Virginia Equipment Lease - General

Description

How to fill out Equipment Lease - General?

Are you presently facing the circumstance where you need documents for both professional and personal purposes almost every day.

There are numerous official document templates accessible online, but finding versions you can rely on isn’t easy.

US Legal Forms provides a vast selection of form templates, such as the Virginia Equipment Lease - General, designed to comply with federal and state regulations.

Once you find the appropriate form, click Purchase now.

Choose the payment plan you prefer, provide the necessary information to create your account, and complete your order using your PayPal or Visa or Mastercard.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Virginia Equipment Lease - General template.

- If you do not possess an account and wish to start using US Legal Forms, adhere to these steps.

- Select the form you desire and ensure it is for the correct area/region.

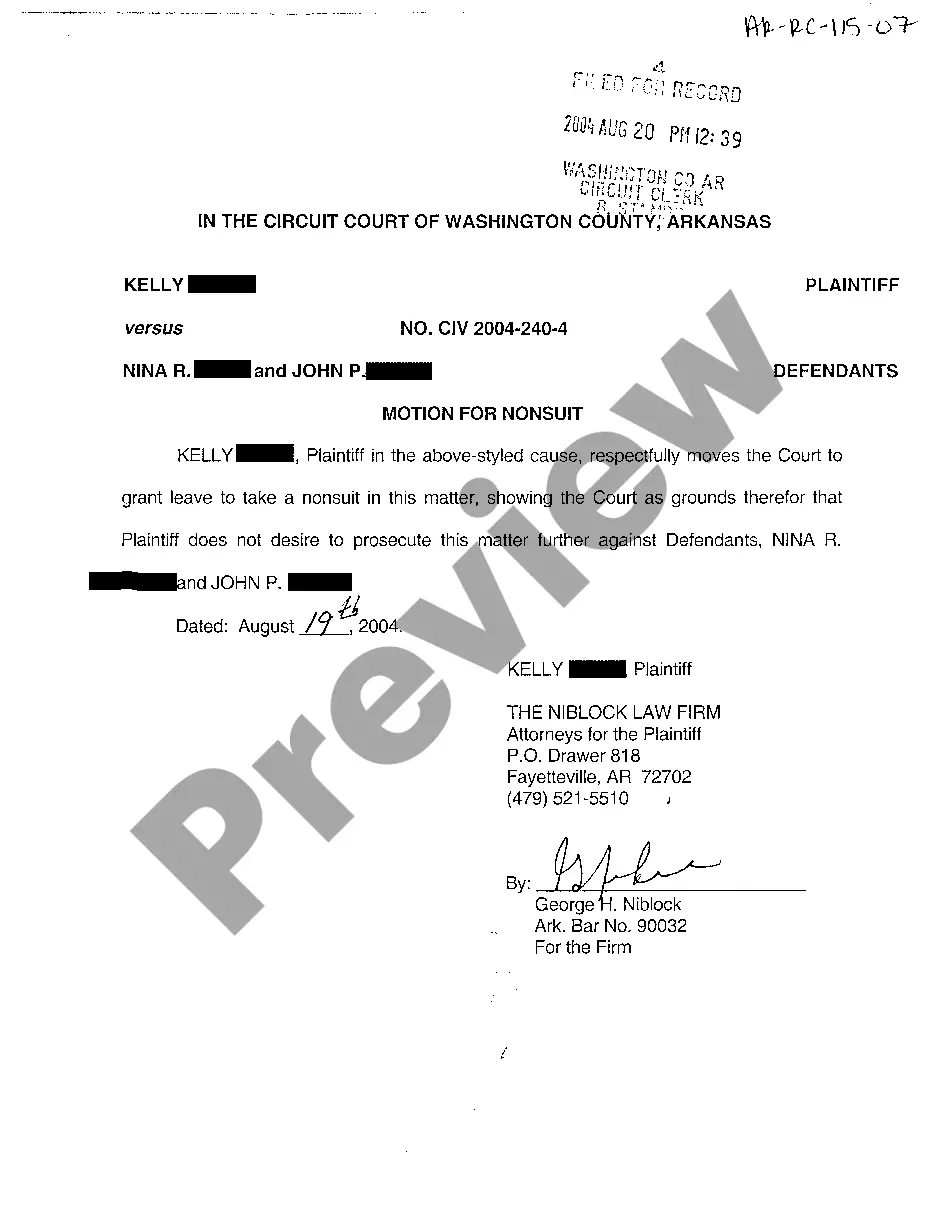

- Use the Preview button to review the form.

- Examine the details to confirm that you have selected the correct form.

- If the form isn’t what you're searching for, utilize the Search bar to find the form that fits your requirements and specifications.

Form popularity

FAQ

Certain items are exempt from sales tax in Virginia, which can be beneficial when considering a Virginia Equipment Lease - General. For example, machinery and equipment used directly in manufacturing may be exempt. Additionally, specific non-profit organizations can also qualify for sales tax exemptions. To navigate these exemptions effectively, consider using platforms like US Legal Forms for detailed guidance.

In Virginia, rentals typically fall under the sales tax requirements. When you enter into a Virginia Equipment Lease - General, it is crucial to consider that the rental payments may be subject to sales tax. This tax applies to tangible personal property, which includes most leased equipment. To understand how this might affect your lease, consulting with tax professionals or using resources like US Legal Forms can provide clarity.

Setting up a Virginia Equipment Lease - General involves a few key steps. First, outline your needs and budget to select suitable equipment. After that, gather the necessary documents, decide on the lease length, and consult with a professional or use tools available on uslegalforms to draft a well-structured lease agreement that protects all parties involved.

To set up a Virginia Equipment Lease - General, start by identifying the equipment you wish to lease. Next, determine the terms of the lease, such as duration, payment amounts, and maintenance responsibilities. Once you have that information, you can draft the lease agreement or utilize platforms like uslegalforms to ensure compliance with state regulations.

A good lease rate often falls below the average for the specific equipment you are leasing. Generally, if your rate is competitive and aligns with your financial situation and business goals, it's considered good. While seeking a Virginia Equipment Lease - General, don’t hesitate to analyze different offers; finding the right rate can significantly impact your bottom line.

Typically, lease interest rates can vary depending on the type of equipment and the duration of the lease. Generally, they might range from 5% to 15%. When you look for a Virginia Equipment Lease - General, understanding these rates can empower you to make informed decisions, especially when planning for long-term operational costs.

The average interest rate on equipment financing can range significantly based on market conditions and the lessee's credit profile. Typically, rates may fall between 3% to 10%. For those exploring a Virginia Equipment Lease - General, comparing multiple financing options can help you find a rate that meets your financial objectives.

In Virginia, lease agreements generally do not require notarization to be valid; however, some situations may call for it. A notarized document can provide additional legal protection and help resolve potential disputes. If you are considering a Virginia Equipment Lease - General, always check the specifics of your agreement with a legal professional to ensure compliance.

The lease rate factor of equipment reflects how much a business pays per dollar of leased equipment. It often varies based on factors like creditworthiness and lease terms. When looking at a Virginia Equipment Lease - General, understanding this factor can help you estimate your monthly payments, making budgeting easier.

Yes, you can write a lease yourself, including a Virginia Equipment Lease - General, if you follow the proper guidelines. Understand the essential elements that must be included, such as the identities of both parties, lease terms, payment details, and obligations. However, consider using a reliable platform like US Legal Forms to access templates and ensure that your lease complies with Virginia laws.