Utah Joint Filing of Rule 13d-1(f)(1) Agreement

Description

How to fill out Joint Filing Of Rule 13d-1(f)(1) Agreement?

If you need to comprehensive, acquire, or print out authorized file templates, use US Legal Forms, the biggest collection of authorized forms, which can be found online. Use the site`s simple and practical lookup to get the files you need. Various templates for organization and personal reasons are categorized by classes and says, or keywords and phrases. Use US Legal Forms to get the Utah Joint Filing of Rule 13d-1(f)(1) Agreement in a handful of click throughs.

When you are already a US Legal Forms consumer, log in to the bank account and click the Acquire option to find the Utah Joint Filing of Rule 13d-1(f)(1) Agreement. You may also accessibility forms you earlier saved inside the My Forms tab of your respective bank account.

Should you use US Legal Forms the first time, follow the instructions under:

- Step 1. Be sure you have selected the shape for that right town/land.

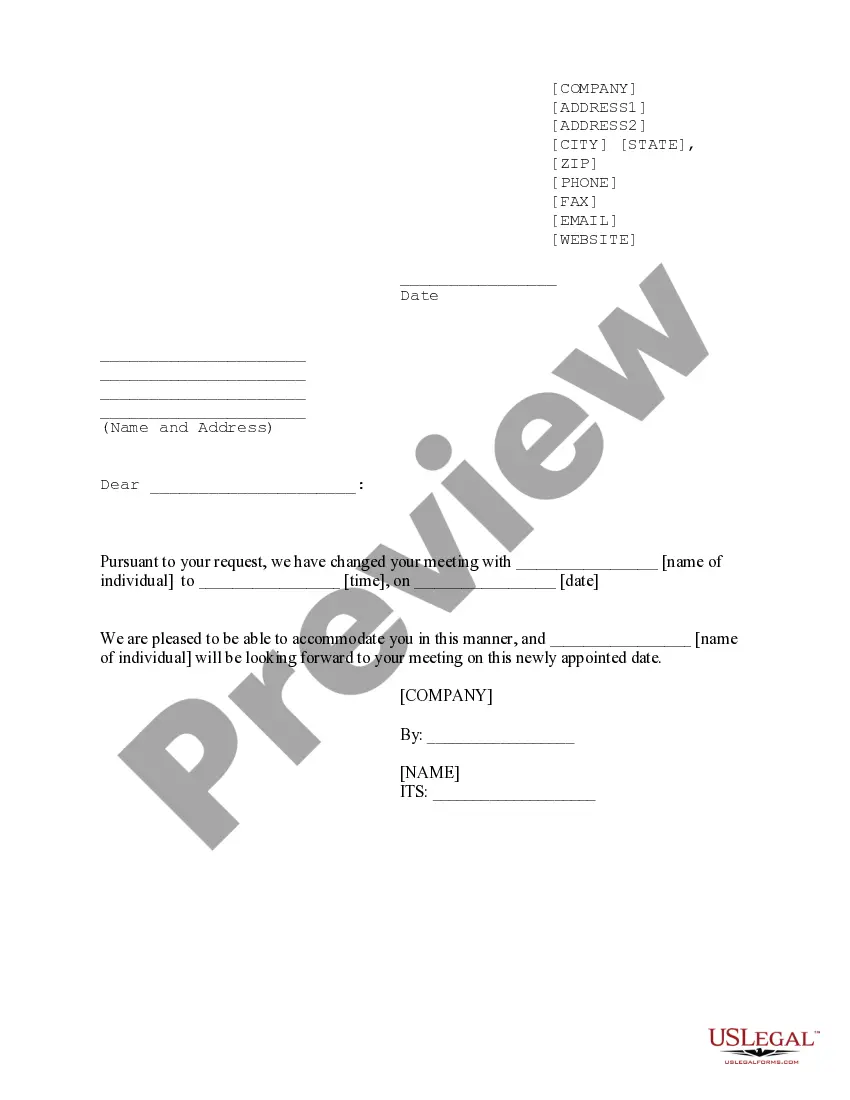

- Step 2. Utilize the Preview method to examine the form`s content. Never forget to see the explanation.

- Step 3. When you are not happy with the kind, make use of the Research field at the top of the monitor to locate other types of your authorized kind template.

- Step 4. Once you have identified the shape you need, click the Purchase now option. Pick the pricing prepare you favor and add your references to register to have an bank account.

- Step 5. Approach the purchase. You should use your Мisa or Ьastercard or PayPal bank account to finish the purchase.

- Step 6. Find the structure of your authorized kind and acquire it on your device.

- Step 7. Full, modify and print out or sign the Utah Joint Filing of Rule 13d-1(f)(1) Agreement.

Each authorized file template you get is yours for a long time. You may have acces to every kind you saved inside your acccount. Go through the My Forms portion and choose a kind to print out or acquire once again.

Compete and acquire, and print out the Utah Joint Filing of Rule 13d-1(f)(1) Agreement with US Legal Forms. There are many skilled and status-certain forms you can use for your personal organization or personal requirements.

Form popularity

FAQ

Schedule 13D is a form that must be filed with the U.S. Securities and Exchange Commission (SEC) when a person or group acquires more than 5% of a voting class of a company's equity shares. Schedule 13D must be filed within 10 days of the filer reaching a 5% stake.

A person or group of persons that acquires beneficial ownership of more than 5% of a covered class of equity securities must report that acquisition on an initial Schedule 13D.

Hear this out loud PauseUnder the prior rule, new 13D filers, including those who previously filed a Schedule 13G, were required to file their initial Schedule 13D within 10 days after acquiring beneficial ownership of greater than 5% of a covered class of equity securities or losing 13G eligibility.

Hear this out loud PauseSchedule 13D reports the acquisition and other information within 10 days after the purchase. The schedule is filed with the SEC and is provided to the company that issued the securities and each exchange where the security is traded.

Hear this out loud PauseForm 13Ds are similar to 13Fs but are more stringent; an investor with a large stake in a company must report all changes in that position within just 10 days of any action, meaning that it's much easier for outsiders to see what's happening much closer to real time than in the case of a 13F.

Hear this out loud PauseSchedule 13G is a shorter version of Schedule 13D with fewer reporting requirements. Schedule 13G can be filed in lieu of the SEC Schedule 13D form as long as the filer meets one of several exemptions.