Virgin Islands Service Bureau Form

Description

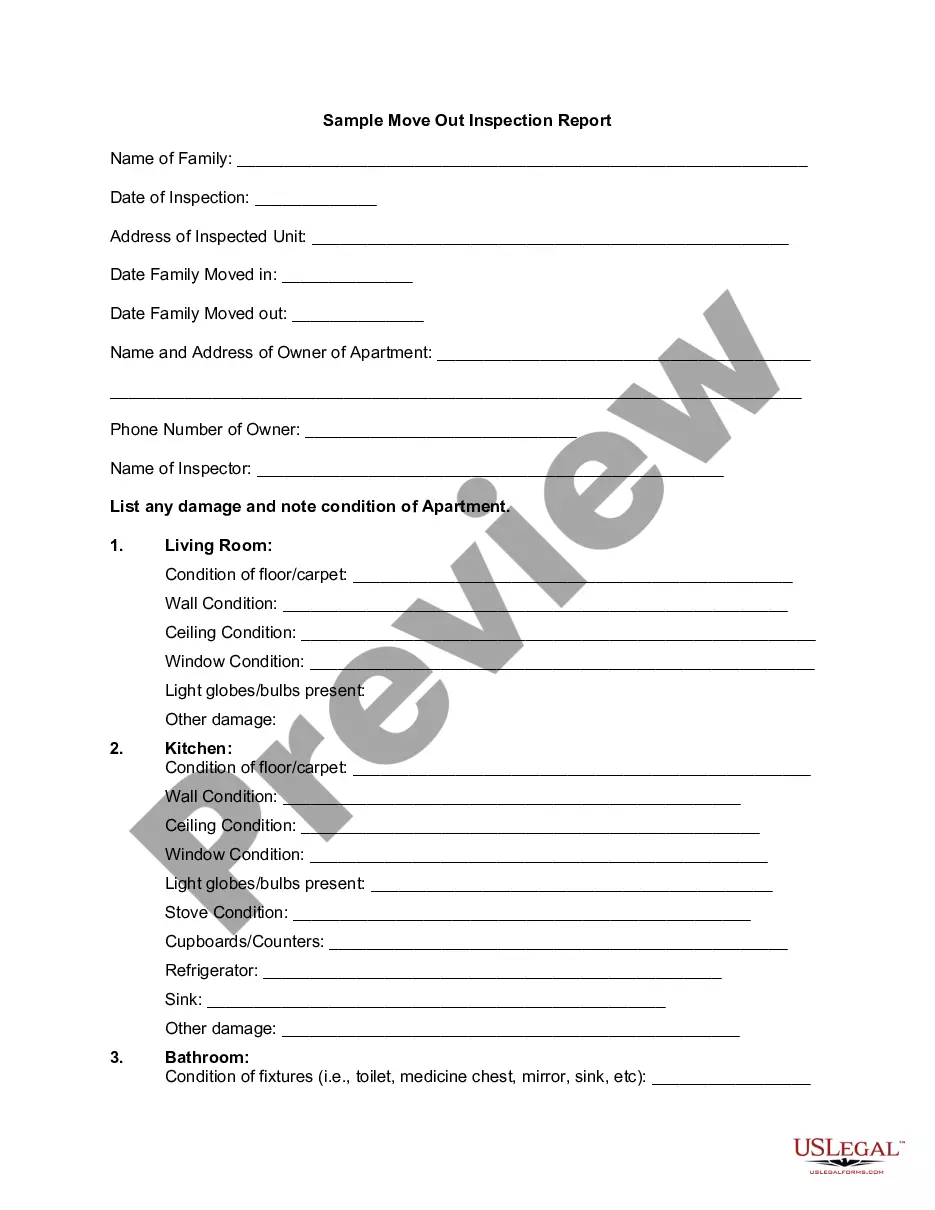

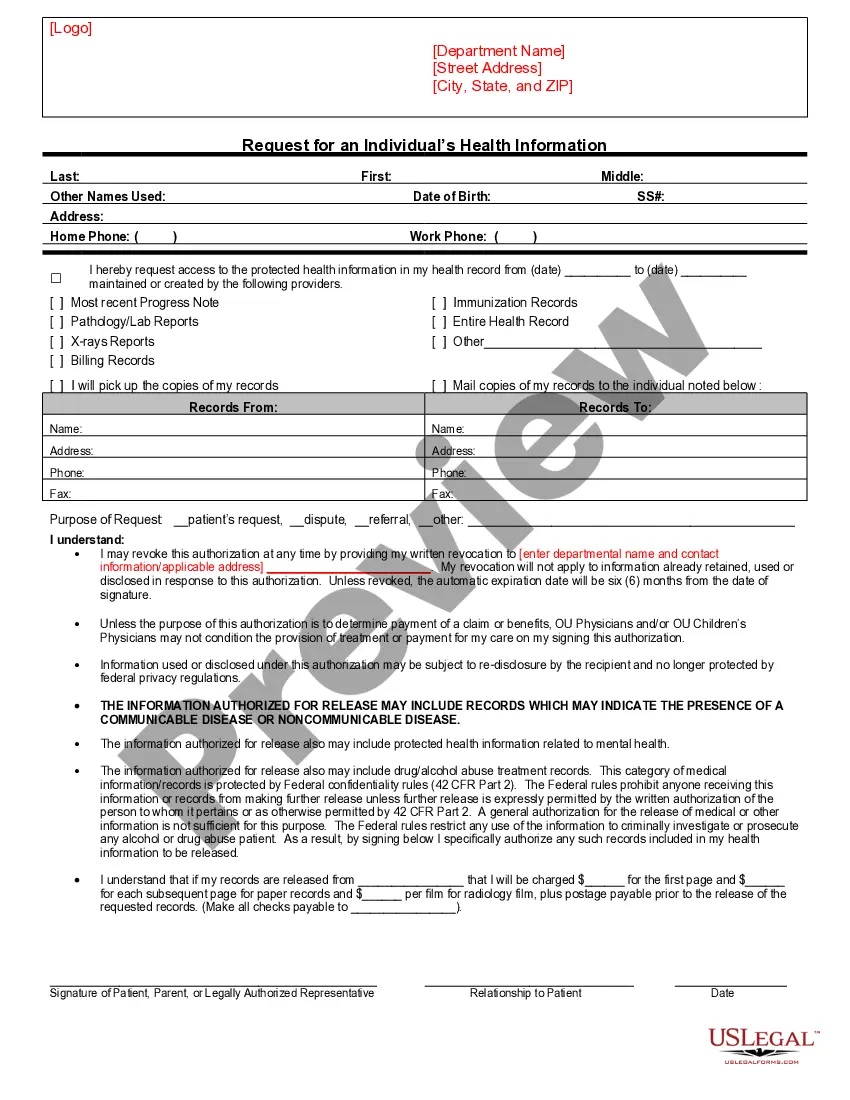

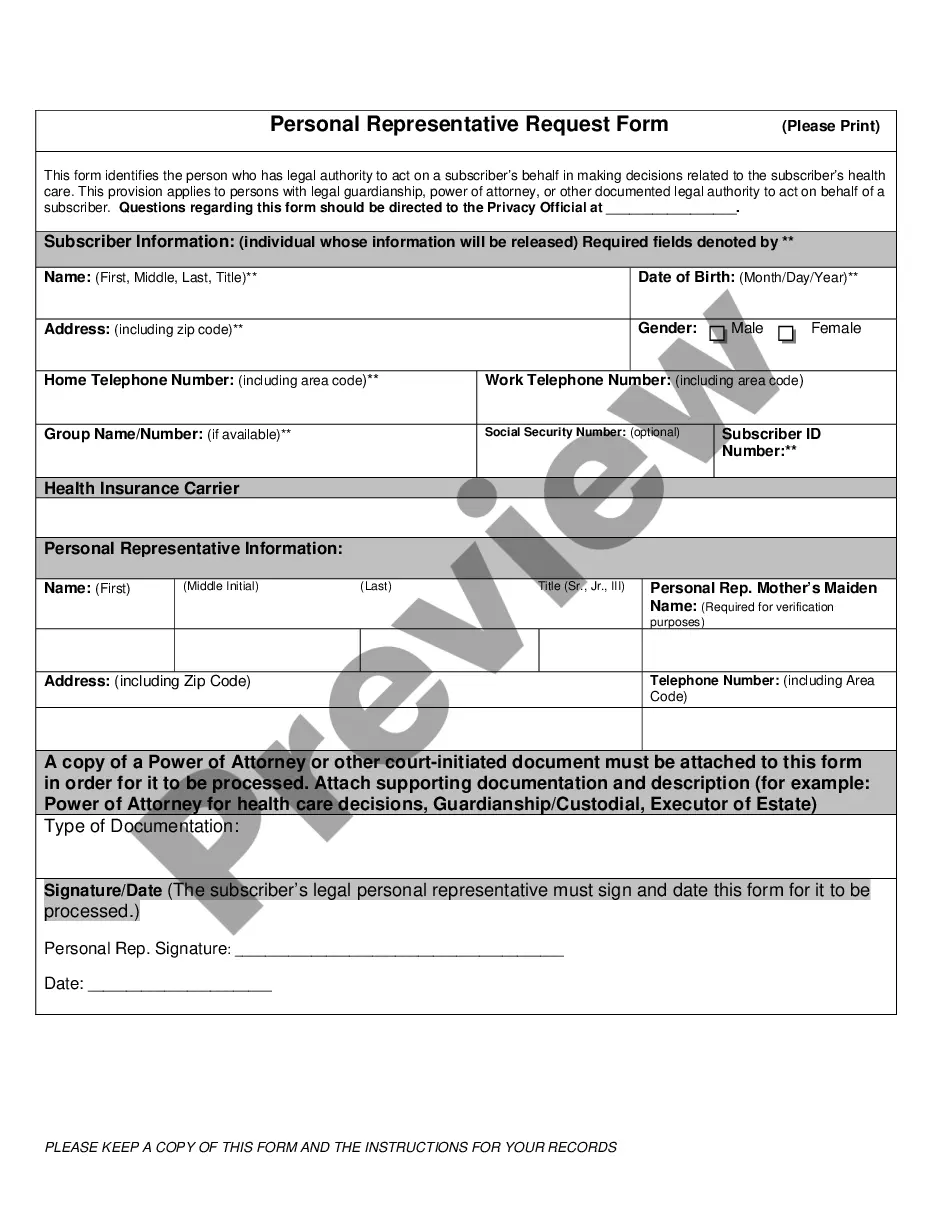

How to fill out Service Bureau Form?

Discovering the appropriate legal document template can be somewhat of a challenge.

Of course, there is a multitude of templates available online, but how do you find the legal document you require.

Utilize the US Legal Forms website. This service offers thousands of templates, including the Virgin Islands Service Bureau Form, which you can use for both business and personal purposes.

If the form does not meet your requirements, use the Search field to find the appropriate document. Once you are certain that the form is right, click on the Buy now button to obtain it. Select the pricing plan you wish to use and fill in the necessary information. Create your account and pay for the order using your PayPal account or credit card. Choose the document format and download the legal document template to your device. Complete, edit, print, and sign the downloaded Virgin Islands Service Bureau Form. US Legal Forms is the largest repository of legal forms from which you can obtain numerous document templates. Take advantage of the service to acquire professionally crafted documents that comply with state requirements.

- All forms are verified by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to access the Virgin Islands Service Bureau Form.

- Use your account to view the legal forms you have purchased previously.

- Navigate to the My documents tab in your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are some straightforward steps to follow.

- First, ensure you have selected the correct form for your city/state. You can review the document using the Review button and read the form description to confirm it’s suitable for you.

Form popularity

FAQ

Where to file. You must file identical tax returns with the United States and the USVI. If you are not enclosing a check or money order, file your original tax return (including Form 8689) with the Department of the Treasury, Internal Revenue Service Center, Austin, TX 73301-0215 USA.

The amount of tax paid to the Virgin Islands is reported on Line 46. This amount is then reported on Line 33 of your Form 1040 and taken as a credit.

Under Reg. 1.937-1(c)(1), an individual taxpayer must be physically located in the Virgin Islands for at least 183 days during the tax year. So long as an individual is physically present in the Virgin Islands at any time during the day, for any amount of time, the day will count for purposes of the presence test.

There is no electronic filing in the Virgin Islands at this time. Taxpayers must drop off in person or mail the returns to the Bureau for processing. For more information about filing requirements for bona fide residents, please call the Office of Chief Counsel at 715-1040, ext. 2249.

About Form 8689, Allocation of Individual Income Tax to the U.S. Virgin Islands Internal Revenue Service.

I.R.C. § 932(c). By paying the Virgin Islands Bureau of Internal Revenue the tax on all worldwide income, a bona fide United States Virgin Islands resident is relieved of any income tax liability to the United States, even on non-United States Virgin Islands source income.

To take the credit, you must complete Form 8689 and attach it to your Form 1040 or 1040-SR. Add line 41 and line 46 of Form 8689 and include the amount in the total on Form 1040 or 1040-SR, Total payments line. On the dotted line next to it, enter Form 8689 and the amount paid.

The mailing address is 9601 Estate Thomas, St. Thomas, VI 00802.

IRS Form W-2VI is used to report wage and salary information for employees earning Virgin Island wages.