Virginia Term Nonparticipating Royalty Deed from Mineral Owner

Description

How to fill out Term Nonparticipating Royalty Deed From Mineral Owner?

Choosing the best lawful document format might be a struggle. Obviously, there are plenty of layouts accessible on the Internet, but how will you find the lawful develop you will need? Take advantage of the US Legal Forms site. The assistance gives a huge number of layouts, such as the Virginia Term Nonparticipating Royalty Deed from Mineral Owner, that can be used for company and personal requires. Every one of the types are inspected by experts and fulfill federal and state demands.

In case you are currently registered, log in for your account and click the Download key to get the Virginia Term Nonparticipating Royalty Deed from Mineral Owner. Make use of your account to appear from the lawful types you may have purchased in the past. Proceed to the My Forms tab of your respective account and acquire yet another version from the document you will need.

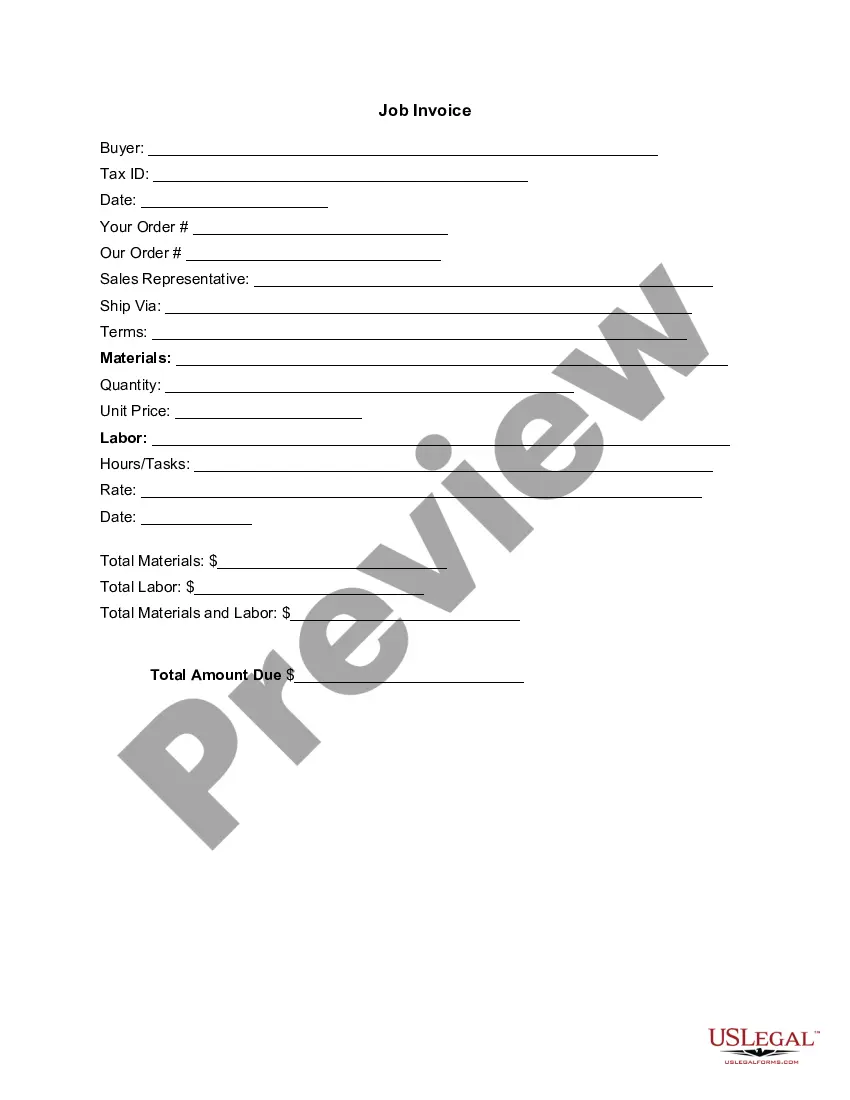

In case you are a new end user of US Legal Forms, here are simple directions so that you can stick to:

- First, ensure you have selected the proper develop for the city/area. It is possible to check out the form while using Preview key and browse the form outline to make sure it will be the right one for you.

- In the event the develop will not fulfill your preferences, utilize the Seach industry to find the appropriate develop.

- Once you are sure that the form is suitable, select the Acquire now key to get the develop.

- Select the rates strategy you desire and enter in the required information. Create your account and buy an order making use of your PayPal account or credit card.

- Opt for the data file format and down load the lawful document format for your device.

- Comprehensive, change and printing and sign the obtained Virginia Term Nonparticipating Royalty Deed from Mineral Owner.

US Legal Forms is the greatest collection of lawful types for which you will find a variety of document layouts. Take advantage of the service to down load skillfully-manufactured papers that stick to express demands.

Form popularity

FAQ

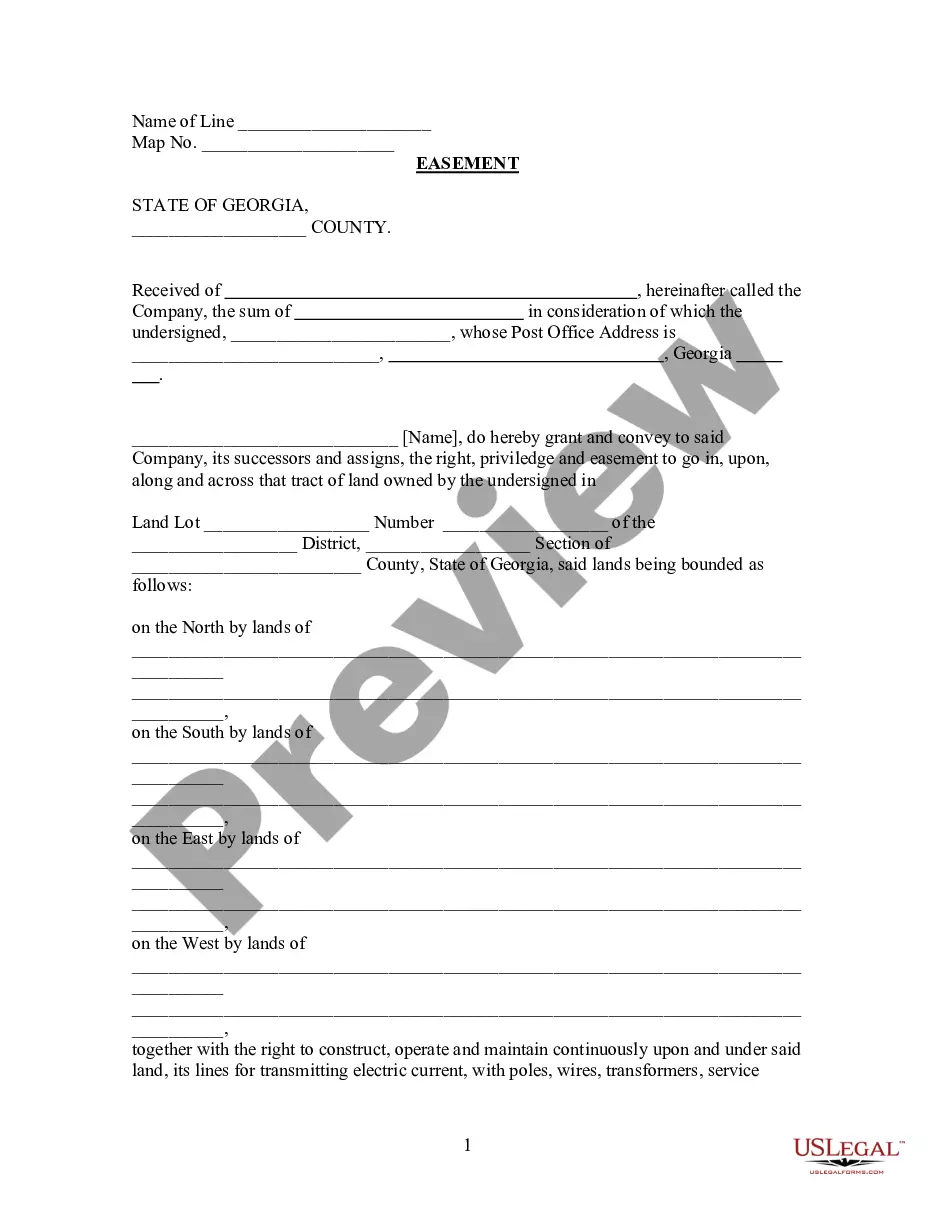

The default is that the rights to minerals ? including diamonds (like the 23-carat diamond found in Richmond in 1855!)* ? that exist under a piece of property convey with the land itself. In Virginia, owners can separate mineral rights from other property rights.

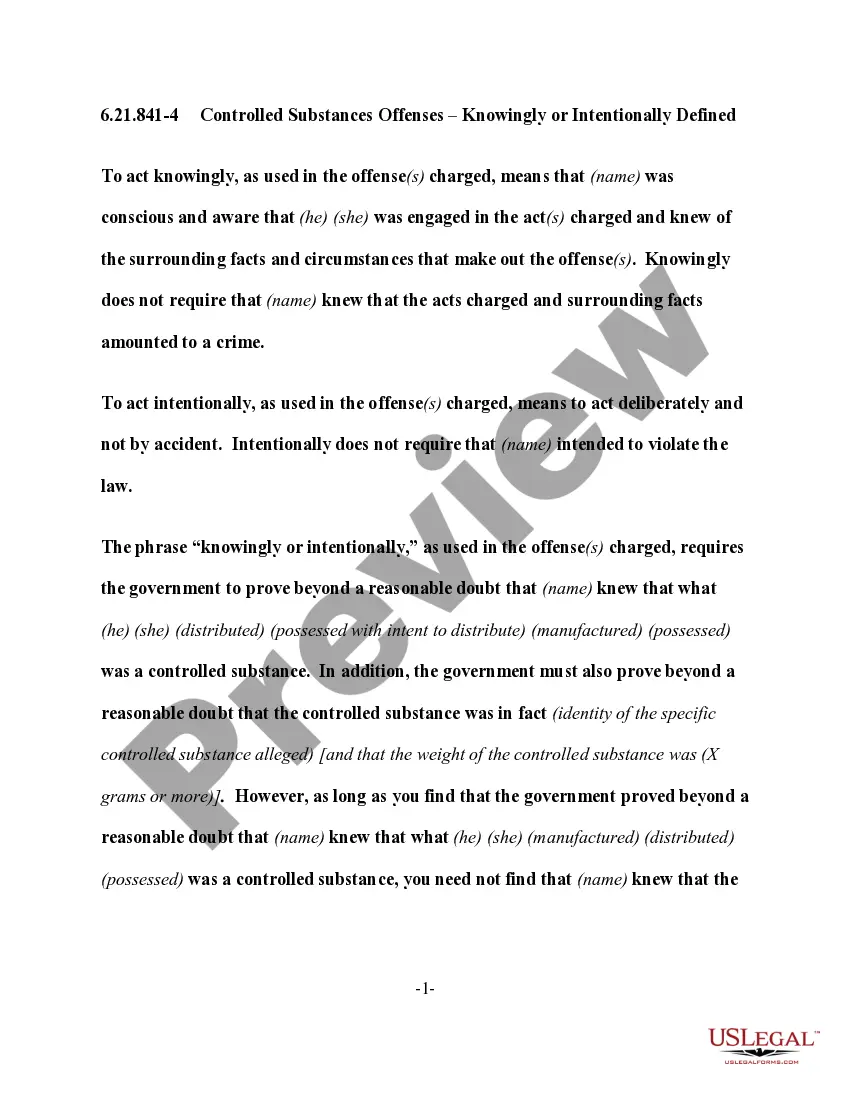

NRA = 40.00 net mineral acres x ([1/5] Lease Royalty Rate / [1/8] Standard Royalty Rate) NRA = 40.00 x (0.20 / 0.125) NRA = 40.00 x 1.60 NRA = 64.00 Net Royalty Acres This mathematical concept can also be used inversely to calculate your net mineral acres in a parcel based on the Net Revenue Interest (NRI) you are ...

If there is more than one mineral owner, multiply the net revenue by the fractional interest of each owner to determine their respective royalty interest.

The value of an overriding royalty interest is simple to calculate since it is a percent of the working interest lease. The ORRI value is based on production on the acreage leased by the working interest.

The most common way is through a will or estate plan. When the mineral rights owner dies, their heirs will become the new owners. Another way to transfer mineral rights is through a lease. If the mineral rights are leased to a third party, the new owner will need approval from the current lessee to claim them.

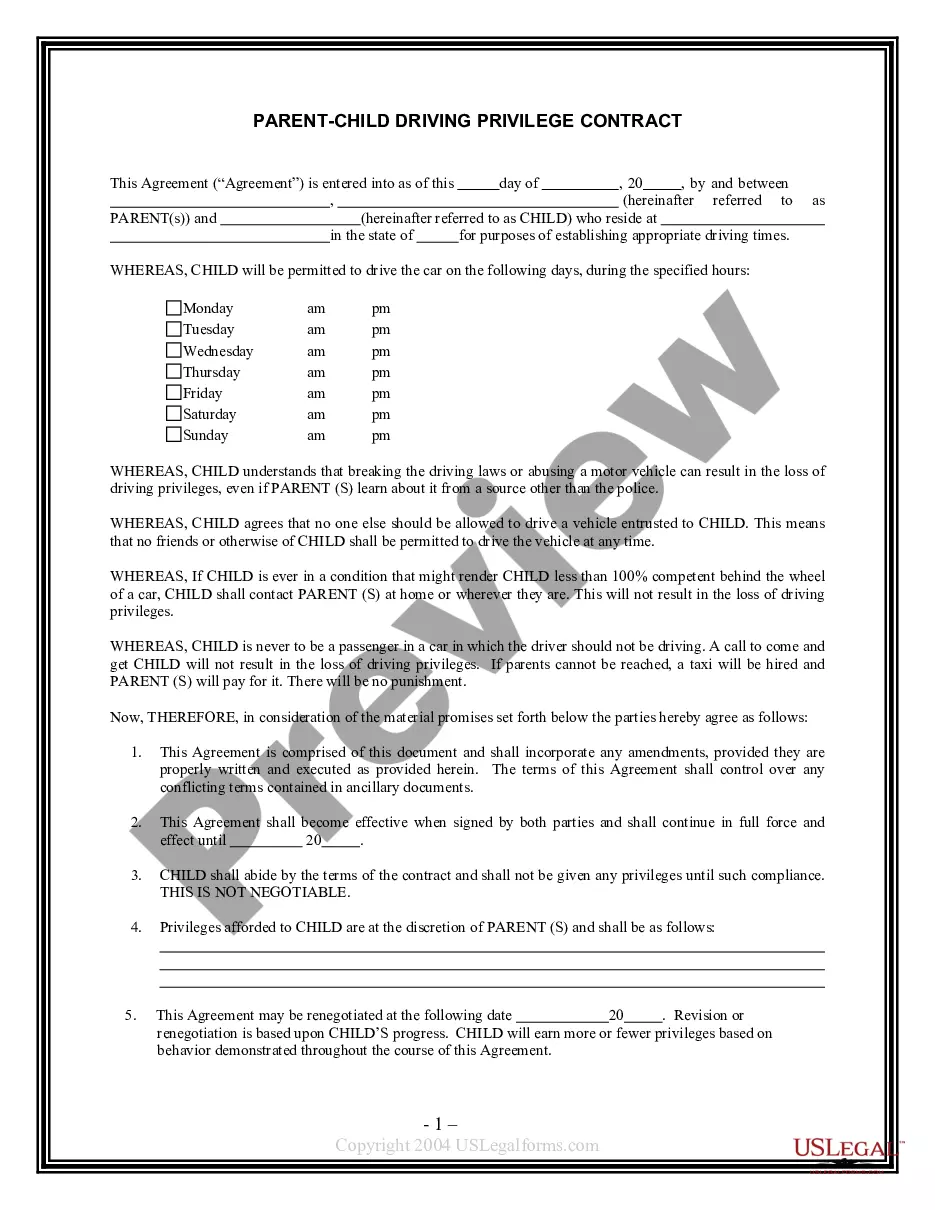

Typically, NPRIs are created by an express grant or reservation in a deed and are entirely different from a ?leasehold? royalty. The holder of a NPRI has no power to negotiate or execute an oil and gas lease and has no power to enter upon the land to extract the hydrocarbons.

Calculating Overriding Royalty Interest An ORRI is a straight percentage. For example, a 2% override would appear on the royalty statement as 0.02 interest in the proceeds from the sale of the leased hydrocarbons.

The formula to calculate NPRI without proportionate share reduction is LRR ? RI = NPRI. As an example, reducing your revenue interest from 25% LRR results in 1/16 NPRI, leaving 75% NRI for working interest owners.