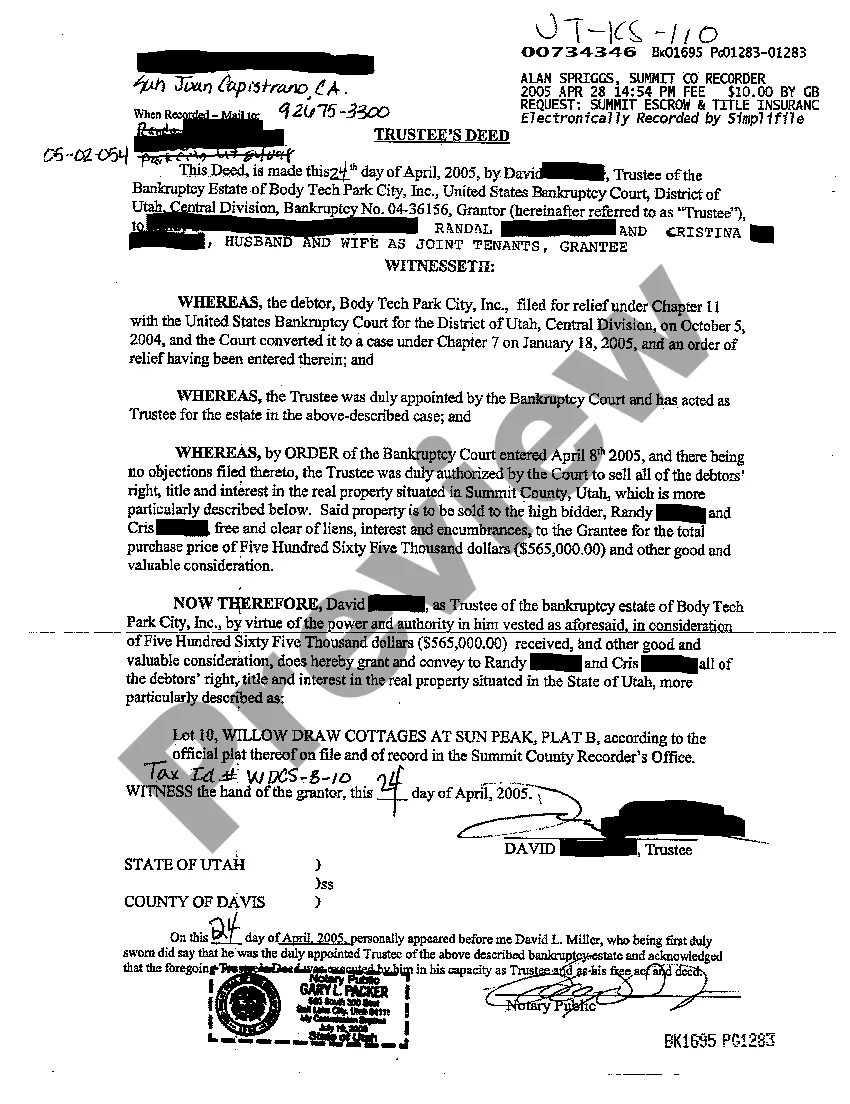

Utah Bankruptcy Trustee's Deed to Real Estate of Debtor

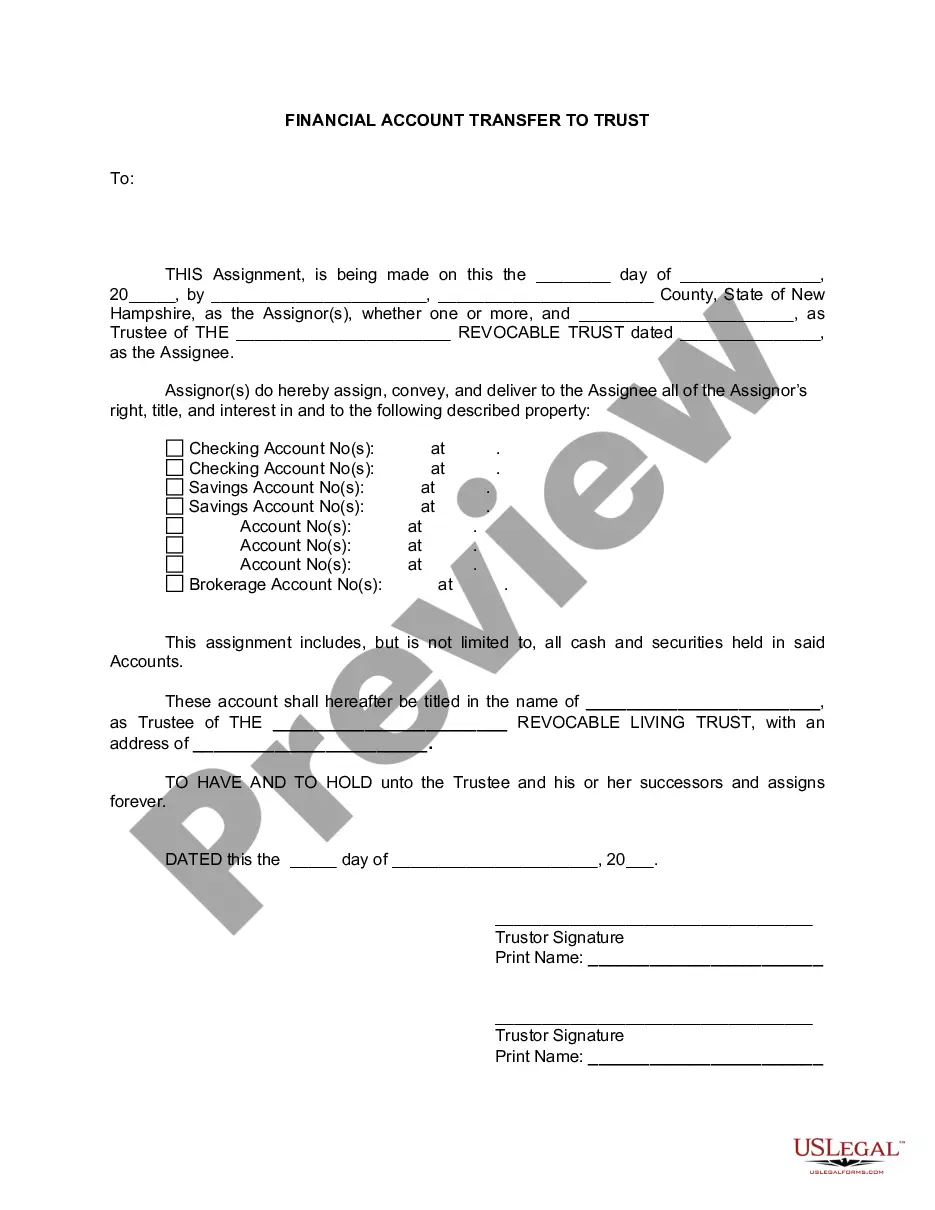

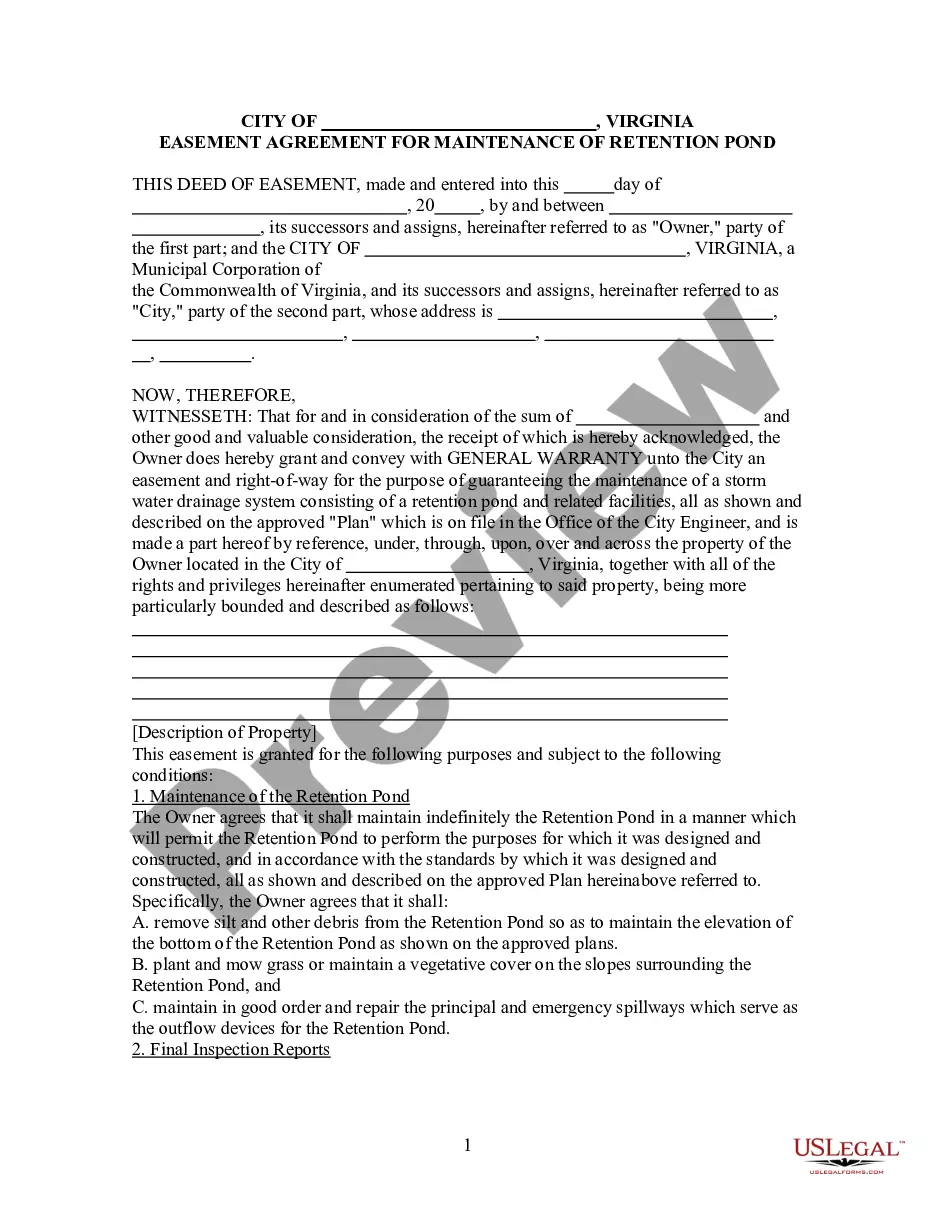

Description

How to fill out Utah Bankruptcy Trustee's Deed To Real Estate Of Debtor?

Among countless free and paid templates that you can get on the internet, you can't be sure about their reliability. For example, who created them or if they are qualified enough to deal with the thing you need them to. Always keep relaxed and make use of US Legal Forms! Locate Utah Bankruptcy Trustee's Deed to Real Estate of Debtor templates created by skilled attorneys and get away from the costly and time-consuming process of looking for an attorney and then having to pay them to draft a document for you that you can easily find yourself.

If you already have a subscription, log in to your account and find the Download button near the form you are seeking. You'll also be able to access all your earlier downloaded files in the My Forms menu.

If you are utilizing our service the very first time, follow the instructions listed below to get your Utah Bankruptcy Trustee's Deed to Real Estate of Debtor fast:

- Ensure that the file you find is valid in your state.

- Review the template by reading the description for using the Preview function.

- Click Buy Now to start the purchasing process or find another template utilizing the Search field found in the header.

- Select a pricing plan and create an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred format.

As soon as you have signed up and purchased your subscription, you can utilize your Utah Bankruptcy Trustee's Deed to Real Estate of Debtor as often as you need or for as long as it stays active where you live. Change it with your favorite online or offline editor, fill it out, sign it, and create a hard copy of it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

A. The Chapter 7 trustee can keep the case open for about four to six months after filing the bankruptcy papers.

Property You Own That's Not in Your Possession. Property You're Entitled to Receive. Some Assets Acquired After Filing. Revenues and Profits of Estate Property. Recovered Fraudulent Transfers. Preferential Creditor Payments. Community Property.

The short answer is: Yes, you can sell your house after a bankruptcy discharge. However, the long answer to this question is more complex, and it will require the help of your reliable, experienced attorney. Discharged bankruptcy doesn't necessarily mean that your case is finalized and closed.

Usually the trustee will only take action to sell the home if there is equity in the home. Having equity means that your home is currently worth more than the value of the debts secured against it.If there is no equity in the home, the trustee may not sell the home.

As part of the process, consumers may have their assets seized and sold off to pay off at least a portion of their debts. However, not all of their property can be seized. Some assets including cash, your home and your car are exempt from the bankruptcy, based on how much they are worth.

The bankruptcy trustees go about finding hidden assets by taking a close look at your debts, as well as doing public record searches, online analysis, tax returns, review reports from former spouses or friends, as well as payroll slips that may show deposits into banks or accounts that you have not listed in your

Defaulting (failing to make payments) on your Chapter 13 plan has many unfortunate consequences. It can lead to your creditors obtaining permission from the court to foreclose on your house or repossess your car. Or the court might dismiss your case or never approve it in the first place.

Refusing to SellCan the Trustee do this? No.If the Trustee wants to keep the home, or some of the other beneficiaries want to keep the home, then they will need to buy out your interest in the home. If they refuse, then you and your lawyer can go to court and ask the court to order a sale of the home.

In most no-asset cases, nothing remains to be done after discharge. After the trustee files a report stating that there are no assets to administer, if there is no outstanding litigation, the court enters an order closing the case.