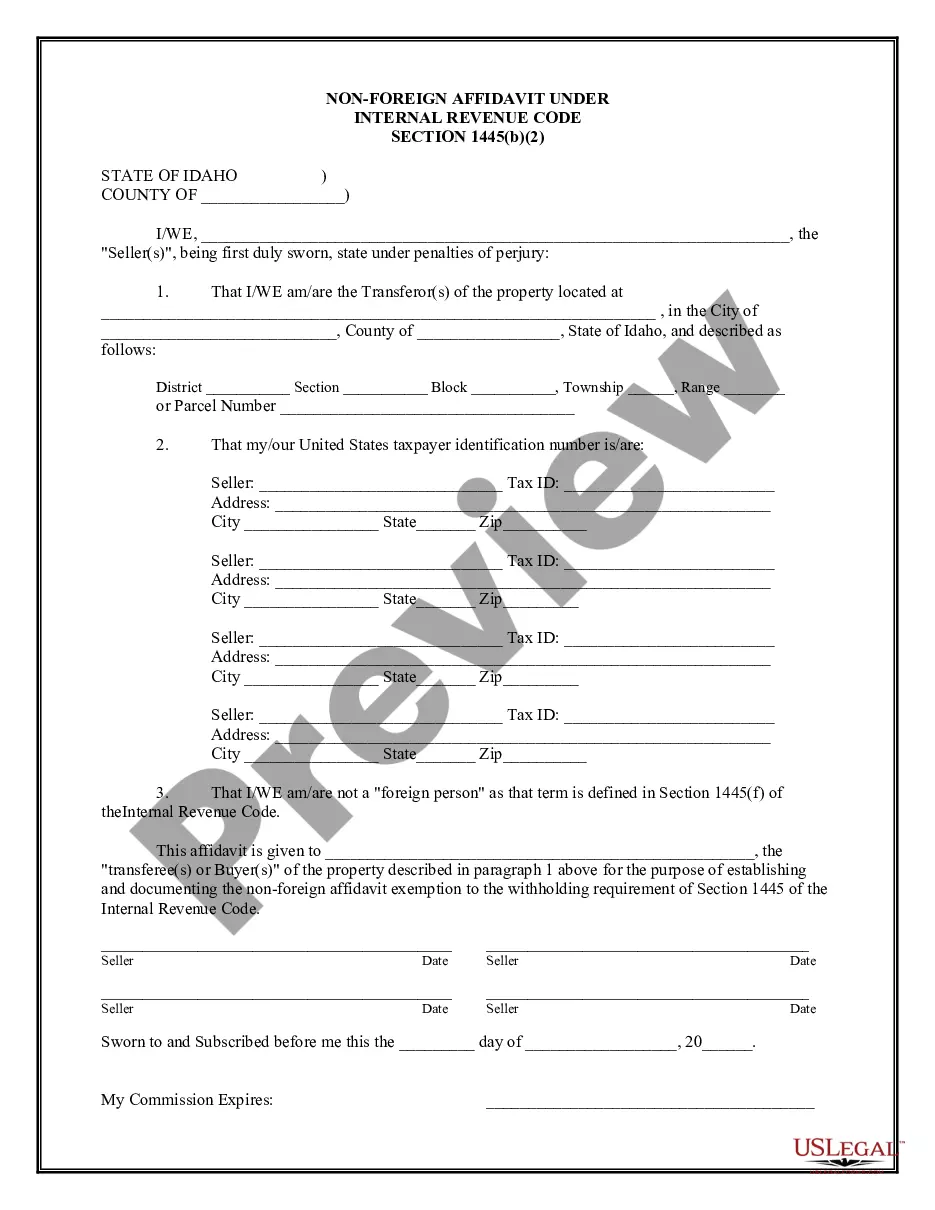

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Idaho Non-Foreign Affidavit Under IRC 1445

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

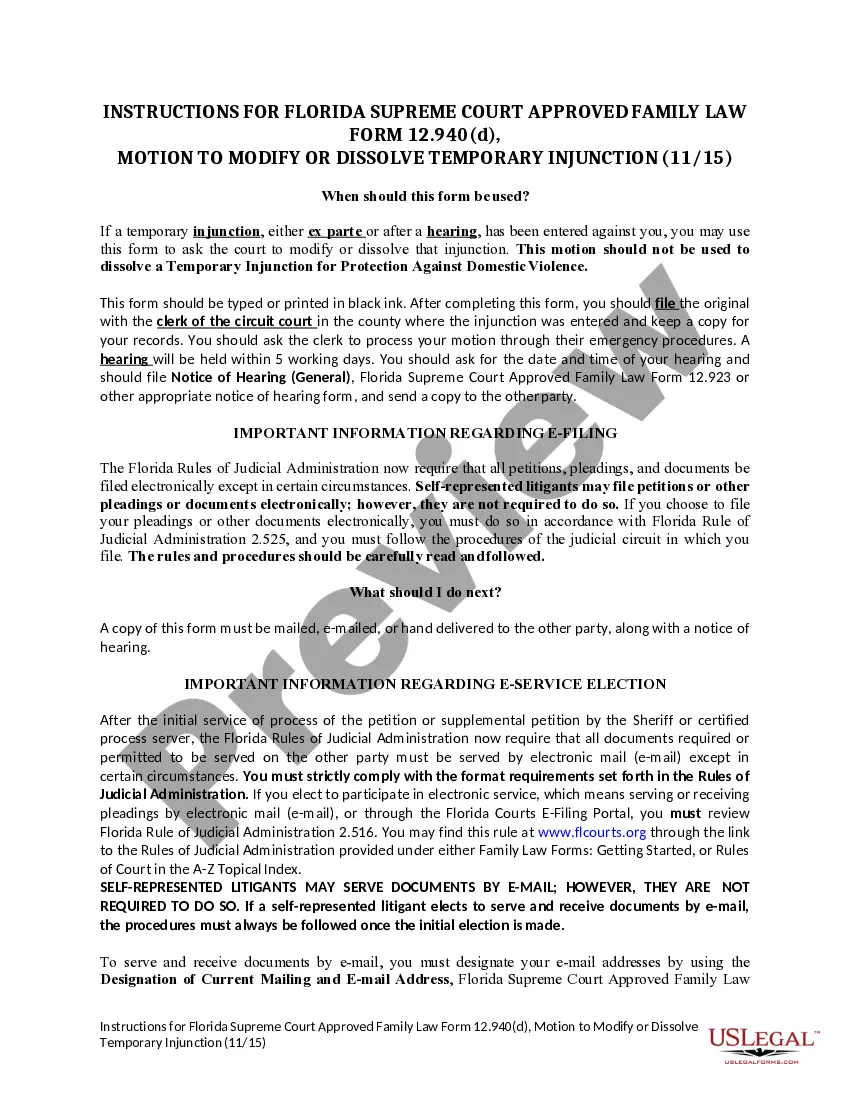

How to fill out Idaho Non-Foreign Affidavit Under IRC 1445?

Looking for Idaho Non-Foreign Affidavit Under IRC 1445 examples and filling them out might be challenging.

To reduce time, expenses, and effort, utilize US Legal Forms to find the proper template specifically for your state in just a few clicks.

Our attorneys prepare every document, so you only need to complete them. It's truly that simple.

You can print the Idaho Non-Foreign Affidavit Under IRC 1445 example or complete it using any online editor. Don’t worry about making mistakes, as your template can be used, submitted, and printed out as many times as needed. Try US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and go back to the form's page to store the template.

- All your stored templates can be found in My documents and are always available for future use.

- If you haven't signed up yet, you need to register.

- Review our detailed guidelines on how to obtain your Idaho Non-Foreign Affidavit Under IRC 1445 example in minutes.

- To acquire a valid example, confirm it is suitable for your state.

- Examine the example using the Preview feature (if available).

- If there is a description, read it to understand the particulars.

- Click Buy Now if you see what you need.

- Select your plan on the pricing page and establish your account.

- Decide whether to pay by credit card or PayPal.

- Download the document in the desired file format.

Form popularity

FAQ

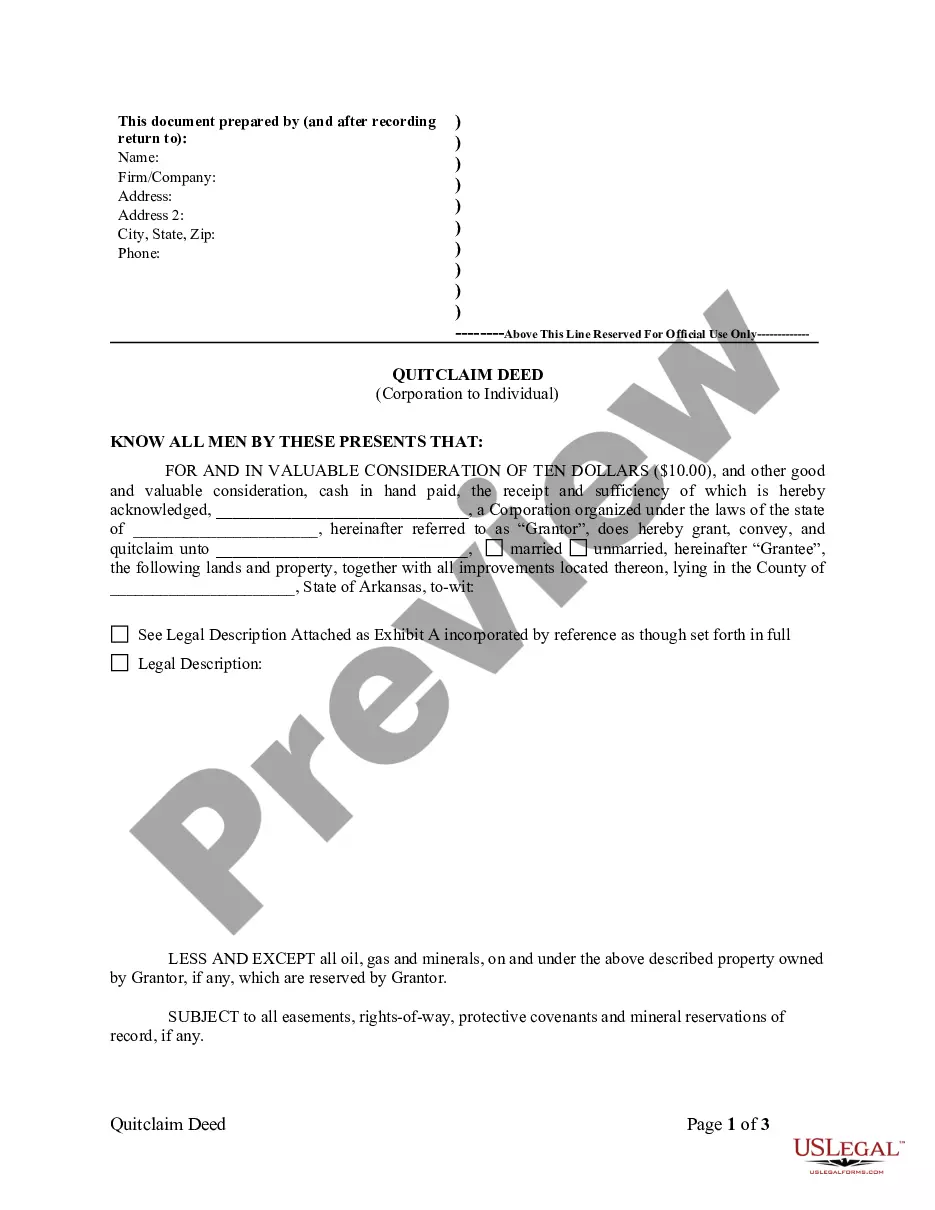

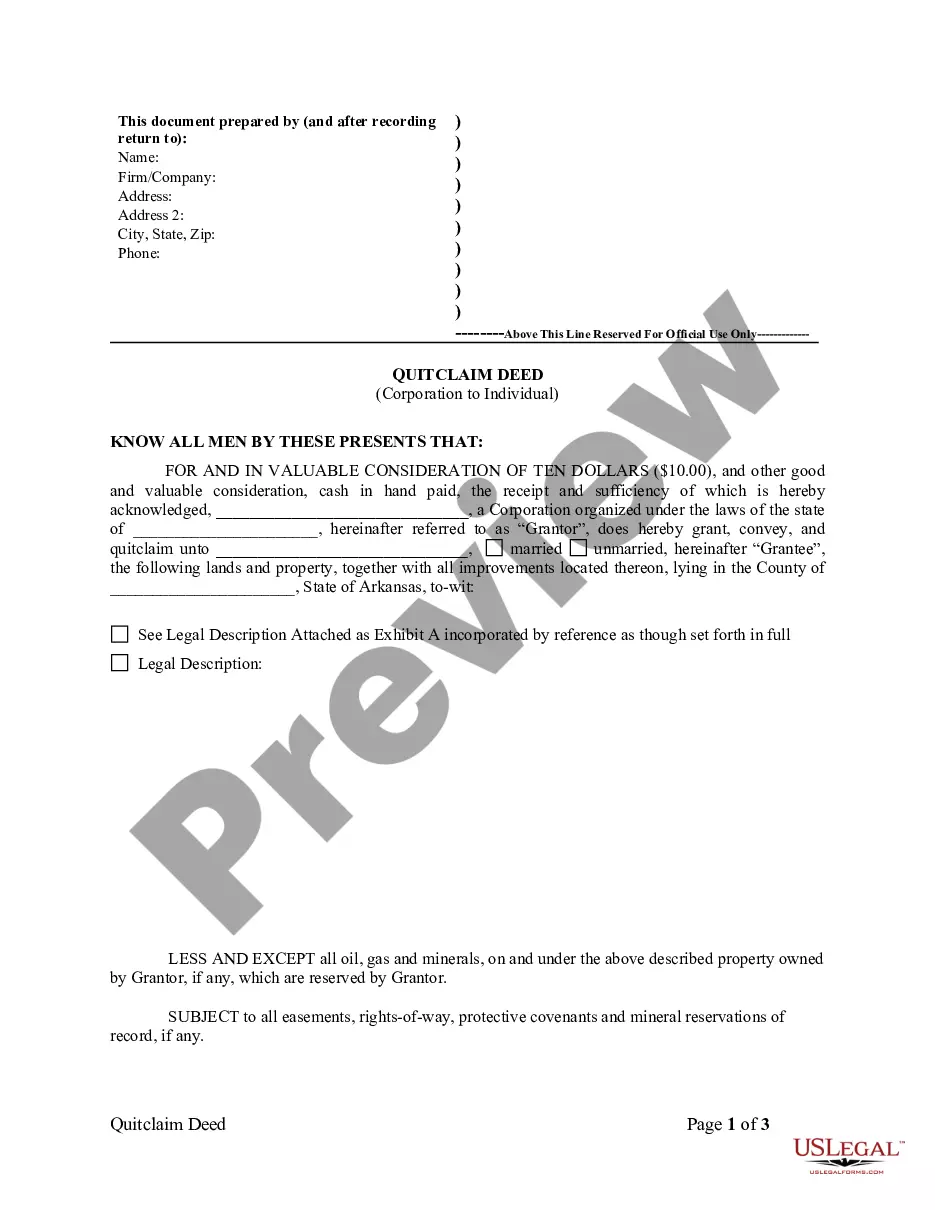

The Foreign Investment in Real Property Transfer Act (FIRPTA) requires any buyer of a U.S. real property interest to withhold ten percent of the amount realized by a foreign seller. 26 USC § 1445(a).

Persons purchasing U.S. real property interests (transferees) from foreign persons, certain purchasers' agents, and settlement officers are required to withhold 15% (10% for dispositions before February 17, 2016) of the amount realized on the disposition (special rules for foreign corporations).

A foreign person includes a nonresident alien individual, foreign corporation, foreign partnership, foreign trust, foreign estate, and any other person that is not a U.S. person. It also includes a foreign branch of a U.S. financial institution if the foreign branch is a qualified intermediary.

What Is a Certification of Non-Foreign Status? With a Certification of Non-Foreign Status, the seller of real estate is certifying under penalty of perjury, that the seller is not foreign. Therefore, the seller and the transaction will not have the withholding requirements.

The disposition of a U.S. real property interest by a foreign person (the transferor) is subject to the Foreign Investment in Real Property Tax Act of 1980 (FIRPTA) income tax withholding. FIRPTA authorized the United States to tax foreign persons on dispositions of U.S. real property interests.

This document, included in the seller's opening package, requests that the seller swears under penalty of perjury that they are not a non-resident alien for purposes of United States income taxation. A Seller unable to complete this affidavit may be subject to withholding up to 15%.

FIRPTA Exemptions The sales price is $300,000 or less, and. The buyer signs affidavit at or before closing stating they intend to use property for personal purposes for at least 50% of time property occupied for the each of the first two 12 month periods immediately after closing.

You or a member of your family must have definite plans to reside at the property for at least 50% of the number of days the property is used by any person during each of the first two 12-month periods following the date of transfer.

The disposition of a U.S. real property interest by a foreign person (the transferor) is subject to income tax withholding (IRC section 1445). The transferee is the withholding agent.If the transferor is a foreign person and you fail to withhold, you may be held liable for the tax.