Utah Approval of Incentive Stock Option Plan

Description

How to fill out Approval Of Incentive Stock Option Plan?

You can devote hours on-line attempting to find the lawful document format that fits the federal and state requirements you need. US Legal Forms supplies a large number of lawful forms which are reviewed by pros. You can easily obtain or produce the Utah Approval of Incentive Stock Option Plan from my service.

If you already have a US Legal Forms account, you can log in and click on the Down load option. After that, you can comprehensive, change, produce, or indication the Utah Approval of Incentive Stock Option Plan. Every lawful document format you acquire is your own property eternally. To get one more duplicate of the purchased kind, check out the My Forms tab and click on the corresponding option.

If you are using the US Legal Forms internet site initially, follow the simple guidelines below:

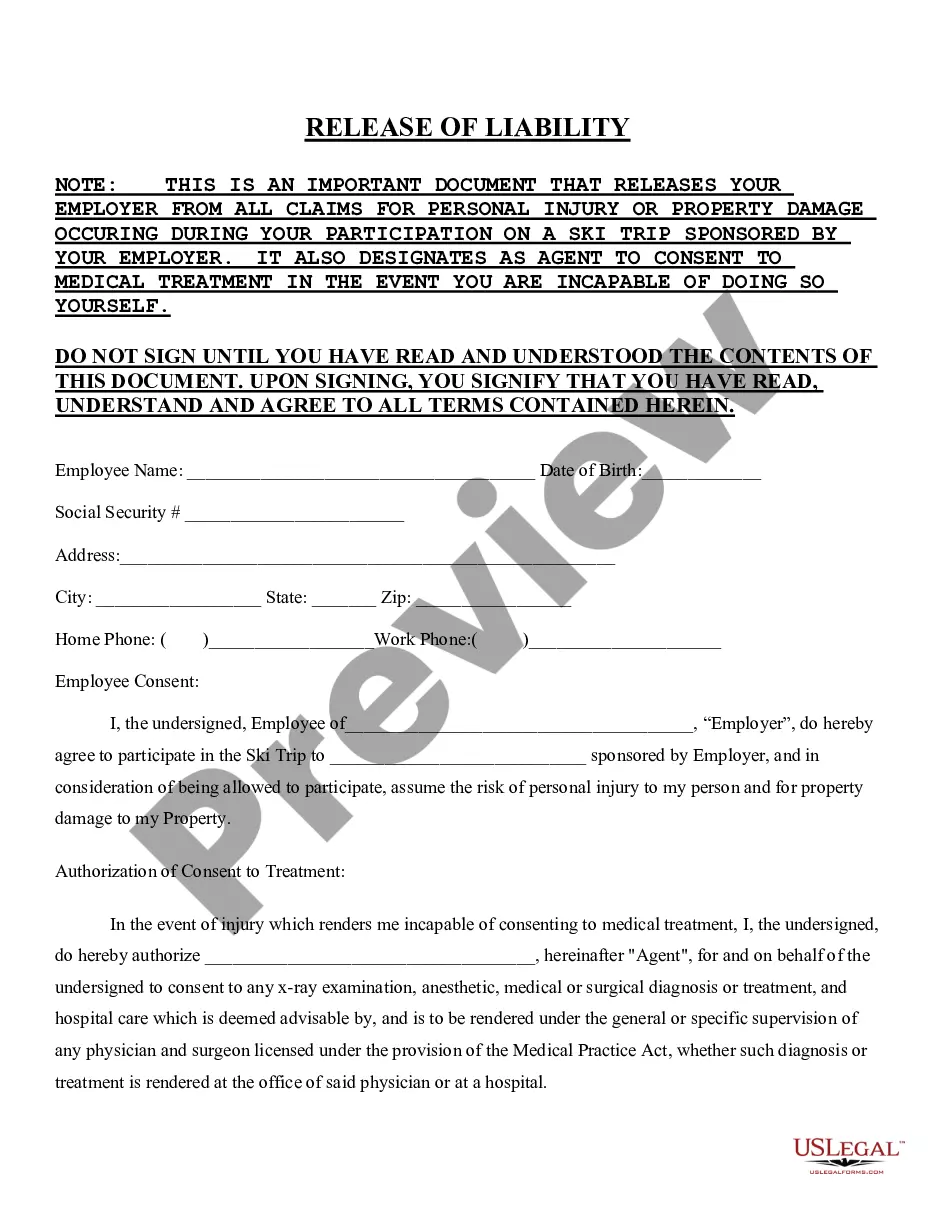

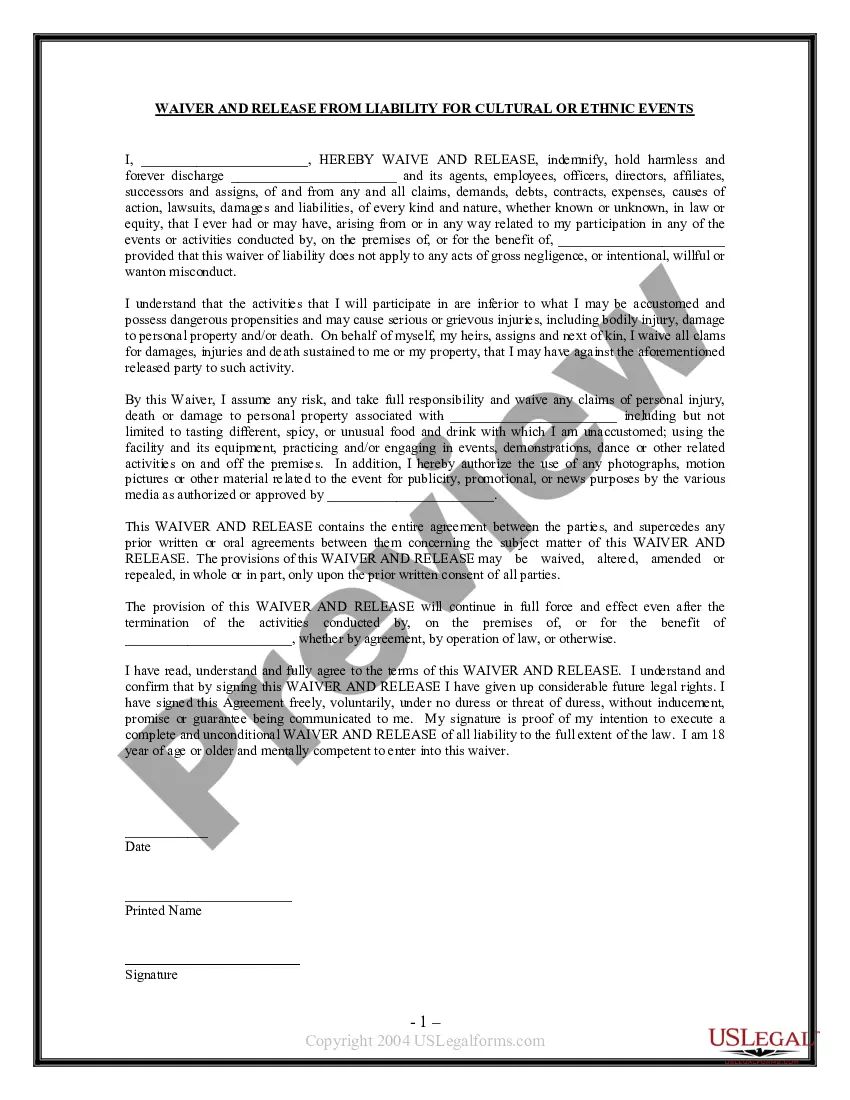

- Initially, make certain you have selected the correct document format to the region/area of your choice. Look at the kind explanation to ensure you have picked the appropriate kind. If available, use the Review option to look through the document format too.

- If you want to find one more version from the kind, use the Research discipline to discover the format that meets your needs and requirements.

- When you have identified the format you need, click on Get now to proceed.

- Choose the pricing plan you need, type in your credentials, and register for an account on US Legal Forms.

- Total the transaction. You can use your charge card or PayPal account to cover the lawful kind.

- Choose the file format from the document and obtain it to your system.

- Make modifications to your document if required. You can comprehensive, change and indication and produce Utah Approval of Incentive Stock Option Plan.

Down load and produce a large number of document web templates using the US Legal Forms site, which provides the biggest collection of lawful forms. Use specialist and express-distinct web templates to take on your small business or specific needs.

Form popularity

FAQ

The option plan must be approved by the stockholders within 12 months before or after the plan is adopted (see also Explanation: §423, Shareholder Approval Requirement) (IRC § 422(b)(1); Reg. §1.422-3).

Once you have a plan in place, you can simply make amendments to increase the number of shares in the option pool on an as-needed basis. The initial plan and any expansions must be approved by your board of directors and then by shareholders.

Incentive or statutory stock options are offered by some companies to encourage employees to remain long-term with a company and contribute to its growth and development and to the subsequent rise in its stock price.

The US federal tax laws do not generally address the level of approval required for equity awards, but the tax rules that govern the qualification of so-called incentive stock options require that the options be granted under a shareholder-approved plan.

Stock options are a benefit often associated with startup companies, which may issue them in order to reward early employees when and if the company goes public. They are awarded by some fast-growing companies as an incentive for employees to work towards growing the value of the company's shares.

There are many requirements on using ISOs. First, the employee must not sell the stock until after two years from the date of receiving the options, and they must hold the stock for at least a year after exercising the option like other capital gains. Secondly, the stock option must last ten years.

A stock option plan must be adopted by the company's directors and, in some cases, approved by the company's shareholders.

Once approved by the stockholders, an ESPP does not need to be approved by the stockholders again unless there is an amendment to the ESPP that would be considered the ?adoption of a new plan.? As a practical matter, this means a change in the number of shares reserved for issuance or a change in the related ...