Utah Withdrawal of Registration of a Foreign Limited Liability Limited Partnership (LL LP) is the process by which a foreign LL LP that is registered in Utah dissolves its registration with the state. This is done by submitting a written request to the Utah Division of Corporations and Commercial Code (DCC) that contains the name of the partnership, the date of filing of the registration, and the signature of a general partner. After filing the request, the foreign LL LP will be removed from the state’s records and will no longer be able to conduct business in Utah. There are two types of Utah Withdrawal of Registration of a Foreign LL LP: Voluntary and Involuntary. Voluntary withdrawal is when the foreign LL LP itself requests to terminate its registration with Utah. Involuntary withdrawal may be required by the state if the foreign LL LP has failed to comply with certain requirements, such as filing an annual report or paying taxes.

Utah Withdrawal of Registration of a Foreign LLLP

Description

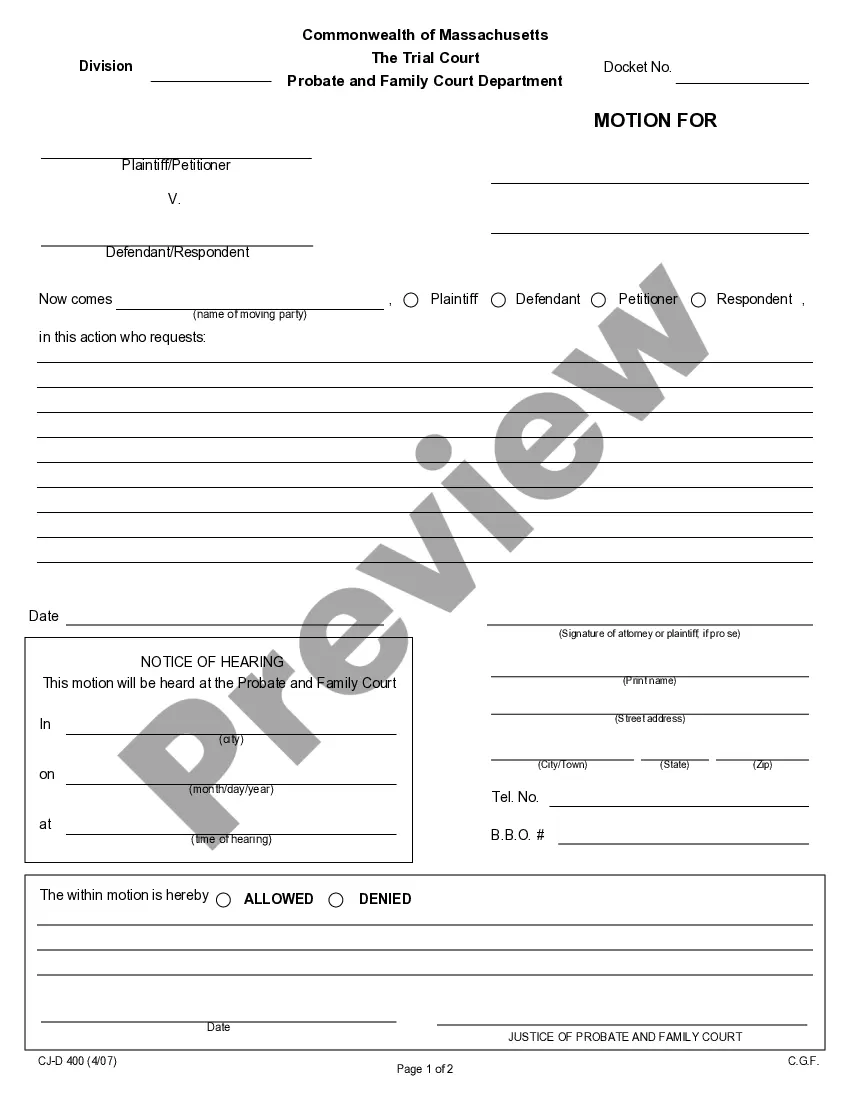

How to fill out Utah Withdrawal Of Registration Of A Foreign LLLP?

Handling legal paperwork requires attention, precision, and using well-drafted blanks. US Legal Forms has been helping people across the country do just that for 25 years, so when you pick your Utah Withdrawal of Registration of a Foreign LLLP template from our service, you can be sure it meets federal and state laws.

Working with our service is simple and quick. To get the necessary document, all you’ll need is an account with a valid subscription. Here’s a quick guide for you to find your Utah Withdrawal of Registration of a Foreign LLLP within minutes:

- Make sure to carefully look through the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Search for an alternative formal blank if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Utah Withdrawal of Registration of a Foreign LLLP in the format you prefer. If it’s your first time with our website, click Buy now to proceed.

- Register for an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to save your form and click Download. Print the blank or upload it to a professional PDF editor to prepare it paper-free.

All documents are created for multi-usage, like the Utah Withdrawal of Registration of a Foreign LLLP you see on this page. If you need them one more time, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and prepare your business and personal paperwork rapidly and in total legal compliance!

Form popularity

FAQ

Utah Annual Report Service & Filing Instructions. The state of Utah requires all corporations, nonprofits, LLCs, LPs, LLPs, and LLLPs to file an annual report. These reports must be submitted to the Utah Division of Corporations & Commercial Code each year.

A foreign entity is any corporation, business association, partnership, trust, society or any other entity or group that is not incorporated or organized to do business in the United States, as well as international organizations, foreign governments and any agency or subdivision of foreign governments.

The main advantage of forming a foreign LLC is that it allows you to do business in multiple states without having to form separate LLCs in each state. This can be especially beneficial if you have customers or clients in multiple states or if you plan to expand your business into new states in the future.

A foreign corporation is a corporation which is incorporated or registered under the laws of one state or foreign country and does business in another. In comparison, a domestic corporation is a corporation which is incorporated in the state it is doing business in.

When used in the context of American corporate law, a foreign LLC means it conducts business in a state other than the one where it was originally registered. It does not refer to entities headquartered in other countries.

A domestic LLC or corporation is a business that is formed within its home (domestic) state. Foreign qualification is when a legal entity conducts business in a state or jurisdiction other than the one in which it was originally formed. (It is not to be confused with being a business in a foreign country.)

Submit a UT Registration Information Change form When you remove a member from a Utah LLC, you must submit an LLC Registration Information Change form ($13) with the Utah Division of Corporations. You can file this form online, by mail, or by fax. By Fax: (801) 530-6438.

A Foreign Profit Corporation is organized and chartered under the laws of another state, government, or country. You are always encouraged to consult an attorney to ensure appropriate consideration of all the legal implications of your choice of entity and filing.