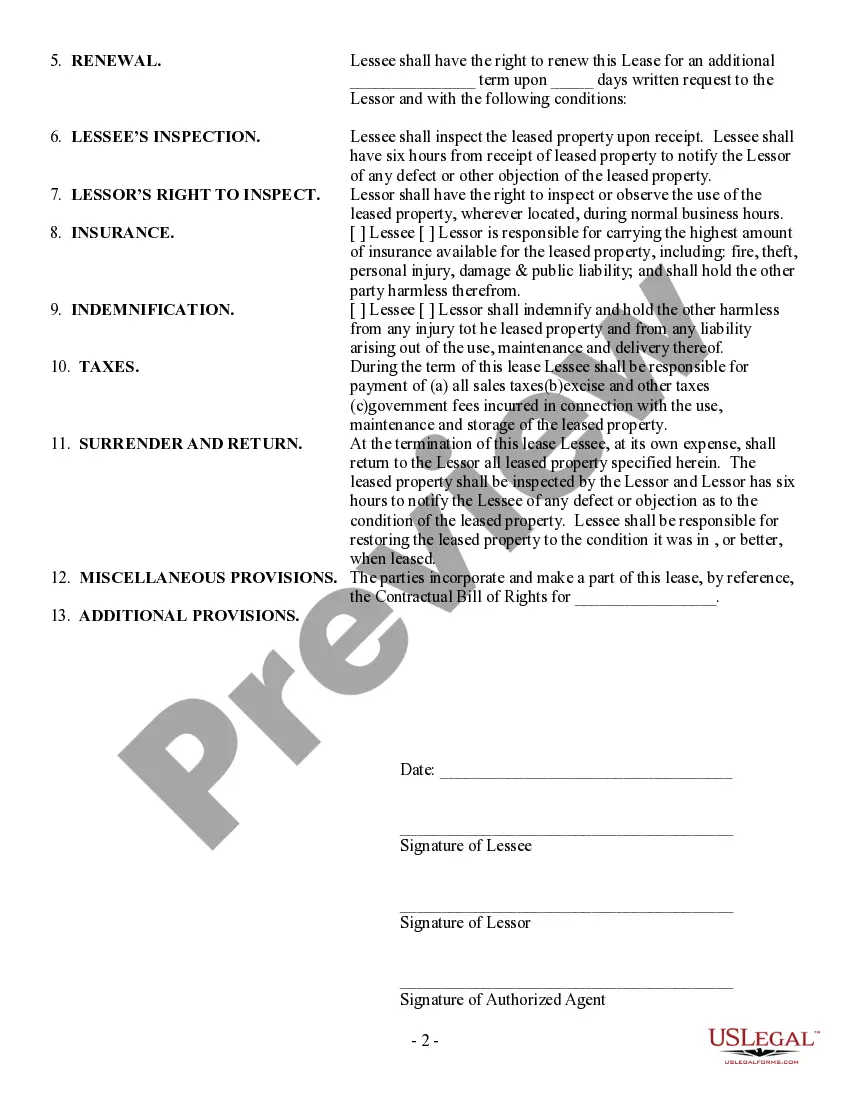

Virginia Simple Equipment Lease

Description

How to fill out Simple Equipment Lease?

Finding the appropriate legal document template can be quite a challenge.

Of course, there are numerous templates available online, but how do you acquire the legal form you need.

Utilize the US Legal Forms website.

First, ensure that you have chosen the correct form for your city/state. You can examine the document using the Review button and read the description to confirm it is suitable for your needs.

- The service offers thousands of templates, including the Virginia Simple Equipment Lease, that can be utilized for both business and personal purposes.

- All documents are reviewed by professionals and comply with federal and state requirements.

- If you are already registered, Log In to your account and click on the Download button to obtain the Virginia Simple Equipment Lease.

- Use your account to browse through the legal forms you have previously purchased.

- Go to the My documents section of your account to retrieve another copy of the document you need.

- If you are a new customer of US Legal Forms, here are simple instructions for you to follow.

Form popularity

FAQ

Several factors can invalidate a lease agreement in Virginia, including lack of mutual consent or violation of local laws. Additionally, if essential elements are missing, such as a clear description of the leased equipment or terms, the lease can become unenforceable. To prevent potential complications, it’s best to use a Virginia Simple Equipment Lease template, ensuring all critical components are included and clearly defined.

While verbal lease agreements are technically binding in Virginia, proving their terms can be challenging in disputes. A written Virginia Simple Equipment Lease provides clear documentation and terms, making it easier for parties to understand their rights and responsibilities. Therefore, it is advisable to formalize any lease agreements in writing to avoid misunderstandings.

To legally break a lease in Virginia, you should follow the specific terms outlined in your lease agreement. Common reasons include significant property damage or health violations. If you must leave the lease early, consult with an attorney or a reputable resource, such as the Virginia Simple Equipment Lease guidelines, to ensure you comply with legal requirements and minimize potential penalties.

A good equipment lease rate typically ranges based on factors such as the type of equipment, lease duration, and market demand. Generally, expect a rate of around 1% to 3% of the equipment's value monthly. To determine the best rate for your needs, consider using the Virginia Simple Equipment Lease template to compare rates and ensure you secure a competitive deal.

In Virginia, a lease becomes legally binding when it includes essential elements such as a clear agreement between parties, a specific start and end date, and defined terms. Both the lessor and lessee must demonstrate mutual consent, typically through signatures. Furthermore, having a written document in place, such as a Virginia Simple Equipment Lease, strengthens the enforceability of the agreement.

No, a lease does not need to be notarized in Virginia; however, notarization can provide an extra layer of assurance. While not a requirement, many individuals prefer to have their Virginia Simple Equipment Lease notarized to prevent any misunderstandings. If you are unsure about the implications of notarization, consider using resources from uslegalforms, which can offer templates and guidance tailored to your needs.

Yes, a handwritten lease agreement can be legally binding in Virginia as long as it contains all necessary terms and is signed by both parties. A Virginia Simple Equipment Lease, whether typed or handwritten, must clearly outline important details like duration, payment, and responsibilities. It is always advisable to keep a clear copy for your records to avoid disputes down the line.

Generally, a lease does not need to be notarized to be legally enforceable in Virginia. However, certain situations, such as leases longer than a year, may benefit from notarization for added security. If you are using a Virginia Simple Equipment Lease, having it notarized can enhance its credibility but is not a strict requirement. Consulting legal resources can guide you on best practices.

In Virginia, a lease is valid when it includes essential elements such as clear terms, mutual agreement between parties, and a legal purpose. The parties involved must intend to create a binding agreement. Furthermore, for a Virginia Simple Equipment Lease, both parties should sign the lease to affirm their consent. Ensuring these components are in place can protect your interests.

The minimum credit score required for a Virginia Simple Equipment Lease usually starts at around 600, though this can vary based on the lender's policies. It is important to understand that some companies might accept lower scores under certain conditions, such as strong business revenue. Your financial stability and leasing history can also influence this requirement. Consulting with uslegalforms can help you navigate leasing options that align with your financial profile.