Virgin Islands Fax Transmittal Form

Description

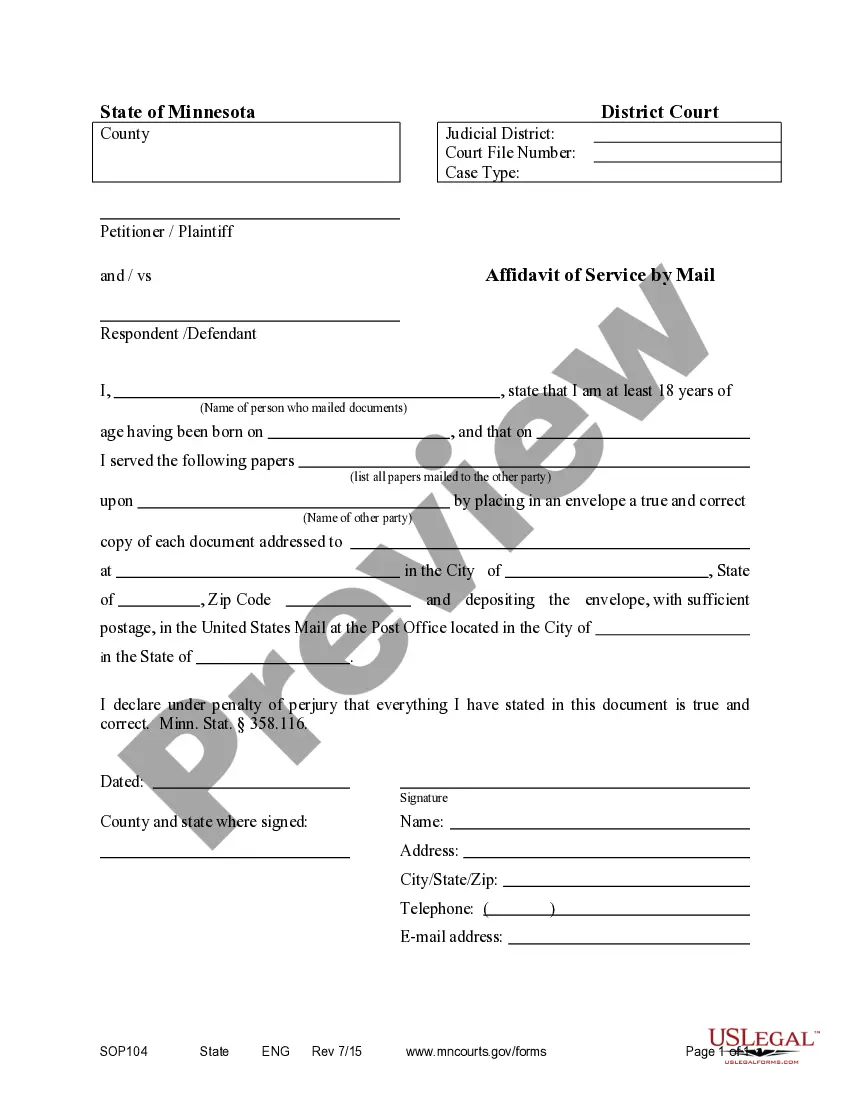

How to fill out Fax Transmittal Form?

US Legal Forms - among the greatest libraries of legal varieties in America - gives an array of legal record layouts you can acquire or print. Making use of the site, you may get thousands of varieties for business and person uses, categorized by groups, says, or key phrases.You will find the newest models of varieties such as the Virgin Islands Fax Transmittal Form in seconds.

If you have a registration, log in and acquire Virgin Islands Fax Transmittal Form in the US Legal Forms catalogue. The Download button will appear on every single develop you look at. You gain access to all in the past saved varieties in the My Forms tab of your own bank account.

If you want to use US Legal Forms the very first time, listed below are straightforward recommendations to obtain began:

- Be sure to have selected the proper develop for the town/region. Click the Preview button to examine the form`s articles. See the develop description to ensure that you have selected the correct develop.

- In case the develop does not fit your specifications, utilize the Look for field at the top of the screen to discover the one that does.

- When you are satisfied with the shape, confirm your option by clicking the Acquire now button. Then, pick the costs prepare you prefer and offer your qualifications to register for an bank account.

- Procedure the transaction. Make use of your bank card or PayPal bank account to accomplish the transaction.

- Choose the format and acquire the shape on the device.

- Make alterations. Fill out, revise and print and sign the saved Virgin Islands Fax Transmittal Form.

Every single format you included with your account does not have an expiry time and is the one you have eternally. So, if you wish to acquire or print another copy, just check out the My Forms area and click around the develop you will need.

Gain access to the Virgin Islands Fax Transmittal Form with US Legal Forms, by far the most considerable catalogue of legal record layouts. Use thousands of skilled and status-particular layouts that fulfill your business or person requires and specifications.

Form popularity

FAQ

Nonresident aliens are generally subject to U.S. income tax only on their U.S. source income. They are subject to two different tax rates, one for effectively connected income, and one for fixed or determinable, annual, or periodic (FDAP) income that is non-effectively connected income.

Puerto Rico is an unincorporated territory of the United States and Puerto Ricans are U.S. citizens; however, Puerto Rico is not a U.S. state, but a U.S. insular area. Consequently, while all Puerto Rico residents pay federal taxes, many residents are not required to pay federal income taxes.

Sending a Fax Place your document into the feeder tray ? you can add multiple pages. ... Dial the fax number you want to send your document to. Press Send or Fax ? usually a large round button differently colored from the others. ... Wait for a confirmation page to print out. Remove your papers from the outlet tray.

What should I write on letters? Your complete address includes your address number, street name, Estate name, plus the Island and ZIP Code. If you currently have a ZIP Code, please keep using it. We will be working with the U.S. Postal Service to identify areas which may need new or additional ZIP Codes.

An individual who qualifies as a bona fide resident of the U.S. Virgin Islands (or who files a joint U.S. return with a U.S. citizen or resident with U.S. Virgin Islands income) will generally have no U.S. tax liability so long as the taxpayer reports all income from all sources on the return filed with the U.S. Virgin ...

Because the United States Virgin Islands is part of the United States, you can use regular domestic stamps. No need for any extra postage.

US Virgin Islands is not a tax haven or offshore jurisdiction, but USVI companies (or corporations) could be established as "USVI Exempt Companies" with partial or full exemption from local and US federal income taxes.

US social security (FICA) and self-employment taxes are imposed in the US Virgin Islands. Payments are remitted to the US mainland rather than to the Virgin Islands Bureau of Internal Revenue.