Virginia Request for Loan Modification RMA Under Home Affordable Modification Program HAMP

Description

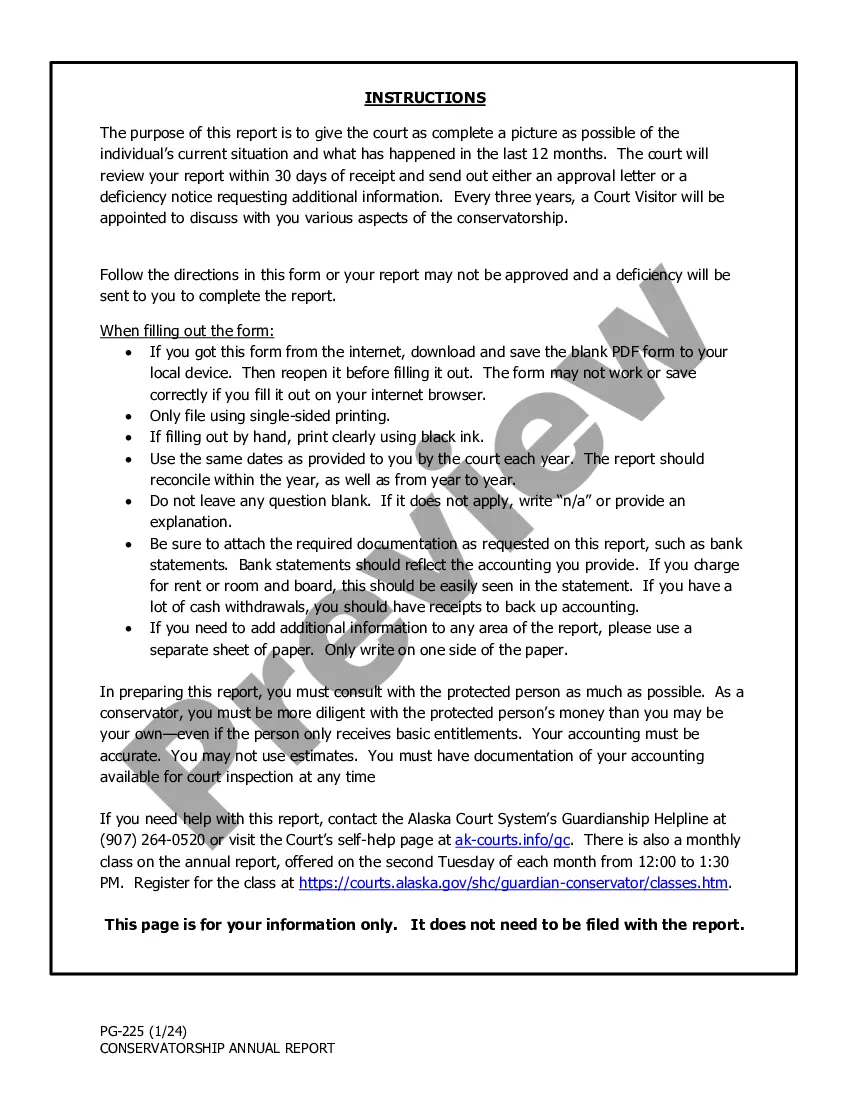

How to fill out Request For Loan Modification RMA Under Home Affordable Modification Program HAMP?

Are you presently in a scenario where you require documents for either business or personal reasons almost every day.

There are numerous legal document templates available online, but finding reliable ones is not easy.

US Legal Forms offers thousands of form templates, such as the Virginia Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, which are designed to comply with federal and state regulations.

Select a convenient file format and download your copy.

You can find all the document templates you have purchased in the My documents section. You can obtain another copy of the Virginia Request for Loan Modification RMA Under Home Affordable Modification Program HAMP at any time if needed. Just pull up the necessary form to download or print the template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you will be able to download the Virginia Request for Loan Modification RMA Under Home Affordable Modification Program HAMP template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

- Utilize the Preview button to review the form.

- Check the description to ensure you have selected the correct document.

- If the form isn’t what you are looking for, use the Search field to find the form that meets your needs and criteria.

- Once you locate the appropriate form, click on Buy now.

- Choose the payment plan you prefer, enter the required information to create your account, and complete the transaction using your PayPal or credit card.

Form popularity

FAQ

Requesting a mature modification on your loan requires clear communication with your lender. Begin by utilizing the Virginia Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, which outlines the necessary steps. It's important to submit your request alongside supporting documents that explain your current situation. If you feel overwhelmed, uslegalforms offers valuable resources to help you draft your request effectively.

The Home Affordable Modification Program, or HAMP, offers financial relief to homeowners facing difficulties. The Virginia Request for Loan Modification RMA Under Home Affordable Modification Program HAMP helps lower monthly mortgage payments to make them more affordable. This program aims to stabilize homeownership and prevent foreclosure by providing modified loan terms. Understanding its benefits allows homeowners to explore their options and make informed decisions.

Qualifying for a loan modification often depends on your financial situation and ability to show hardship. The Virginia Request for Loan Modification RMA Under Home Affordable Modification Program HAMP typically requires proof of income, current mortgage status, and evidence of financial difficulties. Each lender may have specific criteria, so reviewing their guidelines is essential. Seeking professional guidance can improve your chances of meeting the requirements.

Applying for a loan modification typically begins with a clear understanding of your lender’s requirements. To initiate the Virginia Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, you will need to gather personal financial information, such as income statements and mortgage details. It’s wise to submit a formal request along with the necessary documentation to your lender. If you need support during this process, consider utilizing platforms like uslegalforms to simplify the steps.

Getting approved for a loan modification can be challenging, but understanding the process helps. With the Virginia Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, homeowners may find it easier to navigate approval. Gathering necessary documentation, demonstrating financial hardship, and meeting eligibility criteria are crucial. Remember, many homeowners experience similar situations, and assistance is available to help you through the process.

As of now, the Home Affordable Modification Program HAMP may have officially ended, but alternative assistance options are often available. It's essential to stay up to date on current programs and assistance plans, as new initiatives may emerge to help struggling homeowners. The Virginia Request for Loan Modification RMA can also guide you toward available resources, ensuring you continue to explore every avenue for help in maintaining your home.

While loan modification can be a lifeline during tough financial times, it does have potential downsides. For instance, modifying your loan may negatively impact your credit score, as it shows lenders you struggled to meet your original terms. Furthermore, you should consider that the Virginia Request for Loan Modification RMA Under Home Affordable Modification Program HAMP is not a one-time fix; it requires careful management of your new payment structure to avoid further complications.

The Home Affordable Modification Program (HAMP) assists homeowners in modifying their mortgage terms to make monthly payments more manageable. Under the Virginia Request for Loan Modification RMA, the program reduces your interest rate or extends the loan term, based on your financial situation. This initiative aims to prevent foreclosure and keep you in your home, alleviating some of the stress that comes with financial hardship.

To apply for a loan modification under the Virginia Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, gather necessary documents such as your income statements and financial hardship evidence. Next, complete the required application forms from your lender or service provider. You can also utilize platforms like USLegalForms to simplify the process and ensure that you submit accurate information.

The Mortgage Modification Act in Virginia was enacted to assist homeowners in modifying their loans without extensive delays. It encourages lenders to evaluate and process modifications in a timely manner, allowing for smoother transactions. If you're interested in modifying your loan through the Virginia Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, this Act can facilitate your experience. Understanding this legislation empowers you to navigate the modification process effectively.