Utah Approval of Ambase Corporation's Stock Incentive Plan

Description

How to fill out Approval Of Ambase Corporation's Stock Incentive Plan?

US Legal Forms - one of many biggest libraries of legitimate kinds in the USA - offers a wide range of legitimate document layouts you are able to download or print. Making use of the site, you can find a huge number of kinds for organization and specific purposes, categorized by categories, suggests, or keywords.You will find the latest variations of kinds like the Utah Approval of Ambase Corporation's Stock Incentive Plan in seconds.

If you currently have a subscription, log in and download Utah Approval of Ambase Corporation's Stock Incentive Plan through the US Legal Forms library. The Download switch can look on every develop you look at. You have accessibility to all in the past delivered electronically kinds in the My Forms tab of your account.

If you wish to use US Legal Forms the very first time, allow me to share basic guidelines to help you get started:

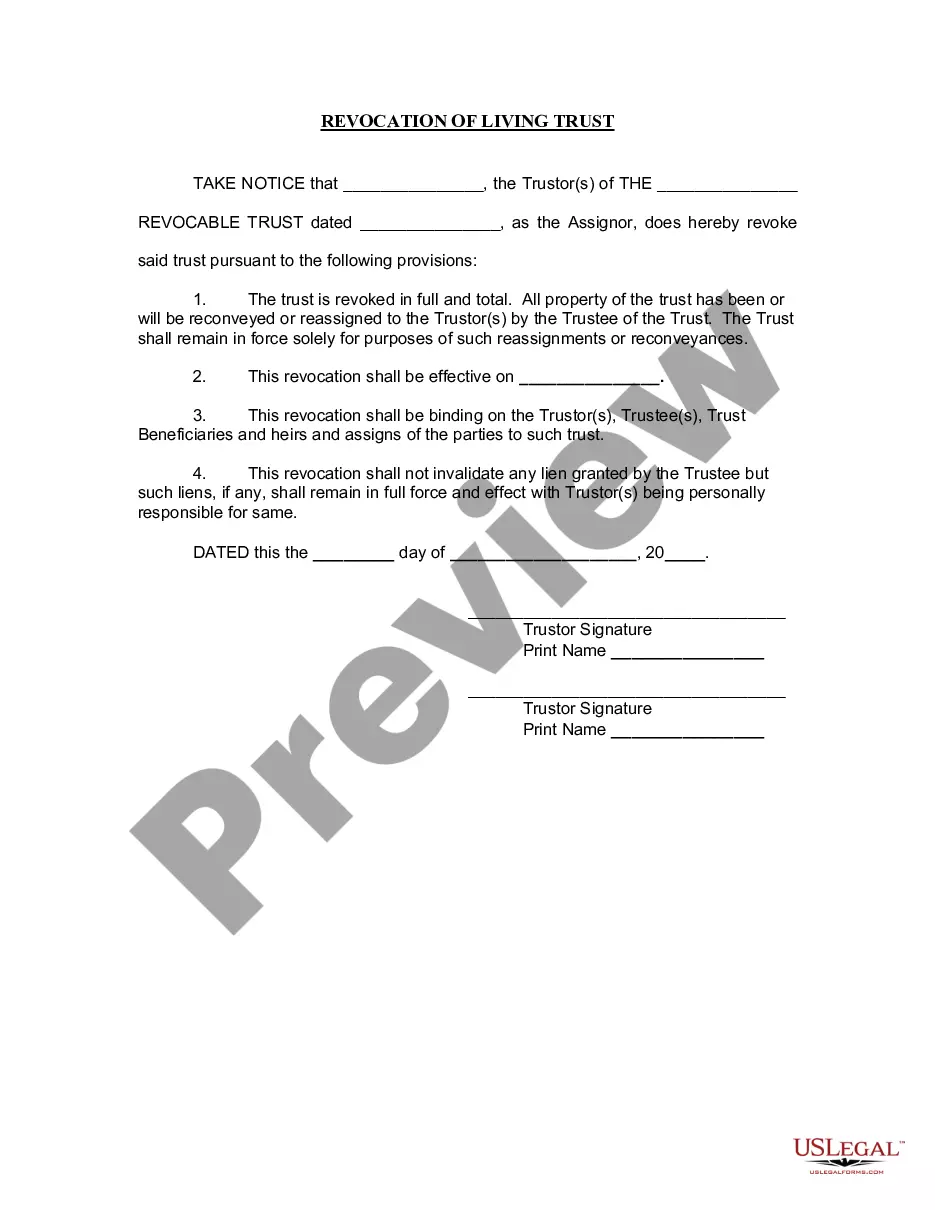

- Be sure to have selected the proper develop to your town/region. Select the Preview switch to examine the form`s content material. Read the develop description to ensure that you have selected the right develop.

- When the develop doesn`t satisfy your demands, utilize the Lookup area near the top of the monitor to get the one who does.

- If you are satisfied with the form, validate your option by simply clicking the Buy now switch. Then, choose the costs strategy you like and offer your qualifications to register for an account.

- Method the deal. Utilize your charge card or PayPal account to perform the deal.

- Find the structure and download the form in your product.

- Make changes. Load, change and print and sign the delivered electronically Utah Approval of Ambase Corporation's Stock Incentive Plan.

Each and every template you included in your bank account does not have an expiry time and is also your own for a long time. So, if you want to download or print another version, just visit the My Forms portion and click around the develop you will need.

Gain access to the Utah Approval of Ambase Corporation's Stock Incentive Plan with US Legal Forms, the most comprehensive library of legitimate document layouts. Use a huge number of specialist and state-certain layouts that satisfy your company or specific demands and demands.

Form popularity

FAQ

Here's an example: You can purchase 1,000 shares of company stock at $20 a share with your vested ISO. Shares are trading for $40 in the market. If you already own 500 company shares, you can swap those shares (500 shares x $40 market price = $20,000) for the 1,000 new shares, rather than paying $20,000 in cash.

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit. The profit on qualified ISOs is usually taxed at the capital gains rate, not the higher rate for ordinary income.

They provide employees the right, but not the obligation, to purchase shares of their employer's stock at a certain price for a certain period of time. Options are usually granted at the current market price of the stock and last for up to 10 years.

The benefit of incentive stock options Over time, you can make a significant amount of money on your shares. You not only owe a portion of the business, but you also benefit from the company's growth. Companies offering ISOs can also increase employee motivation .

An incentive stock option (ISO) is an employee benefit that gives the right to buy stock at a discount with a tax break on any potential profit. A statutory stock option is a type of tax-advantaged employee stock option offered to employees by employers.

An equity incentive program offers an employee shares of the company they work for. Shares can be awarded through stock options, stocks, warrants, or bonds.