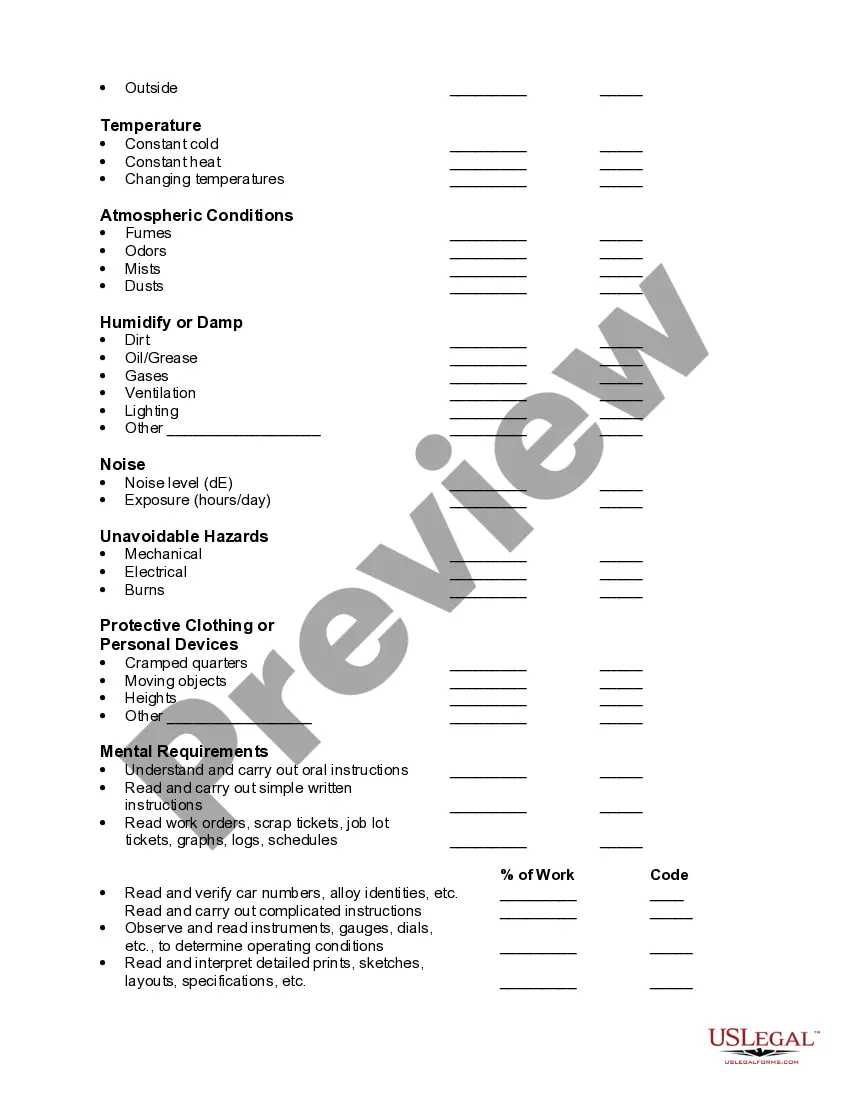

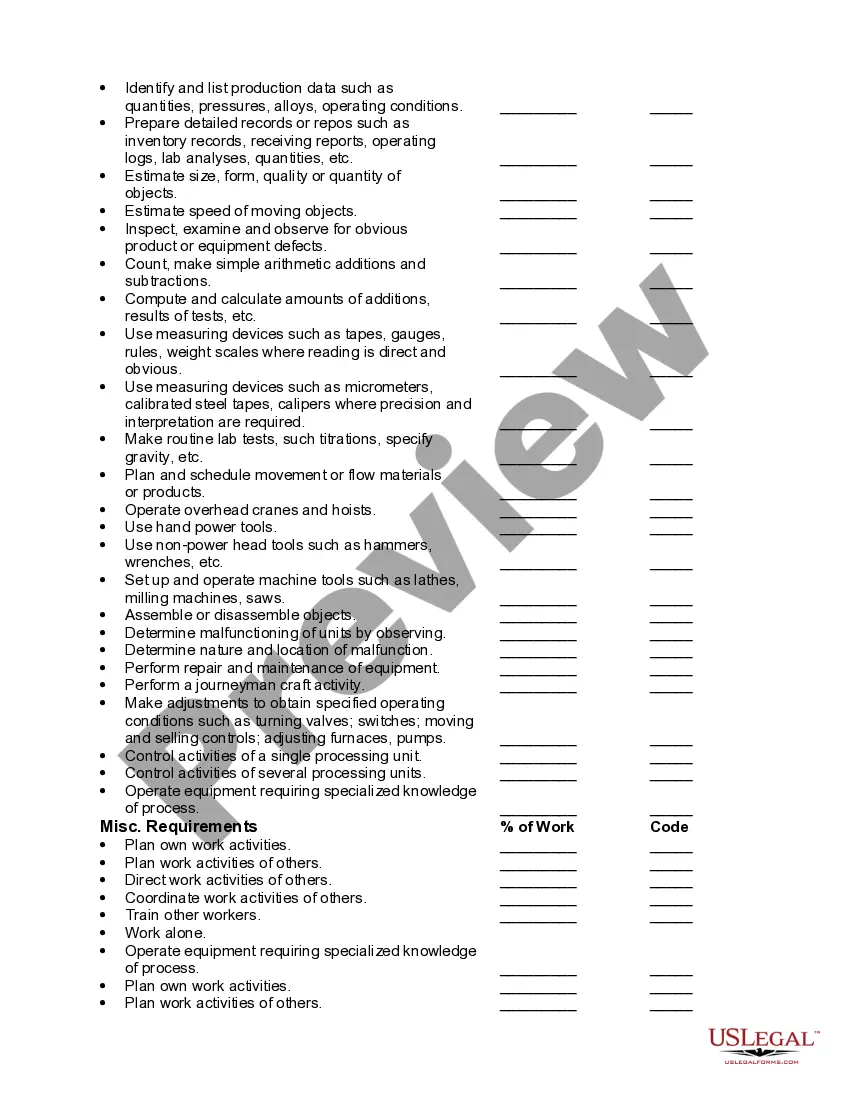

Virgin Islands Sample Job Requirements Worksheet

Description

How to fill out Sample Job Requirements Worksheet?

If you need to be thorough, acquire, or printing sanctioned document templates, utilize US Legal Forms, the largest variety of legal forms, which are accessible online.

Take advantage of the site's straightforward and user-friendly search feature to locate the documents you require.

A collection of templates for business and individual purposes is categorized by types and states, or keywords.

Step 4. Once you have found the form you need, click the Acquire now button. Choose the payment plan you prefer and enter your credentials to register for the account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to locate the Virgin Islands Sample Job Requirements Worksheet in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Obtain button to find the Virgin Islands Sample Job Requirements Worksheet.

- You can also retrieve forms you previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, adhere to the guidelines below.

- Step 1. Ensure you have chosen the form for the correct city/region.

- Step 2. Utilize the Review option to examine the form's details. Remember to read the description.

- Step 3. If you are not satisfied with the form, leverage the Search field at the top of the screen to explore alternative types of your legal form template.

Form popularity

FAQ

The state with the highest weekly payout for unemployment is Massachusetts. The maximum weekly payout is $855. What states are ending the extended unemployment benefits early?

There is no electronic filing in the Virgin Islands at this time. Taxpayers must drop off in person or mail the returns to the Bureau for processing. For more information about filing requirements for bona fide residents, please call the Office of Chief Counsel at 715-1040, ext. 2249.

How Do I Apply?You should contact your state's unemployment insurance program as soon as possible after becoming unemployed.Generally, you should file your claim with the state where you worked.When you file a claim, you will be asked for certain information, such as addresses and dates of your former employment.More items...

Be fully or partially unemployed;Be unemployed through no fault of your own the law imposes disqualifications for certain types of separations from employment;Be physically and mentally able to work full time;Be available for full-time work;Be registered with the American Job Center;More items...

The Maximum Weekly Benefit Amount (MWBA) in the Virgin Islands for the benefit year beginning January 1, 2021, is $677.00 and the Taxable Wage Base (TWB) for employer contributions is $32,500.00.

All states use a base period, or base year, to determine whether laid off workers have earned enough wages to qualify for UI benefits. A base period is typically four calendar quarters. (The calendar quarters are January through March, April through June, July through September, and October through December.)

Form 8689 is a tax form distributed by the Internal Revenue Service (IRS) for use by U.S. citizens and resident aliens who earned income from sources in the U.S. Virgin Islands (USVI) but are not bona fide residents. The U.S. Virgin Islands are considered an unincorporated territory of the United States.

The majority of U.S. states offer unemployment benefits for up to 26 weeks. Benefits range from $235 a week to $823. Policies and benefits vary by state. Mississippi has the lowest maximum unemployment benefits in the U.S. of $235 per week, while Massachusetts has the highest at $823.

To file a UI claim online, visit .

The Maximum Weekly Benefit Amount (MWBA) in the Virgin Islands for the benefit year beginning January 1, 2021, is $677.00 and the Taxable Wage Base (TWB) for employer contributions is $32,500.00.