Virginia Closing Statement

Overview of this form

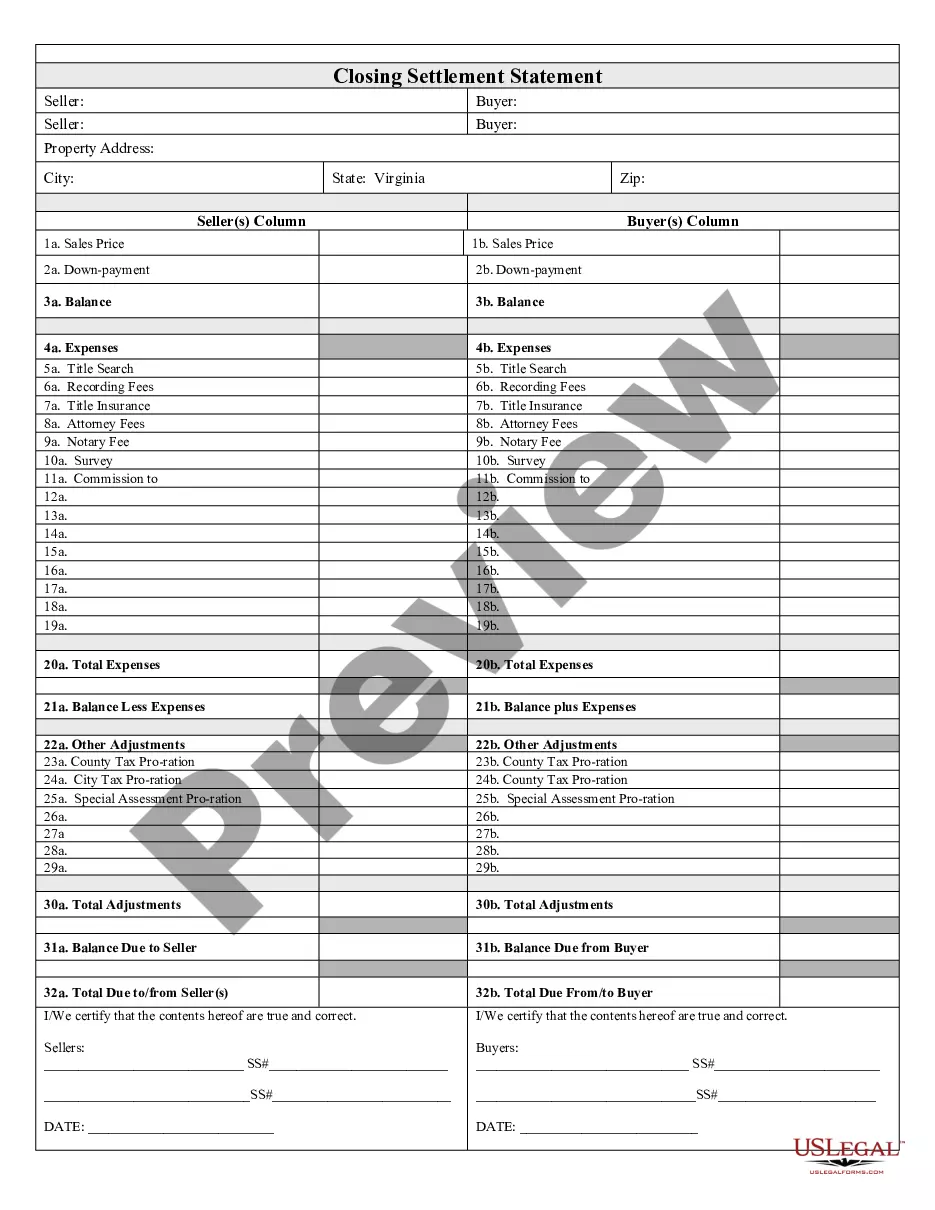

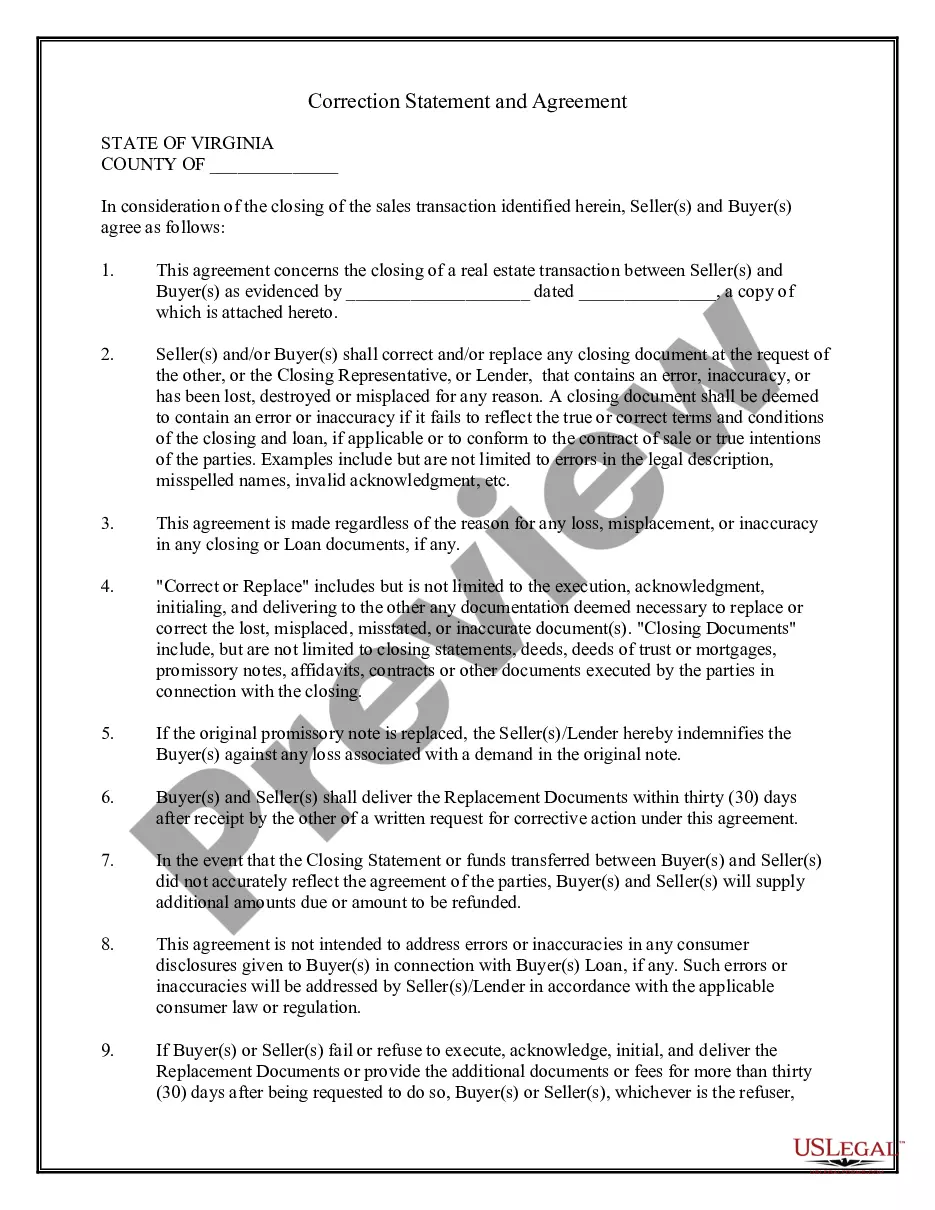

The Closing Statement is a crucial document used in real estate transactions that involve cash sales or owner financing. This form serves as a comprehensive settlement statement, detailing the financial aspects of the transaction. It is verified and signed by both the seller and the buyer, ensuring clarity in the terms of the deal. Unlike other forms, the Closing Statement consolidates all expenses and balances owed, providing a clear summary of the financial exchange involved in the property transfer.

Main sections of this form

- Balance: Displays the final amounts owed after all deductions.

- Expenses: Lists various costs associated with the transaction, including title searches, recording fees, and attorney fees.

- Title Insurance: Documents the insurance coverage for the property's title.

- Adjustments: Covers any financial adjustments, like tax prorations, between the buyer and seller.

- Certification: Ensures that both parties verify the information provided in the statement.

Common use cases

The Closing Statement should be used during any real estate transaction where money exchanges hands directly, either as a cash sale or through owner financing. It is necessary to finalize the sale process by clearly outlining all financial obligations and ensuring both parties understand what they owe and are owed. This document should be completed before the closing day, allowing all parties to review the expenses and balances involved in the transaction.

Who can use this document

- Homebuyers and sellers involved in a cash transaction or owner financing arrangement.

- Real estate agents needing to provide clarity in the transaction's costs.

- Attorneys representing clients in real estate transactions.

- Investors purchasing real estate directly from owners without bank financing.

Completing this form step by step

- Identify the parties involved: Specify the seller and buyer's names and contact information.

- Detail the property: Include a description of the property being sold.

- List all expenses: Enter all relevant costs associated with the transaction, such as title searches and attorney fees.

- Calculate adjustments: Determine and record any prorations or financial adjustments needed.

- Obtain signatures: Ensure both parties sign and date the form to verify its accuracy.

Does this document require notarization?

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to include all relevant expenses, leading to confusion at closing.

- Not obtaining the required signatures from both parties.

- Inaccurate calculations of balances or adjustments, causing disputes later.

- Neglecting to review local regulations that may affect the form's acceptance.

Benefits of using this form online

- Convenience: Easily download and fill out the form from any location.

- Editability: Make adjustments as necessary before finalizing the document.

- Reliability: Forms are drafted by licensed attorneys, ensuring legal validity.

Looking for another form?

Form popularity

FAQ

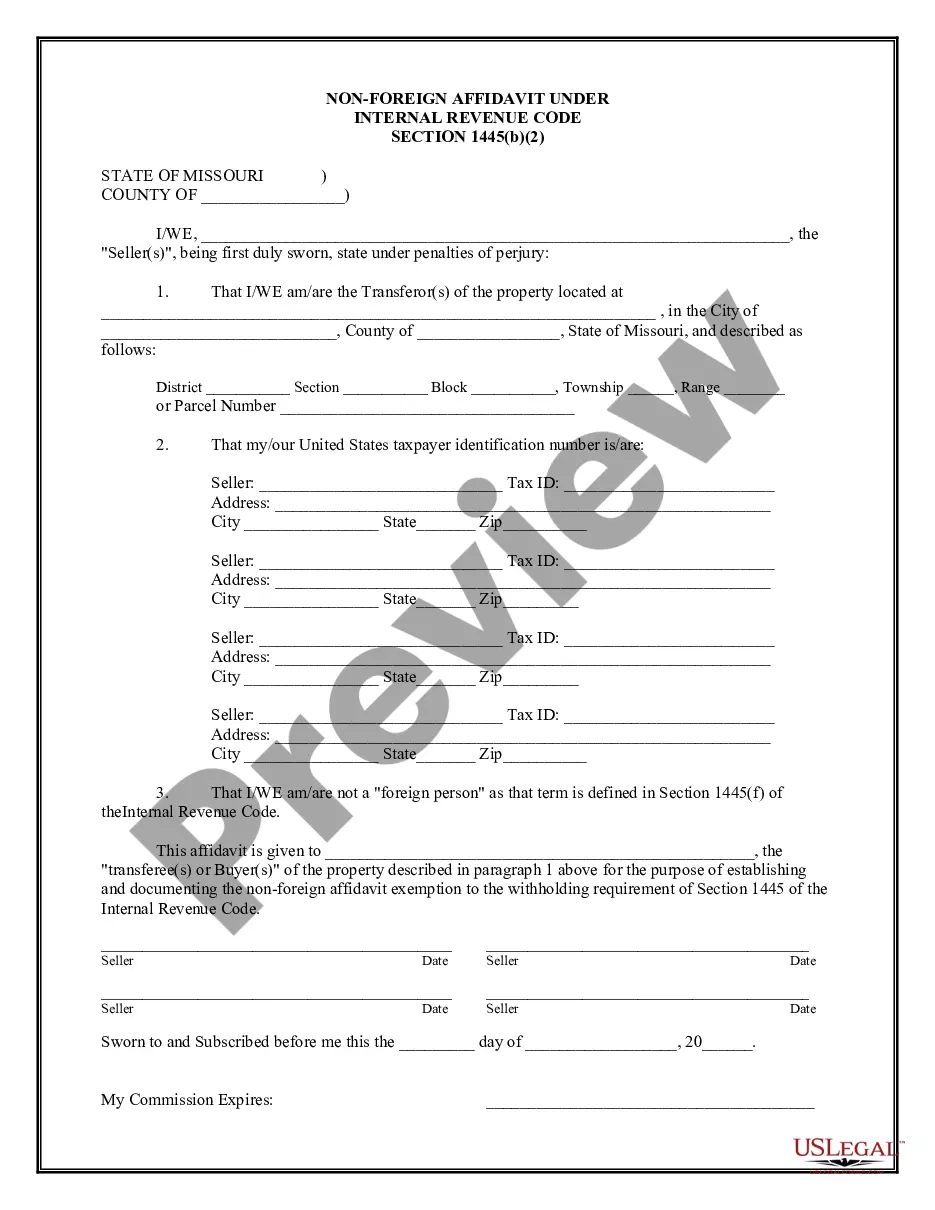

A closing agent prepares the closing statement, which is settlement sheet. It's a comprehensive list of every expense that the buyer and seller must pay to complete the real estate transaction. Fees listed on this sheet include commissions, mortgage insurance, and property tax deposits.

Page 1: Information, loan terms, projected payments costs at closing. Page 2: Closing cost details including loan costs and other costs. Page 3: Cash needed to close and a summary of the transaction. Page 4: Additional information about your loan. Page 5: Loan calculations, disclosure information and contact information.

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called closing agents, to itemize all charges imposed upon a borrower and seller for a real estate transaction. The statement is no longer used, with one exceptionreverse mortgages.

A HUD-1 or HUD-1A Settlement Statement is prepared by a creditor or, more typically, by the settlement agent who conducts the closing on the creditor's behalf.

Completing Part B of HUD-1Fill in the property location and the name and address for the borrower, seller and lender. The settlement agent, date and location also are needed. Fill in the appropriate lines in sections J and K, which are summaries of the borrower's and seller's transactions, respectively.

As of October 3, 2015, the Closing Disclosure form replaced the HUD-1 form for most real estate transactions. However, if you applied for a mortgage on or before October 3, 2015, you received a HUD-1.

Does Closing Disclosure mean clear to close? If the Closing Disclosure meets your expectations, you are clear to close. However, the loan doesn't become official until you sign all the paperwork at closing. And things can change in the three business days before loan settlement.

The HUD-1 form is used in purchase transactions, and it includes lines for both borrower charges/fees and seller charges/fees.The HUD-1A is an option, instead of using the HUD-1, for loan transactions that do not include a seller (refinance). The HUD-1 is three pages, while the HUD-1A is only two pages.

Check the spelling of your name. Check that loan term, purpose, product, and loan type match your most recent Loan Estimate. Check that the loan amount matches your most recent Loan Estimate. Check your interest rate. Monthly Principal & Interest. Does your loan have a prepayment penalty?