Virgin Islands Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check)

Description

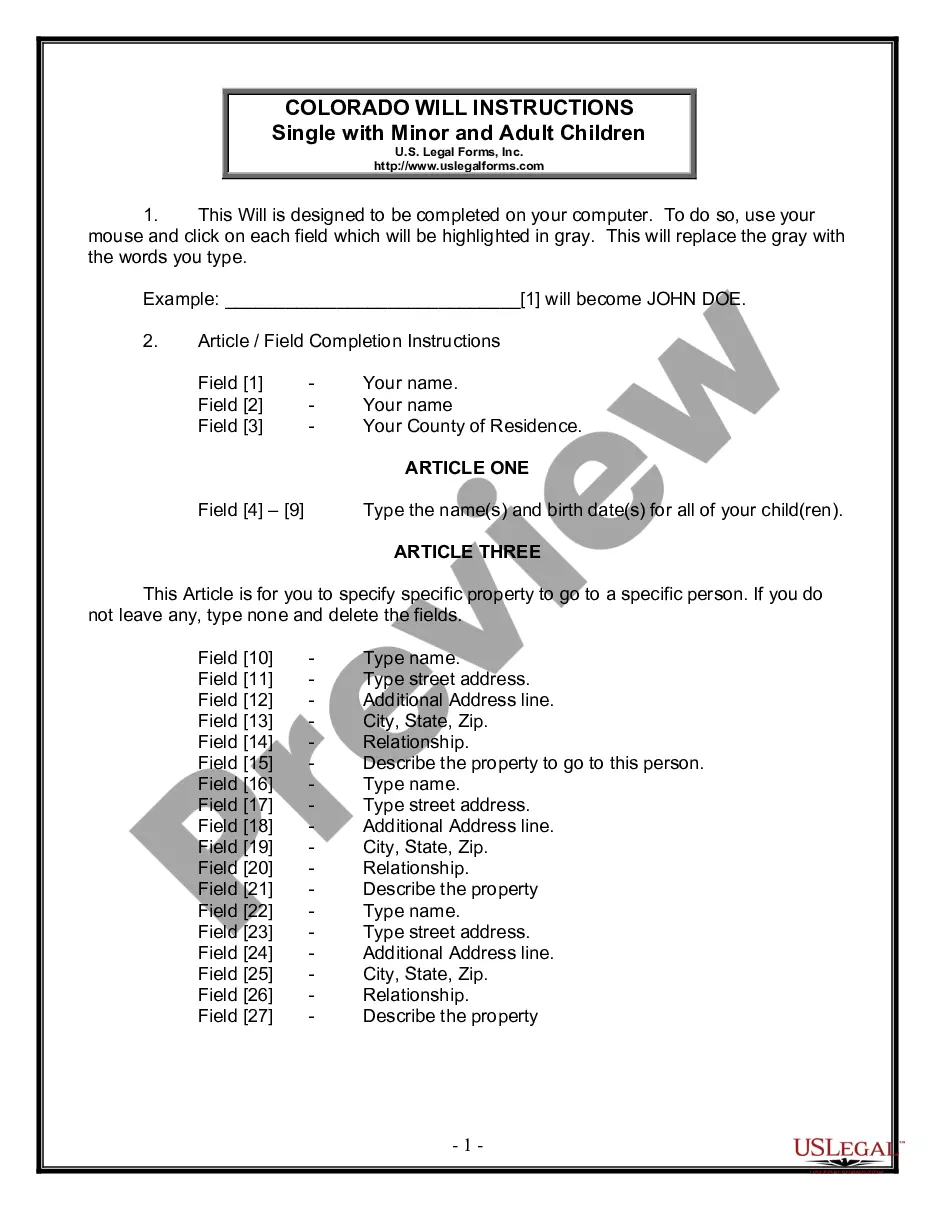

How to fill out Complaint Against Drawer Of Check That Was Dishonored Due To Insufficient Funds (Bad Check)?

Are you currently inside a place that you will need paperwork for either enterprise or person purposes just about every day? There are a variety of authorized file layouts accessible on the Internet, but getting kinds you can rely is not easy. US Legal Forms offers a huge number of develop layouts, much like the Virgin Islands Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check), that happen to be published to fulfill state and federal needs.

If you are currently informed about US Legal Forms site and also have an account, merely log in. Following that, it is possible to acquire the Virgin Islands Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check) design.

Unless you offer an account and would like to start using US Legal Forms, follow these steps:

- Obtain the develop you require and ensure it is for that appropriate metropolis/state.

- Use the Review option to analyze the shape.

- Browse the description to actually have selected the appropriate develop.

- If the develop is not what you are looking for, make use of the Research industry to obtain the develop that meets your requirements and needs.

- If you get the appropriate develop, simply click Acquire now.

- Pick the pricing plan you need, fill in the necessary info to generate your account, and pay for an order utilizing your PayPal or charge card.

- Choose a practical document format and acquire your backup.

Discover each of the file layouts you might have purchased in the My Forms food selection. You can get a more backup of Virgin Islands Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check) any time, if needed. Just select the essential develop to acquire or print the file design.

Use US Legal Forms, probably the most substantial collection of authorized types, to save efforts and steer clear of mistakes. The services offers expertly made authorized file layouts which can be used for a variety of purposes. Generate an account on US Legal Forms and begin creating your life easier.

Form popularity

FAQ

When you cash or deposit a check and there's not enough funds to cover it in the account it's drawn on, this is also considered non-sufficient funds (NSF). When a check is returned for NSF in this manner, the check is generally returned back to you. This allows you to redeposit the check at a later time, if available.

Make sure you look up the phone number on the bank's official website and don't use the phone number printed on the check (that could be a phone number controlled and answered by the scam artist). Next, call the official number and ask them to verify the check.

As the recipient of a bounced check, you will need to get in touch with the check issuer and request payment. If you're unable to resolve it with a conversation, you could take further action by sending a demand letter via certified mail.

The charges depend on the check amount. For example, knowingly cashing a bad check for $1,000 to $74,999 will be treated as a misdemeanor, while doing the same for a check for $75,000 or more will be treated as a felony. The misdemeanor could result in a fine between $1,500 and $10,000 and jail time ? up to five years.

Writing a check against an account with insufficient funds will always result in a bounced check and incur a fee. In fact, people who knowingly write a check against an account with insufficient funds may be committing a crime.

Your bank likely will charge you an NSF fee for bouncing a check. The average NSF fee, ing to Bankrate's 2022 checking account and ATM fee study, is $26.58. If the bank pays the check, even though you don't have enough money in your account to cover it, it might charge you an overdraft fee.

Under California Penal Code Section 476a, the crime of writing a bad check while aware of insufficient funds with intent to defraud is punishable as a misdemeanor if the total amount of the checks written does not exceed $950.

If someone comes into the bank and uses a check to make a fraudulent withdrawal from an account that is not theirs, the bank is typically liable for the fraud. Similarly, if a bank cashes a check that was created fraudulently, the bank is also responsible for covering those funds.