Virginia Equipment Lease - Detailed

Description

How to fill out Equipment Lease - Detailed?

If you wish to finalize, retrieve, or create legal document templates, utilize US Legal Forms, the premier collection of legal documents available online.

Employ the site's straightforward and user-friendly search to find the documents you need.

A variety of templates for business and personal purposes are organized by categories and regions, or keywords.

Each legal document template you acquire is yours permanently. You will have access to every document you downloaded in your account. Click on the My documents section and select a document to print or download again.

Stay competitive and download, and print the Virginia Equipment Lease - Detailed with US Legal Forms. There are numerous professional and state-specific documents available for your business or personal needs.

- Use US Legal Forms to find the Virginia Equipment Lease - Detailed with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Virginia Equipment Lease - Detailed.

- You can also access forms you previously downloaded from the My documents tab in your account.

- If you are utilizing US Legal Forms for the first time, follow the steps below.

- Step 1. Make sure you have selected the form for the appropriate city/state.

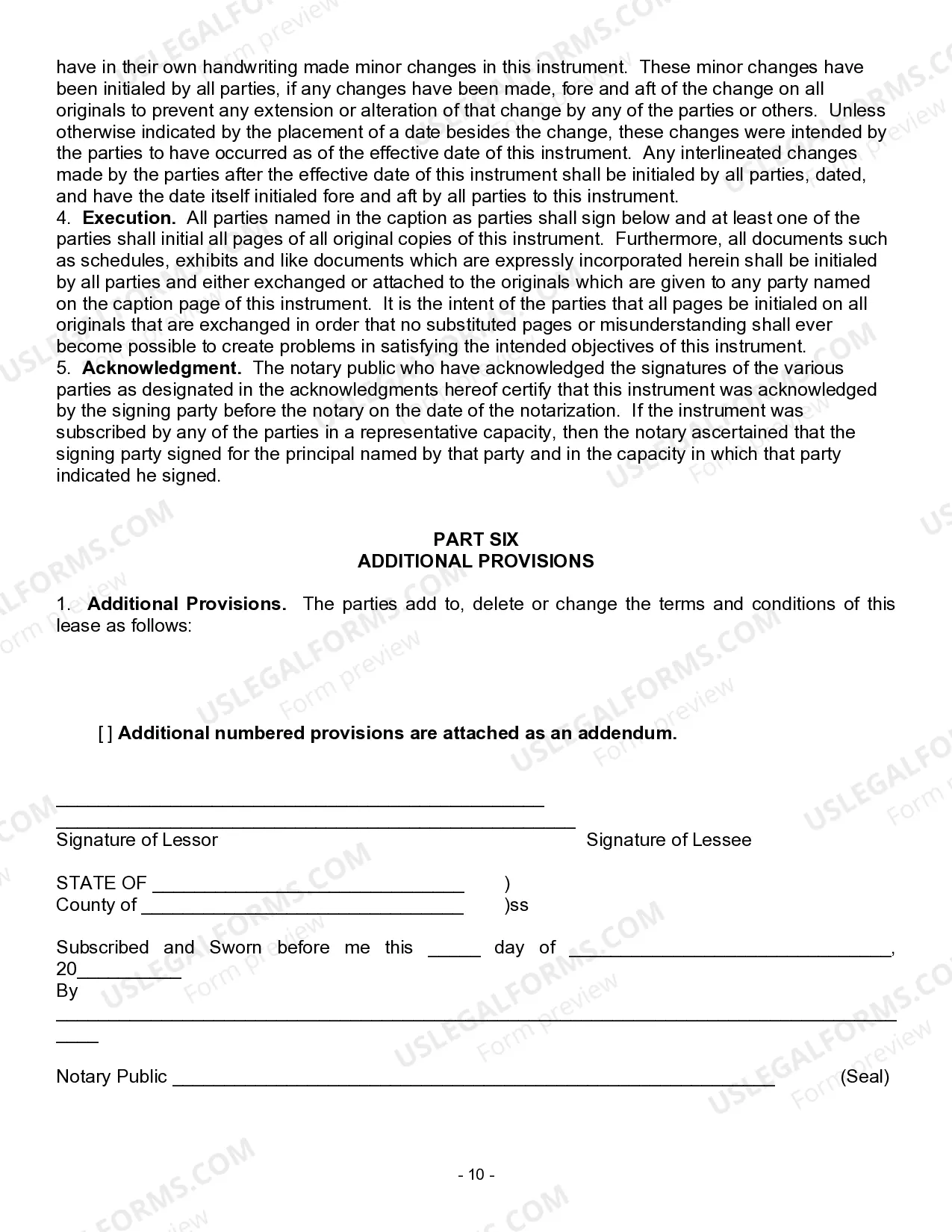

- Step 2. Use the Review option to examine the form's details. Be sure to read the summary.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, select the Buy now button. Choose the pricing plan you prefer and enter your information to create an account.

- Step 5. Complete the purchase. You may use your Visa or Mastercard or PayPal account to process the payment.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Fill out, modify, and print or sign the Virginia Equipment Lease - Detailed.

Form popularity

FAQ

The recordation tax on a lease in Virginia depends on the terms of the lease and whether it involves real property. Generally, typical lease agreements may not incur recordation tax, but it's wise to consult specific regulations for unique cases. Knowing the details can help you manage your Virginia Equipment Lease - Detailed effectively. Use US Legal Forms for accurate documentation and to stay informed about your tax responsibilities.

In Virginia, a transfer tax typically applies to real estate transactions rather than leases. However, it’s important to review the specific terms of your Virginia Equipment Lease - Detailed, as other fees may apply based on the lease terms. To navigate these regulations smoothly, consider utilizing US Legal Forms, which can guide you through lease agreements and related tax obligations.

Recordation tax and transfer tax are related but not the same. Recordation tax applies specifically to the recording of legal documents with the appropriate local government office, while transfer tax is imposed on the transaction itself. When discussing your Virginia Equipment Lease - Detailed, be aware of both taxes as they may impact your overall costs. For more detailed explanations, you can explore the resources available on US Legal Forms.

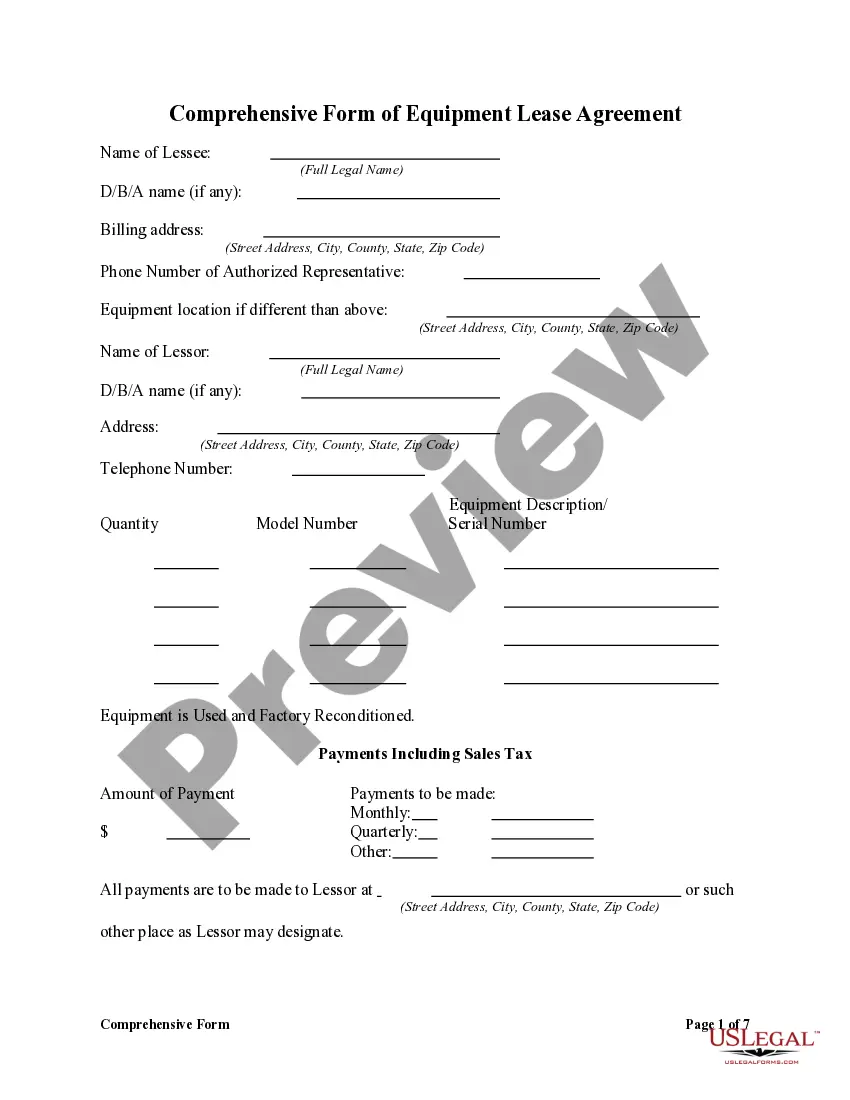

Creating a rental agreement for equipment is a straightforward process. You'll need to outline key details, such as the equipment description, rental period, payment terms, and responsibilities for maintenance and damages. To ensure your agreement complies with legal standards, consider using resources like US Legal Forms for templates tailored to a Virginia Equipment Lease - Detailed.

A good equipment lease rate can vary based on the type of equipment, the market, and the duration of the lease. Generally, you should look for rates that are competitive while ensuring that they fit your budget. To determine a fair rate, research industry standards and consult with professionals; platforms like US Legal Forms can offer helpful resources to guide you.

In Virginia, property tax is generally the responsibility of the owner of the equipment, which is usually the lessor. However, depending on the agreement, the lessee may be required to reimburse the lessor for this tax. It's crucial to clarify this in your Virginia Equipment Lease - Detailed to avoid surprises and misunderstandings later.

Setting up an equipment lease involves several straightforward steps. First, identify the equipment you need and research leasing options that fit your budget. Then, draft a leasing agreement that outlines terms such as lease duration, payment amounts, and maintenance responsibilities; consider using platforms like US Legal Forms to find templates and professional guidance.

Exiting an equipment lease agreement can be complex, but it's manageable with the right information. Begin by reviewing your lease terms for any exit clauses, as many agreements include these provisions. Consider negotiating with the leasing company or look into early termination options, which may involve fees. If you need more clarity, uslegalforms can offer tools and resources to help you navigate this process effectively.

Writing off leased equipment in a Virginia Equipment Lease - Detailed is straightforward. Generally, you track the lease payments on your tax return, as you can deduct them as business expenses. It is essential to maintain proper documentation to substantiate these deductions. If you need assistance, platforms like uslegalforms can guide you through the process.

A lease becomes legally binding in Virginia when both parties agree to its terms, which must be clear and detailed. Essential elements include the lease duration, payment amount, and equipment description. Any amendments or additional clauses should be documented in writing. For a comprehensive understanding of your obligations under a Virginia Equipment Lease - Detailed, consulting legal resources or professionals is advisable.