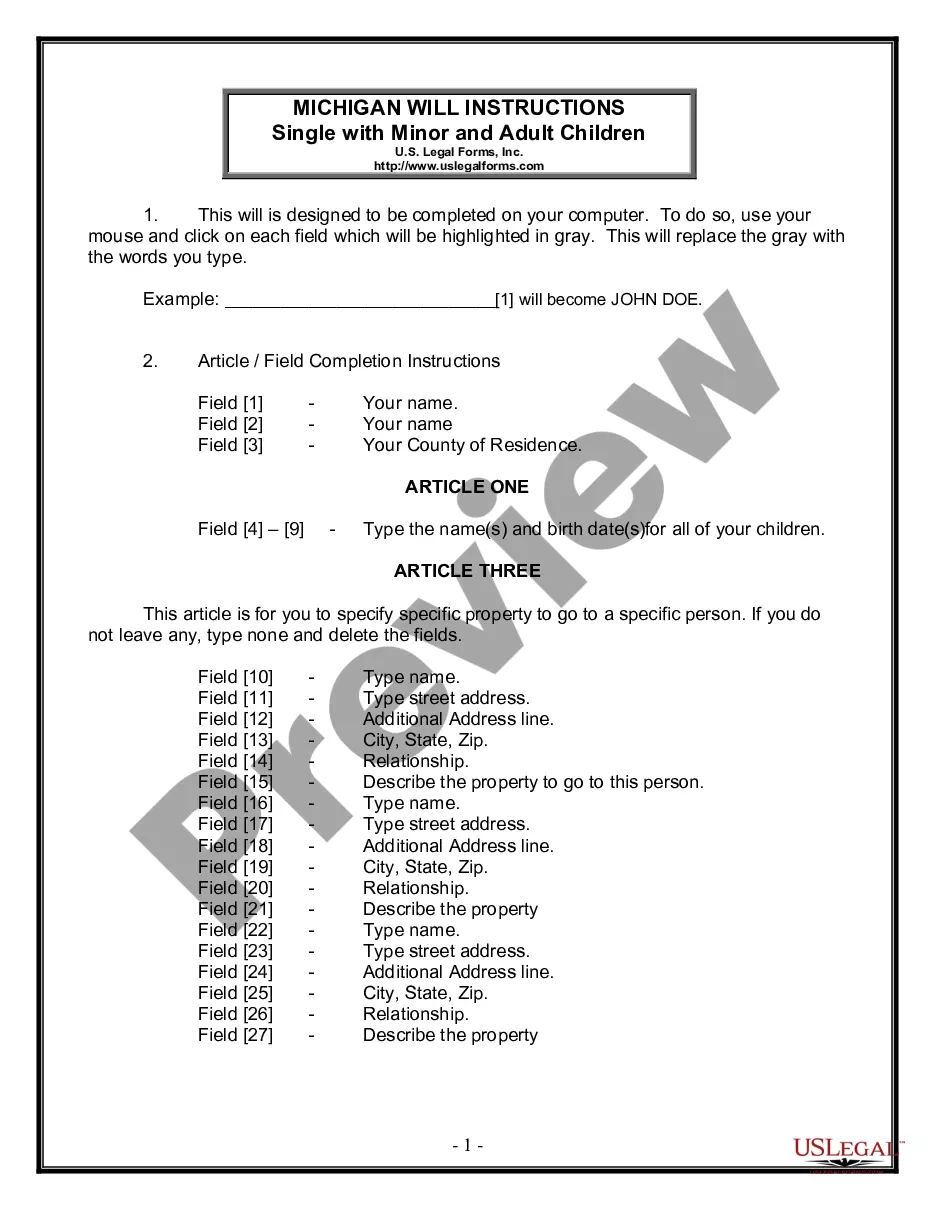

How to fill out Sample FCRA Letter To Applicant?

Are you presently in a circumstance where you require documentation for both business or personal reasons almost every day.

There are numerous legitimate document templates accessible online, but finding forms you can trust is not simple.

US Legal Forms offers a vast array of form templates, such as the Virgin Islands Sample FCRA Letter to Applicant, which is designed to comply with state and federal regulations.

Once you locate the appropriate form, click Purchase now.

Select the pricing plan you prefer, enter the required information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, just sign in.

- Once logged in, you can download the Virgin Islands Sample FCRA Letter to Applicant template.

- If you do not have an account and want to start using US Legal Forms, follow these instructions.

- Find the form you need and verify that it is for the correct city/region.

- Use the Preview button to review the form.

- Check the details to ensure you have selected the correct form.

- If the form is not what you are looking for, use the Search section to find the form that fits your needs and requirements.

Form popularity

FAQ

FCRA Authorization: Obtain Permission for a Background Check A compliant FCRA authorization form is an acknowledgement that a pre-employment background check will be conducted. It can be presented as a self-contained document or jointly with an FCRA disclosure form.

Credit Report Adverse Action Letter A post-decision form sent by entities to consumers after deciding to deny/reject them due to their credit score and/or other information found in a consumer credit report.

The FCRA requires employers to disclose that consumer reports may be used for employment decisions and to secure consent from employees or applicants to obtain these reports.

FCRA compliance typically means adhering to the requirements set forth by the Fair Credit Reporting Act. These requirements generally require employers to conduct background checks that are accurate, transparent, and fair to consumers.

Four Basic Steps to FCRA ComplianceStep 1: Disclosure & Written Consent. Before requesting a consumer or investigative report, an employer must:Step 2: Certification To The Consumer Reporting Agency.Step 3: Provide Applicant With Pre-Adverse Action Documents.Step 4: Notify Applicant Of Adverse Action.

Properly inform the applicant of adverse action: In your final adverse action letter, you must explain your choice and tell the applicant that they have the right to dispute your decision. Provide the necessary information for them to get another copy of their report.

Four Basic Steps to FCRA ComplianceStep 1: Disclosure & Written Consent. Before requesting a consumer or investigative report, an employer must:Step 2: Certification To The Consumer Reporting Agency.Step 3: Provide Applicant With Pre-Adverse Action Documents.Step 4: Notify Applicant Of Adverse Action.

A Summary of Your Rights Under the Fair Credit Reporting Act. The federal Fair Credit Reporting Act (FCRA) promotes the accuracy, fairness, and privacy of. information in the files of consumer reporting agencies.

Credit Report Adverse Action Letter A post-decision form sent by entities to consumers after deciding to deny/reject them due to their credit score and/or other information found in a consumer credit report.

An adverse action notice is to inform you that you have been denied credit, employment, insurance, or other benefits based on information in a credit report. The notice should indicate which credit reporting agency was used, and how to contact them.