Virginia Employment Application for Artist

Description

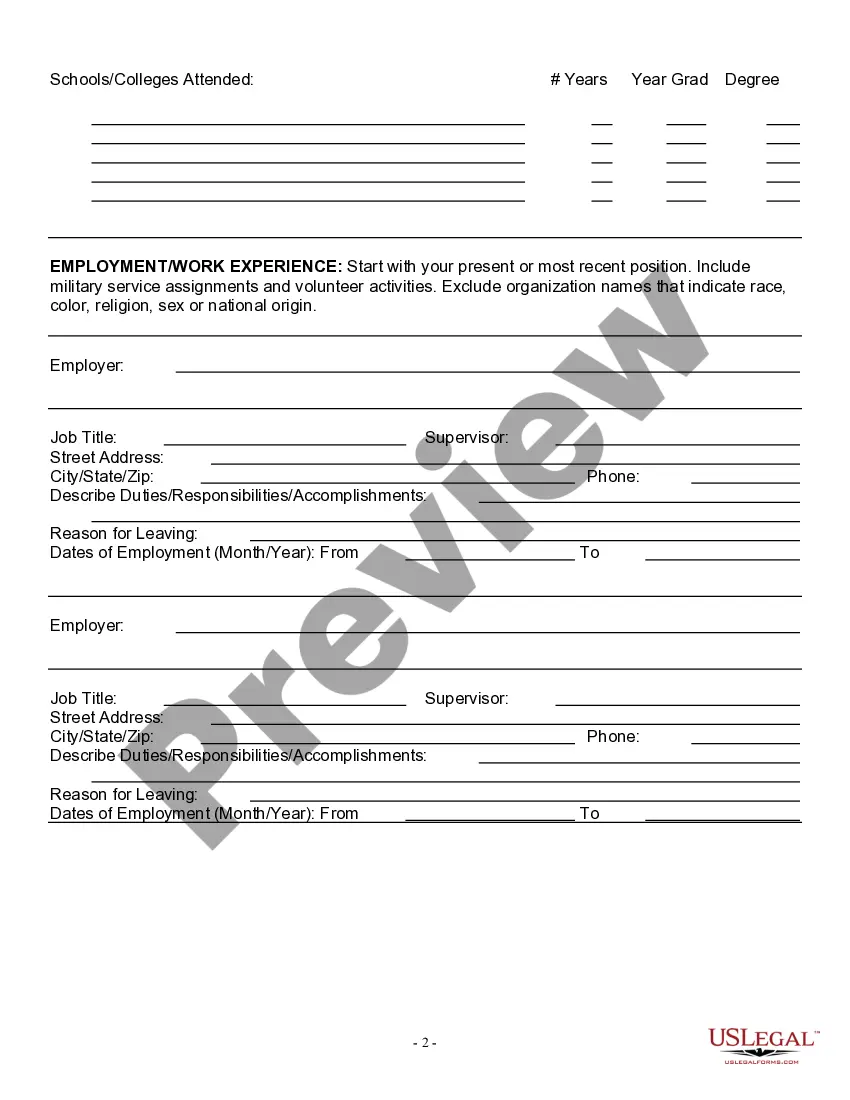

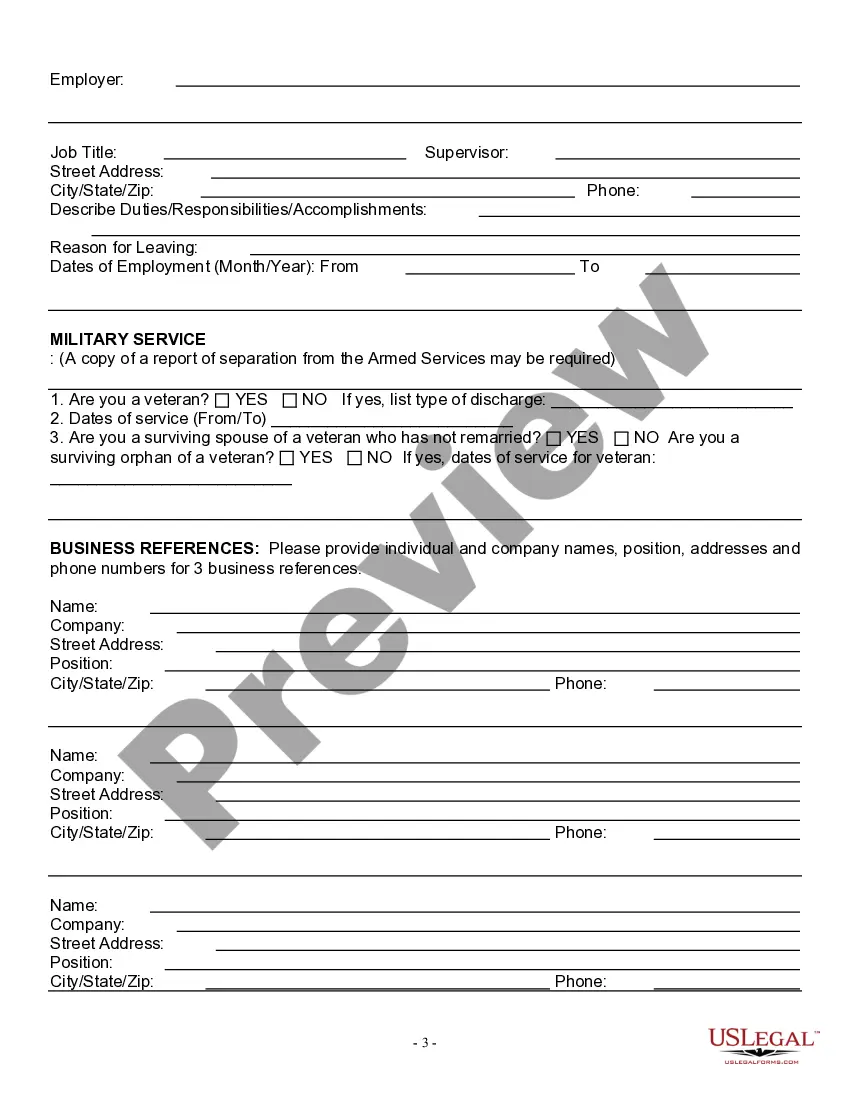

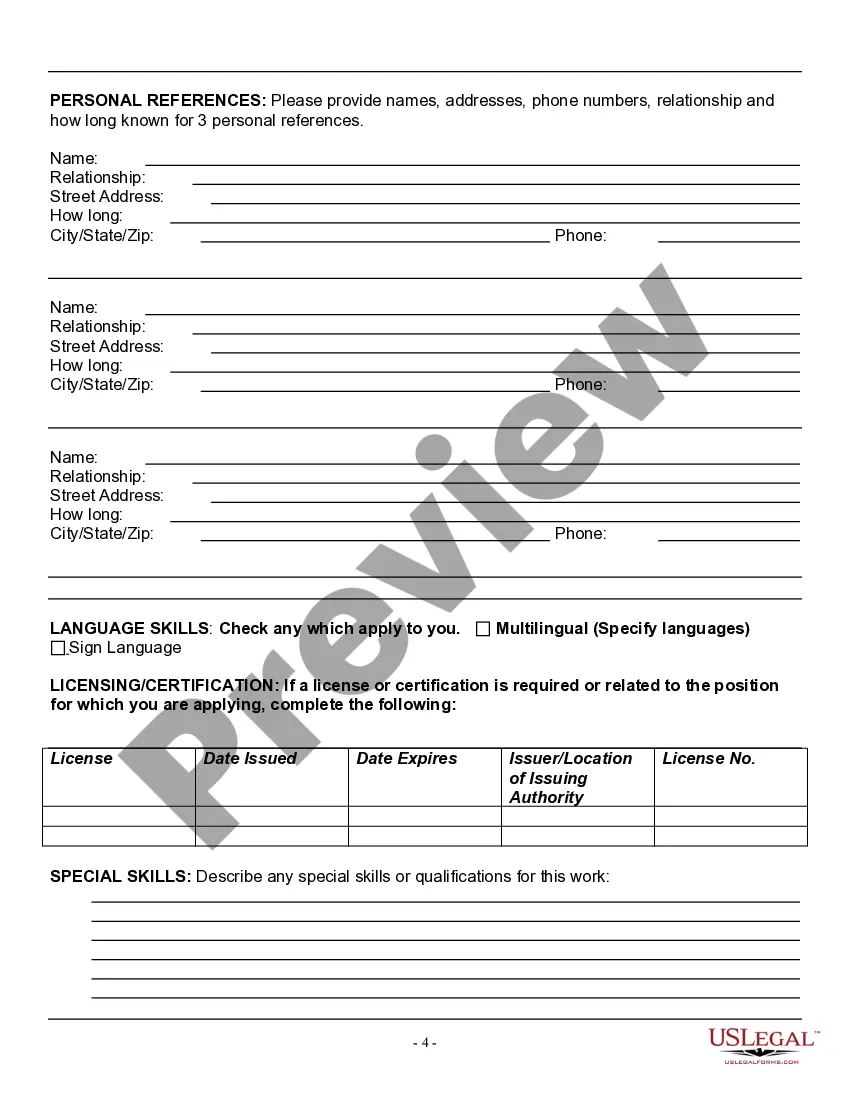

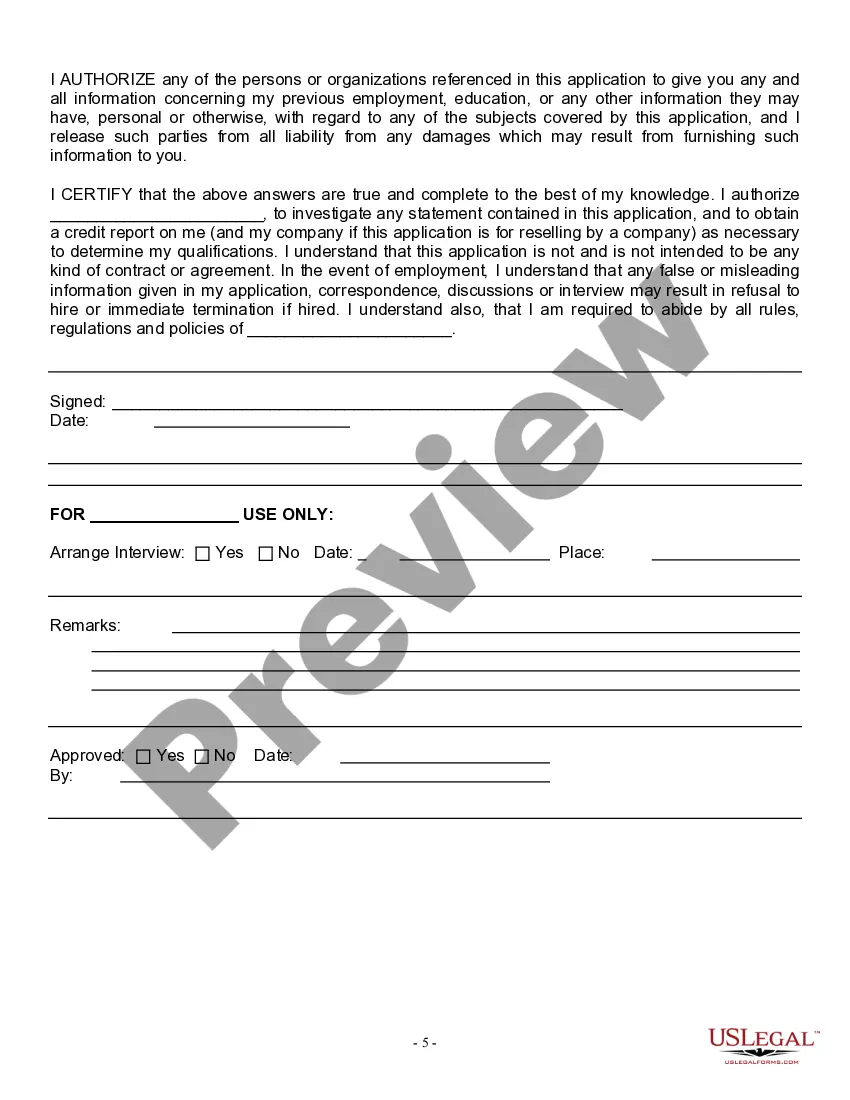

How to fill out Employment Application For Artist?

It's feasible to spend hours online searching for the legal document template that meets both federal and state requirements you need.

US Legal Forms offers a vast array of legal forms that have been reviewed by experts.

You can effortlessly download or print the Virginia Employment Application for Artist from the service.

If available, utilize the Review button to examine the document template concurrently.

- If you already have a US Legal Forms account, you may Log In and click the Download button.

- Subsequently, you can fill out, modify, print, or sign the Virginia Employment Application for Artist.

- Every legal document template you obtain is yours indefinitely.

- To acquire an additional copy of a purchased type, navigate to the My documents section and click the corresponding button.

- If you're using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for the area/town of your choice.

- Review the template details to confirm you have selected the right one.

Form popularity

FAQ

In order to be eligible to receive unemployment benefits, you must have sufficient earnings in your base period from a covered employer. The base period is defined as the first four of the last five completed calendar quarters. Without sufficient earnings, you will not be eligible to receive benefits.

To qualify for PUA benefits, you must not be eligible for regular unemployment benefits and be unemployed, partially unemployed, or unable or unavailable to work because of certain health or economic consequences of the COVID-19 pandemic.

Contacting the VECVEC Customer Contact Center.Voice Response system. 1-800-897-5630.VEC Administrative Office Location. 6606 West Broad Street.Correspondence mailing address. Virginia Employment Commission.Virginia Relay. (Telecommunications Relay Service) Press "711"Toll free access. 800-828-1140 (voice)

There are numerous provisions that affect the Unemployment Insurance Program. Workers who are not eligible under current state law such as gig economy workers, self-employed individuals, or workers paid by 1099 may be eligible for unemployment insurance benefits under the CARES Act.

In Virginia, an employee is guilty of misconduct connected with her work sufficient to disqualify her from receiving unemployment benefits when she deliberately violates a company rule reasonably designed to protect the legitimate business interests of her employer, or when his acts or omissions are of such a nature

You will be disqualified if the deputy determines that you quit your job without good cause, or you were fired from your job for misconduct in connection with your work. You and your employer have the right to appeal the deputy's determination if either of you disagrees with the results.

Under the CARES Act, self-employed workers and independent contractors can apply for temporary unemployment benefits. RICHMOND, Va. The Virginia Employment Commission said it has an application available for self-employed workers to receive unemployment benefits during the COVID-19 outbreak.

Filing Your Initial Claim To file by using the telephone, please call 1-866-832-2363. Call volume in our contact centers is exceedingly high. If you experience delays, please use the online portal to file your initial claim for UI benefits.

To qualify for PUA benefits, you must not be eligible for regular unemployment benefits and be unemployed, partially unemployed, or unable or unavailable to work because of certain health or economic consequences of the COVID-19 pandemic.

Examples of acceptable documents self-employed individuals may submit to show proof of employment and earnings Federal or state income tax returns for the 2019 calendar year.Business financial statements/records.