The chapter 13 plan contains a plan summary and the provisions of the plan. The form also contains a notice of the chapter 13 plan which must be completed and signed by the attorney for the debtor(s) or the pro se debtor(s).

Virginia Chapter 13 Plan and Related Motions

Description

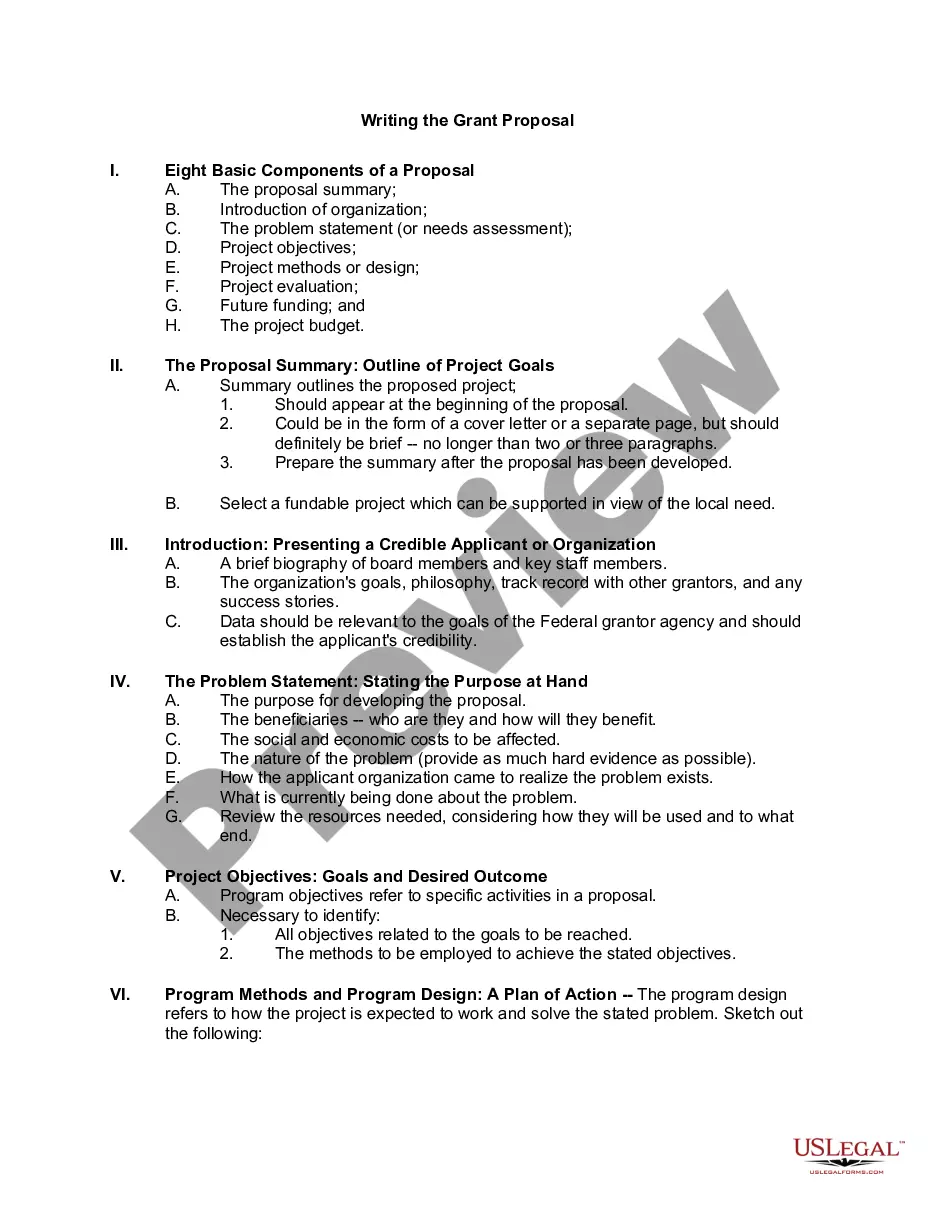

How to fill out Virginia Chapter 13 Plan And Related Motions?

Searching for a Virginia Chapter 13 Plan and Related Motions on the internet might be stressful. All too often, you find documents that you simply think are ok to use, but find out later they are not. US Legal Forms provides more than 85,000 state-specific legal and tax documents drafted by professional attorneys according to state requirements. Have any form you are searching for quickly, hassle-free.

If you already have the US Legal Forms subscription, merely log in and download the sample. It will immediately be included in your My Forms section. If you do not have an account, you should sign-up and pick a subscription plan first.

Follow the step-by-step recommendations below to download Virginia Chapter 13 Plan and Related Motions from the website:

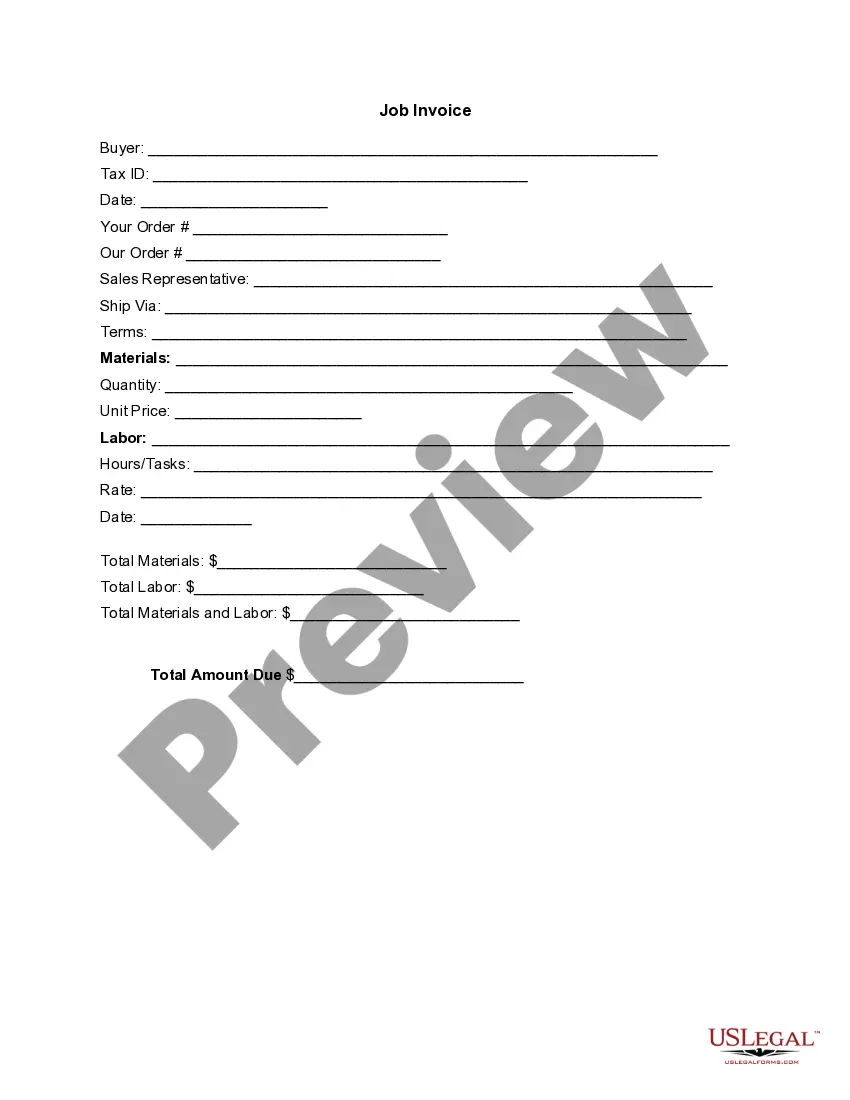

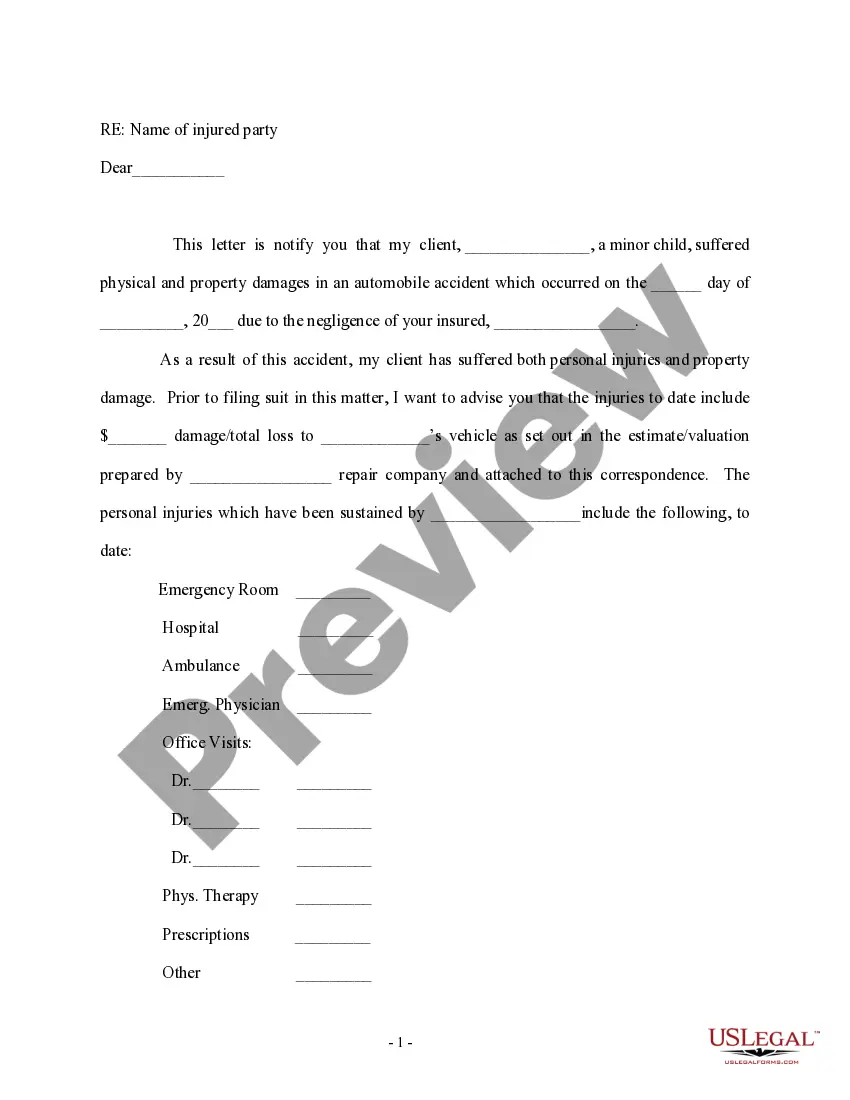

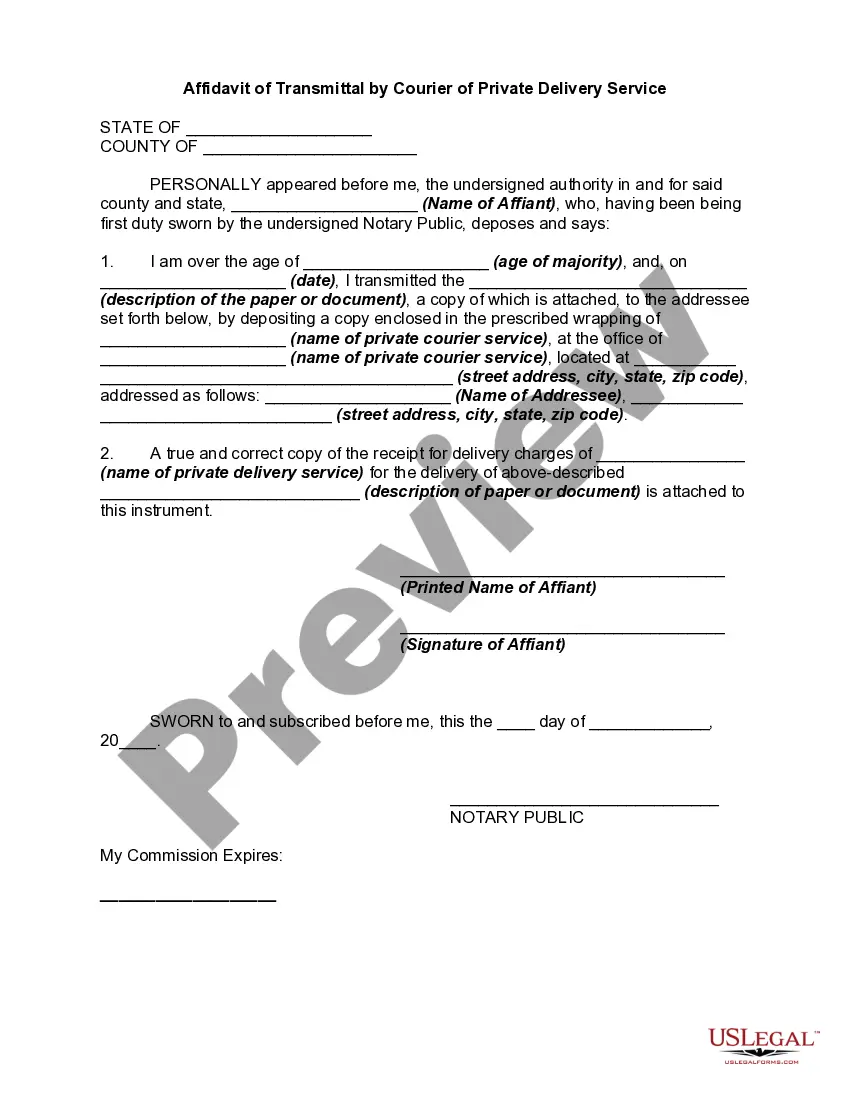

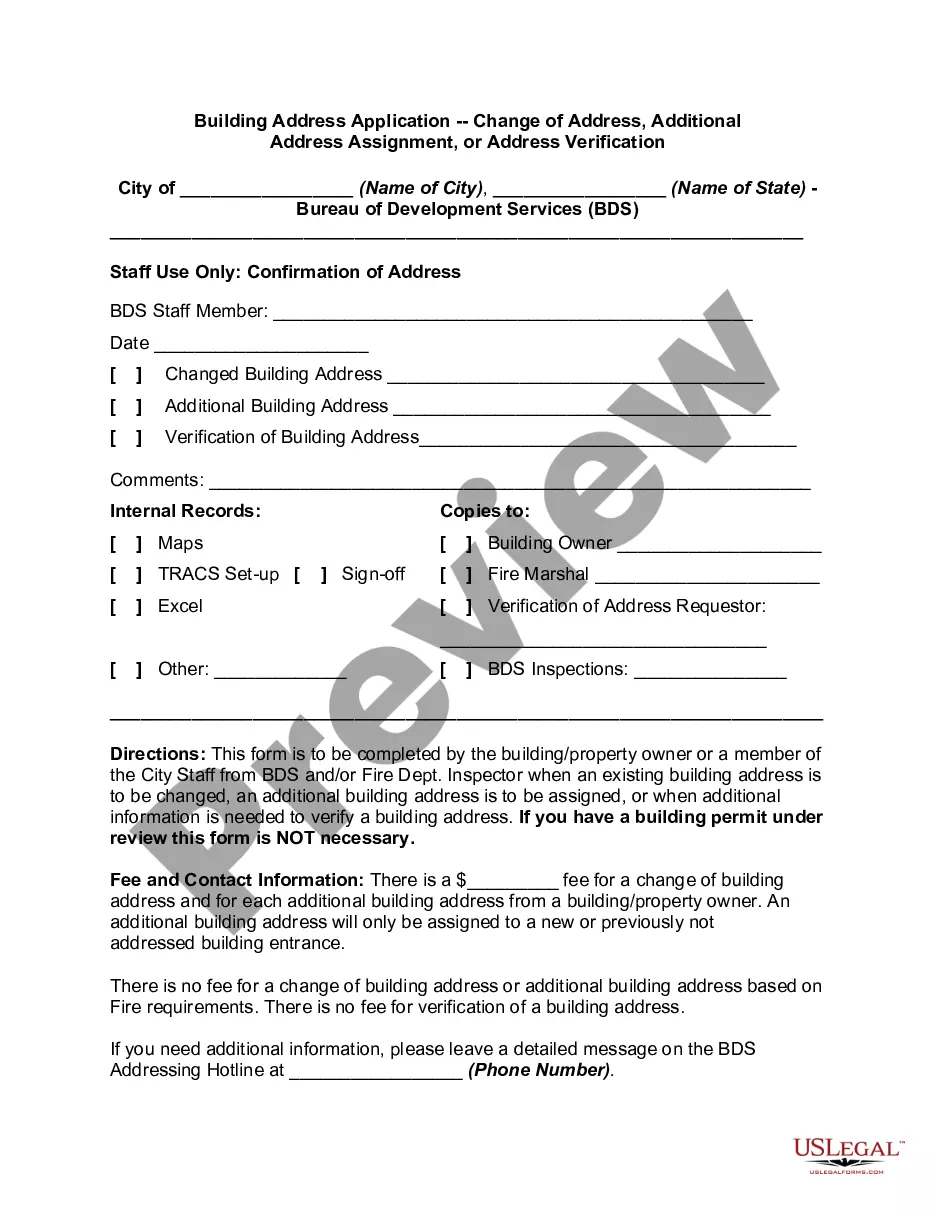

- Read the document description and press Preview (if available) to check whether the form suits your requirements or not.

- In case the form is not what you need, find others using the Search field or the provided recommendations.

- If it is appropriate, click Buy Now.

- Choose a subscription plan and create an account.

- Pay via credit card or PayPal and download the template in a preferable format.

- Right after getting it, you are able to fill it out, sign and print it.

Obtain access to 85,000 legal forms right from our US Legal Forms library. Besides professionally drafted templates, customers may also be supported with step-by-step guidelines concerning how to find, download, and complete templates.

Form popularity

FAQ

Generally speaking, the funds you have in your bank accounts are safe when you file for Chapter 13 bankruptcy.Chapter 13 also allows debtors to keep bank account funds in excess of the allowable exemption amount provided the excess amounts are worked into the Chapter 13 plan and paid back over the life of the plan.

You should disclose any payments to insiders on your Statement of Financial Affairs (Official Form 107). Bankruptcy trustees will also look through your bank statements to see your cash deposits and withdrawals. Any large deposits in your account should be accounted for.

If you get a promotion and/or raise while in Chapter 13 bankruptcy, be sure to report your change in income to the bankruptcy court immediately. If you delay or fail to reveal the change, your actions could be perceived as bad faith and that could jeopardize your case.

The Overall Chapter 13 Average Payment. The average payment for a Chapter 13 case overall is probably about $500 to $600 per month. This information, however, may not be very helpful for your particular situation.

In Chapter 13 bankruptcy , the average completion is 3 to 5 years.In most cases, if you move out of state, the bankruptcy proceedings won't be affected. Meaning, your case doesn't need to be transferred to the court in the state you are moving to.

Debts You Must Pay in Full Through Your Plan. Add up the following debts and divide by the number of months your plan will last. Secured Debt Payments on Property You Want to Keep. Unsecured Debts. Length of Your Repayment Plan.

What is a motion for relief from the automatic stay? A motion for relief from the automatic stay, also called a stay relief motion, is a request a creditor can submit to the bankruptcy court to ask for permission to take certain collection actions against the person who filed bankruptcy.

You may be worried your bank will freeze your account as soon as it becomes aware of the bankruptcy but that rarely happens.Please be aware that your trustee does not have access to your personal account. A separate account is opened to manage your bankrupt estate.

Chapter 13 allows you to keep all of your assets, even if you have $1 million in cash in the bank. In return, the court asks you to pay at least some of your debt back over the next three or five years.