Utah Merger Agreement for Type A Reorganization

Description

How to fill out Merger Agreement For Type A Reorganization?

Choosing the right legitimate record format could be a have difficulties. Naturally, there are tons of themes available online, but how do you discover the legitimate type you need? Make use of the US Legal Forms website. The assistance offers thousands of themes, for example the Utah Merger Agreement for Type A Reorganization, which can be used for business and personal needs. Each of the varieties are inspected by pros and meet state and federal specifications.

In case you are presently signed up, log in in your bank account and then click the Down load key to get the Utah Merger Agreement for Type A Reorganization. Make use of your bank account to look through the legitimate varieties you have purchased in the past. Visit the My Forms tab of your own bank account and obtain yet another duplicate of your record you need.

In case you are a brand new end user of US Legal Forms, here are straightforward recommendations that you should stick to:

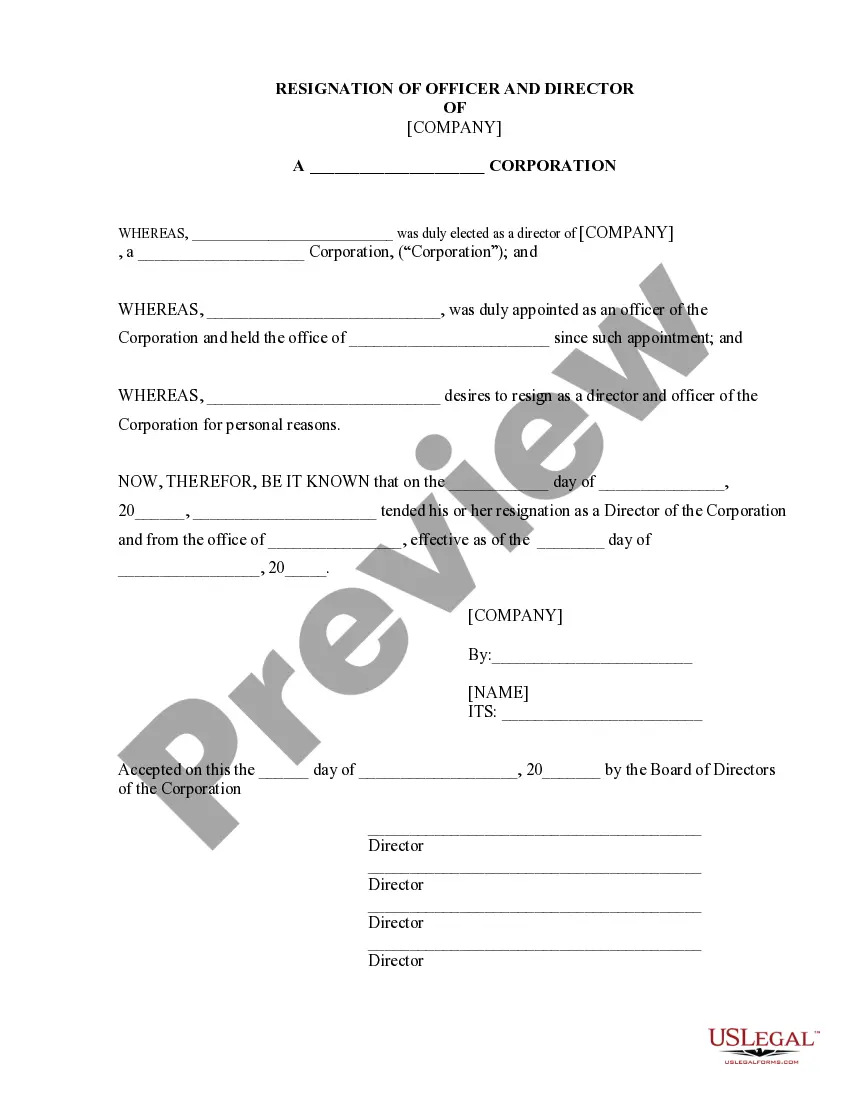

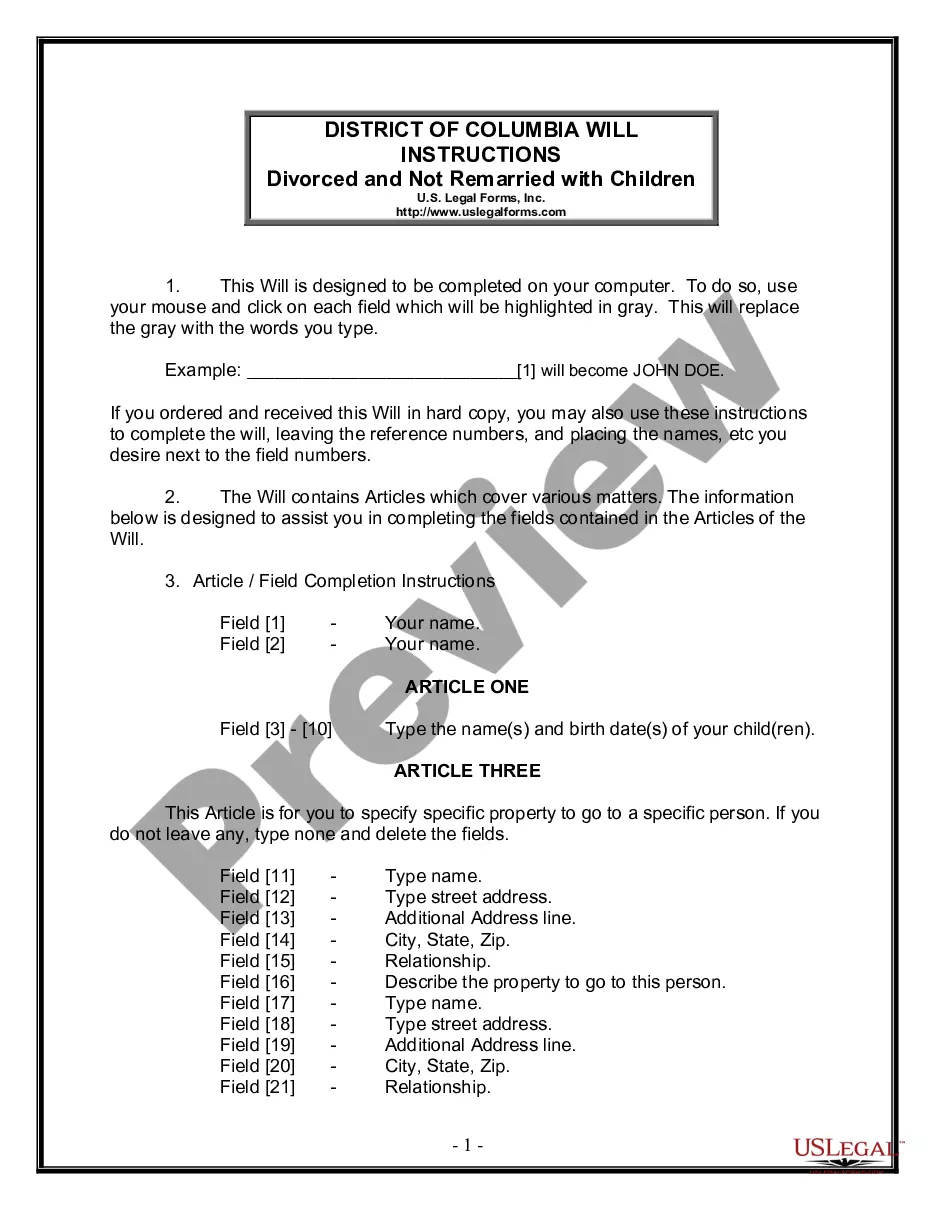

- Initially, ensure you have chosen the correct type for your town/county. You can check out the shape using the Preview key and browse the shape description to make certain it will be the right one for you.

- In case the type is not going to meet your requirements, utilize the Seach discipline to find the correct type.

- When you are certain that the shape is suitable, click the Acquire now key to get the type.

- Select the pricing prepare you want and type in the needed details. Create your bank account and buy the transaction with your PayPal bank account or charge card.

- Opt for the data file format and acquire the legitimate record format in your device.

- Complete, modify and print out and signal the obtained Utah Merger Agreement for Type A Reorganization.

US Legal Forms may be the greatest collection of legitimate varieties for which you can find a variety of record themes. Make use of the company to acquire professionally-manufactured files that stick to express specifications.

Form popularity

FAQ

A type A Reorganization is a tax-free merger or consolidation. Generally, in a merger, one corporation (the acquiring corporation) acquires the assets and assumes the liabilities of another corporation (the target corporation) in exchange for its stock.

A type A Reorganization is a tax-free merger or consolidation. Generally, in a merger, one corporation (the acquiring corporation) acquires the assets and assumes the liabilities of another corporation (the target corporation) in exchange for its stock.

The sole requirement here is that the acquiring/parent company own above and beyond majority ownership of the acquiree after the transaction. This requires that the target corporation exchange around 75-85% ownership to the acquiring company (IRC § 368(a)(1)(B)).

A Type A reorganization must fulfill the continuity of interests requirement. That is, the shareholders in the acquired company must receive enough stock in the acquiring firm that they have a continuing financial interest in the buyer.

A merger is the union of two or more corporations, with one of the corporations retaining its corporate existence and absorbing the others. The other corporations cease to exist by operation of law. A consolidation occurs when a new corporation is created to take the place of two or more corporations.

Parts of merger and acquisition contracts ?Parties and recitals. ?Price, currencies, and structure. ?Representations and warranties. ?Covenants. ?Conditions. ?Termination provisions. ?Indemnification. ?Tax.

A. In a Type A reorganization under recent Treasury? Regulations, at least? 30% of the consideration used must be the acquiring? corporation's stock. This rule permits money securities and other property to constitute up to? 70% of the total consideration used.

What is a Type ?A? Reorganization? Under IRC § 368(a)(1)(A), a Type A reorganization is a ?statutory merger or consolidation.? An ?A? reorganization must meet the requirements of applicable state corporate law or the merger laws of a foreign jurisdiction, as well as regulatory requirements in Treas.