Utah Cash Receipts Control Log

Description

How to fill out Cash Receipts Control Log?

If you desire to complete, obtain, or print authentic document templates, utilize US Legal Forms, the leading collection of legal documents, accessible online.

Take advantage of the website's user-friendly and efficient search function to find the paperwork you require.

Numerous templates for business and individual purposes are categorized by categories and jurisdictions, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Choose the payment plan you prefer and provide your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to access the Utah Cash Receipts Control Log with just a few clicks.

- If you are currently a US Legal Forms customer, sign in to your account and click the Download button to retrieve the Utah Cash Receipts Control Log.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

- Step 2. Use the Preview option to review the content of the form. Don't forget to read through the information.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Cash controls are internal systems used to prevent unapproved payments, theft, and fraud. These systems include procedures at predefined steps to create segmentation of duties and introduce checks in the process to identify and correct errors.

Examples of Cash ManagementA computer manufacturing company, Abc Limited, uses supplier Alpha & Co. to purchase raw materials. read more. Alpha & Co. has the policy of allowing credit of 30-days. Abc limited has $10 million in cash resources available and has to pay $2 million to Alpha & Co.

To control cash transactions, organizations should adopt some of the following practices: Require background checks for employees, establish segregation of duties, safeguard all cash and assets in secure locations, and use a lockbox to accept cash payments from customers.

Bank deposits and bank account reconciliations are examples of internal control and cash accounting. Retail companies with physical point-of-sale cash registers need to safeguard cash assets in the cash drawer. Ecommerce companies also need to implement adequate cash controls.

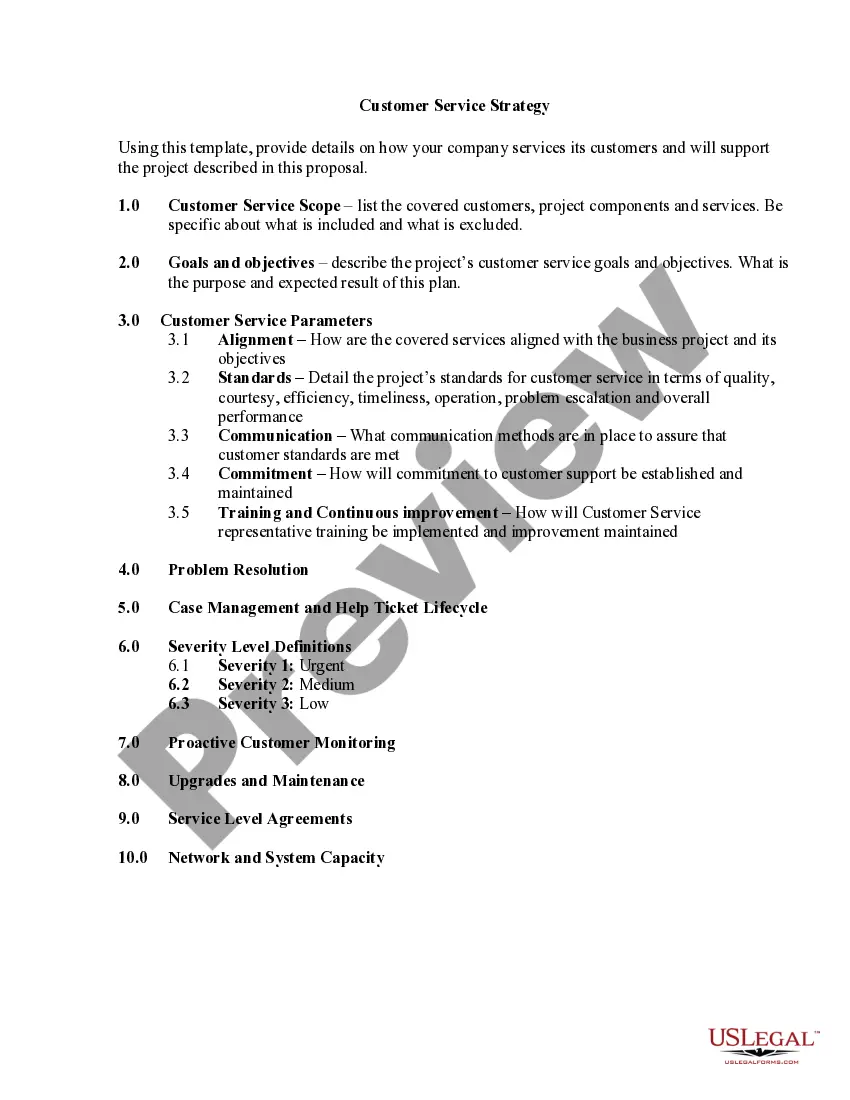

Objective. The objective of cash receipt controls is to ensure that all monies (checks, currency, coin, and credit cards) are properly accounted for and timely deposited.

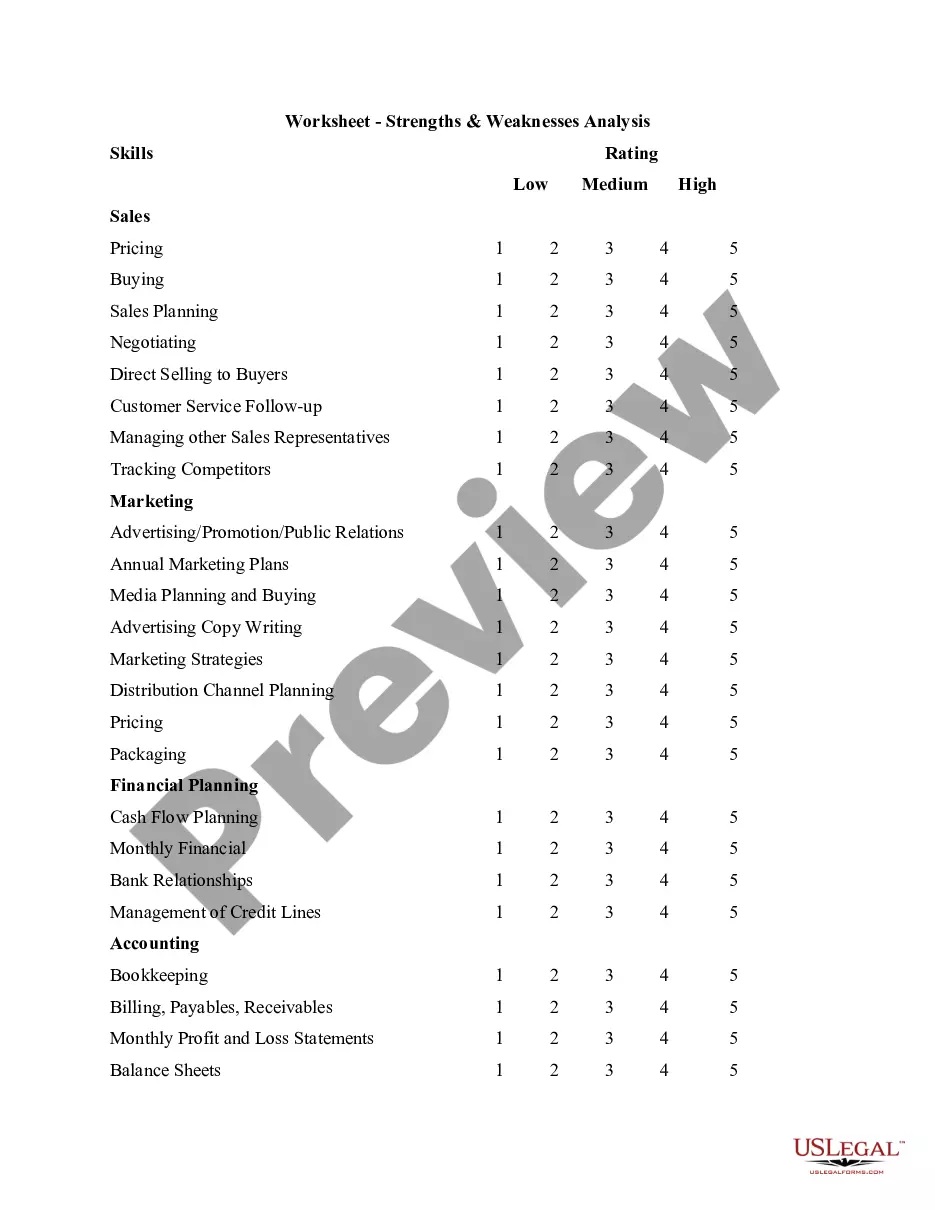

A cash receipts log is used to track the cash receipts of a business. Although the format of the cash receipts log varies from business to business, the essential details presented on the form are the same and include the customer's name, amount of cash receipt and details related to the payment.

Record any cash payments as a debit in your cash receipts journal like usual. Then, debit the customer's accounts receivable account for any purchase made on credit. In your sales journal, record the total credit entry.

These top 10 best practices and procedures can help you handle cash the right way for your business.Organization Is Key to Effective Cash Handling.Keep an Eye on Your Cash.Enforce Policies and Procedures.Keep Less Cash on Site.Engage Your Staff.Maintain a Schedule.Have Enough Staff.Ask for Help.More items...?

Cash control is cash management and internal control over cash and cash-related policies within a company. Cash controlling receipts and cash disbursements reduces erroneous payments, theft, and fraud.

Best practices:Record cash receipts when received.Keep funds secured.Document transfers.Give receipts to each customer.Don't share passwords.Give each cashier a separate cash drawer.Supervisors verify cash deposits.Supervisors approve all voided refunded transactions.