The Virgin Islands Authorization of Travel Expenses Generally or for Specific Event or Meeting — Corporate Resolution Form is a document that allows a company or organization to authorize and approve travel expenses incurred by their employees or representatives. This form ensures that the company is aware of and approves the costs associated with travel and related expenses. This form is used in the context of corporate travel and can apply to various scenarios. It can be used for general travel expenses incurred by employees during a business trip, or it can be specifically designed for a particular event or meeting. The form is flexible and can be customized to meet the specific needs of the company. The purpose of this form is to provide a clear and transparent process for approving travel expenses. It ensures that there is accountability and oversight in the company's travel expenditure. By using this form, companies can establish guidelines and limits on travel expenses, ensuring that the costs are reasonable and aligned with the company's budget and policies. The Virgin Islands Authorization of Travel Expenses Generally or for Specific Event or Meeting — Corporate Resolution Form typically includes the following key information: 1. Company Information: This section captures details about the company, such as the company name, address, and contact information. 2. Employee Information: This section requires the employee's name, department, job title, and other relevant identification details. 3. Purpose and Date of Travel: Here, the purpose of the trip is specified, whether it is for a general business meeting, conference, or specific event. The dates of the travel are also recorded. 4. Budget and Limitations: This section outlines the budget, expenditure limits, and any specific rules or restrictions associated with the authorized travel. 5. Itinerary and Accommodation: Details of the travel itinerary, including flights, transportation, and accommodation arrangements, may be included in this section. 6. Pre-Approved Expenses: This section allows for the pre-approval of certain expenses, such as meals, transportation, lodging, and other miscellaneous costs. 7. Supporting Documentation: The form may require the employee to attach supporting documents, such as receipts or estimates, for travel-related expenses. 8. Approvals: The form includes spaces for relevant parties to sign and approve the travel expenses. This may include signatures from the employee, their supervisor, and other authorized personnel. Different variations of the Virgin Islands Authorization of Travel Expenses Generally or for Specific Event or Meeting — Corporate Resolution Form may exist, each tailored to the specific needs of the company. The variations may include specific fields for different types of expenses or additional sections to capture additional information deemed necessary by the company.

Virgin Islands Authorization of Travel Expenses Generally or for Specific Event or Meeting - Corporate Resolution Form

Description

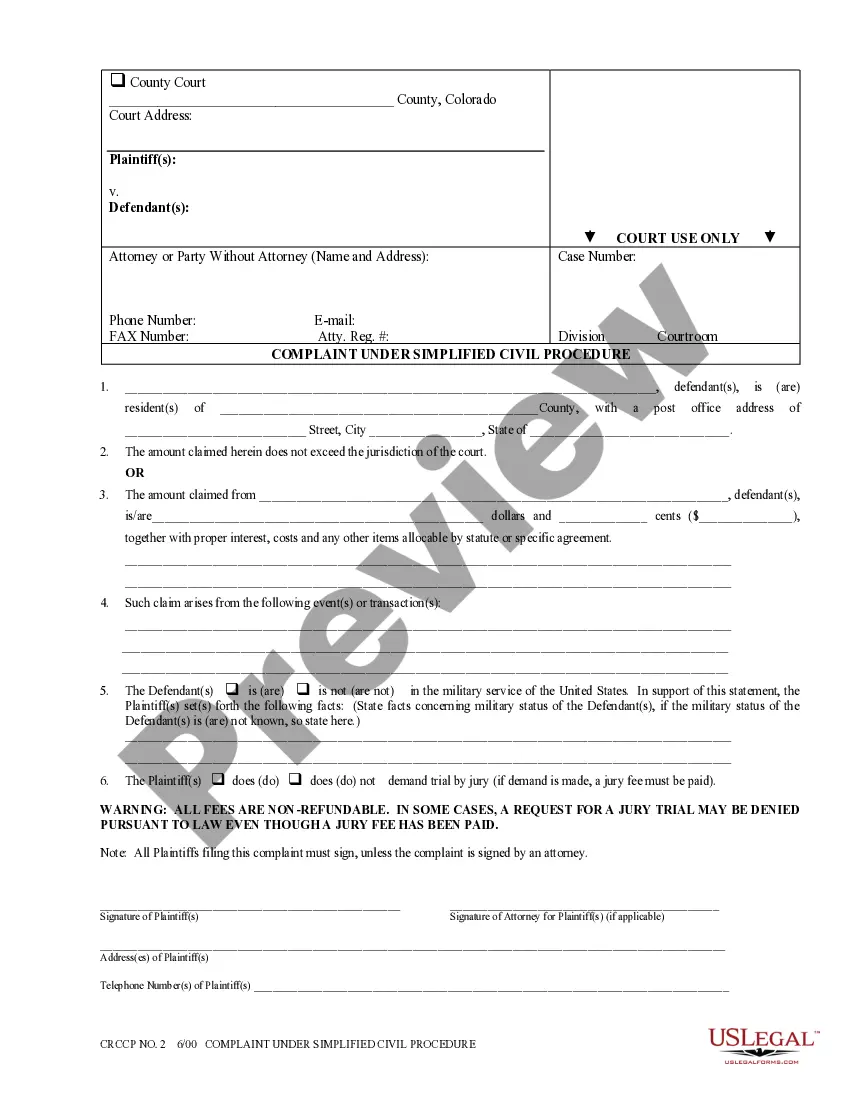

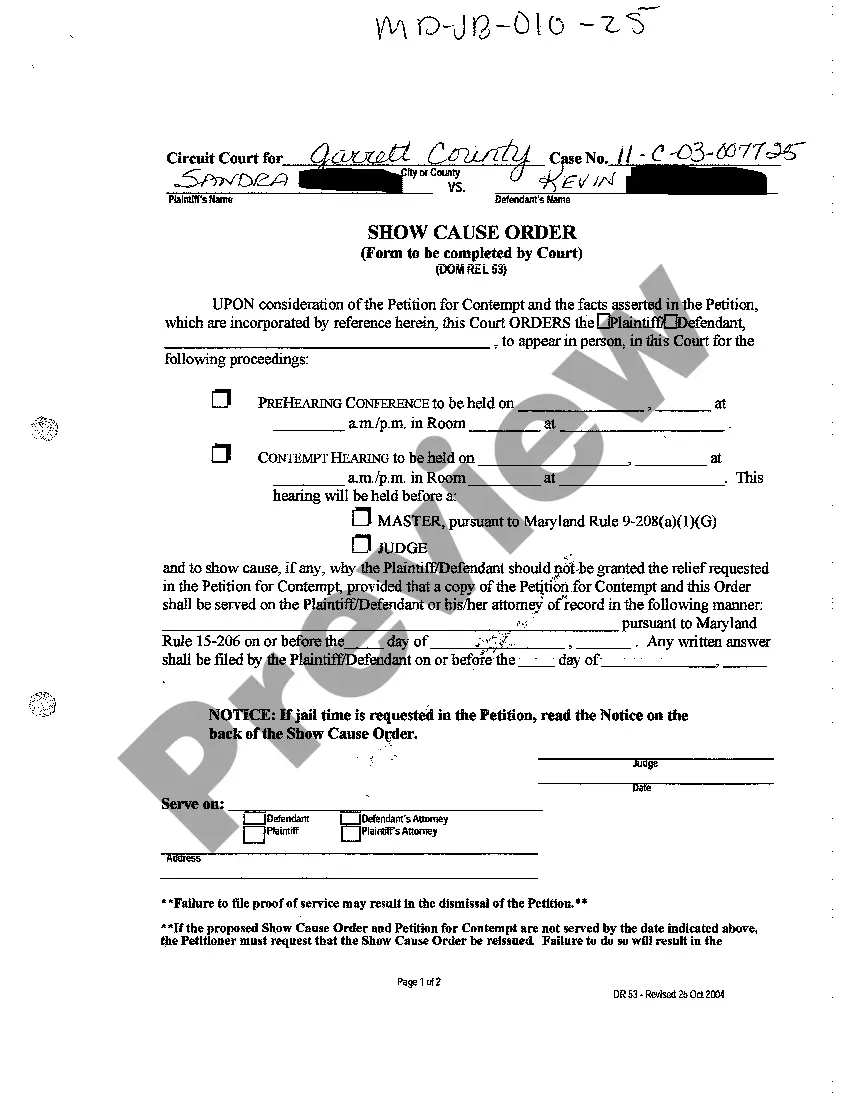

How to fill out Virgin Islands Authorization Of Travel Expenses Generally Or For Specific Event Or Meeting - Corporate Resolution Form?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a variety of legal paper templates that you can download or print.

Using the website, you can find thousands of forms for business and personal purposes, categorized by type, state, or keywords.

You can find the latest versions of forms such as the Virgin Islands Authorization of Travel Expenses Generally or for Specific Event or Meeting - Corporate Resolution Form in seconds.

If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

If you are content with the form, confirm your choice by clicking the Purchase now button. Then, choose the pricing plan you want and provide your details to sign up for an account.

- If you already have a monthly subscription, Log In and download the Virgin Islands Authorization of Travel Expenses Generally or for Specific Event or Meeting - Corporate Resolution Form from the US Legal Forms library.

- The Download button will be visible on every form you view.

- You have access to all previously downloaded forms in the My documents tab of your account.

- If you are using US Legal Forms for the first time, here are simple steps to get you started.

- Make sure you have selected the appropriate form for your city/county.

- Click the Preview button to review the form's content.

Form popularity

FAQ

A foreign corporation that maintains an office or place of business in the United States must generally file Form 1120-F by the 15th day of the 4th month after the end of its tax year. A new corporation filing a short-period return must generally file by the 15th day of the 4th month after the short period ends.

The 2-out-of-five-year rule is a rule that states that you must have lived in your home for a minimum of two out of the last five years before the date of sale. However, these two years don't have to be consecutive and you don't have to live there on the date of the sale.

Form 1120-F is filed by foreign corporations doing business in the US, to report their income, gains, losses, deductions, credits, and to calculate their US income tax liability.

A portion of the gain from the sale of a principal residence can be excluded when the taxpayer fails to meet the requirements for full exclusion of gain (i.e., the ownership and use requirements or the one-sale-in-two-years requirement) when the primary reason for selling or exchanging the principal residence was a

Which of the following rules must be met for a taxpayer to be able to exclude the gain on the sale of a personal residence? A. The taxpayer must have used the property as their principal residence for a total of two or more years during the five year period prior to the sale.

Generally, when a foreign person engages in a trade or business in the United States, all income from sources within the United States connected with the conduct of that trade or business is considered to be Effectively Connected Income (ECI).

Capital gains should not be more than the investment amount. If only a portion of gains were reinvested, an exemption under capital gain would be applicable only on the amount that was reinvested. Specified assets must be held for at least 36 months.

A foreign corporation files this form to report their income, gains, losses, deductions, credits, and to figure their U.S. income tax liability.

In a nutshell, the form gives the IRS an overview of the organization's activities, governance and detailed financial information. Form 990 also includes a section for the organization to outline its accomplishments in the previous year to justify maintaining its tax-exempt status.

You're eligible for the exclusion if you have owned and used your home as your main home for a period aggregating at least two years out of the five years prior to its date of sale. You can meet the ownership and use tests during different 2-year periods.

Interesting Questions

More info

Ute, Police, Security, Coast Guard, Fire Force, Fire Rescue, Army, Navy, Air Force, Military Police, Fire Department.