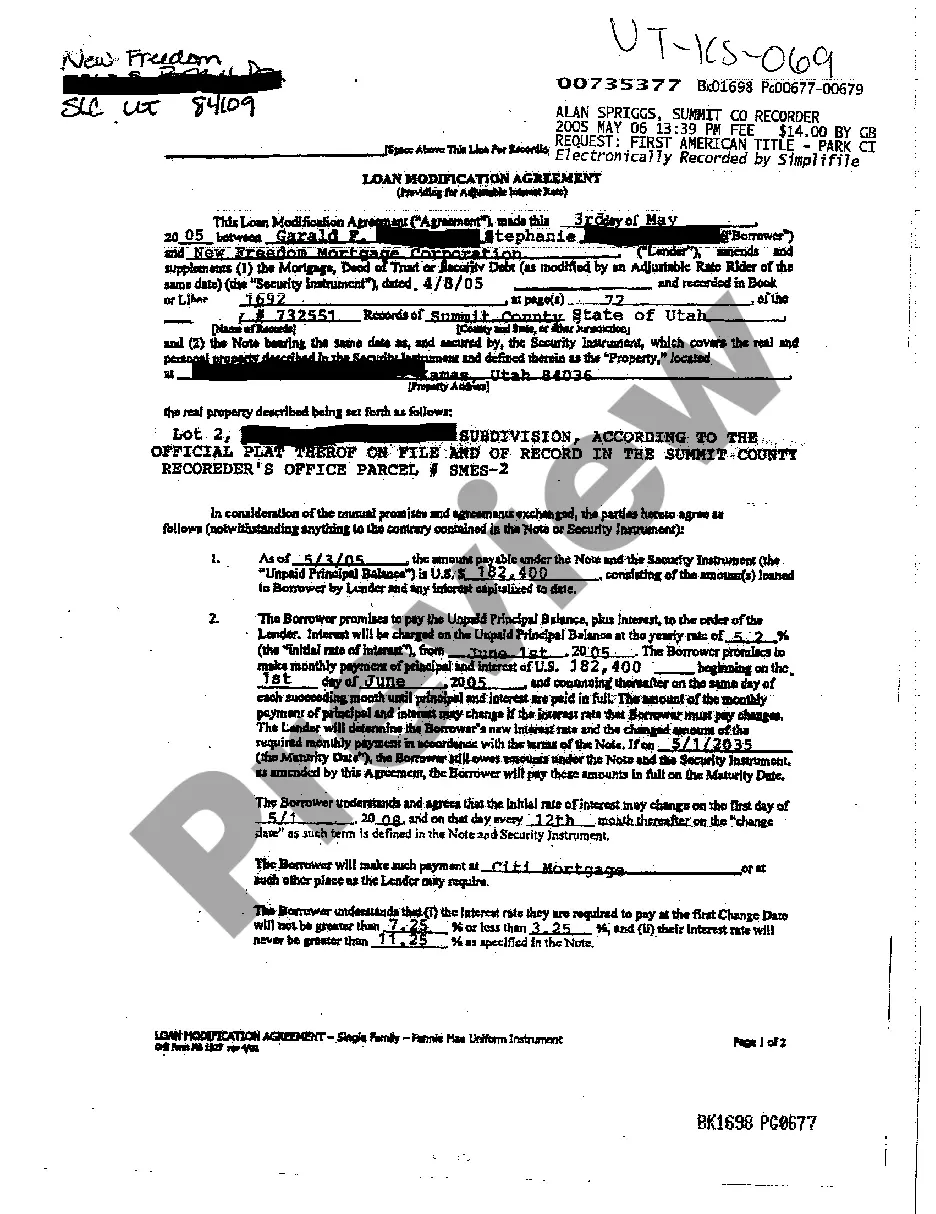

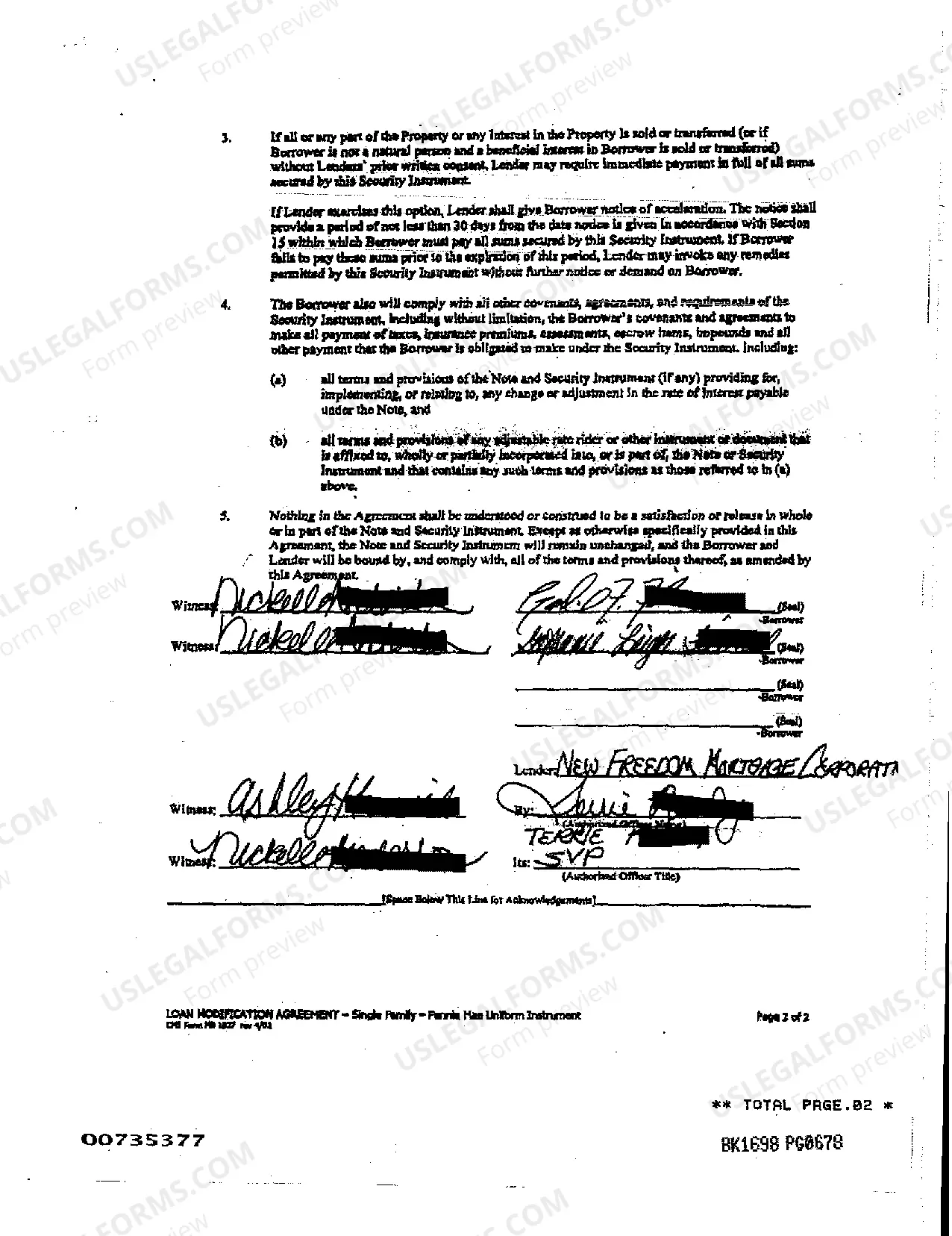

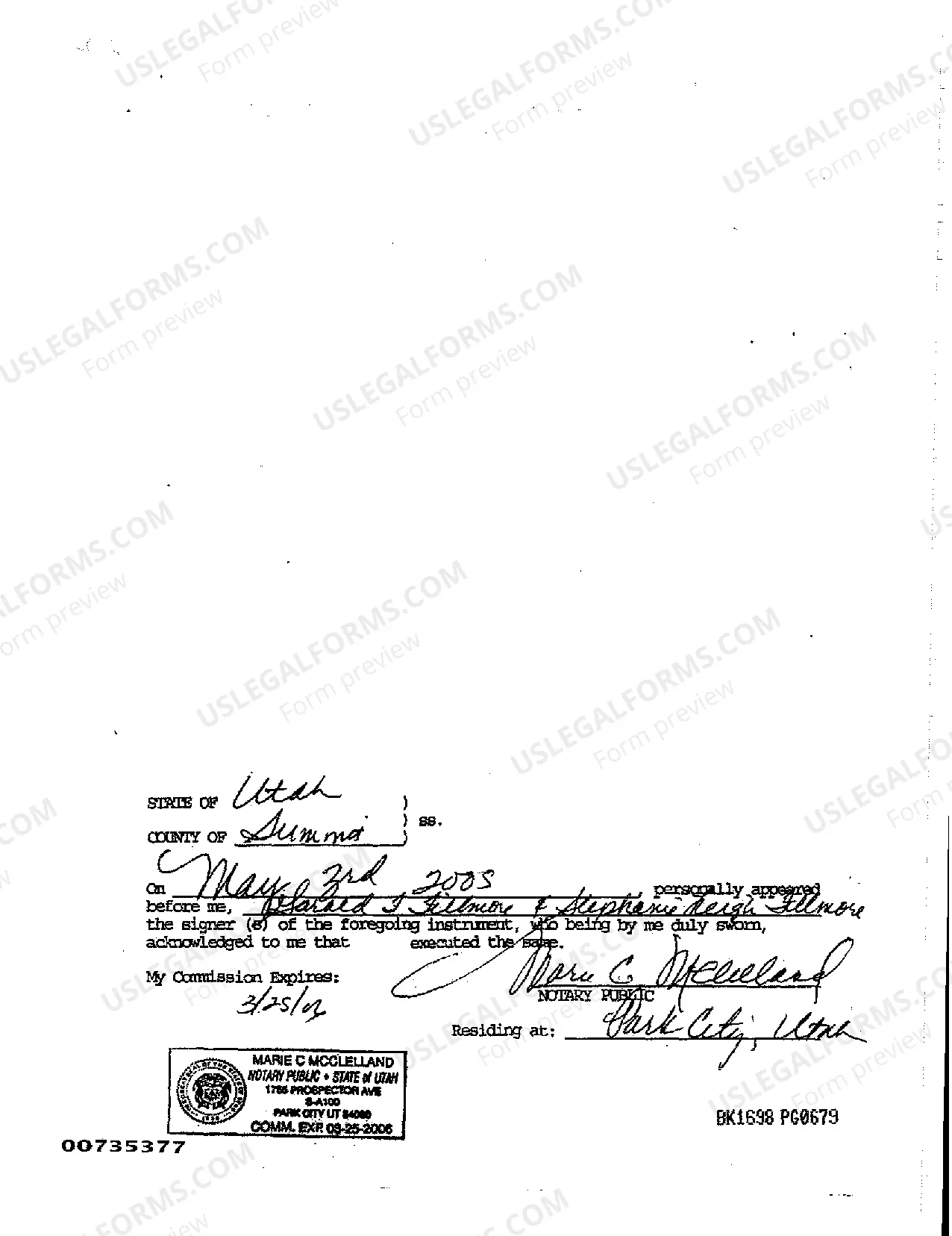

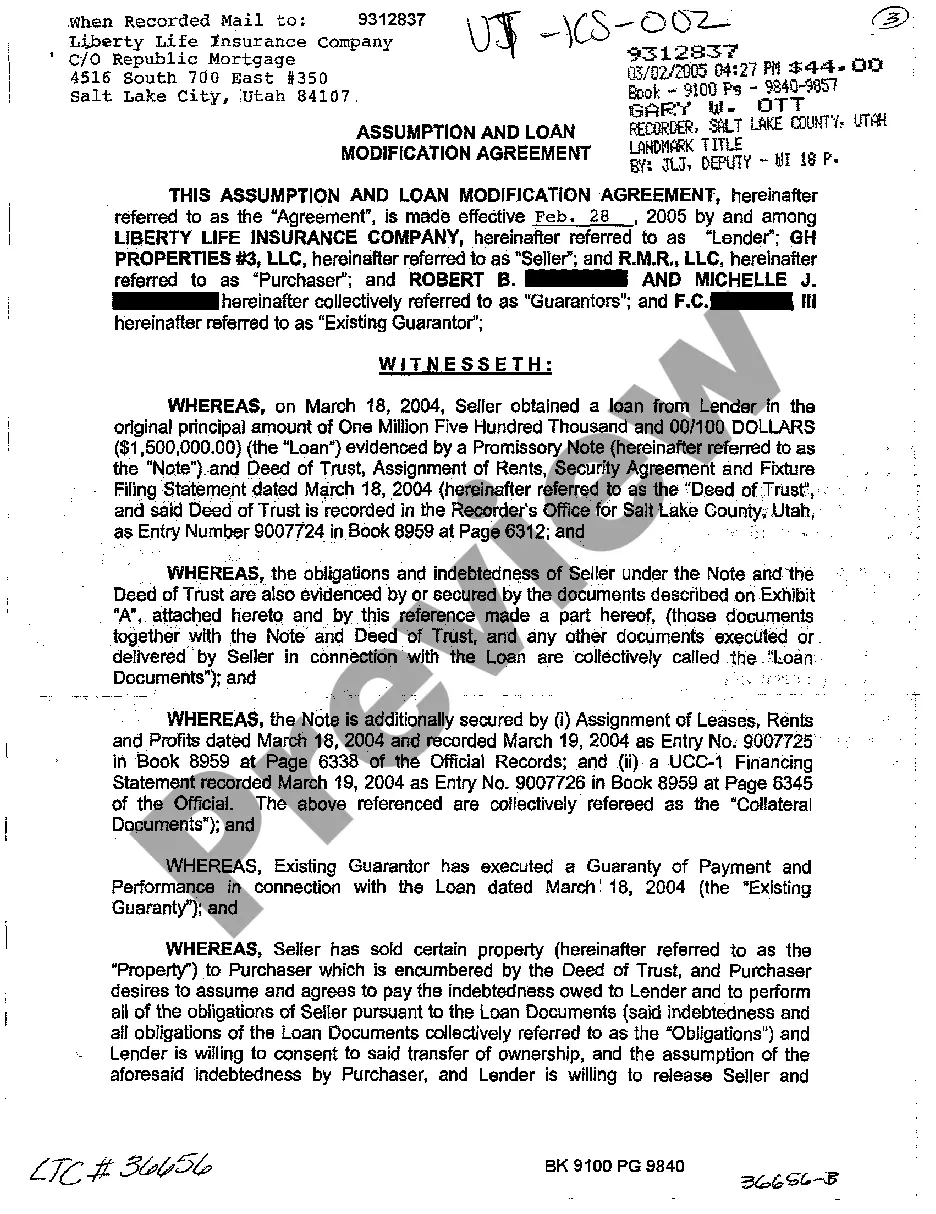

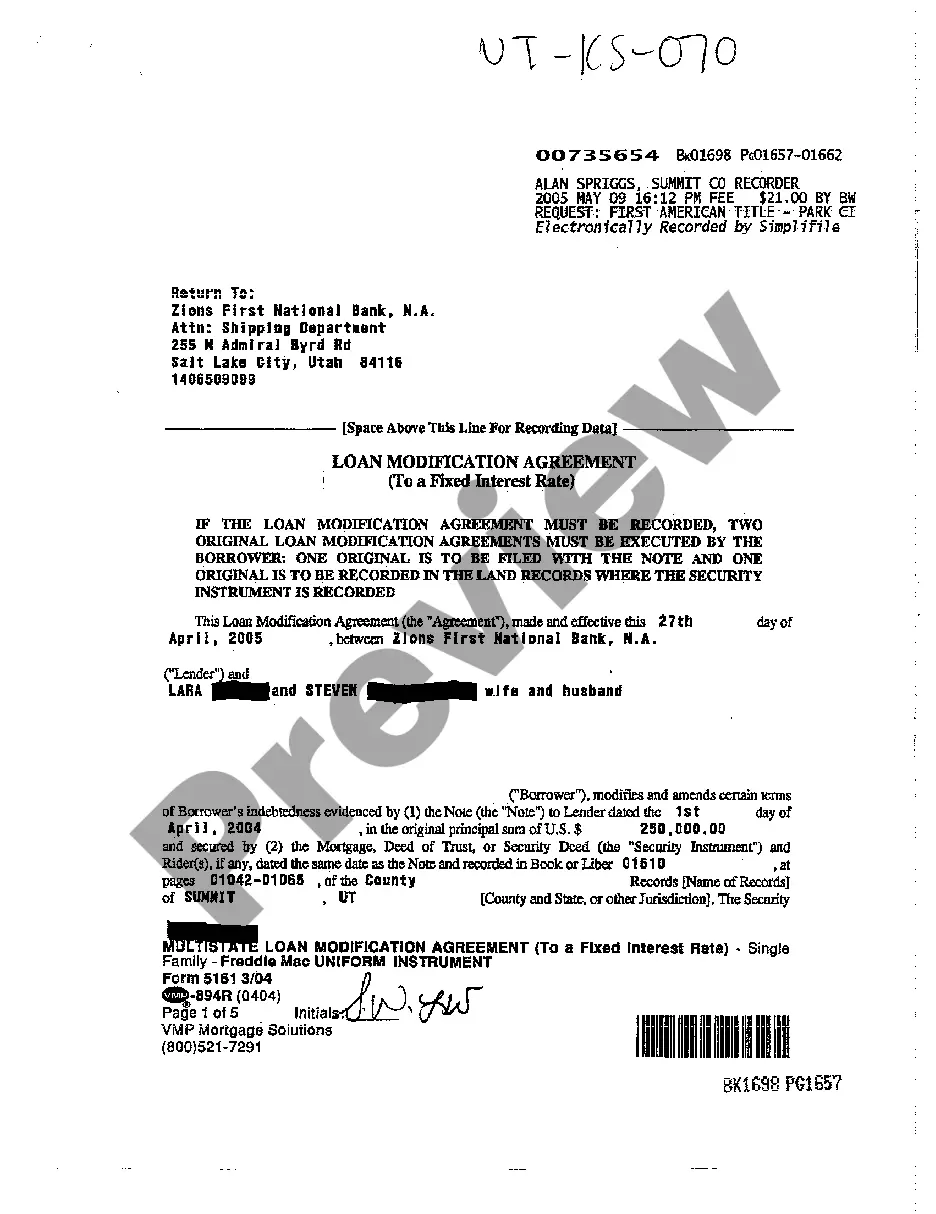

Utah Loan Modification Agreement

Description

How to fill out Utah Loan Modification Agreement?

Among hundreds of paid and free samples which you find on the internet, you can't be certain about their accuracy. For example, who made them or if they are qualified enough to take care of what you require them to. Always keep relaxed and use US Legal Forms! Find Utah Loan Modification Agreement samples created by professional legal representatives and prevent the high-priced and time-consuming process of looking for an lawyer or attorney and after that paying them to write a papers for you that you can find yourself.

If you already have a subscription, log in to your account and find the Download button next to the file you’re trying to find. You'll also be able to access all your earlier saved documents in the My Forms menu.

If you’re making use of our service the first time, follow the guidelines below to get your Utah Loan Modification Agreement easily:

- Make certain that the file you find is valid in the state where you live.

- Look at the template by reading the information for using the Preview function.

- Click Buy Now to start the ordering process or look for another template utilizing the Search field located in the header.

- Select a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the required file format.

Once you’ve signed up and paid for your subscription, you can use your Utah Loan Modification Agreement as many times as you need or for as long as it continues to be valid in your state. Edit it in your favorite offline or online editor, fill it out, sign it, and print it. Do much more for less with US Legal Forms!

Form popularity

FAQ

The loan modification underwriter will analyze and review the particular circumstances which justify a loan modification. The underwriter will evaluate and assess the borrower's financial status, current income and asset situation and ability to pay.

Generally, the simplest way to calculate a debt to income ratio for loan modification is simply to take total monthly debt obligations and divide it by total monthly gross household income. Anything over about 60-70% is pretty good for loan modification purposes.

You should contact the lender's loss and mitigation department to discuss the reason of you loan modification rejection. Possible reasons for a modification rejection include insufficient income, high debt-to-income ratio, missing documents, or delinquent credit history.

A loan modification can relieve some of the financial pressure you feel by lowering your monthly payments and stopping collection activity. But loan modifications are not foolproof. They could increase the cost of your loan and add derogatory remarks to your credit report.

Some of the most common types of hardship are: job loss, pay reduction, underemployment, declining business revenue, death of a coborrower, illness, injury, and divorce.

A lender may agree to a loan modification during a settlement procedure or in the case of a potential foreclosure.A loan modification agreement is a long-term solution. A loan modification may involve a reduced interest rate, a longer period to repay, a different type of loan, or any combination of these.

Yes, probably. In California, a law called the Homeowner Bill of Rights (HBOR) generally gives borrowers the right to appeal a modification denial. Under HBOR, in most cases, if the servicer denies a borrower's application to modify a first lien loan, the borrower can appeal.

Be at least one regular mortgage payment behind or show that missing a payment is imminent. Provide evidence of significant financial hardship, for reasons such as: