Utah Employee Payroll Record

Description

How to fill out Employee Payroll Record?

Selecting the correct valid document format can be a challenge.

Of course, there are numerous templates accessible online, but how can you find the valid type you require.

Utilize the US Legal Forms website.

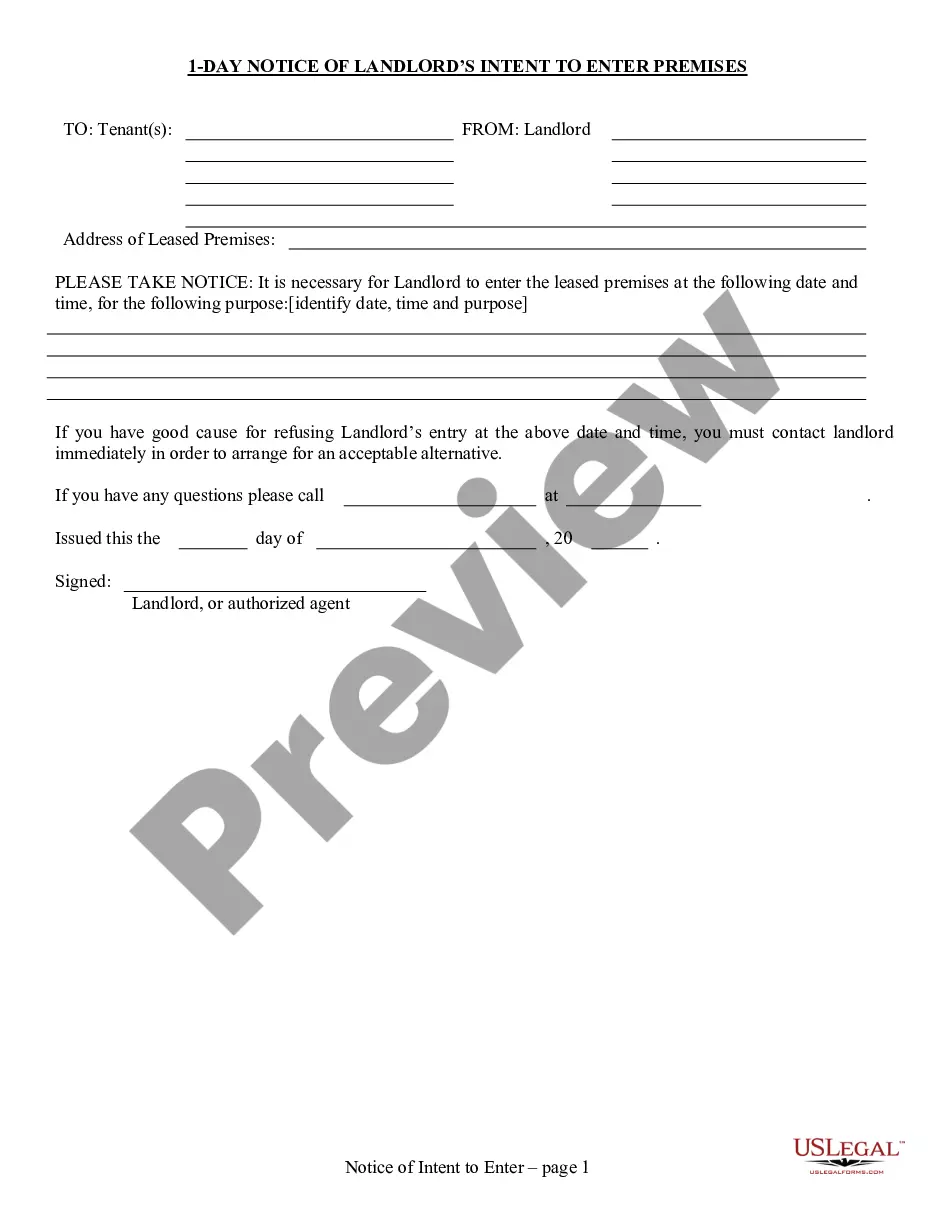

If you are a new user of US Legal Forms, here are simple steps you should follow: Ensure you have selected the appropriate document for your city/state. You can view the document using the Preview button and read the document description to confirm it is suitable for you.

- The service offers thousands of templates, including the Utah Employee Payroll Record, suitable for both business and personal purposes.

- Each document is reviewed by experts and meets federal and state regulations.

- If you are already registered, Log In to your account and click on the Obtain button to locate the Utah Employee Payroll Record.

- Use your account to review the valid documents you have previously acquired.

- Visit the My documents section of your account to download another copy of the document you need.

Form popularity

FAQ

In Utah, various records are considered public, including government documents, financial records, and employee payroll information like the Utah Employee Payroll Record. Access to these records is crucial for promoting government accountability and citizen engagement. Utilizing platforms like US Legal Forms can help individuals effectively request access to these public records.

Utah faced numerous challenges in its journey to statehood, including political, social, and economic factors. The territory had a unique cultural landscape that complicated its admission into the Union. These historical contexts also shaped contemporary practices surrounding records and transparency, such as the handling of the Utah Employee Payroll Record.

Utah's right to know has seen various modifications and updates over the years. These changes aim to improve public access to governmental information while addressing privacy concerns. Understanding these changes can help individuals navigate the nuances of accessing their own records, including the Utah Employee Payroll Record.

Yes, in Utah, it is generally legal to film people in public spaces where there is no reasonable expectation of privacy. However, filming individuals may raise ethical concerns, especially in sensitive situations. If you plan to use any footage for commercial purposes, you may need to obtain consent, which is important to consider alongside your documentation, including the Utah Employee Payroll Record.

In Utah, employers must keep payroll records for at least three years. This includes maintaining detailed documents related to employee compensation, such as the Utah Employee Payroll Record. Proper record-keeping ensures compliance with state laws and provides valuable information for audits and employee inquiries.

Yes, Utah is recognized as a right to know state. This designation allows citizens to access certain government records, including financial documents and employee payroll information, like the Utah Employee Payroll Record. This commitment to transparency builds trust between residents and their government.

Utah's right to know promotes transparency in government operations and ensures public access to information. This law helps employees understand their rights regarding workplace records, including the Utah Employee Payroll Record. By allowing access to information, individuals can better engage with their local government and understand how resources are managed.

Employees can access their ESS payroll through their employer's dedicated Employee Self-Service portal. Typically, this requires a secure login with personal credentials. Once logged in, employees can view their Utah Employee Payroll Record, manage personal information, and access tax documents. If you need assistance navigating these systems, platforms like USLegalForms can provide valuable resources and support.

Accessing Utah public records is straightforward. You can visit the official Utah State website where they provide a portal to search for various public records, including payroll records. Make sure to have the relevant information, such as names and dates, to assist in your search. Tools like USLegalForms can also guide you through the process, helping you find the specific Utah Employee Payroll Record you need.

To obtain a Utah Employee Payroll Record, you may need to contact your employer's payroll department directly. They can provide you with the necessary documents and information regarding your payroll history. If you encounter any difficulties, consider using services from platforms like USLegalForms that simplify record requests. This helps ensure you receive accurate payroll records promptly.