Virginia Term Sheet

Description

The Term Sheet is not a commitment to invest, and is conditioned on the completion of the conditions to closing set forth."

How to fill out Term Sheet?

US Legal Forms - one of many greatest libraries of authorized kinds in the States - delivers a wide array of authorized record web templates it is possible to acquire or printing. While using site, you can find thousands of kinds for company and individual purposes, sorted by groups, says, or key phrases.You will discover the most up-to-date versions of kinds such as the Virginia Term Sheet within minutes.

If you have a registration, log in and acquire Virginia Term Sheet in the US Legal Forms catalogue. The Down load switch will show up on each type you perspective. You have accessibility to all previously delivered electronically kinds inside the My Forms tab of your respective accounts.

If you wish to use US Legal Forms the first time, listed here are straightforward directions to get you began:

- Make sure you have picked the best type for your city/area. Go through the Review switch to analyze the form`s articles. See the type explanation to ensure that you have chosen the correct type.

- When the type doesn`t satisfy your specifications, make use of the Research field near the top of the display screen to discover the the one that does.

- When you are content with the shape, validate your decision by clicking the Acquire now switch. Then, select the rates strategy you like and supply your credentials to sign up to have an accounts.

- Approach the financial transaction. Utilize your bank card or PayPal accounts to finish the financial transaction.

- Find the format and acquire the shape on the product.

- Make adjustments. Fill up, modify and printing and indicator the delivered electronically Virginia Term Sheet.

Each and every format you included with your money lacks an expiration particular date and is your own property permanently. So, if you want to acquire or printing an additional version, just check out the My Forms section and then click about the type you will need.

Obtain access to the Virginia Term Sheet with US Legal Forms, the most substantial catalogue of authorized record web templates. Use thousands of expert and condition-distinct web templates that meet your business or individual demands and specifications.

Form popularity

FAQ

Attorney All deeds must be prepared by the owner of the property or by an attorney licensed to practice in Virginia. Deeds Requirements - - the Norfolk Circuit Court Clerk's Office norfolkcircuitcourt.us ? deeds ? deeds-requi... norfolkcircuitcourt.us ? deeds ? deeds-requi...

How Virginia Tax is Calculated Va Taxable IncomeTax Calculation0 - $3,0002%$3,001 - $5,000$60 + 3% of excess over $3,000$5,001 - $17,000$120 + 5% of excess over $5,000$17,001 -$720 + 5.75% of excess over $17,000

The tax is based on the Federal Adjusted Gross Income. In most cases, your federal adjusted gross income (line 21 on form 1040A; and line 37 on form 1040) plus any Virginia additions and minus any Virginia subtractions computed on Schedule ADJ, is called Virginia Adjusted Gross Income.

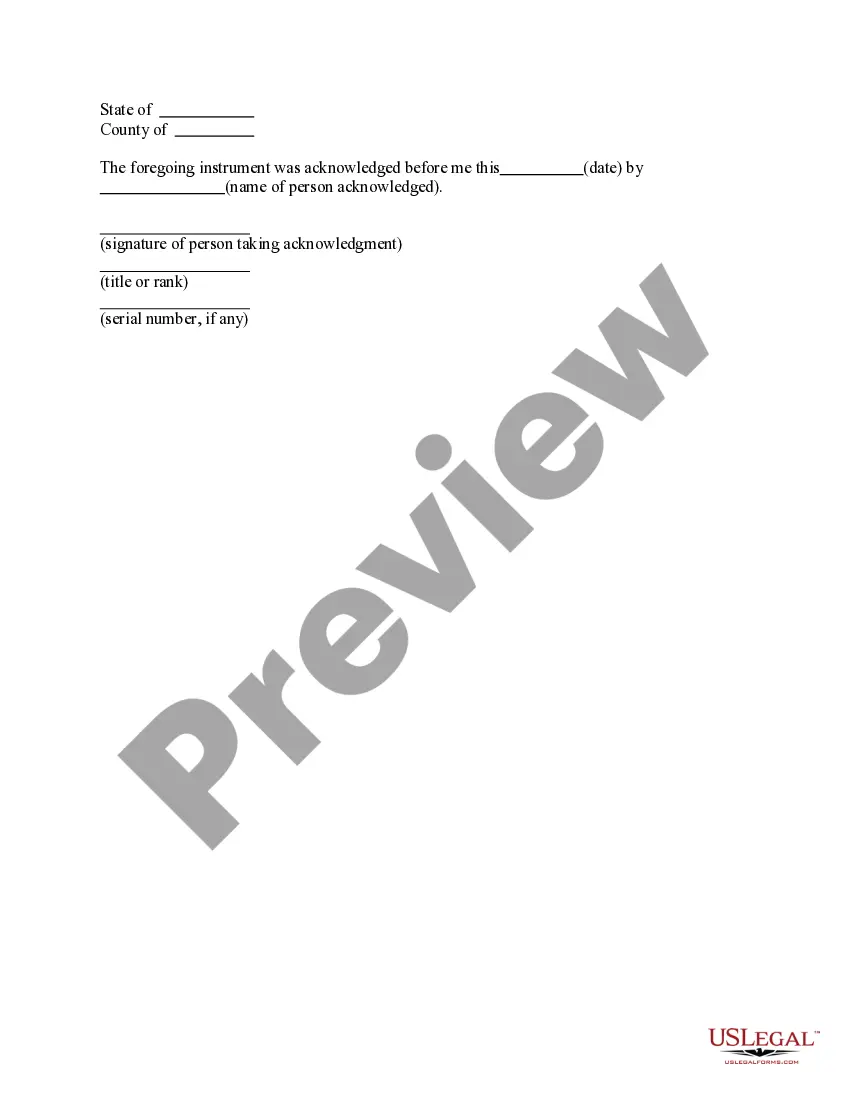

All documents put to record must be acknowledged and contain a notary seal. All acknowledgements by a Virginia notary must include their commission number, expiration date and a darkened seal. Recording Requirements for Land Records | James City County, VA jamescitycountyva.gov ? Recording-Requirements... jamescitycountyva.gov ? Recording-Requirements...

The cover sheet shall be developed in conjunction with the Office of the Executive Secretary of the Supreme Court of Virginia and shall include the following information: (i) the name of each party to be indexed as grantor and the name of each party to be indexed as grantee and, in the case of any individual grantor or ... § 17.1-227.1. Use of cover sheets on deeds or ... - Virginia Law Virginia Law (.gov) ? vacode ? section17.1-227.1 Virginia Law (.gov) ? vacode ? section17.1-227.1

The cover sheet must include the following: All grantors, grantees, and identify surname if applicable. Amount of consideration and actual value if a deed or instrument. State the Virginia or Federal law under which any exemption from recordation taxes being claimed. Tax map or pin number. Who to return to after recordation.

Every deed and corrected or amended deed may be made in the following form, or to the same effect: "This deed, made the ______ day of ______, in the year ____, between (here insert names of parties as grantors or grantees), witnesseth: that in consideration of (here state the consideration, nominal or actual), the said ... § 55.1-300. Form of a deed - Virginia Law virginia.gov ? vacode ? chapter3 ? section55 virginia.gov ? vacode ? chapter3 ? section55

Virginia law conforms to the federal definition of income subject to withholding. Virginia withholding is generally required on any payment for which federal withholding is required. This includes most wages, pensions and annuities, gambling winnings, vacation pay, bonuses, and certain expense reimbursements.