Utah Sample Letter for Passover

Description

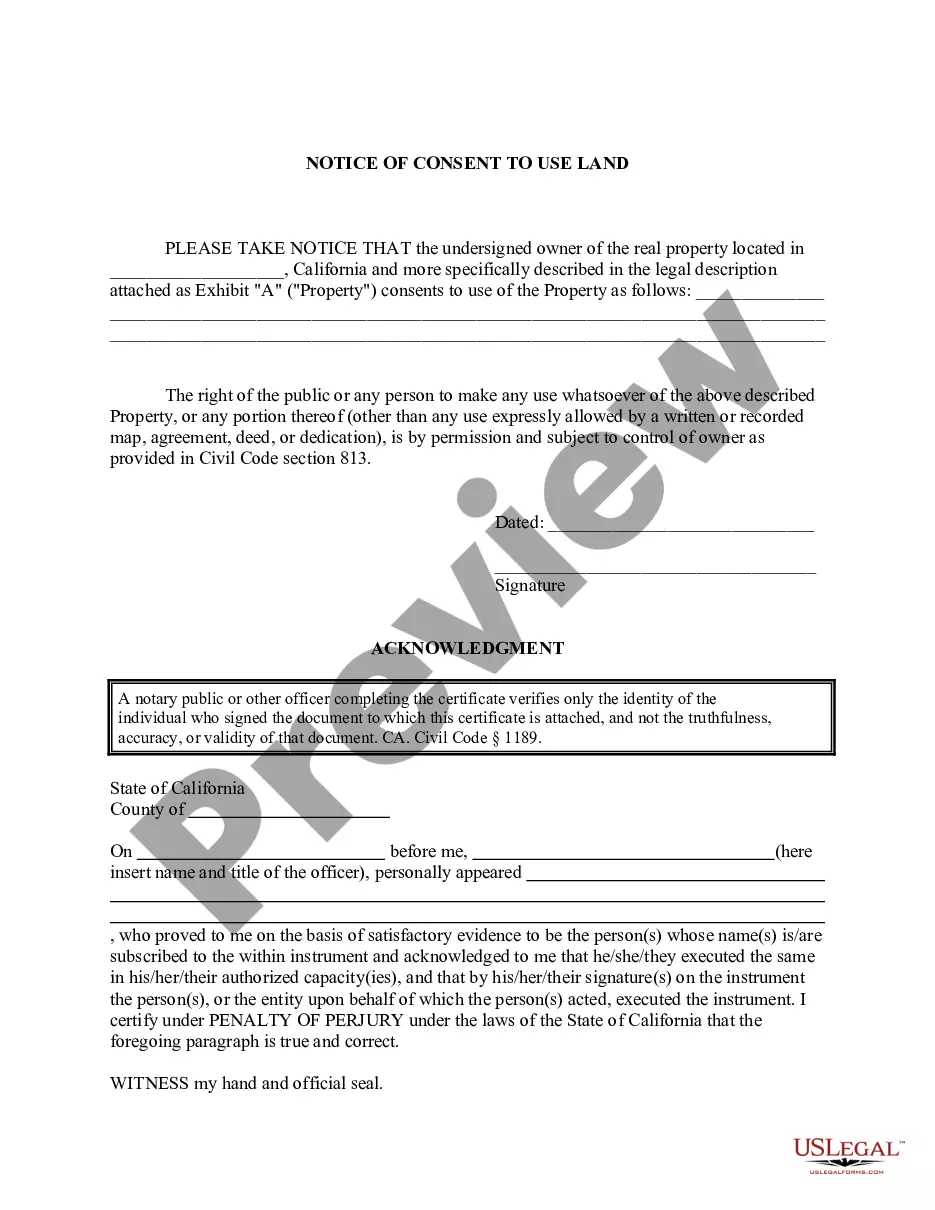

How to fill out Sample Letter For Passover?

You might spend hours online searching for the genuine document template that meets the federal and state guidelines you require.

US Legal Forms offers numerous legal forms that are reviewed by experts.

You can obtain or create the Utah Sample Letter for Passover from the platform.

If available, use the Review button to preview the document template as well.

- If you have a US Legal Forms account, you can Log In and click on the Acquire button.

- Then, you can complete, modify, print, or sign the Utah Sample Letter for Passover.

- Every legal document template you purchase is yours permanently.

- To obtain an additional copy of any purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions listed below.

- First, ensure that you have selected the correct document template for your state/city of choice.

- Review the form information to confirm you have chosen the correct form.

Form popularity

FAQ

S Corps in Utah are required to file Form 1120S with the IRS annually, along with the Utah State income tax return. Additionally, ensure you maintain accurate records and submit any necessary payroll tax filings. Utilizing resources such as the Utah Sample Letter for Passover can provide clarity on your filing obligations.

Yes, you can file for an S Corp yourself, although it requires attention to detail and understanding of the forms involved. It is crucial to fill out the Articles of Incorporation and IRS Form 2553 accurately. For ease and clarity, consider templates like the Utah Sample Letter for Passover from uslegalforms.

To file taxes for an LLC in Utah, you will need your EIN and details of your business income and expenses. Additionally, determine whether your LLC will be taxed as a sole proprietorship, partnership, or corporation. For clear tax documentation processes, check resources like a Utah Sample Letter for Passover from uslegalforms.

An offer in compromise is a proposal to settle your tax debt with the Utah State Tax Commission for less than what you owe. This offer allows you to negotiate a solution based on your financial situation. For legal paperwork, considering tools like the Utah Sample Letter for Passover can help you articulate your proposal effectively.

The benefits of forming an S Corp typically become apparent when your net income exceeds approximately $40,000. At this level, you begin to see tax savings through reduced self-employment taxes. Evaluating your specific situation can help, and tools like the Utah Sample Letter for Passover can assist in your planning.

Filing for an S Corp in Utah involves submitting the Articles of Incorporation to the state. You'll also need to file Form 2553 with the IRS to achieve S Corporation status. If you're looking for guidance, consider using resources like uslegalforms, which provide templates including a Utah Sample Letter for Passover.

To file for an S Corp in Utah, gather essential documents such as the Articles of Incorporation, an employer identification number (EIN), and a completed Form 2553. Additionally, ensure that you comply with any state-specific regulations. Using a Utah Sample Letter for Passover can help you prepare necessary documents efficiently.

An acceptable Passover greeting includes phrases like 'Wishing you a happy and healthy Passover' or 'May your holiday be filled with joy and peace.' Maintaining goodwill and positivity during the celebration is essential. For additional options and more personalized messages, refer to the Utah Sample Letter for Passover for comprehensive ideas.

Common blessings during Passover include the blessing over the matzah and wine, which acknowledge the significance of the Seder meal. Additionally, many families express gratitude for freedom and the lessons of history. Incorporating these blessings into your celebrations can deepen your connection to the holiday. Utilize the Utah Sample Letter for Passover for inspiration on how to articulate these important blessings.

In a Passover card, consider including personal anecdotes or reflections related to the holiday, alongside standard greetings. Expressing your hopes for a meaningful time with family can make your card truly special. The Utah Sample Letter for Passover can provide you with templates and ideas to effectively convey your feelings.