Virgin Islands Fair Credit Act Disclosure Notice

Description

How to fill out Fair Credit Act Disclosure Notice?

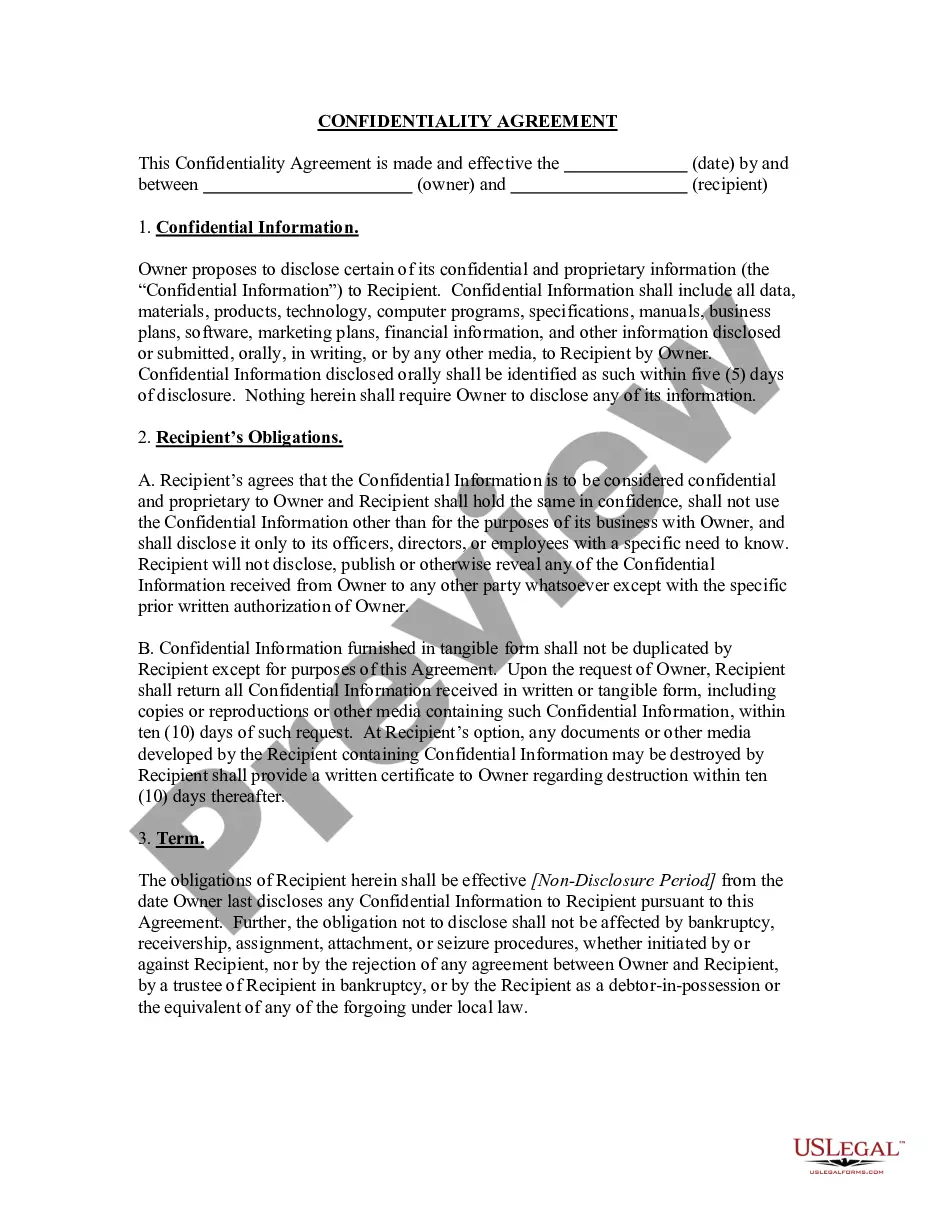

You have the ability to invest several hours online searching for the legal document template that meets the federal and state requirements you need.

US Legal Forms provides a vast array of legal forms that have been evaluated by experts.

You can download or print the Virgin Islands Fair Credit Act Disclosure Notice from their service.

If available, utilize the Preview option to review the document template as well.

- If you possess a US Legal Forms account, you can Log In and select the Download option.

- Afterwards, you can complete, modify, print, or sign the Virgin Islands Fair Credit Act Disclosure Notice.

- Every legal document template you acquire is yours permanently.

- To obtain another copy of any purchased form, go to the My documents tab and click on the corresponding option.

- If you're using the US Legal Forms website for the first time, follow the simple steps below.

- First, ensure that you've chosen the correct document template for your region/city of choice.

- Check the type outline to make sure you've selected the appropriate form.

Form popularity

FAQ

The Act (Title VI of the Consumer Credit Protection Act) protects information collected by consumer reporting agencies such as credit bureaus, medical information companies and tenant screening services. Information in a consumer report cannot be provided to anyone who does not have a purpose specified in the Act.

Under the FCRA, an employer may not run a background check on a prospective employee without first providing "a clear and conspicuous disclosure . . . in a document that consists solely of that disclosure, that a consumer report may be obtained for employment purposes." For efficiency, many employers include all

Common violations of the FCRA include:Creditors give reporting agencies inaccurate financial information about you. Reporting agencies mixing up one person's information with another's because of similar (or same) name or social security number. Agencies fail to follow guidelines for handling disputes.

Consumer reporting agencies must correct or delete inaccurate, incomplete, or unverifiable information. Inaccurate, incomplete, or unverifiable information must be removed or corrected, usually within 30 days. However, a consumer reporting agency may continue to report information it has verified as accurate.

On July 21, 2010, Congress passed the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act). Section 1100F of the Dodd-Frank Act amended the FCRA to require disclosure of credit scores and information relating to credit scores for both risk-based pricing and FCRA adverse action notices.

Notice must be made without unreasonable delay but not later than 60 days after determination of a security breach, unless a shorter time period applies under federal law.

A credit file disclosure provides you with all of the information in your credit file maintained by a consumer reporting company that could be provided by the consumer reporting company in a consumer report about you to a third party, such as a lender.

A creditor must disclose the credit score used by the person in making the credit decision on a risk-based pricing notice. Credit score has the same meaning used in §609(f)(2)(a) of the FCRA. Most credit scores that meet the FCRA definition are scores that creditors obtain from consumer reporting agencies.

The FCRA gives you the right to be told if information in your credit file is used against you to deny your application for credit, employment or insurance. The FCRA also gives you the right to request and access all the information a consumer reporting agency has about you (this is called "file disclosure").

Under the FCRA, an employer may not run a background check on a prospective employee without first providing "a clear and conspicuous disclosure . . . in a document that consists solely of that disclosure, that a consumer report may be obtained for employment purposes." For efficiency, many employers include all