Utah Sworn Statement of Identity Theft

Description

1. Obtains, records, or accesses identifying information that would assist in accessing financial resources, obtaining identification documents, or obtaining benefits of the victim.

2. Obtains goods or services through the use of identifying information of the victim.

3. Obtains identification documents in the victim's name.

Identity theft statutes vary by state and usually do not include use of false identification by a minor to obtain liquor, tobacco, or entrance to adult business establishments. The types of information protected from misuse by identity theft statutes includes, among others:

-Name

-Date of birth

-Social Security number

-Driver's license number

-Financial services account numbers, including checking and savings accounts

-Credit or debit card numbers

-Personal identification numbers (PIN)

-Electronic identification codes

-Automated or electronic signatures

-Biometric data

-Fingerprints

-Passwords

-Parent's legal surname prior to marriage

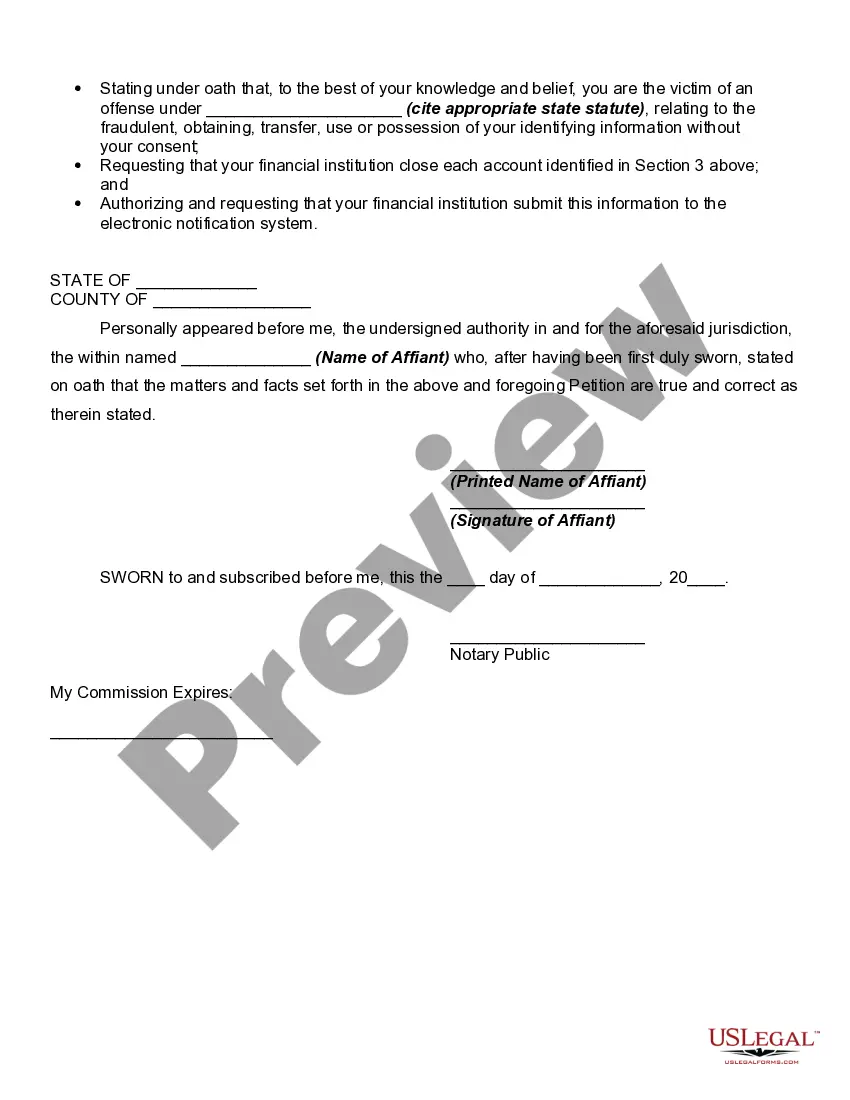

How to fill out Sworn Statement Of Identity Theft?

You may commit hours on the Internet searching for the authorized papers format which fits the state and federal requirements you require. US Legal Forms supplies 1000s of authorized varieties which are examined by pros. It is possible to down load or produce the Utah Sworn Statement of Identity Theft from my support.

If you have a US Legal Forms account, it is possible to log in and click on the Download option. Following that, it is possible to complete, change, produce, or indicator the Utah Sworn Statement of Identity Theft. Each and every authorized papers format you buy is your own permanently. To have another duplicate of the obtained form, visit the My Forms tab and click on the related option.

If you use the US Legal Forms web site the very first time, follow the easy recommendations under:

- First, be sure that you have selected the proper papers format for the region/metropolis of your choosing. Look at the form explanation to ensure you have picked out the proper form. If available, take advantage of the Preview option to check from the papers format as well.

- In order to discover another model of the form, take advantage of the Lookup industry to discover the format that meets your needs and requirements.

- Once you have found the format you would like, click on Get now to move forward.

- Find the costs prepare you would like, type in your qualifications, and register for your account on US Legal Forms.

- Full the purchase. You can utilize your charge card or PayPal account to purchase the authorized form.

- Find the format of the papers and down load it in your product.

- Make modifications in your papers if necessary. You may complete, change and indicator and produce Utah Sworn Statement of Identity Theft.

Download and produce 1000s of papers web templates while using US Legal Forms site, which provides the most important collection of authorized varieties. Use professional and condition-particular web templates to take on your small business or specific demands.

Form popularity

FAQ

Identity theft happens when someone takes your name and personal information (like your social security number) and uses it without your permission to do things like open new accounts, use your existing accounts, or obtain medical services.

Report ? .idtheft.utah.gov, the ID Theft Central, which is the official law enforcement web site from which claims are reported to local, state or federal law enforcement agencies.

Class A Misdemeanor ? if the perpetrator stole less than $1,000, they can be sentenced to one year in jail and fined up to $2,500. Third-Degree Felony ? if the perpetrator stole more than $1,000 but less than $5,000, they can be sentenced to up to five years in prison and fined up to $5,000.

I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.

I am a victim of identity theft, and I did not make [this/these] charge(s). I request that you remove the fraudulent charge(s) and any related finance charge and other charges from my account, send me an updated and accurate statement, and close the account (if applicable).

In most cases, taxpayers do not need to complete this form. Only victims of tax-related identity theft should submit the Form 14039, and only if they haven't received certain letters from the IRS.