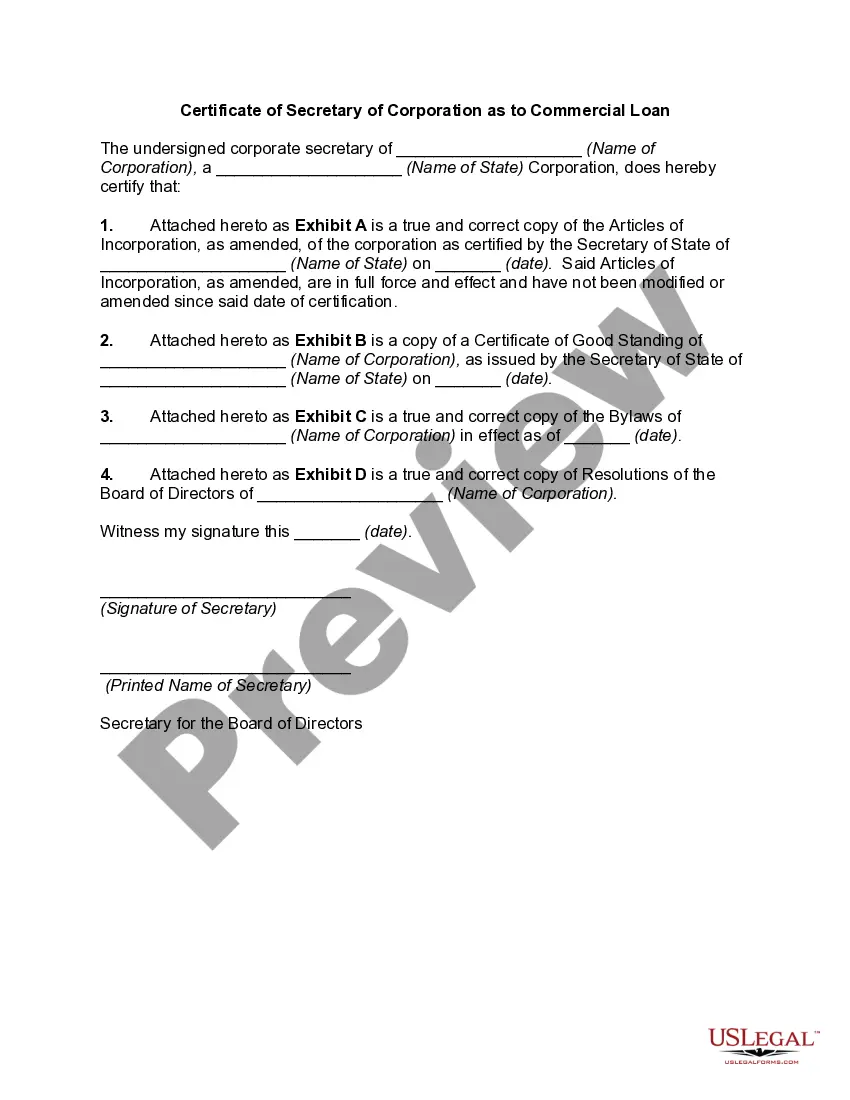

Virgin Islands Certificate of Secretary of Corporation as to Commercial Loan

Description

How to fill out Certificate Of Secretary Of Corporation As To Commercial Loan?

If you need to total, obtain, or print out lawful record templates, use US Legal Forms, the biggest variety of lawful varieties, that can be found on the web. Use the site`s basic and convenient search to get the paperwork you require. Numerous templates for business and individual reasons are sorted by types and suggests, or search phrases. Use US Legal Forms to get the Virgin Islands Certificate of Secretary of Corporation as to Commercial Loan within a couple of mouse clicks.

In case you are currently a US Legal Forms customer, log in in your account and then click the Download key to obtain the Virgin Islands Certificate of Secretary of Corporation as to Commercial Loan. You can even access varieties you in the past saved in the My Forms tab of the account.

If you work with US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Be sure you have selected the form for that correct area/land.

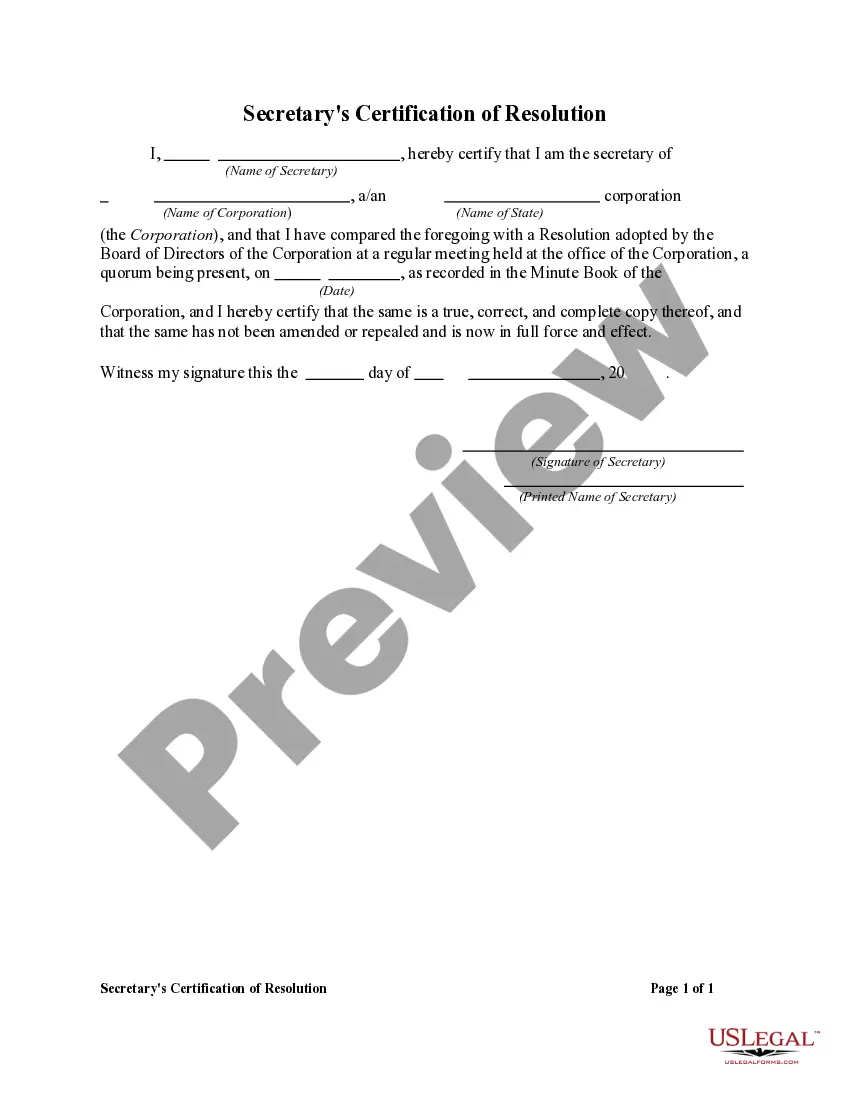

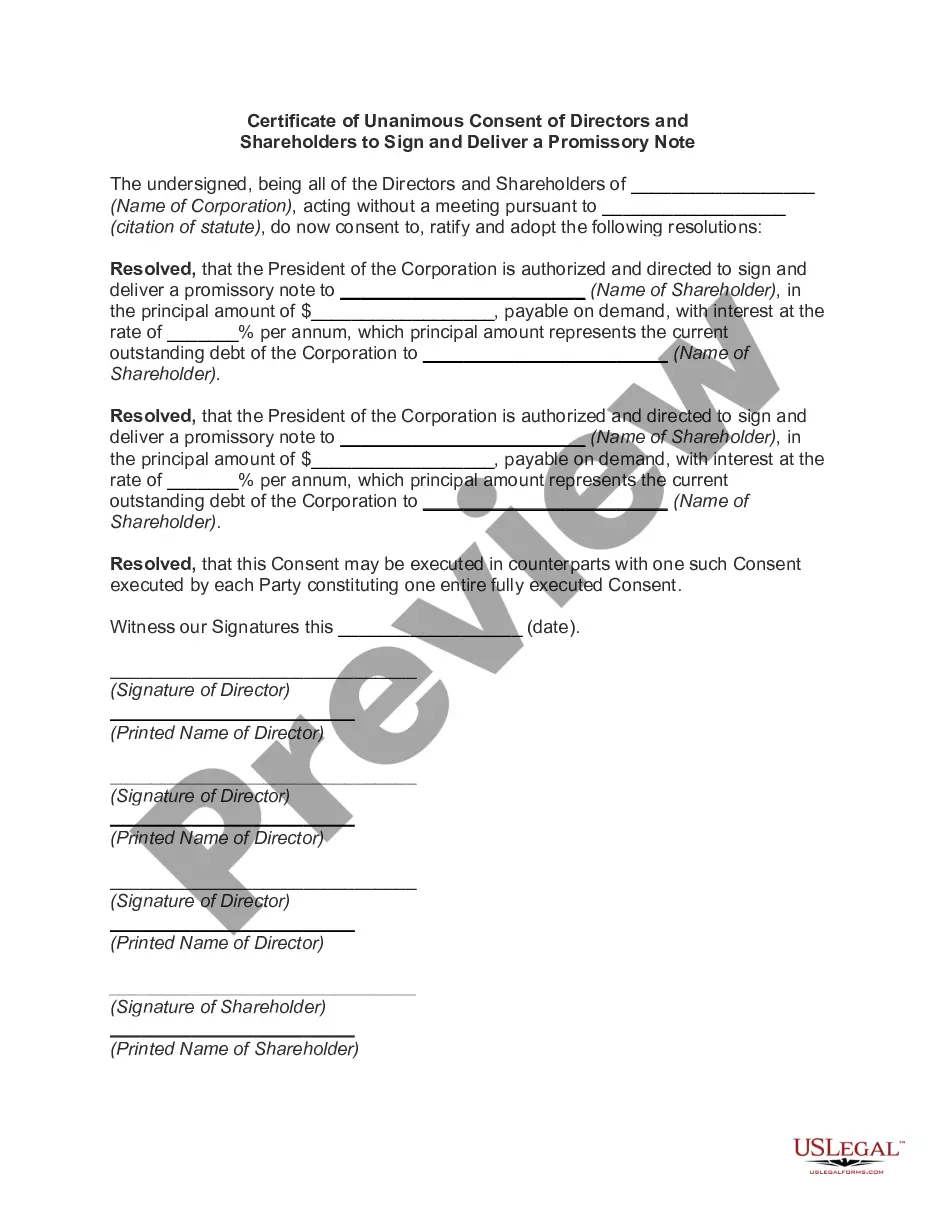

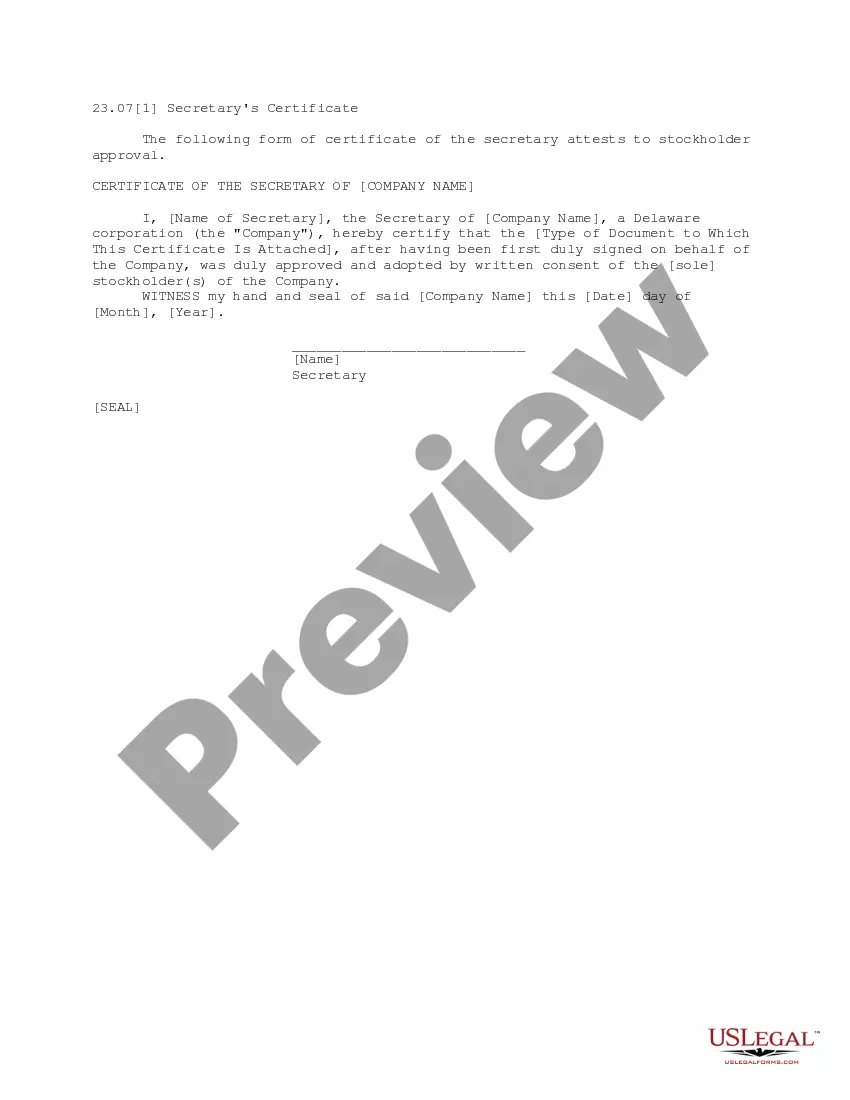

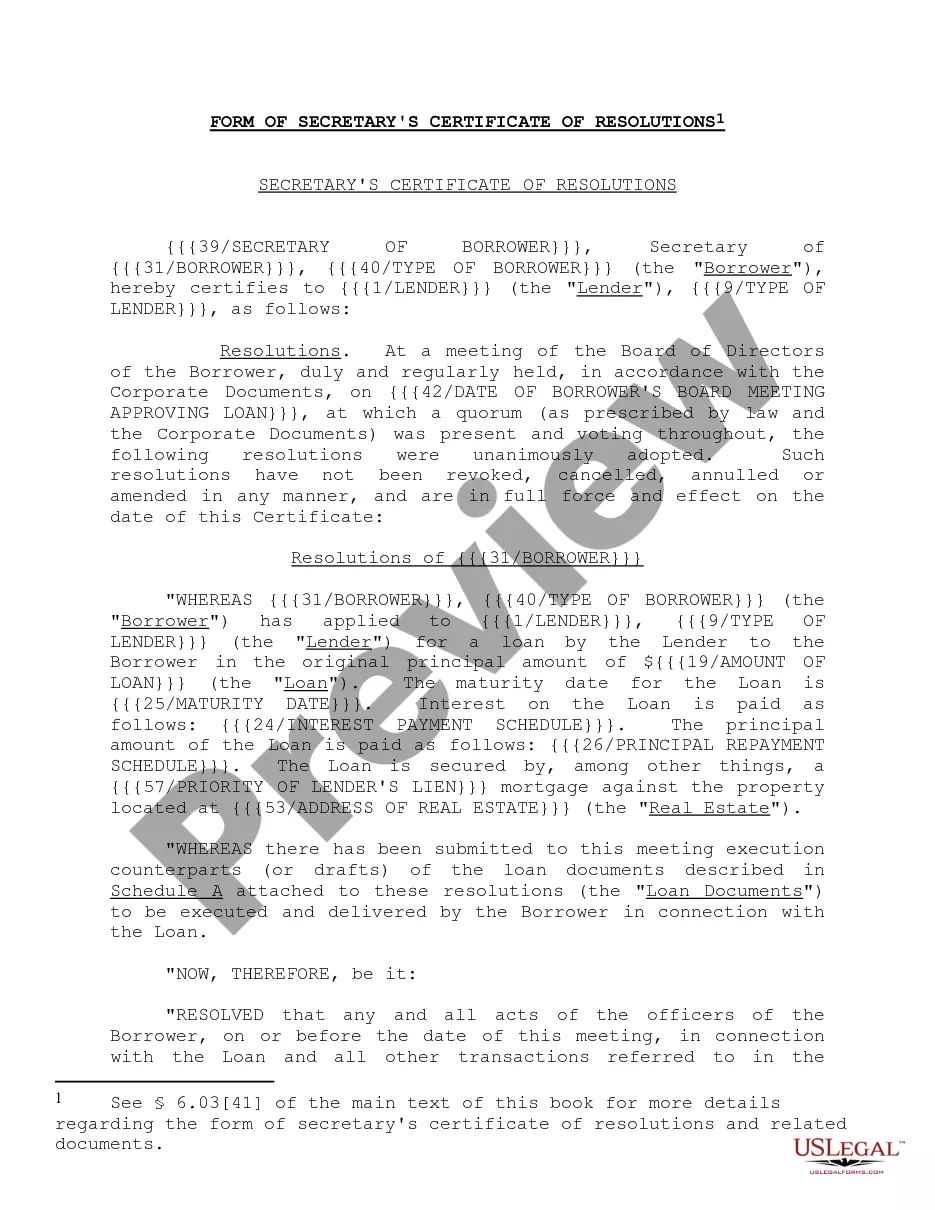

- Step 2. Utilize the Preview solution to check out the form`s content material. Never neglect to read the explanation.

- Step 3. In case you are not happy together with the develop, use the Lookup industry at the top of the display screen to find other variations of your lawful develop format.

- Step 4. When you have identified the form you require, click the Buy now key. Choose the costs program you choose and add your qualifications to register for an account.

- Step 5. Method the deal. You should use your bank card or PayPal account to perform the deal.

- Step 6. Pick the formatting of your lawful develop and obtain it on your own gadget.

- Step 7. Full, change and print out or sign the Virgin Islands Certificate of Secretary of Corporation as to Commercial Loan.

Every lawful record format you purchase is yours for a long time. You may have acces to each develop you saved inside your acccount. Go through the My Forms area and decide on a develop to print out or obtain once more.

Be competitive and obtain, and print out the Virgin Islands Certificate of Secretary of Corporation as to Commercial Loan with US Legal Forms. There are thousands of skilled and status-specific varieties you may use for your personal business or individual demands.

Form popularity

FAQ

People who retire in the US Virgin Islands can enjoy a wide range of activities and sports. In addition to snorkeling, diving, sailing and fishing, the islands offer land-based activities like golf, tennis and bicycling.

US Virgin Islands is not a tax haven or offshore jurisdiction, but USVI companies (or corporations) could be established as "USVI Exempt Companies" with partial or full exemption from local and US federal income taxes.

As a territory, the U.S. Congress is empowered to "make all needful Rules and Regulations respecting" the USVI. As far as taxes go, Congress requires that the USVI impose an income tax that "mirrors" the U.S. federal income tax found in United States Code, Title 26 (also known as the "Internal Revenue Code" or "IRC").

BVI has a ?Territorial Tax System? which means IBCs (International Business Companies) that incorporate in the BVI but do business outside of the country are not taxed. Companies don't have to pay taxes on items, including income, capital gains, customs duties, sales, profits, inheritances, dividends and interests.

The set of corporate documents for a BVI Business Company or will always include the standard logical sequence of documentation: electronic copy of Certificate of Incorporation, Memorandum of Association, Articles of Association, the Minutes and Resolutions dealing with the appointment of Directors and the allocation ...

Land tax is payable on every acre or part of an acre of land in the territory. House tax is payable on the assessed value of every house in the territory. The combined (Land and House) tax, referred to as Property Tax, is charged to every owner who erects, reconstructs, enlarges or repairs any existing building.

To start a business in the U.S. Virgin Islands you will need to obtain a business license from the Department of Licensing and Consumer Affairs (DLCA). DLCA will complete the "One Step" review process with the following government agencies: Police Department. VI Bureau of Internal Revenue (tax clearance)

Antigua and Barbuda and St Kitts and Nevis don't have a personal income tax. In other countries, the tax rate is progressive: 10% to 35%, depending on the income amount. One must spend at least 183 days a year in the chosen Caribbean country to become its tax resident.