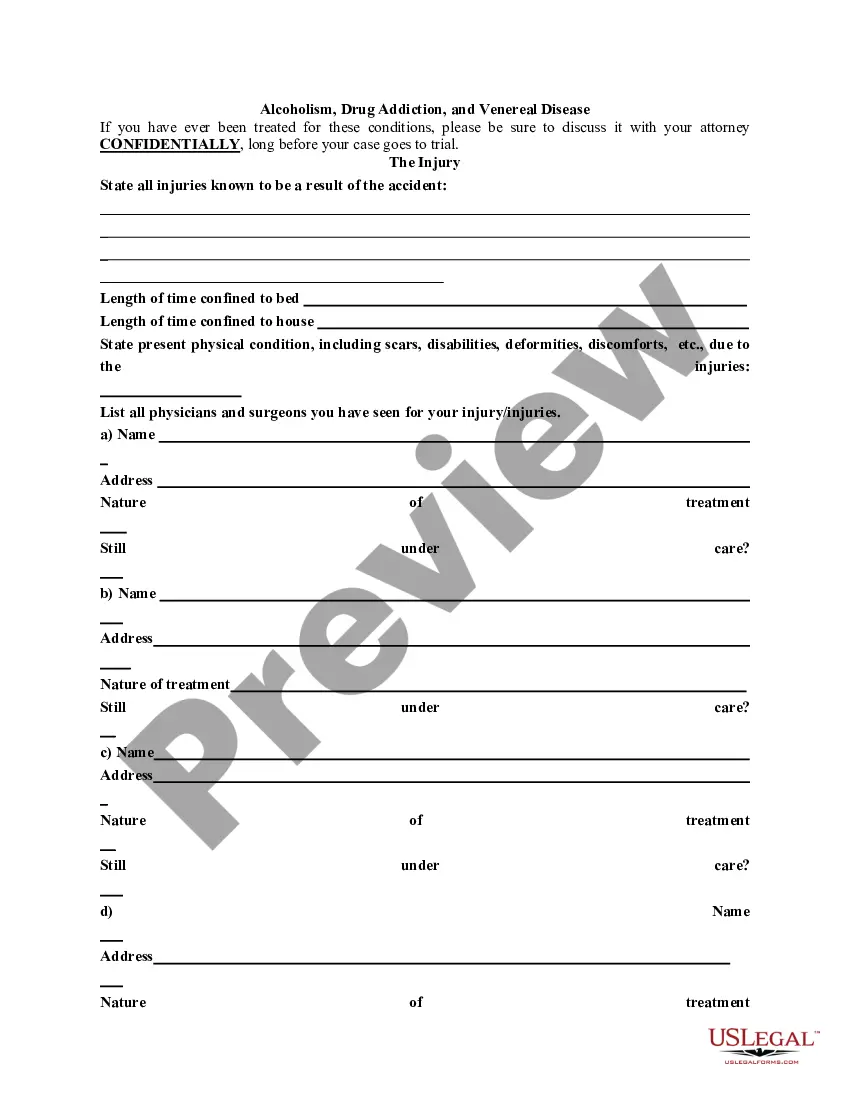

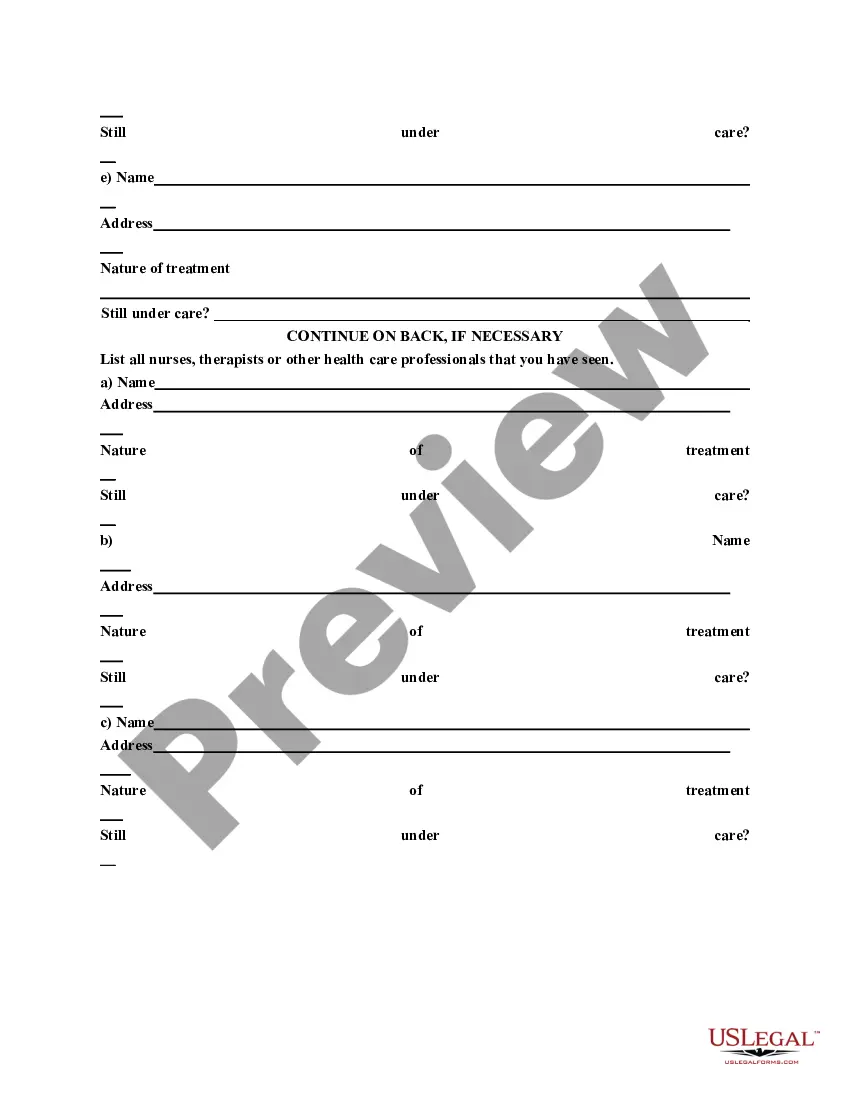

The first part of this questionnaire is designed to be useful in most civil and criminal representations. The last part can be used when screening prospective personal injury litigation clients. The questionnaire can be completed by the attorney during a first meeting with prospective clients or mailed to the client in advance and reviewed at a first meeting.

Utah General Information Questionnaire

Description

How to fill out General Information Questionnaire?

US Legal Forms - one of the largest collections of official documents in the United States - provides a broad selection of official file templates that you can download or print. When utilizing the website, you will discover thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can locate the most recent versions of forms such as the Utah General Information Questionnaire in seconds.

If you already have a monthly subscription, Log In and download the Utah General Information Questionnaire from your US Legal Forms library. The Download button will appear on every type you view. You can access all previously saved forms from the My documents tab of your account.

To use US Legal Forms for the first time, here are simple steps to help you begin: Ensure you have selected the correct form for your city/state. Click the Preview button to review the form’s content. Read the form description to ensure you have chosen the right form. If the form does not meet your needs, use the Search area at the top of the screen to find one that does. If you are satisfied with the form, confirm your selection by clicking the Get now button. Then, choose the pricing plan you prefer and provide your information to register for an account. Process the transaction. Use your credit card or PayPal account to complete the transaction. Select the format and download the form to your device. Make changes. Fill out, modify, print, and sign the saved Utah General Information Questionnaire. Every template you added to your account has no expiration date and is yours indefinitely. So, to download or print another copy, just go to the My documents section and click on the form you need.

- Access the Utah General Information Questionnaire with US Legal Forms, the most comprehensive collection of official file templates.

- Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

Form popularity

FAQ

Tax Year 2022 Filing Thresholds by Filing Status Filing StatusTaxpayer age at the end of 2022A taxpayer must file a return if their gross income was at least:singleunder 65$12,950single65 or older$14,700head of householdunder 65$19,400head of household65 or older$21,1506 more rows

Companies who pay employees in Utah must register at the OneStop Online Business Registration to receive both a Withholding Account ID and an Employer Registration Number (for unemployment taxes). Apply to receive a Withholding Account Number within 2 weeks.

However, Utah sets its licensing requirements for handypeople based on the value of the projects they work on. You do not need a contractor license if your projects have a value of less than $3,000, including labor and materials.

If you're considered an independent contractor, there would be no federal tax withheld from your pay. In fact, your employer would not withhold any tax at all. If this is the case: You probably received a Form 1099-MISC instead of a W-2 to report your wages.

How the process works. If your return is chosen, we will send you an Identity Protection Verification letter that asks you to complete a verification process. Depending on the situation, this letter may ask you to take a short online quiz or to provide documents to verify your identity.

You may be exempt from withholding if you do business in Utah for 60 days or less during a calendar year. Advance approval from the Tax Commission is required. See Publication 14, Withholding Tax Guide, for more information.

Where do I pay state taxes if I live in a different state than my employer? As a remote worker, you must pay tax on all your income to the state you live in (if your state has personal income tax). This is true no matter where your employer is located.

Under subsection (ii), you are also considered a Utah resident if you remain in Utah 183 days or more during any tax year. In that case, you will be required to file a Utah resident tax return. If you remain in Utah less than 183 days and you do not establish Utah residency, you are considered a non- resident.