Are you presently within a placement where you need to have papers for either company or personal purposes almost every day? There are plenty of legitimate document layouts accessible on the Internet, but getting ones you can trust is not straightforward. US Legal Forms provides a huge number of develop layouts, much like the Virginia HAMP Loan Modification Package, that are published in order to meet federal and state demands.

In case you are already familiar with US Legal Forms internet site and also have your account, simply log in. After that, you can down load the Virginia HAMP Loan Modification Package web template.

If you do not come with an profile and would like to begin using US Legal Forms, follow these steps:

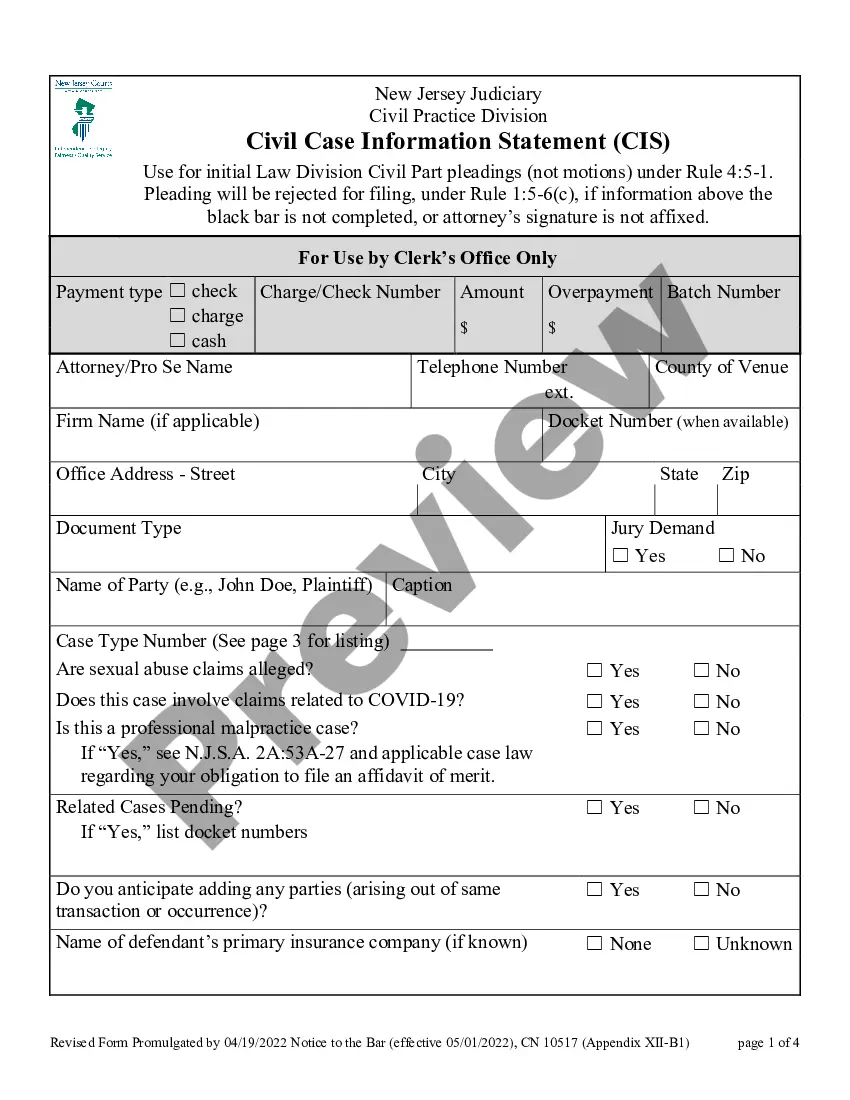

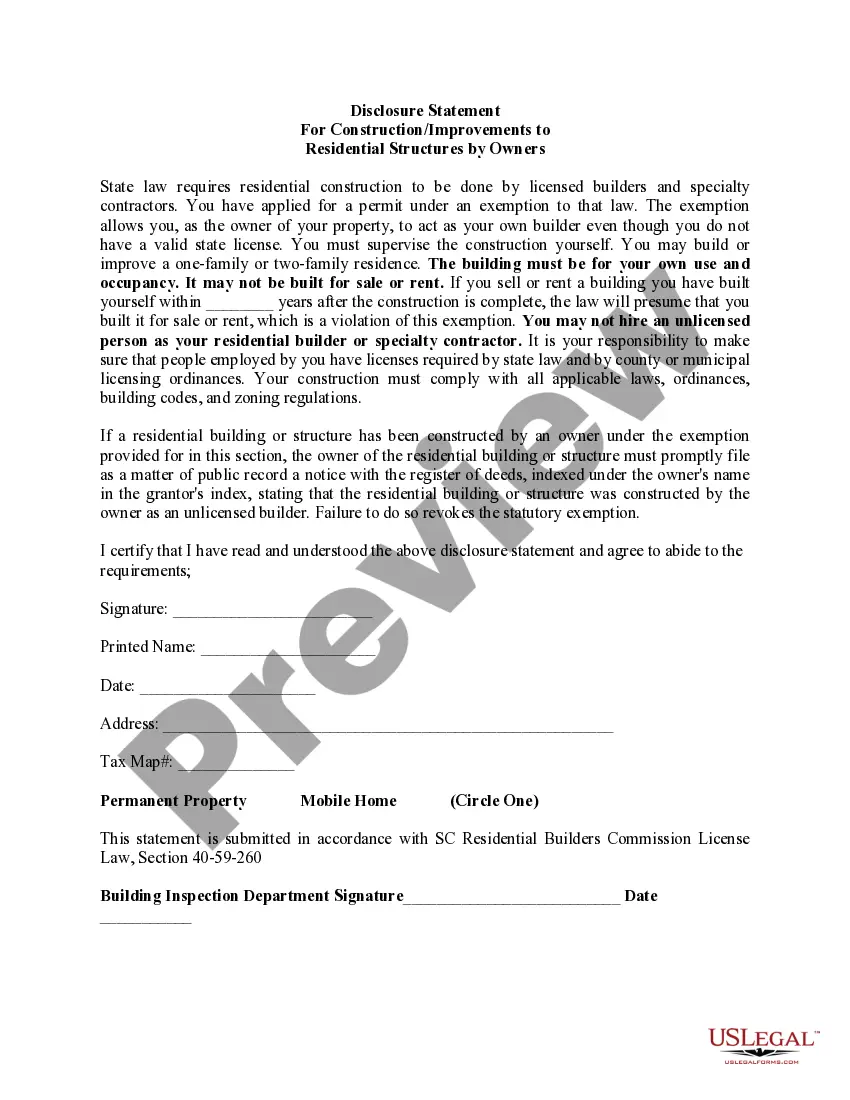

- Get the develop you want and ensure it is for the right area/region.

- Utilize the Review button to analyze the form.

- Look at the description to ensure that you have selected the correct develop.

- In case the develop is not what you are searching for, take advantage of the Look for industry to get the develop that fits your needs and demands.

- If you find the right develop, just click Get now.

- Choose the rates prepare you need, fill in the desired information and facts to make your money, and buy the order utilizing your PayPal or Visa or Mastercard.

- Pick a practical document formatting and down load your backup.

Locate each of the document layouts you possess purchased in the My Forms food selection. You can aquire a extra backup of Virginia HAMP Loan Modification Package any time, if necessary. Just go through the essential develop to down load or printing the document web template.

Use US Legal Forms, the most considerable collection of legitimate types, to conserve some time and stay away from errors. The service provides professionally made legitimate document layouts which can be used for a range of purposes. Generate your account on US Legal Forms and initiate generating your daily life a little easier.