Virginia Jury Instruction - 1.9.5.2 Subsidiary As Alter Ego Of Parent Corporation

Description

How to fill out Jury Instruction - 1.9.5.2 Subsidiary As Alter Ego Of Parent Corporation?

Are you currently in the place the place you require papers for possibly enterprise or specific reasons nearly every time? There are a lot of lawful document layouts available online, but locating kinds you can trust is not straightforward. US Legal Forms offers thousands of type layouts, much like the Virginia Jury Instruction - 1.9.5.2 Subsidiary As Alter Ego Of Parent Corporation, that happen to be composed to satisfy state and federal requirements.

When you are already knowledgeable about US Legal Forms site and get a merchant account, just log in. Afterward, you can obtain the Virginia Jury Instruction - 1.9.5.2 Subsidiary As Alter Ego Of Parent Corporation web template.

Should you not provide an bank account and wish to begin using US Legal Forms, adopt these measures:

- Get the type you require and make sure it is for that right city/county.

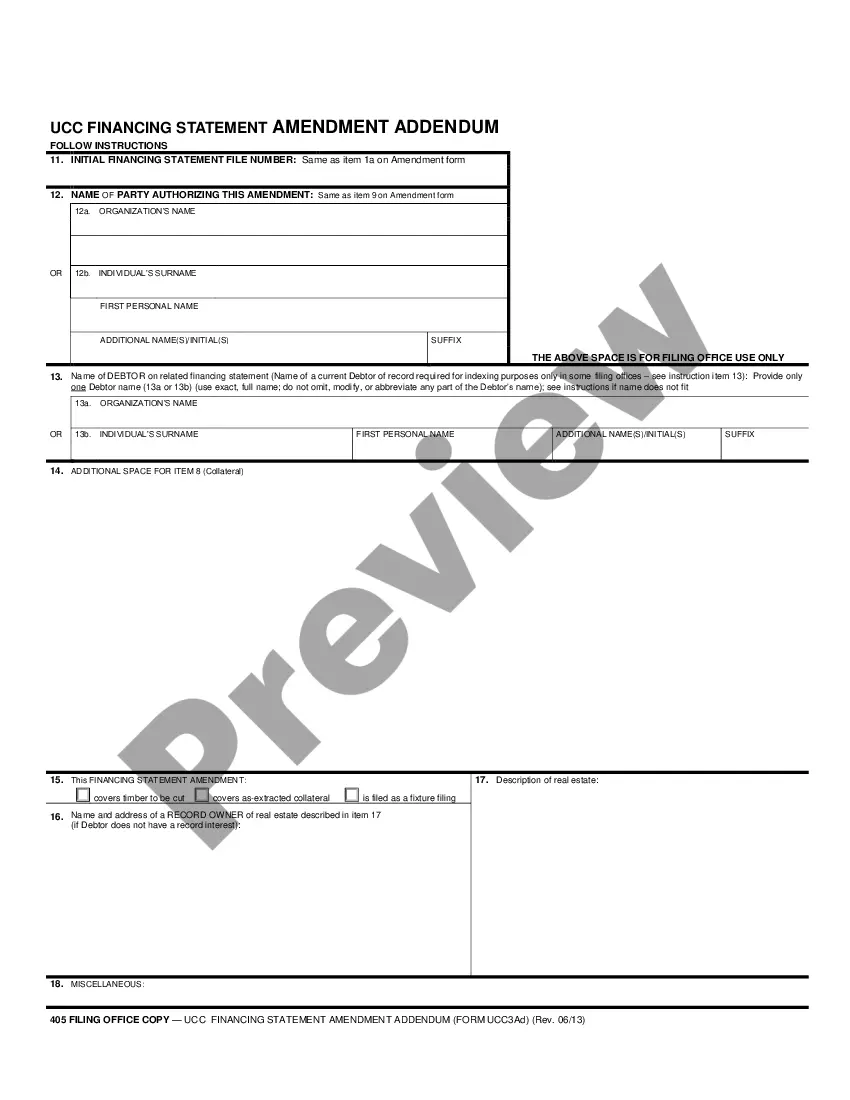

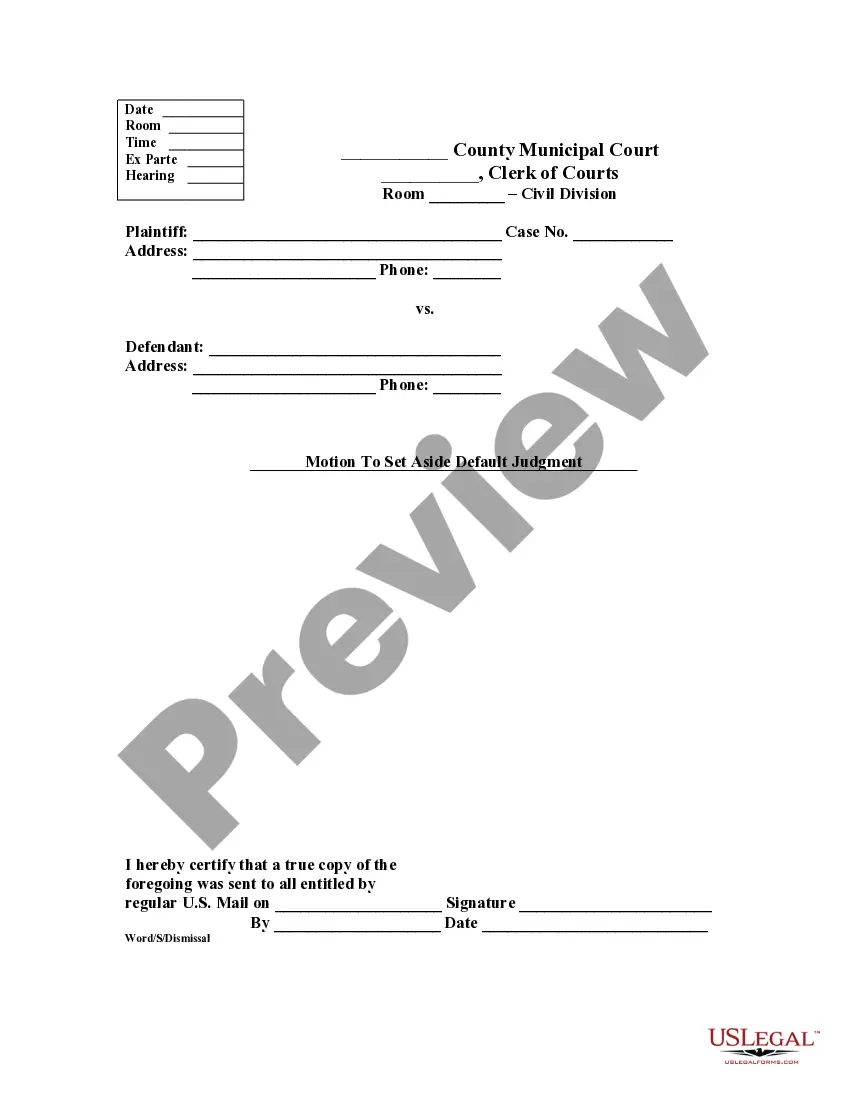

- Use the Preview switch to examine the shape.

- See the explanation to ensure that you have selected the proper type.

- In the event the type is not what you are searching for, utilize the Research field to discover the type that suits you and requirements.

- When you get the right type, click Purchase now.

- Select the rates plan you would like, fill out the required information to make your bank account, and buy the transaction utilizing your PayPal or bank card.

- Select a practical file format and obtain your copy.

Locate all the document layouts you might have purchased in the My Forms menu. You may get a additional copy of Virginia Jury Instruction - 1.9.5.2 Subsidiary As Alter Ego Of Parent Corporation any time, if needed. Just click the required type to obtain or print the document web template.

Use US Legal Forms, one of the most comprehensive assortment of lawful forms, to save lots of time as well as steer clear of blunders. The services offers skillfully made lawful document layouts that can be used for an array of reasons. Produce a merchant account on US Legal Forms and begin producing your life easier.

Form popularity

FAQ

In short, "clear" describes the character of unambiguous evidence, whether true or false; "convincing" describes the effect of evidence on an observer.

The Model Jury Instruction Committee is comprised of outstanding and experienced Virginia judges, practicing attorneys, and law professors who devote substantial time in the maintenance of this essential litigation resource.

In summary, the clear and convincing standard is higher than the preponderance of the evidence standard but lower than the beyond a reasonable doubt standard. It requires a high level of certainty in the evidence presented, but not to the same extent as in criminal cases.

Yes. Every juror must agree on the verdict. This is known as a unanimous verdict. If the jury cannot agree, then the judge must declare a mistrial.

Defendants claim that alter ego liability is a question of law that the Court must determine. Plaintiffs claim just the opposite; that alter ego liability is a matter of fact, to be resolved by the trier of fact: the jury.

The evidence must be credible; the memories of the witnesses must be clear and without confusion; and the sum total of the evidence must be of sufficient weight to convince the trier of fact without hesitancy.

In order to prove something by clear and convincing standard the evidence must prove that it is ?substantially more likely than not? that it is true. There isn't an exact percentage you have to win by under this standard but a rule of thumb would be approximately 80%.

Ing to the Supreme Court in Colorado v. New Mexico, 467 U.S. 310 (1984), "clear and convincing? means that the evidence is highly and substantially more likely to be true than untrue. In other words, the fact finder must be convinced that the contention is highly probable.