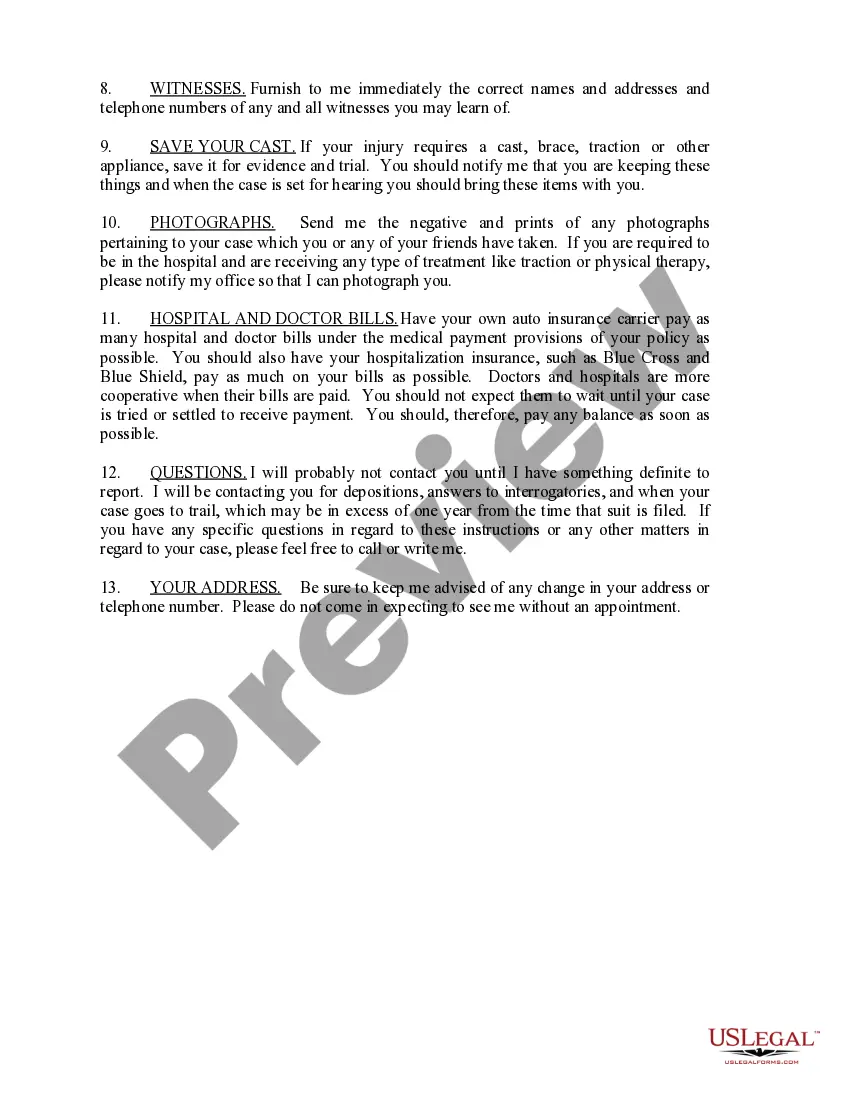

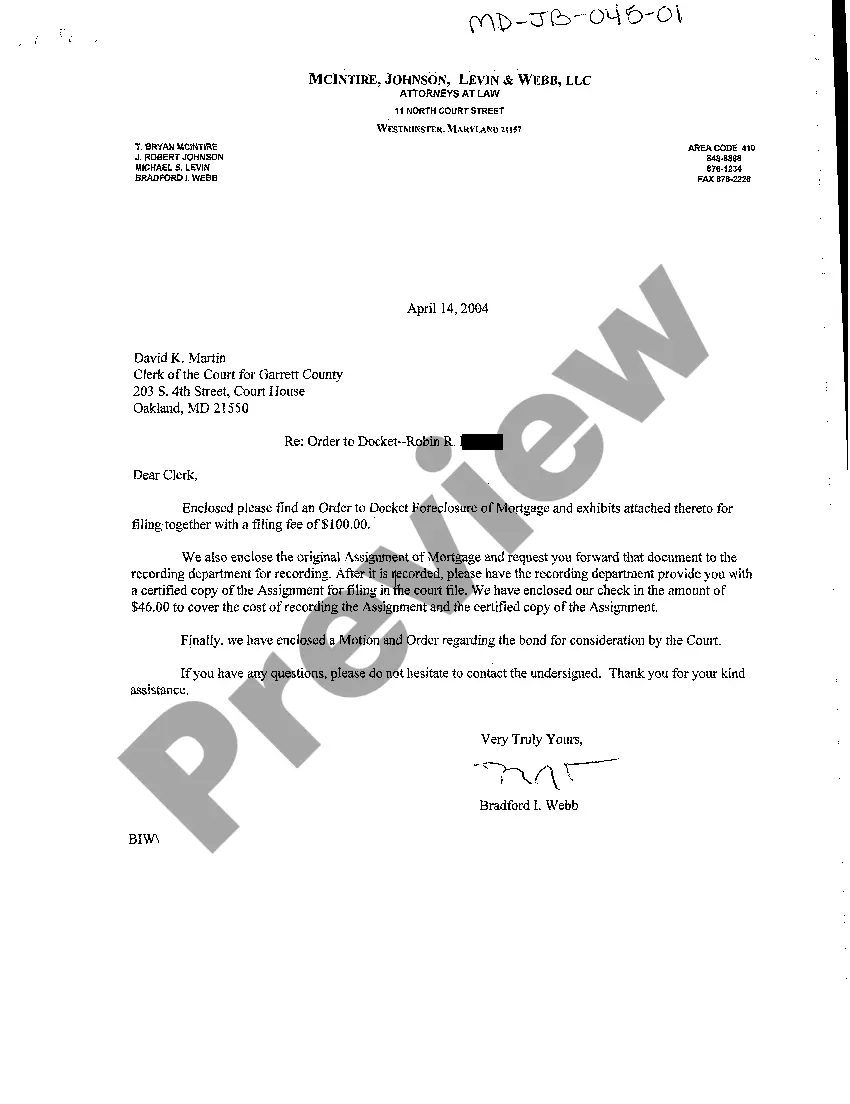

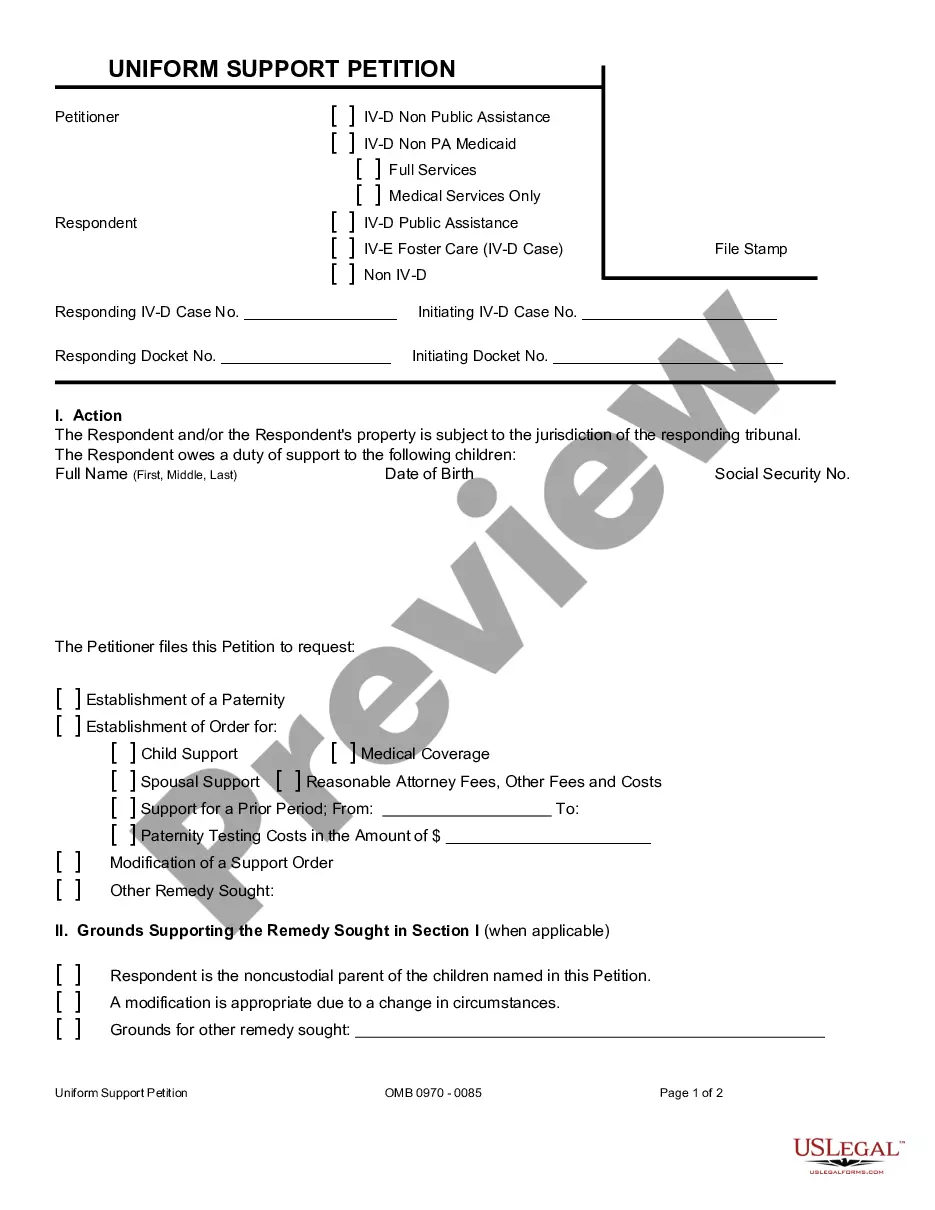

Utah Instructions to Clients - Short

Description

How to fill out Instructions To Clients - Short?

Are you presently in the location where you require documentation for either commercial or personal reasons almost every time.

There are numerous authentic document templates available online, but finding versions you can rely on is not simple.

US Legal Forms offers thousands of form templates, such as the Utah Instructions to Clients - Short, that are designed to meet state and federal standards.

If you find the correct form, click on Purchase now.

Choose the pricing plan you prefer, complete the necessary details to create your account, and pay for the order using your PayPal or credit card. Select a convenient document format and download your copy. Access all the document templates you have purchased in the My documents menu. You can obtain another copy of the Utah Instructions to Clients - Short at any time, if needed. Just click the required form to download or print the document template. Utilize US Legal Forms, one of the most extensive collections of legitimate forms, to save time and avoid errors. The service provides professionally crafted legal document templates that you can use for a variety of purposes. Create your account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have your account, simply Log In.

- After that, you may download the Utah Instructions to Clients - Short template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct area/county.

- Utilize the Preview button to review the form.

- Examine the information to confirm that you have selected the accurate form.

- If the form isn’t what you’re looking for, use the Search box to find the form that suits your needs and requirements.

Form popularity

FAQ

On March 23, 2023, Utah enacted Senate Bill 203, allowing unlimited carryforward of NOLs from taxable years beginning on or after Jan. 1, 2008. NOLs carried forward to a taxable year beginning on or after Jan. 1, 2023 are limited to 80% of Utah taxable income.

If your federal adjusted gross income is less than or equal to your federal standard deduction, you are exempt from Utah income tax.

If you need to change or amend an accepted Utah State Income Tax Return for the current or previous Tax Year you need to complete Form TC-40. Form TC-40 is a Form used for the Tax Return and Tax Amendment. You can prepare a current tax year Utah Tax Amendment on eFile.com, however you can not submit it electronically.

You must file a Utah TC-40 return if you: are a Utah resident or part-year resident who must file a federal return, are a nonresident or part-year resident with income from Utah sources who must file a federal return, or. want a refund of any income tax overpaid.

TC40 data is information collected by a card-issuing bank when a card-holder claims a transaction posted to their account is fraudulent. A TC40 report is the form the bank uses to send the TC40 data to credit card payments companies like VISA and MasterCard.

Here's how it works when you authorize a PTE to pay a tax on behalf of pass-through entity taxpayers who are individuals. Pass-through entities in Utah pay the standard state income tax rate which is 4.95%, which is the same as the individual state income rate.

Ing to Utah Instructions for Form TC-40, you must file a Utah income tax return if: You were a resident or part year resident of Utah that must file a federal return. You were a nonresident or part-year resident with Utah source income and are required to file a federal return.