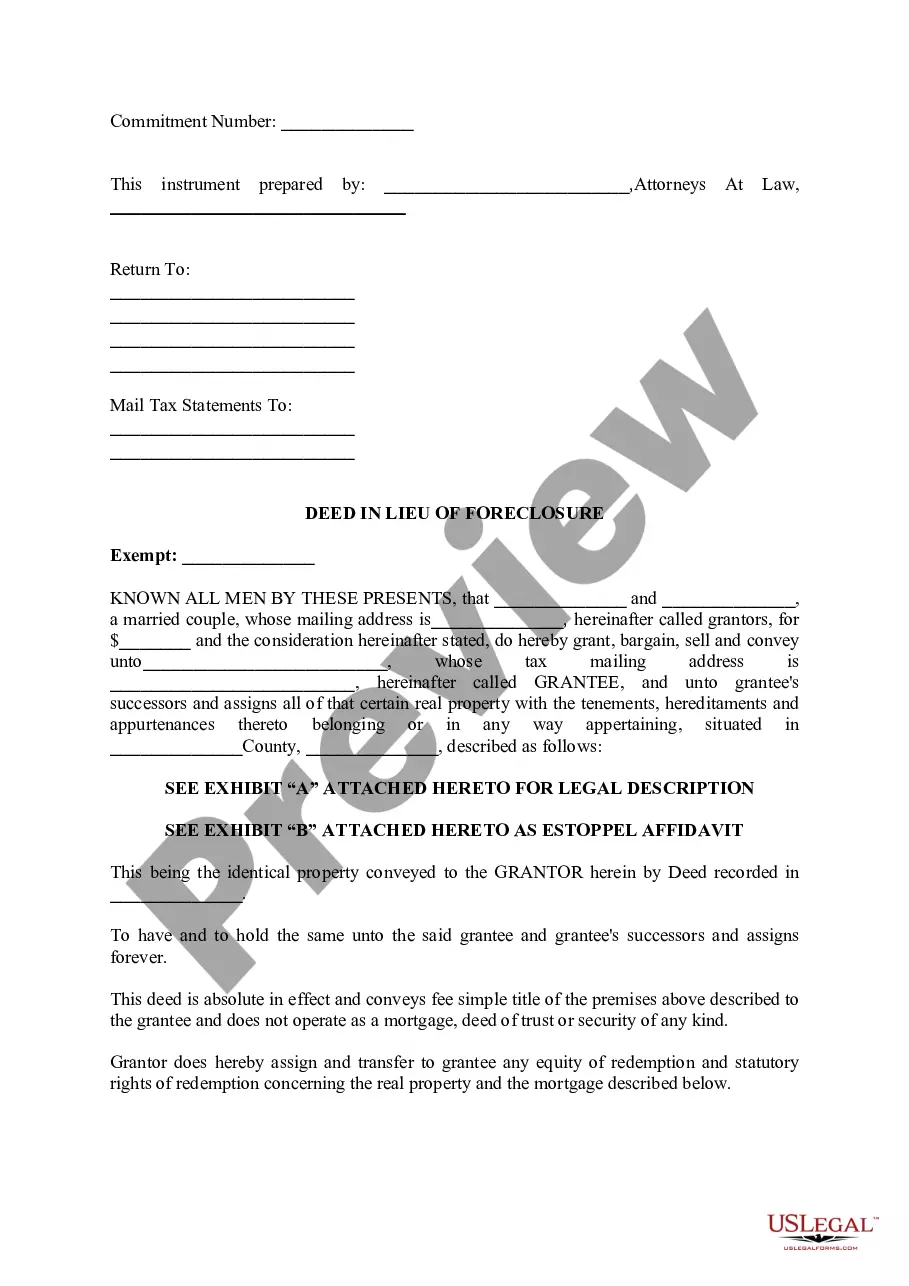

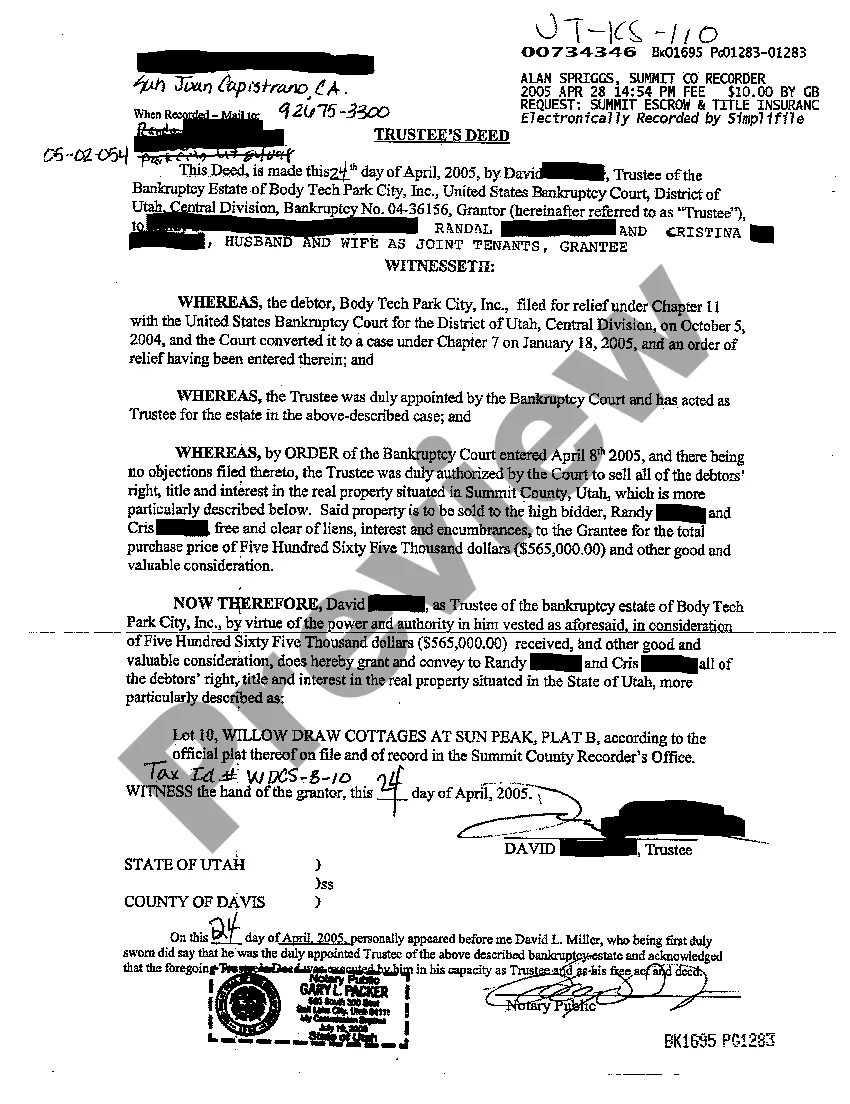

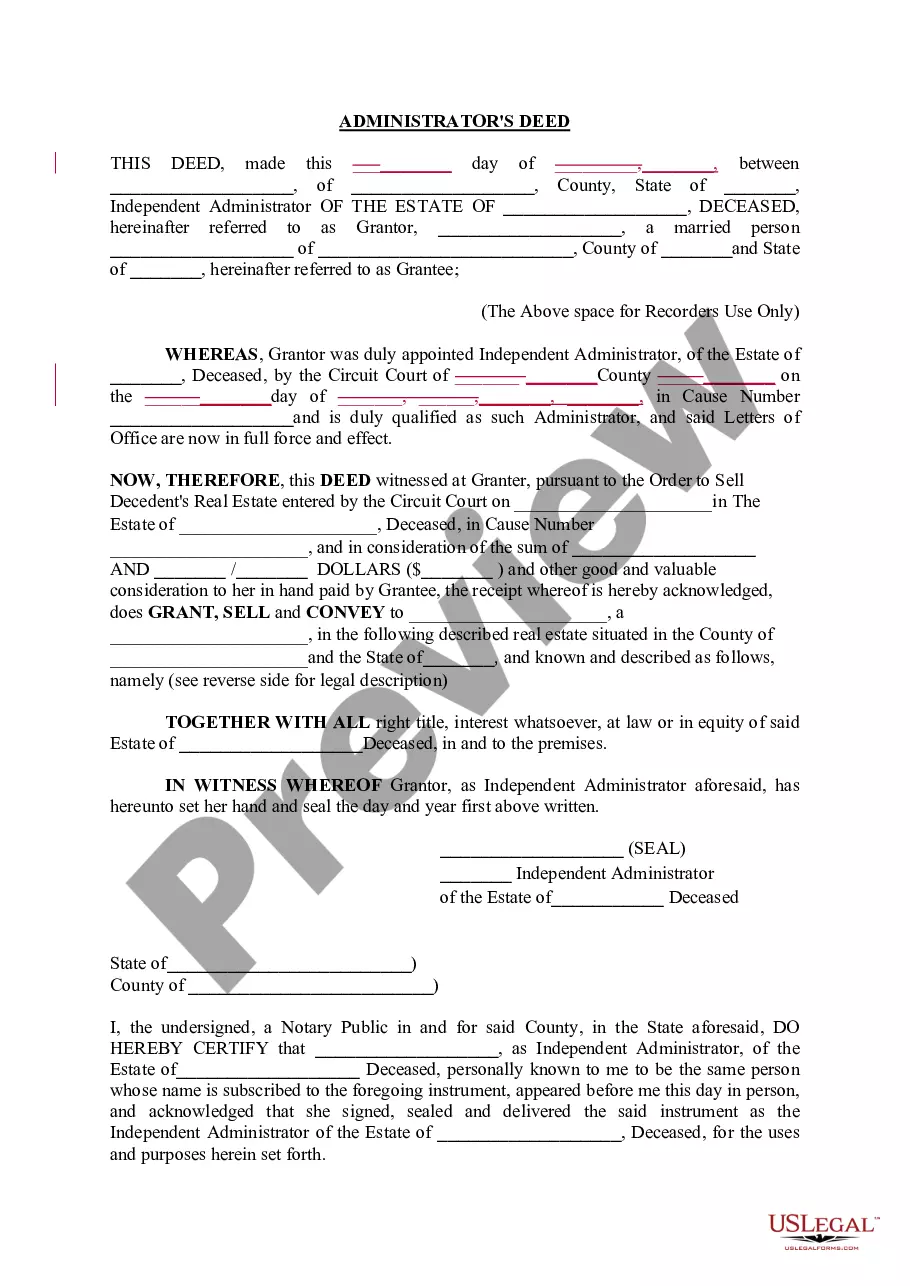

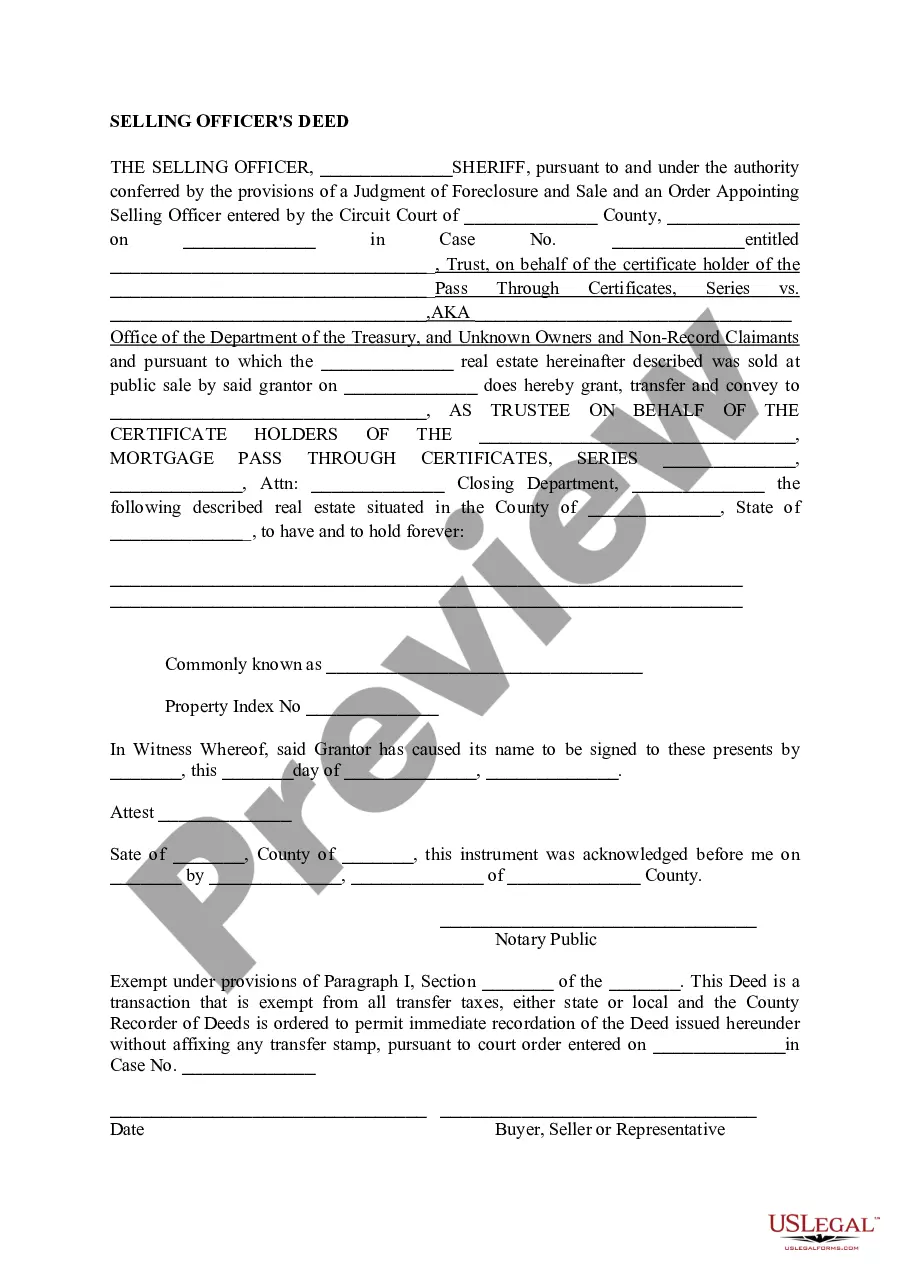

Utah Deed in Lieu of Foreclosure

Description

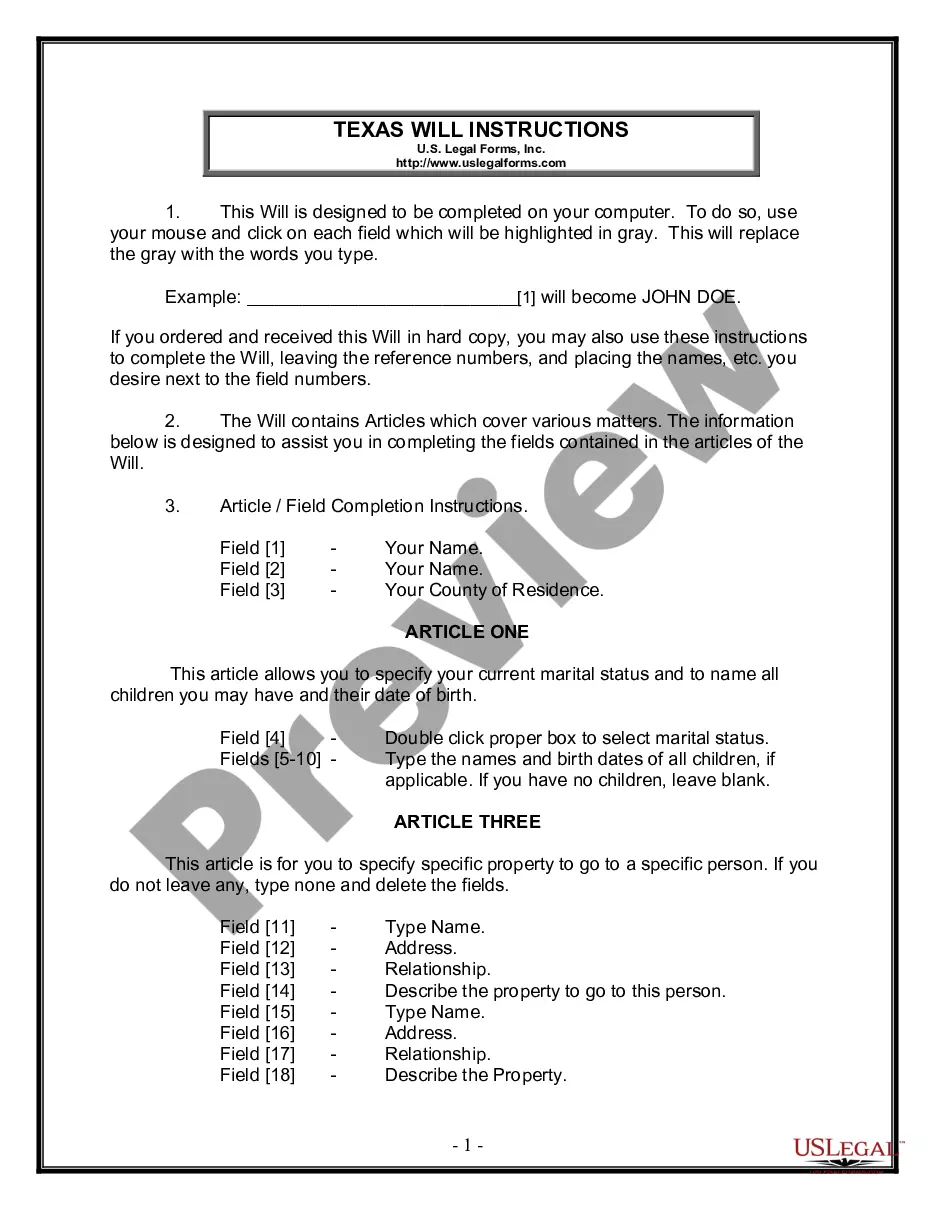

How to fill out Utah Deed In Lieu Of Foreclosure?

Searching for a Utah Deed in Lieu of Foreclosure on the internet might be stressful. All too often, you see documents that you simply believe are ok to use, but discover later on they are not. US Legal Forms provides more than 85,000 state-specific legal and tax documents drafted by professional lawyers according to state requirements. Get any form you are searching for quickly, hassle free.

If you already have the US Legal Forms subscription, just log in and download the sample. It’ll instantly be added to your My Forms section. In case you do not have an account, you have to register and pick a subscription plan first.

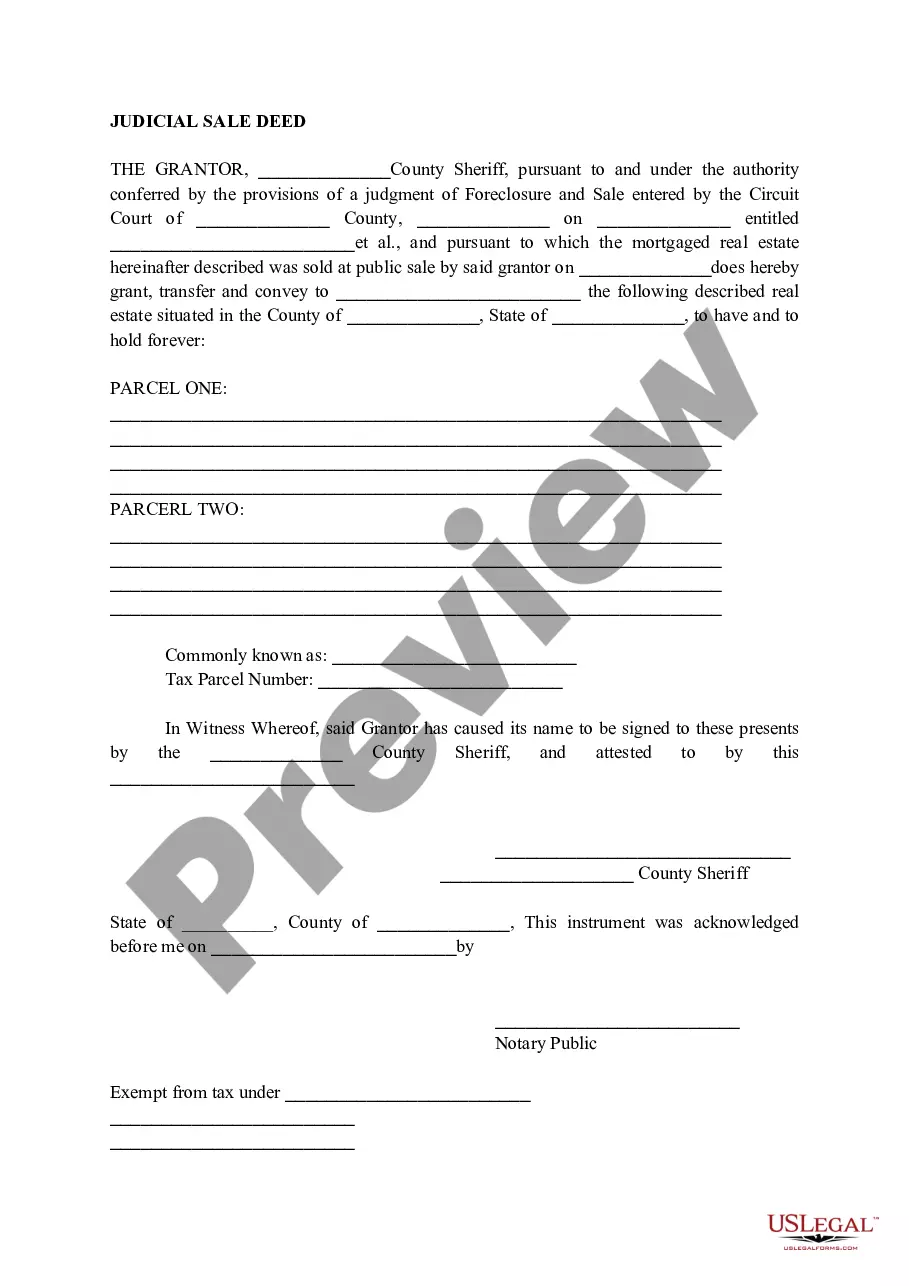

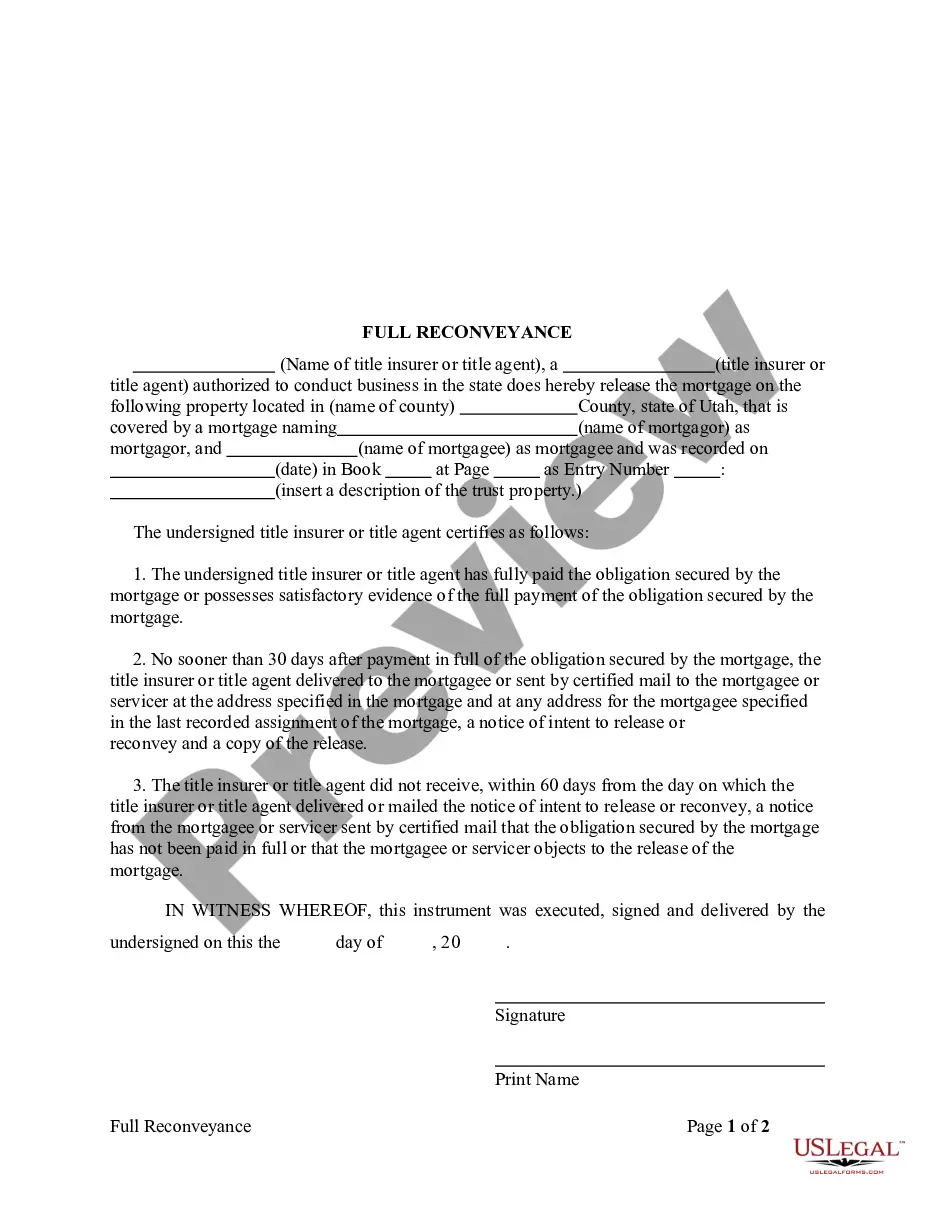

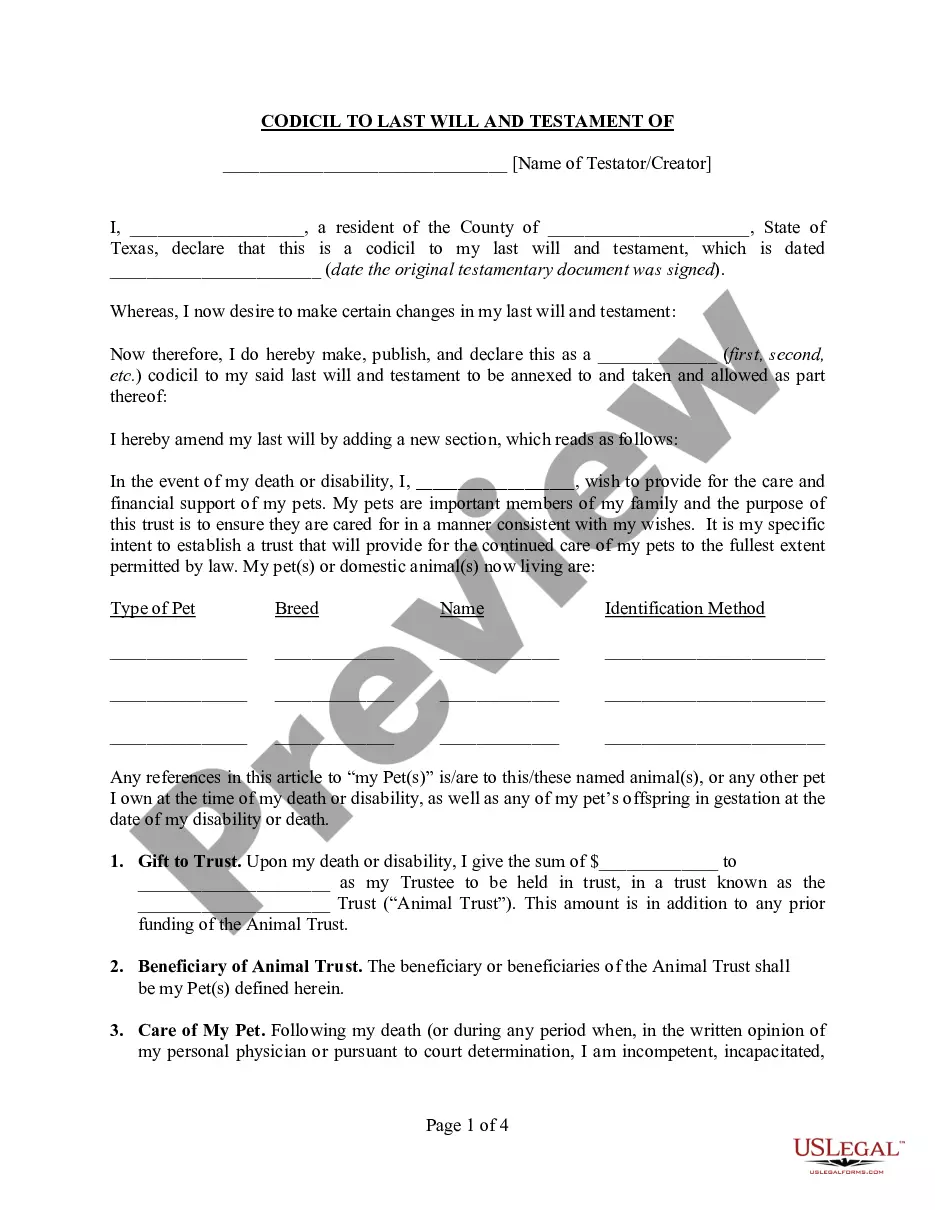

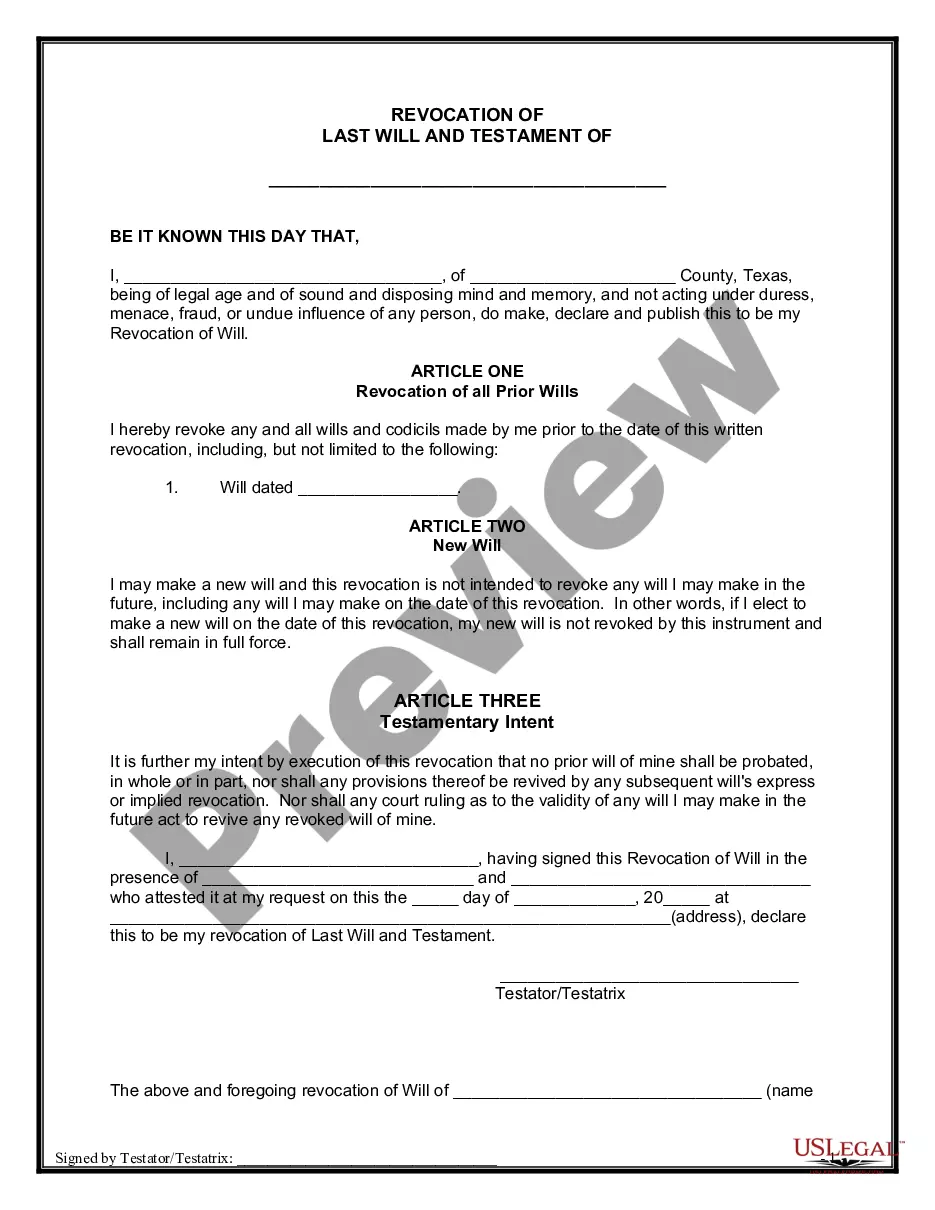

Follow the step-by-step guidelines listed below to download Utah Deed in Lieu of Foreclosure from our website:

- See the document description and hit Preview (if available) to check whether the form meets your requirements or not.

- In case the document is not what you need, get others using the Search field or the provided recommendations.

- If it is appropriate, simply click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a bank card or PayPal and download the document in a preferable format.

- After downloading it, you are able to fill it out, sign and print it.

Obtain access to 85,000 legal templates straight from our US Legal Forms catalogue. In addition to professionally drafted templates, users can also be supported with step-by-step instructions on how to find, download, and complete forms.

Form popularity

FAQ

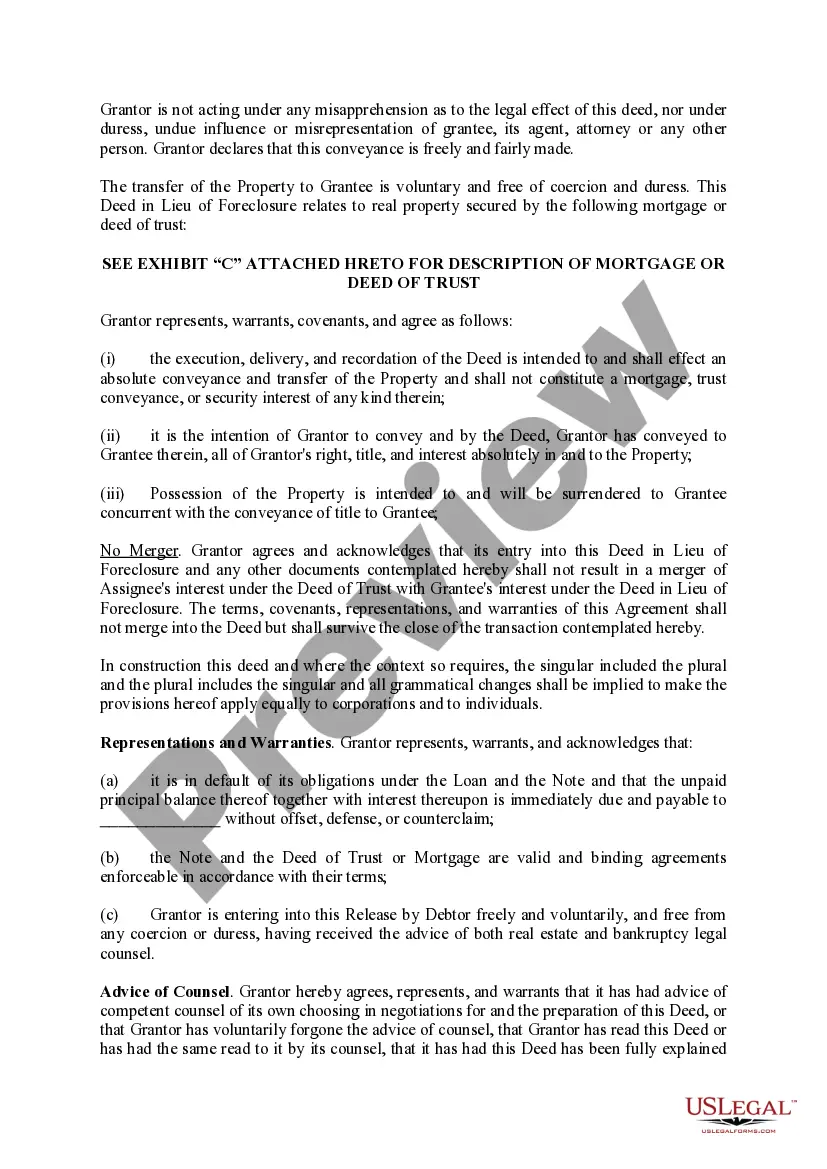

Both short sales and deeds in lieu can help homeowners avoid foreclosure.One benefit to these options is that that you won't have a foreclosure on your credit history. But your credit score will still take a major hit. A short sale or deed in lieu is almost as bad as a foreclosure when it comes to credit scores.

A deed in lieu can eliminate your deficiency if you owe more on your home than the home is worth. In exchange for giving the lender your deed voluntarily and keeping the home in good condition, your lender may agree to forgive your deficiency or greatly reduce it.

The impact that a deed in lieu has on your score depends primarily on your credit history.According to FICO, if you start with a score of around 780, a deed in lieu (without a deficiency balance) shaves 105 to 125 points off your score; but if you start with a score of 680, you'll lose 50 to 70 points.

A deed in lieu of foreclosure is different from a short sale because it transfers the property to the lender instead of selling it to a new buyer.Similar to a short sale, a deed in lieu of foreclosure likely will not damage your credit as severely as a foreclosure or a bankruptcy.

If your lender agrees to a short sale or to accept a deed in lieu of foreclosure, you might owe federal income tax on any forgiven deficiency. The IRS learns of the deficiency when the lender sends it a Form 1099-C, which reports the forgiven debt as income to you.

C. The purchaser must pay off both the mortgage and junior lienholders after the sale. What is a major disadvantage to lenders of accepting a deed in lieu of foreclosure?The lender gains rights to private mortgage insurance.

The deed in lieu of foreclosure offers several advantages to both the borrower and the lender. The principal advantage to the borrower is that it immediately releases him/her from most or all of the personal indebtedness associated with the defaulted loan.