Virginia Proposed book value phantom stock plan with appendices for First Florida Bank, Inc.

Description

How to fill out Proposed Book Value Phantom Stock Plan With Appendices For First Florida Bank, Inc.?

Choosing the right legal file web template can be a battle. Needless to say, there are a variety of layouts available on the Internet, but how can you obtain the legal kind you require? Make use of the US Legal Forms site. The service provides thousands of layouts, such as the Virginia Proposed book value phantom stock plan with appendices for First Florida Bank, Inc., which can be used for organization and private demands. All the forms are checked by specialists and satisfy state and federal demands.

Should you be presently registered, log in for your profile and then click the Down load option to have the Virginia Proposed book value phantom stock plan with appendices for First Florida Bank, Inc.. Use your profile to check throughout the legal forms you may have bought in the past. Go to the My Forms tab of your profile and obtain one more version of the file you require.

Should you be a new customer of US Legal Forms, listed below are basic recommendations for you to follow:

- Initial, make sure you have chosen the right kind for your personal metropolis/county. You may examine the shape while using Preview option and study the shape outline to ensure this is the best for you.

- When the kind fails to satisfy your preferences, take advantage of the Seach area to find the correct kind.

- Once you are positive that the shape is acceptable, go through the Get now option to have the kind.

- Opt for the costs strategy you would like and enter the required information. Build your profile and pay money for your order utilizing your PayPal profile or bank card.

- Select the submit file format and down load the legal file web template for your product.

- Comprehensive, edit and print out and indicator the acquired Virginia Proposed book value phantom stock plan with appendices for First Florida Bank, Inc..

US Legal Forms is definitely the largest local library of legal forms for which you will find various file layouts. Make use of the service to down load expertly-made files that follow express demands.

Form popularity

FAQ

Phantom stock is a contract between an employer and an employee that grants the employee the right to receive a payment based on the value of the employer's stock. When granting phantom stock, the employer does not grant the employee any shares of the employer's stock.

The answer involves two variables: (a) the presumed value of the company, and (b) the number of shares to be used in the plan. Once these two answers are known, the phantom share price is calculated as the former (the value) divided by the latter (the number of shares).

How Phantom Stock Plans Are Taxed. Payments from phantom stock plans are subject to typical income taxes, not capital gains taxes. In turn, companies can deduct phantom plan payouts the year the employee reports the income.

Providing phantom stock allows the company to reward employees for their hard work without worrying about those big problems. Phantom shares are typically used to encourage senior leadership to produce better results for the company.

The definition of Exit Event used in this form phantom plan complies with Section 409A as the plan is designed so that awards are settled upon an Exit Event or, if earlier, a termination of a participant's employment, which is also a permissible payment event for purposes of Section 409A.

For example, capping the cash payment to a company share price limit of $50. If the issuing phantom stock price is $30, and the company's share price at redemption is $100, the cash payment per phantom stock would be capped at $50 ? $30 = $20.

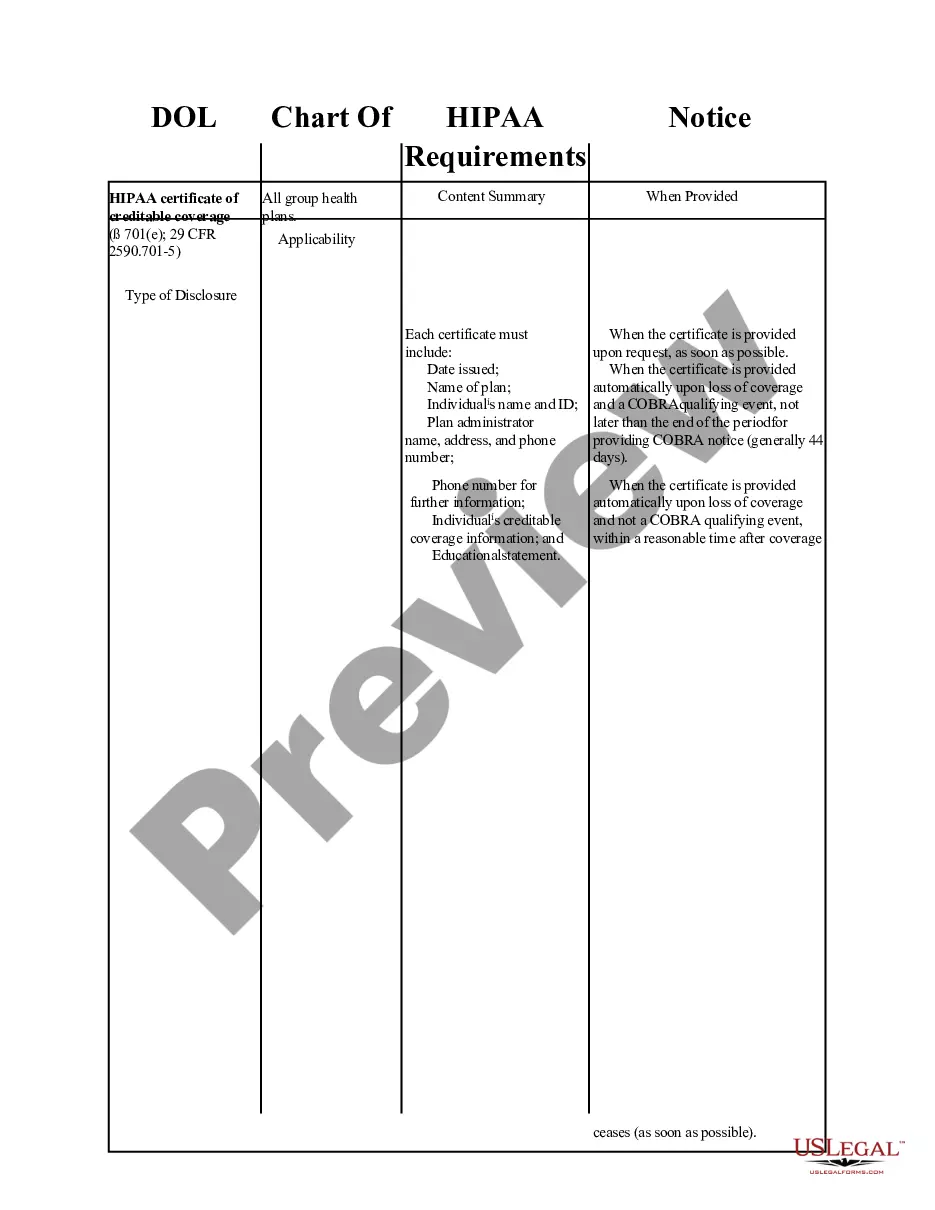

Qualified plans, such as 401(k) programs, are subject to all of the rules and restrictions of ERISA. Nonqualified plans, including most phantom stock plans, are not.

Phantom stock plans are considered ?liability awards? for accounting purposes (assuming they will be settled in cash rather than stock). As such, the sponsoring company must recognize the plan expense ratably over the vesting period. Varying accrual schedules can be found in the market.