Virgin Islands Complaint regarding Insurer's Failure to Pay Claim

Description

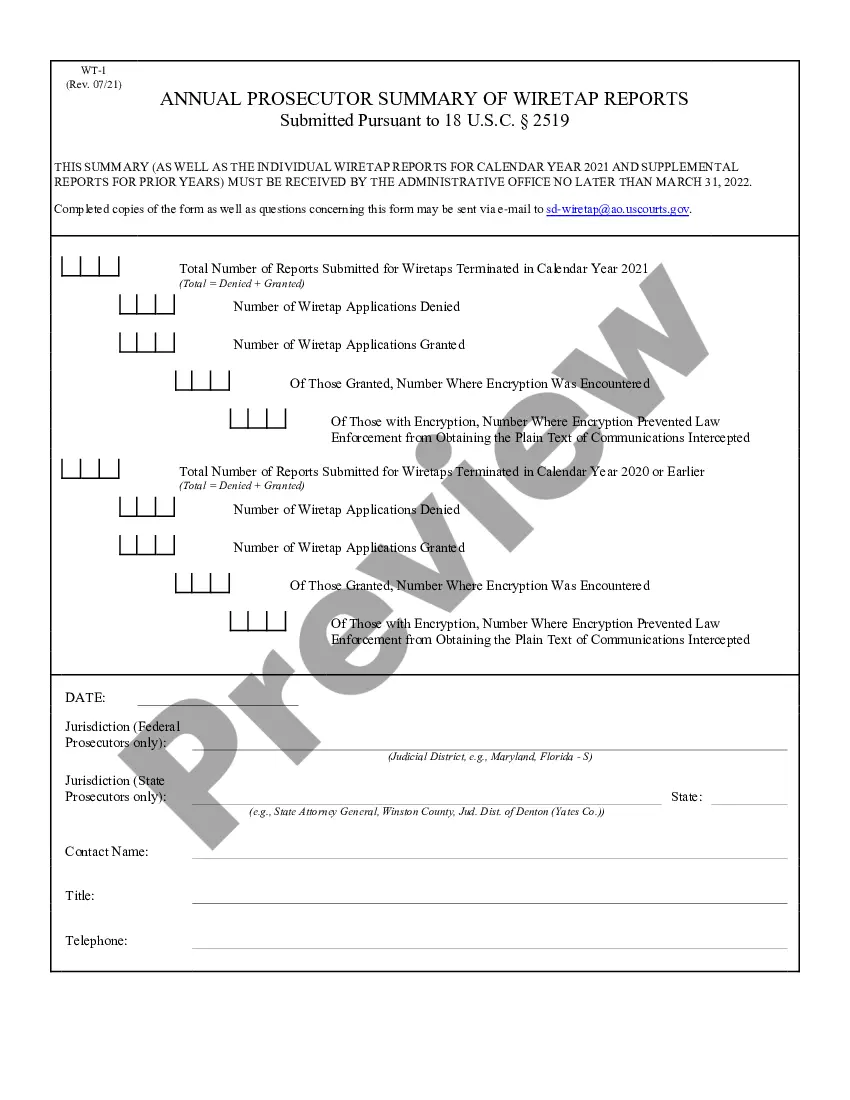

How to fill out Complaint Regarding Insurer's Failure To Pay Claim?

If you wish to comprehensive, down load, or produce lawful record templates, use US Legal Forms, the most important variety of lawful varieties, which can be found online. Take advantage of the site`s simple and easy handy search to obtain the files you want. Numerous templates for enterprise and specific reasons are categorized by groups and states, or key phrases. Use US Legal Forms to obtain the Virgin Islands Complaint regarding Insurer's Failure to Pay Claim within a couple of click throughs.

Should you be already a US Legal Forms client, log in to the profile and click the Acquire option to find the Virgin Islands Complaint regarding Insurer's Failure to Pay Claim. You may also accessibility varieties you in the past delivered electronically from the My Forms tab of your profile.

Should you use US Legal Forms initially, refer to the instructions listed below:

- Step 1. Be sure you have selected the shape for the correct city/region.

- Step 2. Utilize the Review solution to look over the form`s articles. Do not overlook to learn the outline.

- Step 3. Should you be unhappy with all the form, use the Look for discipline at the top of the display to locate other models from the lawful form format.

- Step 4. When you have identified the shape you want, go through the Buy now option. Choose the costs prepare you prefer and add your accreditations to sign up to have an profile.

- Step 5. Method the deal. You should use your bank card or PayPal profile to finish the deal.

- Step 6. Select the formatting from the lawful form and down load it on the system.

- Step 7. Comprehensive, edit and produce or indication the Virgin Islands Complaint regarding Insurer's Failure to Pay Claim.

Every lawful record format you buy is yours eternally. You may have acces to each form you delivered electronically inside your acccount. Click on the My Forms section and select a form to produce or down load once again.

Compete and down load, and produce the Virgin Islands Complaint regarding Insurer's Failure to Pay Claim with US Legal Forms. There are millions of skilled and state-specific varieties you may use for your enterprise or specific requirements.

Form popularity

FAQ

The auto insurance company with the most complaints is United Automobile Insurance, which receives roughly 40 times more complaints than the average insurer its size, ing to the latest NAIC complaint index. The insurance companies with the next most complaints are Ocean Harbor Insurance and California Casualty.

If there is any indication that their policyholder isn't responsible the insurer will deny your claim. Claims may also be denied if there's evidence to show that the policyholder isn't entirely to blame for an accident. In California, anyone who contributes to an accident can be held responsible for resulting injuries.

Insurance claims are often denied if there is a dispute as to fault or liability. Companies will only agree to pay you if there's clear evidence to show that their policyholder is to blame for your injuries. If there is any indication that their policyholder isn't responsible the insurer will deny your claim.

Insurance companies might try to delay or just refuse to give you the settlement you deserve after a serious injury. When insurance companies refuse to cooperate, you may need to consider filing an official lawsuit and possibly taking that case to court.

Third-party bad faith cases typically fall under three categories: Failure to defend. Your insurance company has a duty to provide an adequate defense on your behalf in lawsuit. ... Failure to settle. Your provider has a duty to pay for any damages of which you are found liable in lawsuits. ... Negligent handling of the case.

There are certain situations where a car insurance provider can deny a claim, particularly if the driver has been negligent on the road. Driving under the influence, damaged vehicles, unqualified drivers - all of these things can void a policy. Have you been involved in an incident and need to make a claim?

Bad faith insurance refers to an insurer's attempt to renege on its obligations to its clients, either through refusal to pay a policyholder's legitimate claim or investigate and process a policyholder's claim within a reasonable period.

(List all of your problems, such as refusal to cover physician-prescribed therapy, claim has not been paid or has been denied, etc.) Please accept this letter as a formal written complaint against_______________(insert name of your insurance company).