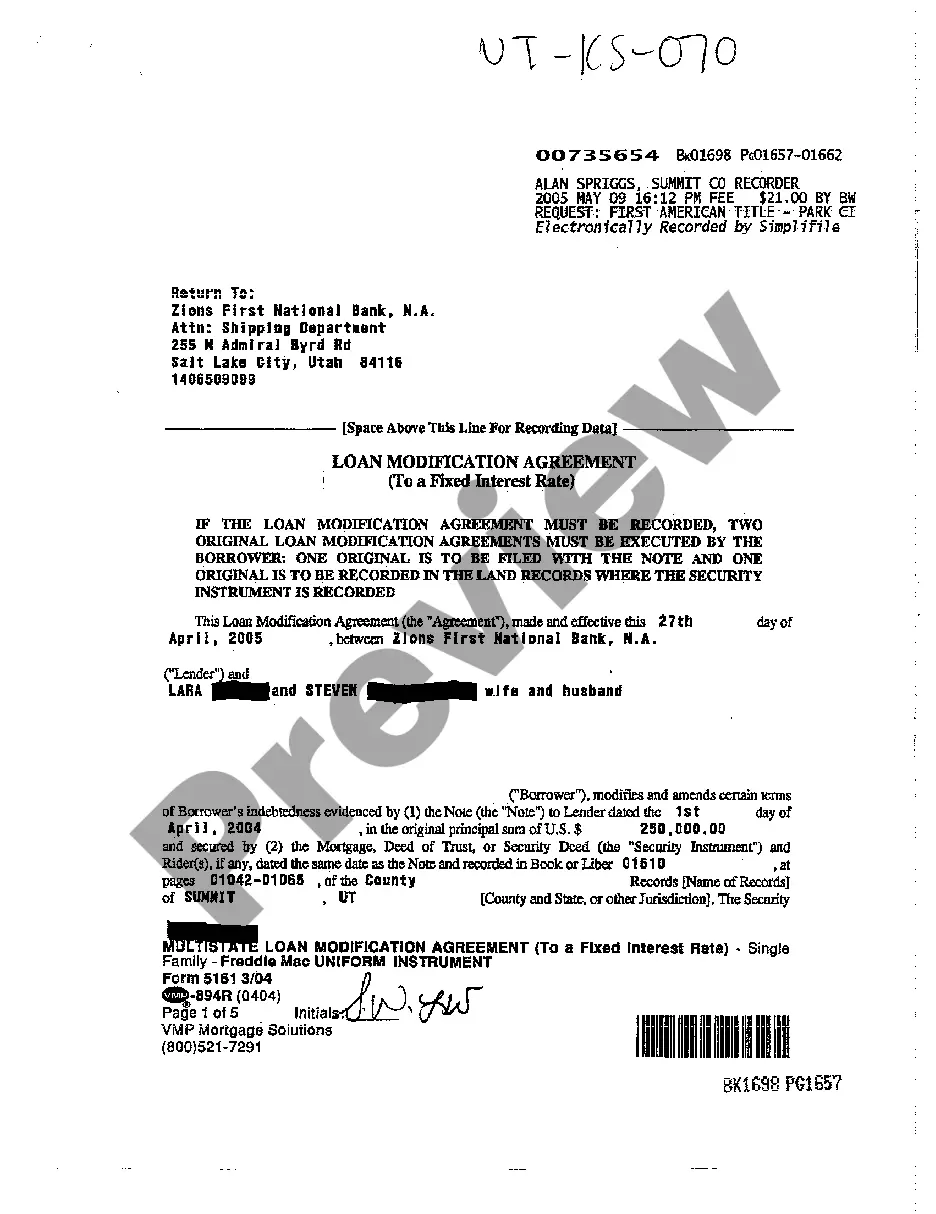

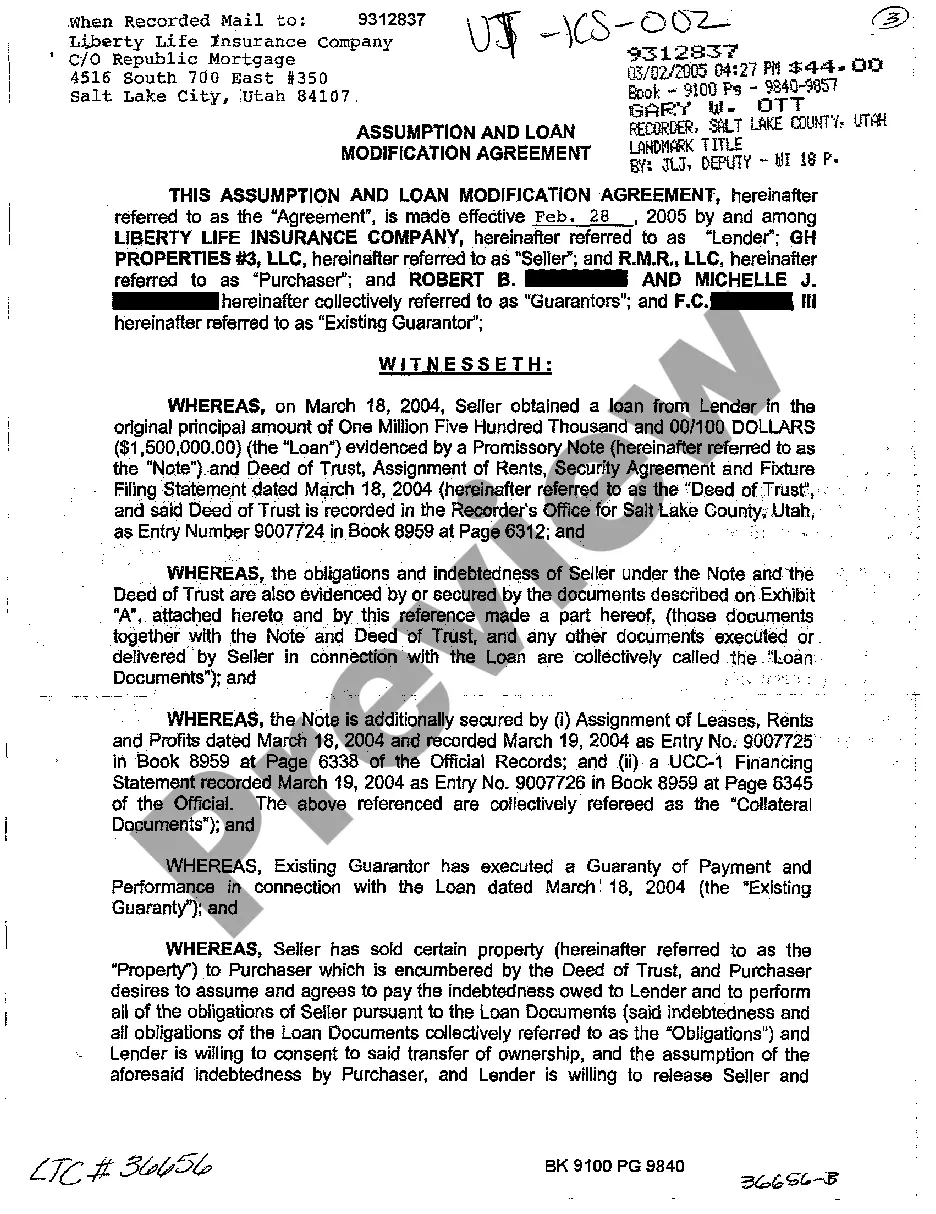

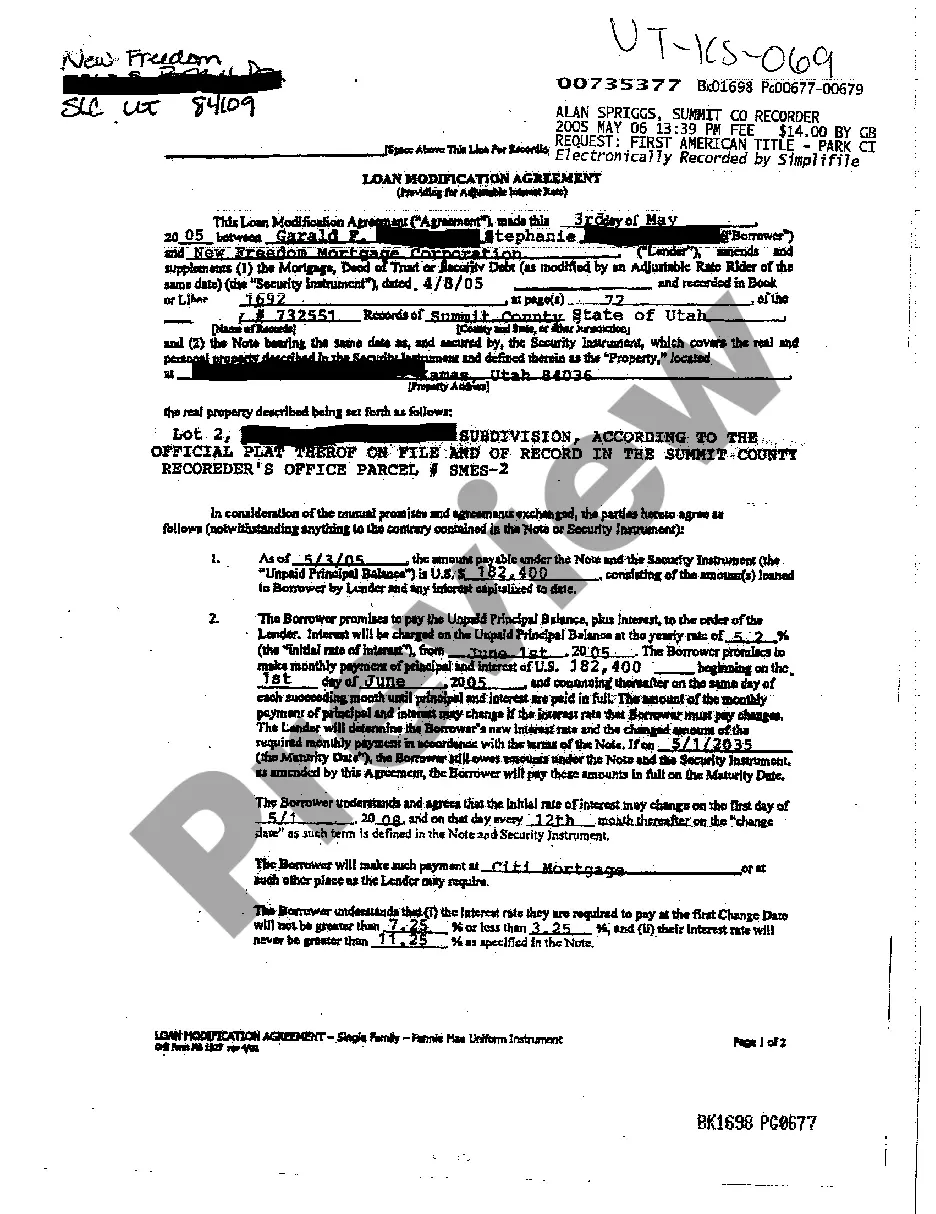

Utah Loan Modification Agreement - To a Fixed Interest Rate

Description

How to fill out Utah Loan Modification Agreement - To A Fixed Interest Rate?

Among lots of free and paid samples which you get on the internet, you can't be sure about their reliability. For example, who made them or if they are skilled enough to deal with what you require those to. Keep calm and utilize US Legal Forms! Discover Utah Loan Modification Agreement - To a Fixed Interest Rate samples made by skilled attorneys and get away from the high-priced and time-consuming procedure of looking for an lawyer and then paying them to write a document for you that you can easily find yourself.

If you already have a subscription, log in to your account and find the Download button near the file you’re seeking. You'll also be able to access all of your earlier saved samples in the My Forms menu.

If you’re using our platform the first time, follow the guidelines listed below to get your Utah Loan Modification Agreement - To a Fixed Interest Rate fast:

- Make certain that the file you find is valid in your state.

- Look at the file by reading the information for using the Preview function.

- Click Buy Now to begin the ordering process or find another sample utilizing the Search field found in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the needed format.

As soon as you’ve signed up and paid for your subscription, you can use your Utah Loan Modification Agreement - To a Fixed Interest Rate as many times as you need or for as long as it remains active in your state. Revise it in your favored online or offline editor, fill it out, sign it, and create a hard copy of it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

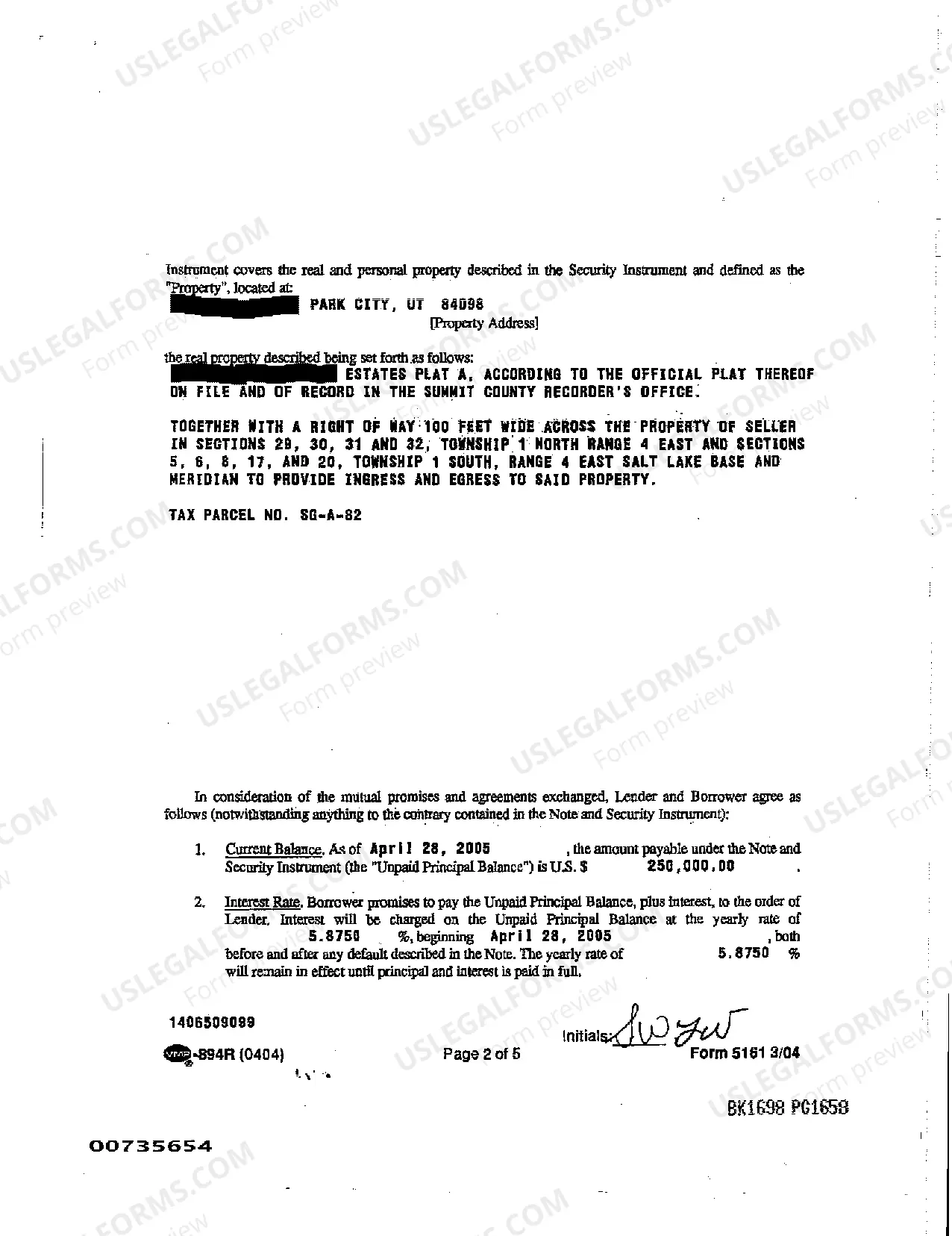

If you are having trouble keeping up with your monthly mortgage payments, you can apply for a loan modification to reduce your interest rate and hence, lower your monthly payments. A lender will review your current mortgage and financial circumstances before deciding to approve or deny you for a modification.

You would avoid foreclosure and remain in your home. If you are behind on payments, you would resolve your delinquency status. You may be able to reduce your monthly payments so they are more affordable. You would suffer less damage to your credit than if the bank foreclosed on your house.

If your servicer or lender agrees to a mortgage loan modification, it may result in lowering your monthly payment, extending or shortening your loan's term, or decreasing the interest rate you pay.

A loan modification is different from a refinance. When you take a loan modification, you change the terms of your loan directly through your lender.When you refinance, you can change your loan's term, your interest rate and even your loan type. You can also take cash out of your equity with a cash-out refinance.

It is still entirely possible for a foreclosure suit from the lender to be moving forward on a parallel track with your loan modification. One department for the lender may be trying to negotiate better terms with you while another is aggressively working to take your home.

A loan modification can relieve some of the financial pressure you feel by lowering your monthly payments and stopping collection activity. But loan modifications are not foolproof. They could increase the cost of your loan and add derogatory remarks to your credit report.

Conventional loan modification In particular, Freddie Mac and Fannie Mae offer Flex Modification programs designed to decrease a qualified borrower's mortgage payment by about 20%.

Some of the most common types of hardship are: job loss, pay reduction, underemployment, declining business revenue, death of a coborrower, illness, injury, and divorce.

However, lenders are allowed to change some costs under certain circumstances. If your interest rate is not locked, it can change at any time. Even if your interest rate is locked, your interest rate can change if there are changes to your application information or if you do not close within the rate-lock timeframe.