Virgin Islands Guaranty without Pledged Collateral

Description

How to fill out Guaranty Without Pledged Collateral?

If you want to thorough, acquire, or produce valid document templates, utilize US Legal Forms, the largest assortment of valid forms, which can be accessed online.

Make use of the website's straightforward and convenient search to find the documents you require.

Numerous templates for business and personal applications are categorized by types and states, or keywords.

Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other versions of the valid form template.

Step 4. Once you have located the form you need, click the Buy now button. Choose the pricing plan you prefer and provide your information to register for an account.

- Utilize US Legal Forms to find the Virgin Islands Guaranty without Pledged Collateral in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to get the Virgin Islands Guaranty without Pledged Collateral.

- You can also access forms you previously acquired from the My documents tab of your account.

- If this is your first time utilizing US Legal Forms, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

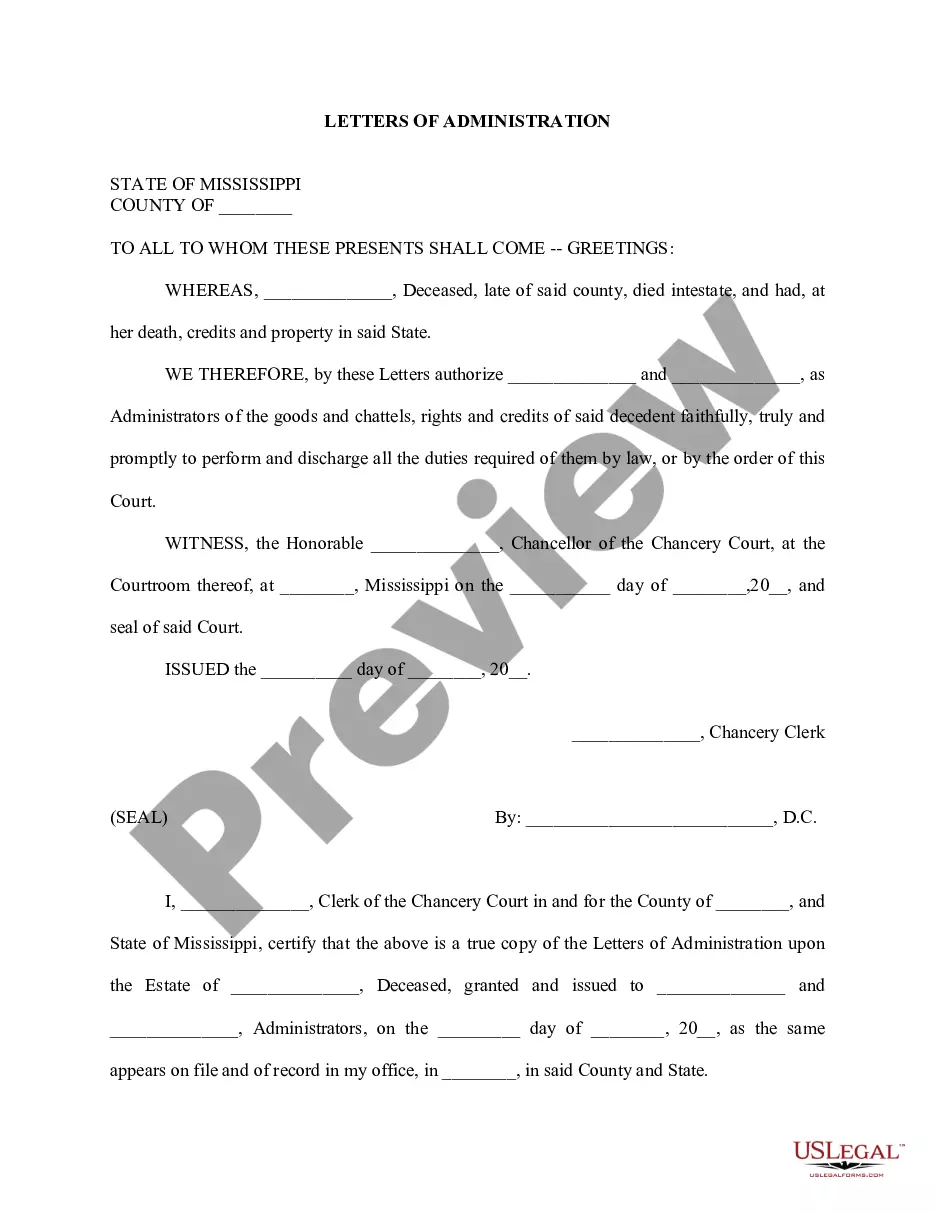

- Step 2. Use the Preview option to review the form's content. Don't forget to check the details.

Form popularity

FAQ

To create a pledge, the pledgee must be in control of the pledged asset in a way which means the debtor can no longer interfere with the asset. The pledgee must have possession, which can be actual or constructive.

From now on, every pledgee will be obliged to secure his pledge by means of its simple registration, because from that moment onwards it will be enforceable against third parties. On the other hand, the registration of the retention of title arrangement in the pledge register is optional and therefore not mandatory.

When used as a verb, to agree to pay another person's debt or perform another person's duty, if that person fails to come through. As a noun, the written document in which this assurance is made.

The Guarantor undertakes to pay compensation up to a certain amount to the Beneficiary in case the Applicant/Instructing Party fails to deliver the goods or to carry out certain work. This type of Guarantee is often issued for 5-10% of the contract value, although the percentage varies case by case.

As nouns the difference between pledge and guaranty is that pledge is a solemn promise to do something while guaranty is (legal) an undertaking to answer for the payment of some debt, or the performance of some contract or duty, of another, in case of the failure of such other to pay or perform; a warranty; a security.

Pledge TypesActive Pledge. Active pledge is defined as a pledge that is active, regardless if it has a payment schedule or not.Annual Fund Pledge.Conditional Pledge.Open Pledge.Pledge Intention.Straight Pledge.Will Commitment.

Guarantee vs collateral what's the difference? A personal guarantee is a signed document that promises to repay back a loan in the event that your business defaults. Collateral is a good or an owned asset that you use toward loan security in the event that your business defaults.

A pledge agreement must be in writing. The same formalities as for a mortgage agreement apply. Pledge must be certified as a deed before a notary public. The same formalities as for a mortgage agreement apply.

Guaranty Agreement a two-party contract in which the first party agrees to perform in the event that a second party fails to perform. Unlike a surety, a guarantor is only required to perform after the obligee has made every reasonable and legal effort to force the principal's performance.