Utah Revocable Trust for Child

Description

How to fill out Revocable Trust For Child?

Locating the appropriate legal document template can be a challenge.

Of course, there are numerous templates available online, but how will you obtain the legal form you require.

Utilize the US Legal Forms website. This service offers thousands of templates, including the Utah Revocable Trust for Child, which can be utilized for business and personal purposes.

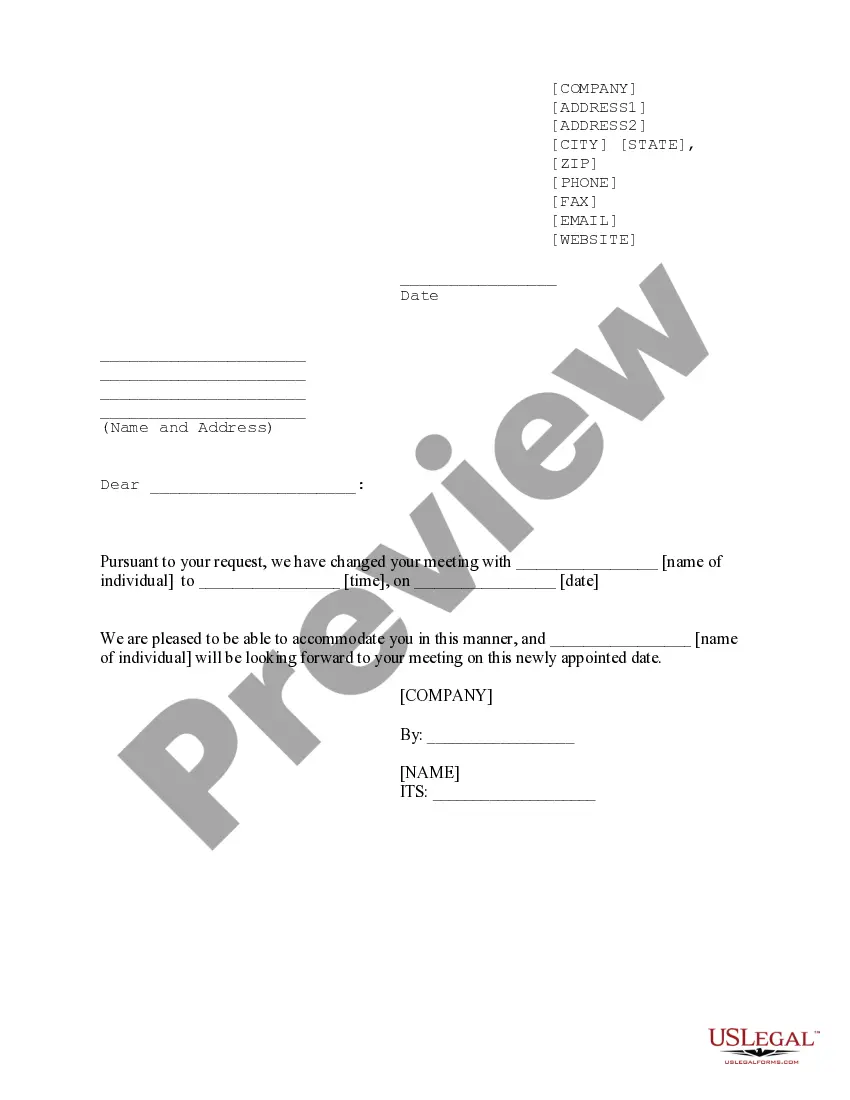

You can preview the form using the Review button and examine the form summary to confirm it suits your needs.

- Each of the forms is reviewed by experts and complies with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to retrieve the Utah Revocable Trust for Child.

- Use your account to browse the legal forms you have previously acquired.

- Visit the My documents tab of your account and get another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

- First, ensure you have selected the correct form for your area/state.

Form popularity

FAQ

One negative aspect of a trust, including a Utah Revocable Trust for Child, is the potential for family conflict, especially if beneficiaries do not understand the trust’s provisions. Additionally, the administrative responsibilities can be burdensome, requiring effective management and oversight. Educating family members about the trust can mitigate these issues.

A Utah Revocable Trust for Child is often considered ideal for providing flexibility while securing a child's future. This type of trust allows parents to make changes as needed, catering to evolving family dynamics. It's important to assess the specific needs and circumstances of your children when choosing the suitable trust.

To set up a revocable living trust in Utah, start by drafting the trust document that outlines terms and beneficiaries, focusing on your child's needs. You will need to fund the trust by transferring assets into it, ensuring it serves its purpose effectively. Consulting with legal experts, such as those at US Legal Forms, can ease the process and help you navigate any legal requirements.

Parents in the UK commonly err by not considering tax implications when setting up a trust fund, similar to what can happen with a Utah Revocable Trust for Child. They may not realize how a trust can impact inheritance tax or gift tax. It's crucial for parents to seek professional advice to navigate these complexities.

The biggest mistake parents often make is not fully understanding their children’s needs when setting up a trust fund, such as a Utah Revocable Trust for Child. Many parents overlook future expenses like education and healthcare. It is essential to integrate specific provisions that align with their children's changing requirements.

Setting up a trust, such as a Utah Revocable Trust for Child, can involve certain pitfalls. Common challenges include misunderstandings about the roles of trustees and beneficiaries, leading to disputes. Additionally, inadequate funding of the trust may leave it ineffective in fulfilling its intended purpose, such as providing for children's needs.

In Utah, a trust does not have to be notarized to be valid, but notarization can add an extra layer of authenticity. For a Utah Revocable Trust for Child, it may be beneficial to have the trust document notarized to prevent any potential disputes in the future. Always consult with a legal expert to ensure that your trust meets all necessary requirements.

In Utah, beneficiaries typically do not receive a copy of the trust document unless the trust creator chooses to share it. However, if a Utah Revocable Trust for Child becomes irrevocable upon the creator's death, beneficiaries have the right to request a copy of the trust. It's crucial to communicate your intentions clearly with your beneficiaries to avoid confusion.

A Utah Revocable Trust for Child often serves as an excellent option for parents wanting to safeguard their children’s inheritance. Revocable trusts provide flexibility, allowing you to adjust terms as needed over time. Furthermore, these trusts can help manage assets on behalf of your children until they reach a suitable age, ensuring their financial security.

To create a valid trust in Utah, you must have a clear intention to form a trust and designate a trustee. Additionally, the trust document must detail the assets involved and outline the beneficiaries, specifically if you are considering a Utah Revocable Trust for Child. It's important to ensure that the trust complies with Utah state laws and is executed with proper formalities.