Virginia Book Value Phantom Stock Plan of First Florida Banks, Inc.

Description

How to fill out Book Value Phantom Stock Plan Of First Florida Banks, Inc.?

Finding the right authorized document web template can be a have difficulties. Naturally, there are plenty of web templates available on the Internet, but how would you find the authorized form you will need? Use the US Legal Forms website. The support offers thousands of web templates, such as the Virginia Book Value Phantom Stock Plan of First Florida Banks, Inc., that you can use for organization and personal requirements. All the varieties are checked out by pros and meet state and federal needs.

If you are previously authorized, log in for your profile and click on the Obtain key to have the Virginia Book Value Phantom Stock Plan of First Florida Banks, Inc.. Make use of your profile to look through the authorized varieties you have purchased formerly. Check out the My Forms tab of your own profile and get one more version from the document you will need.

If you are a new customer of US Legal Forms, here are basic instructions so that you can follow:

- Initially, make certain you have selected the appropriate form for your city/area. You are able to look over the shape utilizing the Review key and read the shape information to make sure this is basically the right one for you.

- In case the form is not going to meet your needs, make use of the Seach industry to find the proper form.

- Once you are positive that the shape is suitable, click on the Buy now key to have the form.

- Choose the prices plan you desire and enter in the required details. Create your profile and pay money for an order utilizing your PayPal profile or bank card.

- Opt for the document file format and down load the authorized document web template for your product.

- Complete, modify and produce and sign the received Virginia Book Value Phantom Stock Plan of First Florida Banks, Inc..

US Legal Forms may be the biggest collection of authorized varieties in which you can find a variety of document web templates. Use the company to down load appropriately-made paperwork that follow express needs.

Form popularity

FAQ

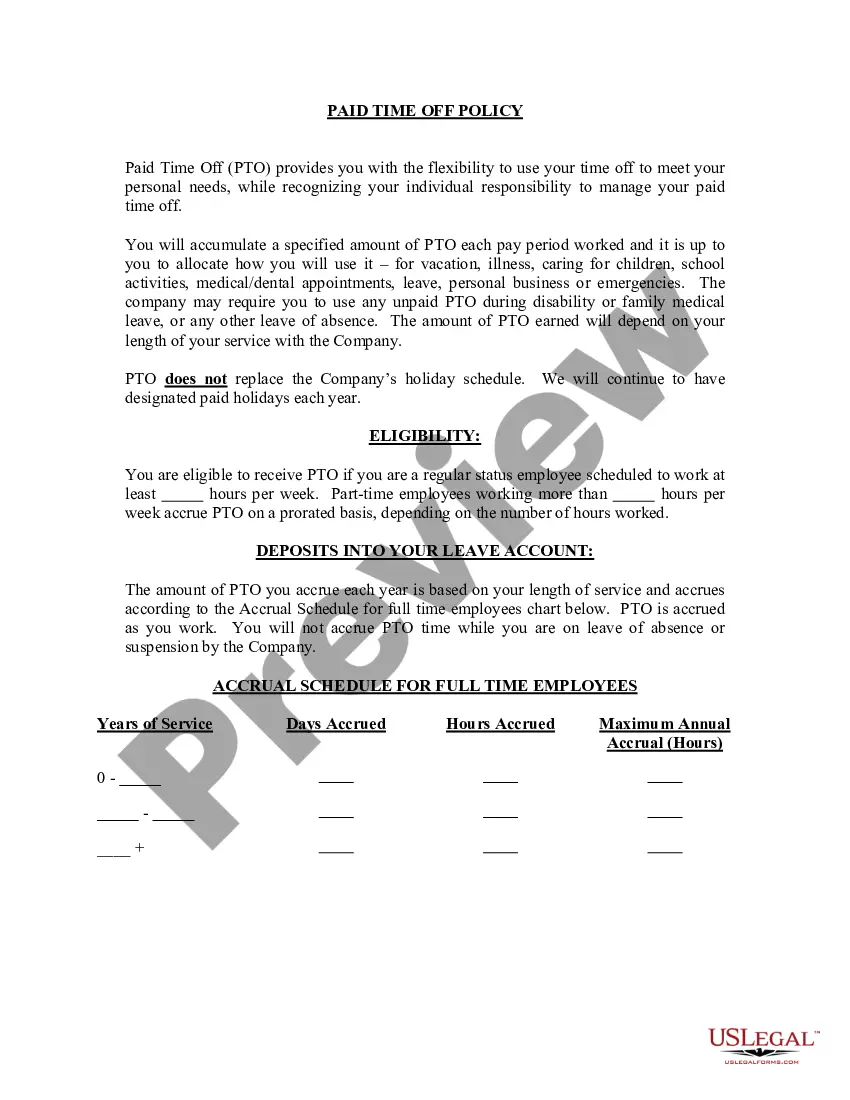

Phantom stock plans are considered ?liability awards? for accounting purposes (assuming they will be settled in cash rather than stock).

However, phantom stocks come with a considerable amount of disadvantages that can diminish participants' perceived control and influence, strain company liquidity, require extensive administrative efforts, introduce tax complexities, create disagreements, and subject participants to volatility in financial benefits ...

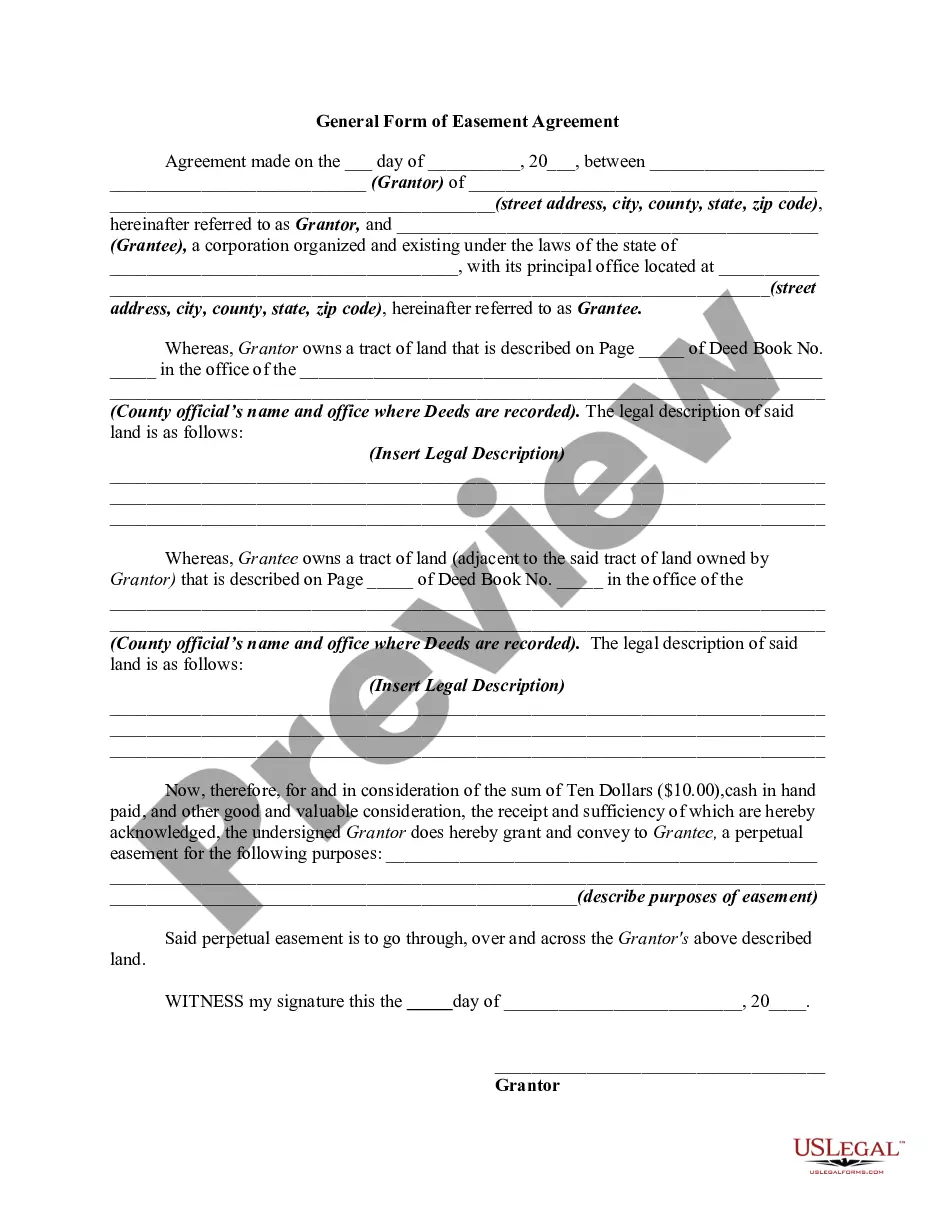

The plan may provide for a single payment, or it may provide for installment payments over a period of time after the phantom stock vests. In some cases, the employer may let the employee elect to receive the payout in the form of an equivalent amount of stock.

Phantom stock plans are considered ?liability awards? for accounting purposes (assuming they will be settled in cash rather than stock). As such, the sponsoring company must recognize the plan expense ratably over the vesting period. Varying accrual schedules can be found in the market.

Phantom shares are usually paid out when the company gets acquired or IPOes. The phantom shares are paid out in cash for their corresponding value.

The answer involves two variables: (a) the presumed value of the company, and (b) the number of shares to be used in the plan. Once these two answers are known, the phantom share price is calculated as the former (the value) divided by the latter (the number of shares).

It is possible to create a phantom stock plan that avoids the application of 409A rules. The key requirement would be to (a) use cliff vesting (any incremental vesting must trigger immediate payment), and (b) pay benefits within 2½ months of the end of the year in which the awards vest.

As a default, this form plan provides for forfeiture of all unvested phantom stock units upon a participant's termination of employment (subject to the terms of the award agreement).