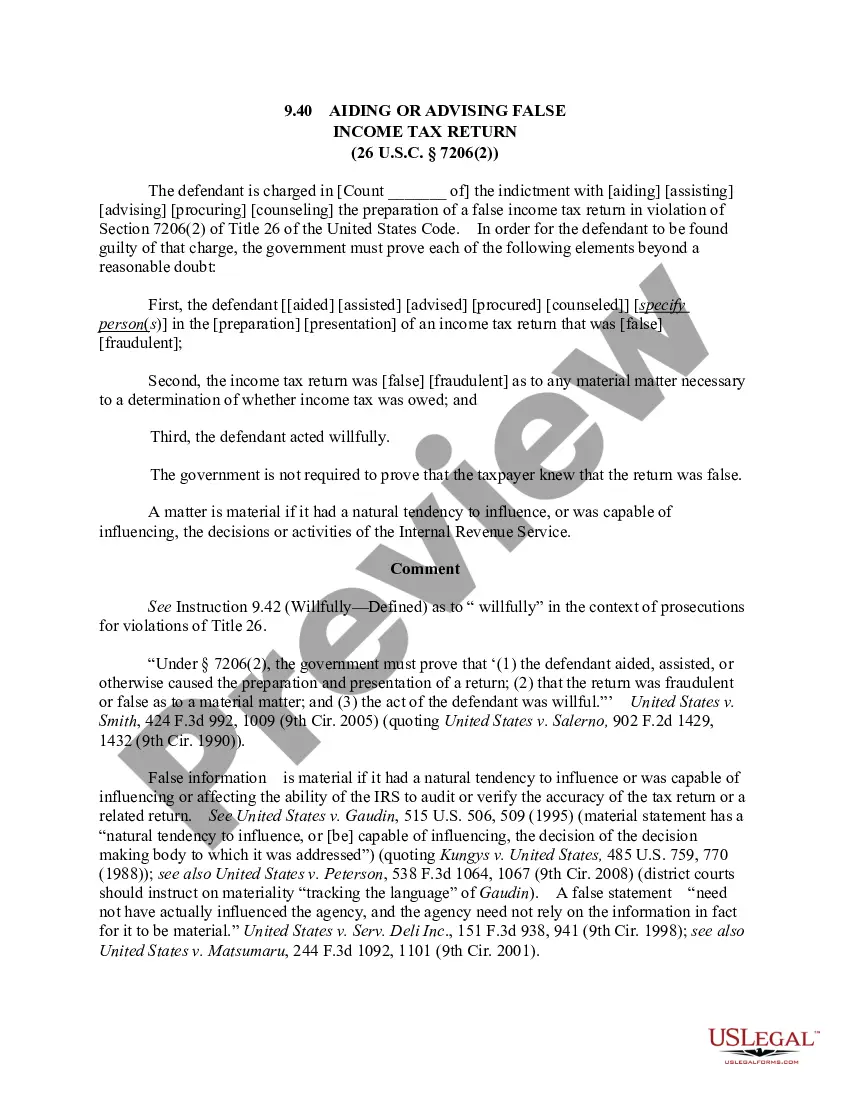

Aiding or Assisting in Preparation of False Documents Under Internal Revenue Laws is a form of tax fraud and involves the act of helping another person to prepare or submit a document to the Internal Revenue Service (IRS) that contains false or misleading information for the purpose of avoiding or reducing taxes. This can include preparing, signing, or submitting a false tax return, providing fraudulent documents to support a tax return, or providing false information to the IRS. Different types of Aiding or Assisting in Preparation of False Documents Under Internal Revenue Laws can include: aiding in the preparation of false or fraudulent tax returns; providing false or misleading information on a tax return; providing false or misleading records; and causing the IRS to issue an incorrect refund or other benefit.

Aiding or Assisting in Preparation of False Documents Under Internal Revenue Laws

Description

How to fill out Aiding Or Assisting In Preparation Of False Documents Under Internal Revenue Laws?

How much time and resources do you usually spend on drafting formal documentation? There’s a better way to get such forms than hiring legal experts or spending hours searching the web for a suitable blank. US Legal Forms is the leading online library that offers professionally designed and verified state-specific legal documents for any purpose, such as the Aiding or Assisting in Preparation of False Documents Under Internal Revenue Laws.

To acquire and prepare an appropriate Aiding or Assisting in Preparation of False Documents Under Internal Revenue Laws blank, follow these simple instructions:

- Look through the form content to make sure it meets your state regulations. To do so, read the form description or utilize the Preview option.

- If your legal template doesn’t meet your needs, locate another one using the search bar at the top of the page.

- If you already have an account with us, log in and download the Aiding or Assisting in Preparation of False Documents Under Internal Revenue Laws. If not, proceed to the next steps.

- Click Buy now once you find the correct blank. Opt for the subscription plan that suits you best to access our library’s full opportunities.

- Register for an account and pay for your subscription. You can make a payment with your credit card or via PayPal - our service is absolutely reliable for that.

- Download your Aiding or Assisting in Preparation of False Documents Under Internal Revenue Laws on your device and fill it out on a printed-out hard copy or electronically.

Another advantage of our library is that you can access previously purchased documents that you securely keep in your profile in the My Forms tab. Obtain them at any moment and re-complete your paperwork as often as you need.

Save time and effort preparing legal paperwork with US Legal Forms, one of the most trusted web solutions. Sign up for us now!

Form popularity

FAQ

Intentionally fails to pay taxes owed. Willfully fails to file a federal income tax return. Fails to report all income. Makes false or fraudulent claims.

Shall be guilty of a felony and, upon conviction thereof, shall be fined not more than $100,000 ($500,000 in the case of a corporation), or imprisoned not more than 3 years, or both, together with the costs of prosecution.

7206 filing a fraudulent and false statement verified via written declaration under penalty of perjury is a felony and carries a penalty of imprisonment for up to 3 years, a $100,000 fine for individuals or a $500,000 fine for corporations, or both, and reimbursement to the federal government to cover the costs of

Each false document a taxpayer signs can result in a separate count of tax perjury. Tax perjury is punishable by up to three years in prison and a fine of up to $250,000.

In rare cases, the IRS can press criminal charges. When the IRS identifies fraud, the IRS can pursue civil or criminal charges. The IRS prosecutes relatively few cases each year ? and they usually involve large omissions of income, tax evasion or tax protest schemes, or lying to the IRS in an audit.

Aid or Assist The willful assistance can include providing a false document that the provider reasonably knows will be used to prepare and file a false tax return, or providing false or misleading advice resulting in the filing of a false tax return, or other action that caused the filing of a false tax return.

Willfully makes and subscribes any return, statement, or other document, which contains or is verified by a written declaration that it is made under the penalties of perjury, and which he does not believe to be true and correct as to every material matter; ?