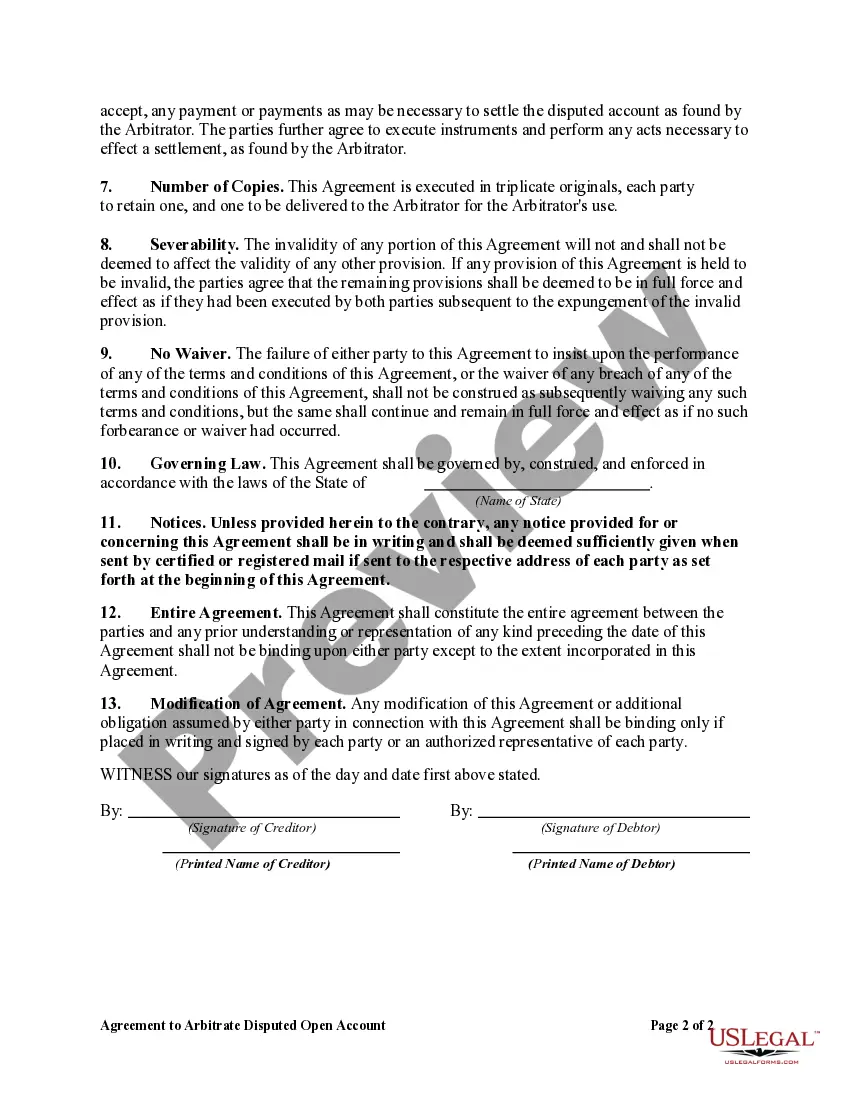

Utah Agreement to Arbitrate Disputed Open Account

Description

How to fill out Agreement To Arbitrate Disputed Open Account?

If you need to compile, acquire, or print authentic document templates, utilize US Legal Forms, the largest repository of legal forms available online.

Make use of the site's straightforward and user-friendly search functionality to locate the documents you require.

Numerous templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to obtain the Utah Agreement to Arbitrate Disputed Open Account within just a few clicks.

Every legal document template you purchase is yours to keep indefinitely. You will have access to every form you've obtained in your account. Select the My documents section and choose a form to print or download again.

Complete and obtain, and print the Utah Agreement to Arbitrate Disputed Open Account with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click on the Acquire button to retrieve the Utah Agreement to Arbitrate Disputed Open Account.

- You can also access forms you have previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Review feature to examine the contents of the form. Don't forget to read the summary.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the page to find alternate versions of the legal document template.

- Step 4. After you have identified the form you need, click the Buy now button. Choose your preferred pricing plan and enter your information to create an account.

- Step 5. Complete the payment process. You can utilize your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Fill out, modify, and print or sign the Utah Agreement to Arbitrate Disputed Open Account.

Form popularity

FAQ

Generally, agreeing to an arbitration agreement is optional and often reflects your financial institution's standard terms. For the Utah Agreement to Arbitrate Disputed Open Account, you usually can opt out, but this may affect your relationship with the bank. It’s crucial to read and understand all terms before making a decision. Remember, being informed empowers you to choose what’s best for your circumstances.

You might consider not agreeing to arbitration if you are concerned about limited appeal options and potential biases of the arbitrator. The Utah Agreement to Arbitrate Disputed Open Account could restrict your rights to pursue further legal action in court. Additionally, some individuals prefer the transparency and formality that come with litigation. Weighing your preferences against the benefits of arbitration is a smart approach.

Agreeing to an arbitration agreement can offer various advantages, such as faster resolution times and less formal proceedings. For the Utah Agreement to Arbitrate Disputed Open Account, this means you may have a more streamlined process for addressing conflicts. However, it is essential to assess your individual situation and the agreement terms. You may wish to seek guidance to ensure this choice aligns with your long-term financial goals.

A bank arbitration agreement is a legal contract specifying that disputes between the bank and its customers will be resolved through arbitration. This type of agreement is present in documents like the Utah Agreement to Arbitrate Disputed Open Account. The main goal is to simplify the resolution process. By understanding these agreements, customers can make informed choices regarding their financial interactions.

An agreement to arbitrate disputes refers to a contract clause where parties agree to resolve disagreements through arbitration instead of litigation. For the Utah Agreement to Arbitrate Disputed Open Account, this means that if a conflict arises, both parties will submit to an arbitrator. This process can save time and resources while providing a resolution. Understanding this agreement is vital for anyone entering the contract.

Choosing arbitration can often lead to quicker resolutions compared to traditional court proceedings. The Utah Agreement to Arbitrate Disputed Open Account is designed to streamline dispute resolution, making it an attractive option for many. However, the benefits vary depending on individual circumstances. Weigh the pros and cons according to your needs before making a choice.

Rejecting an arbitration agreement like the Utah Agreement to Arbitrate Disputed Open Account usually allows you to pursue litigation in court instead. This means you have the right to present your case before a judge and jury. However, be aware that opting out could affect your relationship with the bank, and it may lead to different terms in your agreement. Analyzing the implications of your decision is crucial.

One downside of arbitration is that you may have limited avenues for appeal, meaning once the arbitrator makes a decision, it is typically final. This can be concerning if you believe your case deserves further consideration. Additionally, some view arbitration as less transparent than courtroom litigation. Understanding how the Utah Agreement to Arbitrate Disputed Open Account may affect you can help in making an informed choice.

Whether to opt in or out of an arbitration agreement like the Utah Agreement to Arbitrate Disputed Open Account depends on your personal circumstances. Opting in often leads to a faster resolution process, while opting out preserves your rights to litigation. Take time to review the terms and potential outcomes of both options. Consider consulting a legal expert if you feel uncertain about your choice.

Opting out of the arbitration agreement with your bank can be a significant decision. If you choose to opt out, you might retain the right to file a lawsuit, which can be beneficial in certain situations. However, keep in mind that opting out may not be the best option for everyone. Evaluate your financial situation and consider how the Utah Agreement to Arbitrate Disputed Open Account may impact your future disputes.