Virgin Islands Job Description Worksheet

Description

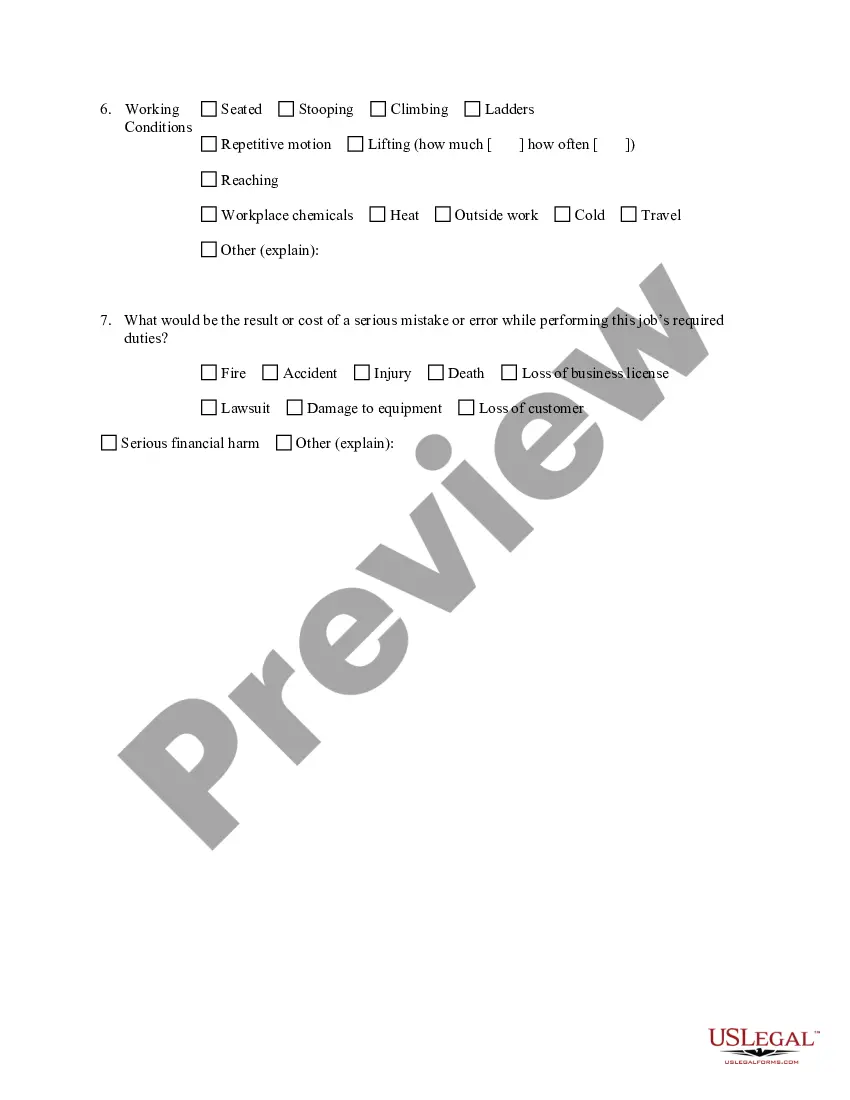

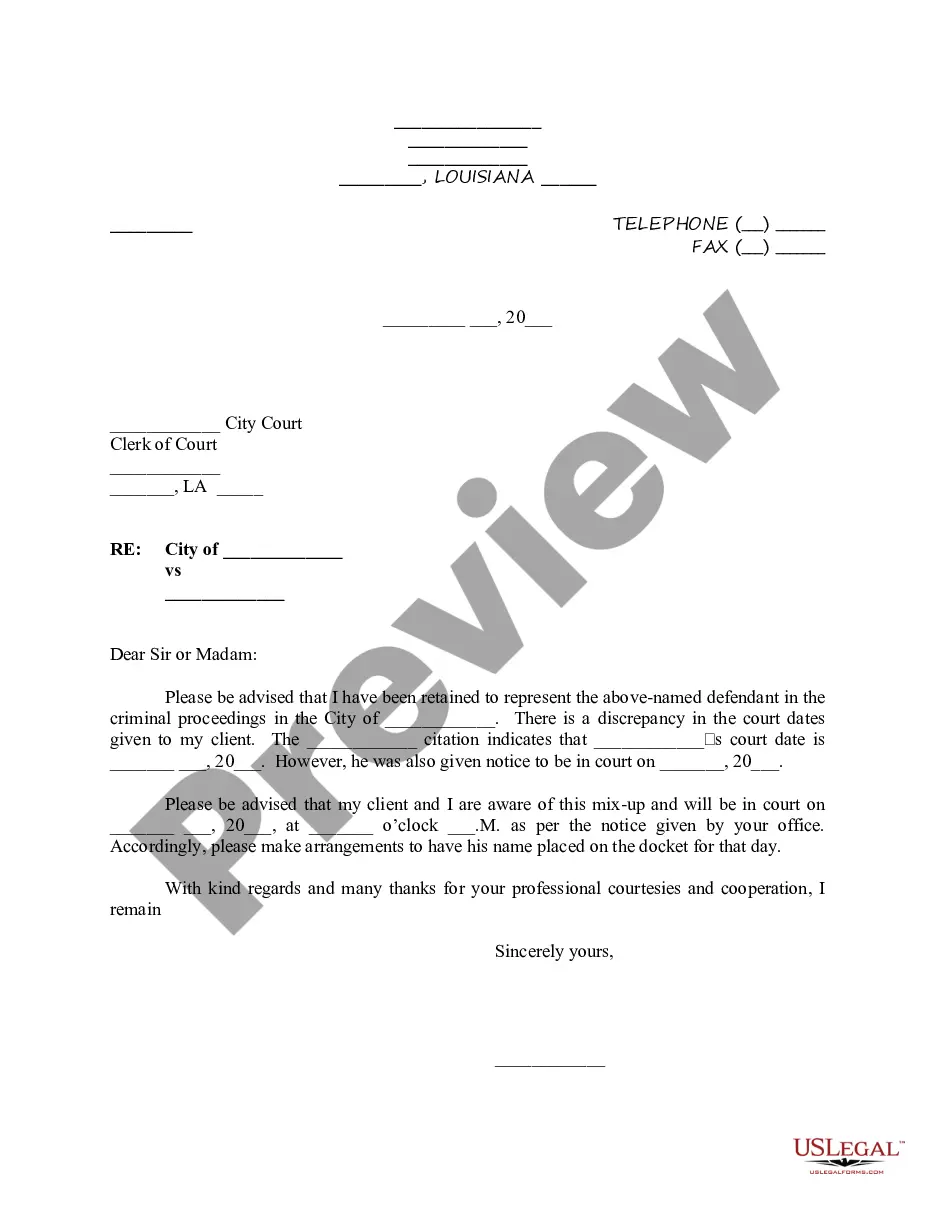

How to fill out Job Description Worksheet?

US Legal Forms - one of the largest repositories of authentic templates in the United States - offers a broad selection of legal document formats that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can obtain the latest templates like the Virgin Islands Job Description Worksheet in moments.

Review the form description to make sure you have chosen the correct one.

If the form does not meet your requirements, use the Search field at the top of the page to find one that does.

- If you have a subscription, Log In and download the Virgin Islands Job Description Worksheet from the US Legal Forms library.

- The Download button will appear on every form you view.

- You have access to all previously downloaded forms in the My documents section of your account.

- If you're using US Legal Forms for the first time, here are some straightforward steps to help you get started.

- Ensure you have selected the right form for your region/county.

- Click the Review button to examine the form's content.

Form popularity

FAQ

The mailing address is 9601 Estate Thomas, St. Thomas, VI 00802.

An applicant for permanent residence must reside in the Virgin Islands consecutively for a period of 20 years before application can be considered. An applicant can only be absent from the Territory for 90 days in any calendar year except when pursuing further education or as a result of illness.

A U.S. citizen or resident alien (other than a bona fide resident of the U.S. Virgin Islands (USVI)) with income from sources in the USVI or income effectively connected with the conduct of a trade or business in the USVI uses this form to figure the amount of U.S. tax allocable to the USVI.

To file a UI claim online, visit .

How Do I Apply?You should contact your state's unemployment insurance program as soon as possible after becoming unemployed.Generally, you should file your claim with the state where you worked.When you file a claim, you will be asked for certain information, such as addresses and dates of your former employment.More items...

You should pay any tax due to the Virgin Islands when you file your return with the Virgin Islands Bureau of Internal Revenue. You receive credit for taxes paid to the Virgin Islands by including the amount on Form 8689, line 32, in the total on Form 1040, line 65.

U.S. Virgin Islands (USVI)The USVI has its own income tax system based on the same laws and tax rates that apply in the United States. An important factor in USVI taxation is whether, during the entire tax year, you are a bona fide resident of the USVI.

The Maximum Weekly Benefit Amount (MWBA) in the Virgin Islands for the benefit year beginning January 1, 2021, is $677.00 and the Taxable Wage Base (TWB) for employer contributions is $32,500.00.

To take the credit, you must complete Form 8689 and attach it to your Form 1040 or 1040-SR. Add line 41 and line 46 of Form 8689 and include the amount in the total on Form 1040 or 1040-SR, Total payments line. On the dotted line next to it, enter Form 8689 and the amount paid.

Box 1 "Wages, tips, other compensation": This is federal, taxable income for payments in the calendar year. The amount is calculated as YTD earnings minus pre- tax retirement and pre-tax benefit deductions plus taxable benefits (i.e., certain educational benefits).