Virginia Closing Statement

What is this form?

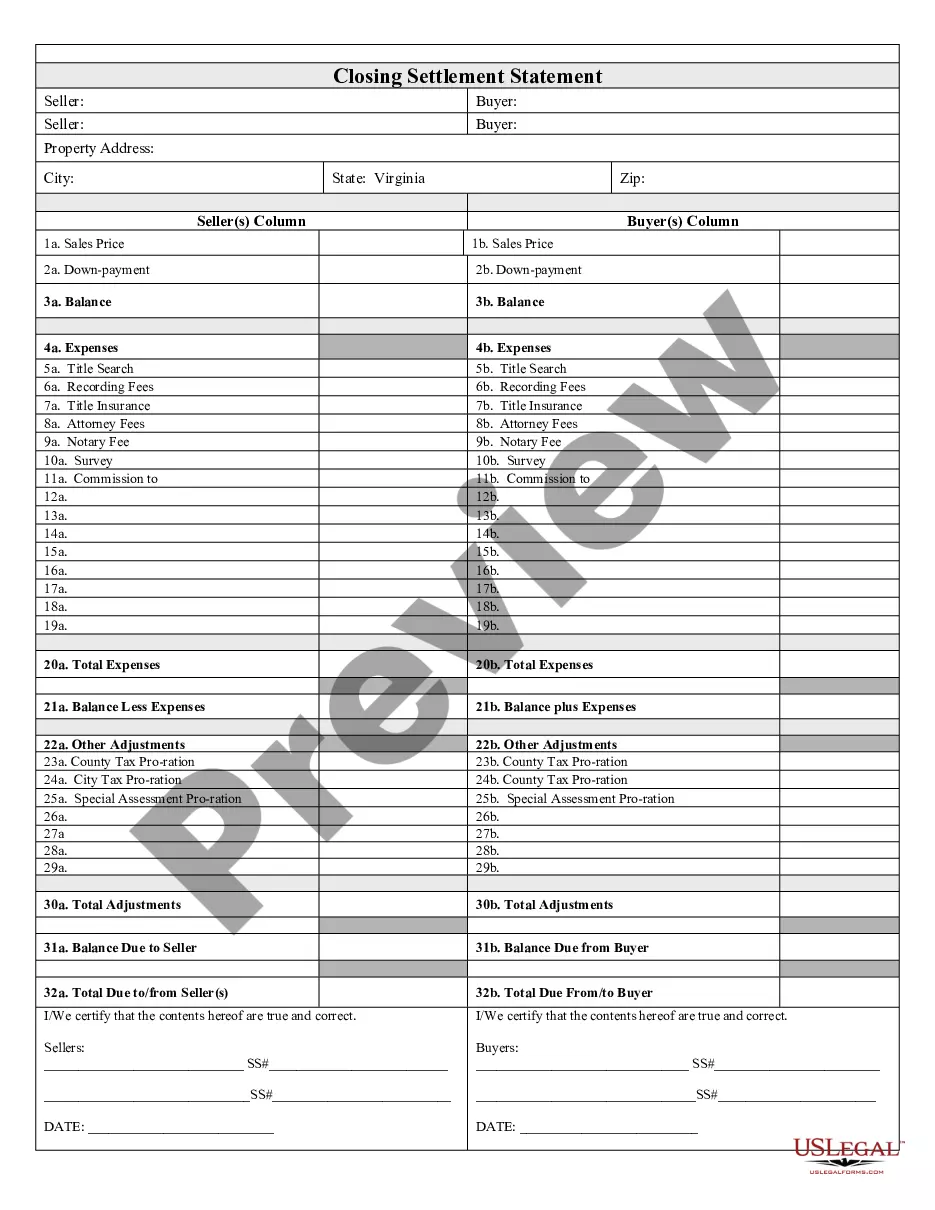

The Closing Statement is a legal document used in real estate transactions, specifically for cash sales or owner financing arrangements. This statement details the financial aspects of the closing process, ensuring that both the seller and buyer verify and sign off on the financial terms before the transaction is completed. Unlike other forms, the Closing Statement provides a comprehensive overview of the expenses, adjustments, and final balances related to the sale, making it essential for transparent and accurate settlements.

Main sections of this form

- Balance calculations to summarize the total financial flow.

- Itemized list of expenses, including title searches and attorney fees.

- Pro-ration details for county and city taxes.

- Signature lines for both the seller and buyer to confirm accuracy.

- Adjustments section to clarify additional costs and credits between parties.

Situations where this form applies

This form is commonly used during the closing process of real estate transactions, especially when money exchanges hands directly (cash sale) or when the buyer finances the purchase through the seller. It is essential when finalizing agreements to ensure that all costs are accurately accounted for and agreed upon by both parties, thereby preventing disputes and providing a clear financial outline.

Intended users of this form

- Home buyers involved in a cash sale or owner-financed transaction.

- Property sellers wishing to document the financial details of the transaction.

- Real estate agents and attorneys assisting clients in real estate transactions.

- Individuals or parties looking to ensure a transparent and verified closing process.

Completing this form step by step

- Identify the parties involved in the transaction, including their full legal names.

- Detail the property being sold, including its address and legal description.

- List all expenses associated with the transaction, ensuring accuracy in calculations.

- Fill in the adjustment sections to reflect any prorated taxes or additional costs.

- Obtain signatures from both the seller and buyer to finalize the document.

Does this form need to be notarized?

This form does not typically require notarization unless specified by local law. Always check your local regulations to ensure compliance with any notarization requirements for the Closing Statement.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to review all financial details for accuracy before signatures.

- Missing signatures from either party, which renders the document incomplete.

- Not accounting for all applicable adjustments, leading to financial disputes.

Advantages of online completion

- Immediate access to a legally vetted form, saving time and effort.

- Easy customization to fit specific transaction details and needs.

- Secure storage and download options to retain important transaction records.

Looking for another form?

Form popularity

FAQ

A closing agent prepares the closing statement, which is settlement sheet. It's a comprehensive list of every expense that the buyer and seller must pay to complete the real estate transaction. Fees listed on this sheet include commissions, mortgage insurance, and property tax deposits.

Page 1: Information, loan terms, projected payments costs at closing. Page 2: Closing cost details including loan costs and other costs. Page 3: Cash needed to close and a summary of the transaction. Page 4: Additional information about your loan. Page 5: Loan calculations, disclosure information and contact information.

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called closing agents, to itemize all charges imposed upon a borrower and seller for a real estate transaction. The statement is no longer used, with one exceptionreverse mortgages.

A HUD-1 or HUD-1A Settlement Statement is prepared by a creditor or, more typically, by the settlement agent who conducts the closing on the creditor's behalf.

Completing Part B of HUD-1Fill in the property location and the name and address for the borrower, seller and lender. The settlement agent, date and location also are needed. Fill in the appropriate lines in sections J and K, which are summaries of the borrower's and seller's transactions, respectively.

As of October 3, 2015, the Closing Disclosure form replaced the HUD-1 form for most real estate transactions. However, if you applied for a mortgage on or before October 3, 2015, you received a HUD-1.

Does Closing Disclosure mean clear to close? If the Closing Disclosure meets your expectations, you are clear to close. However, the loan doesn't become official until you sign all the paperwork at closing. And things can change in the three business days before loan settlement.

The HUD-1 form is used in purchase transactions, and it includes lines for both borrower charges/fees and seller charges/fees.The HUD-1A is an option, instead of using the HUD-1, for loan transactions that do not include a seller (refinance). The HUD-1 is three pages, while the HUD-1A is only two pages.

Check the spelling of your name. Check that loan term, purpose, product, and loan type match your most recent Loan Estimate. Check that the loan amount matches your most recent Loan Estimate. Check your interest rate. Monthly Principal & Interest. Does your loan have a prepayment penalty?