Director's Fee Agreement

What this document covers

The Director's Fee Agreement is a legal document that outlines the terms between a corporation and its director regarding compensation and responsibilities. Unlike other director agreements, this specific form focuses on the financial arrangements and the distinct role of the director within the company, ensuring clarity and compliance with legal standards.

Form components explained

- Director Arrangement: Establishes the director's role and responsibilities.

- Term: Specifies the duration of the director's service.

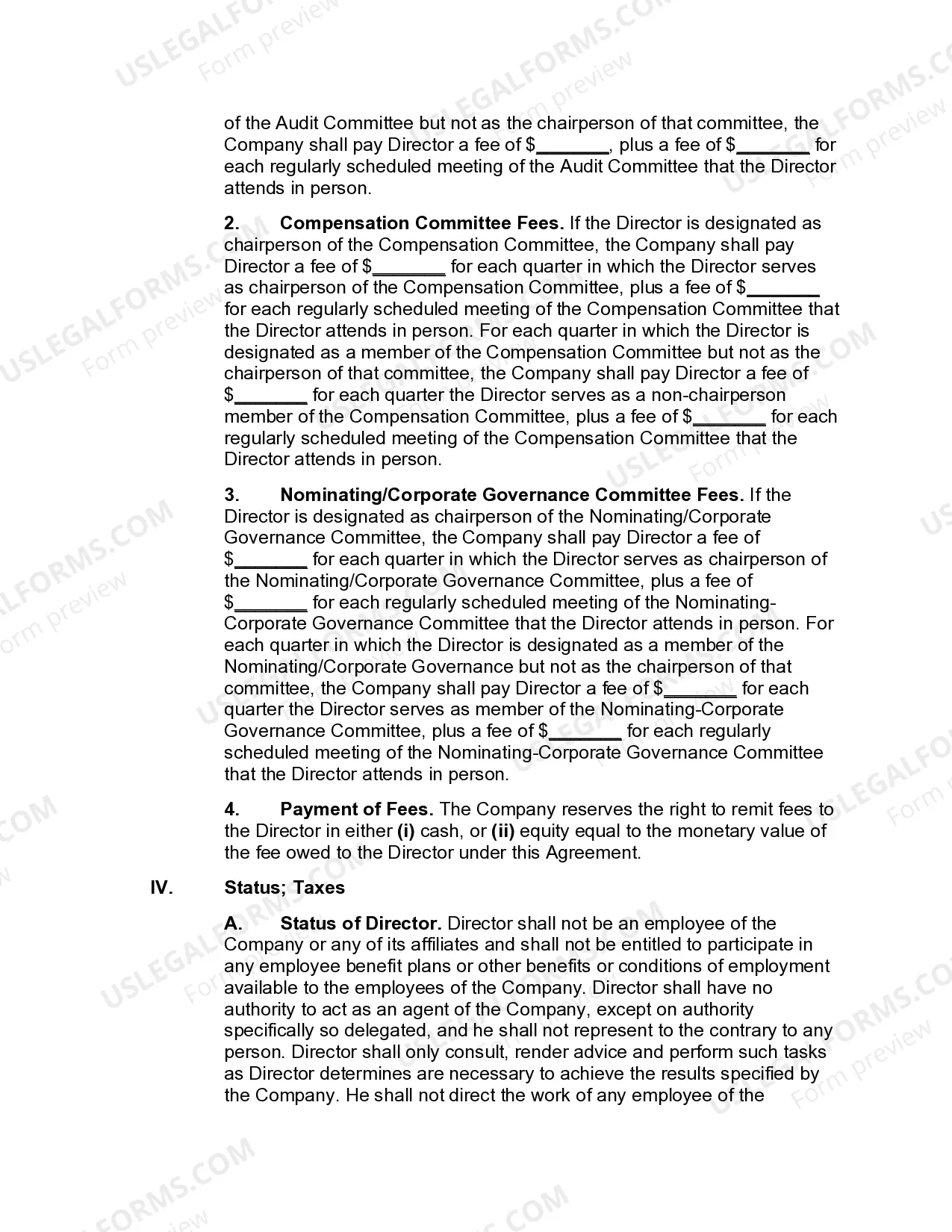

- Compensation Structure: Details annual fees, meeting fees, and additional committee compensation.

- Status of Director: Clarifies the director's non-employee status and tax responsibilities.

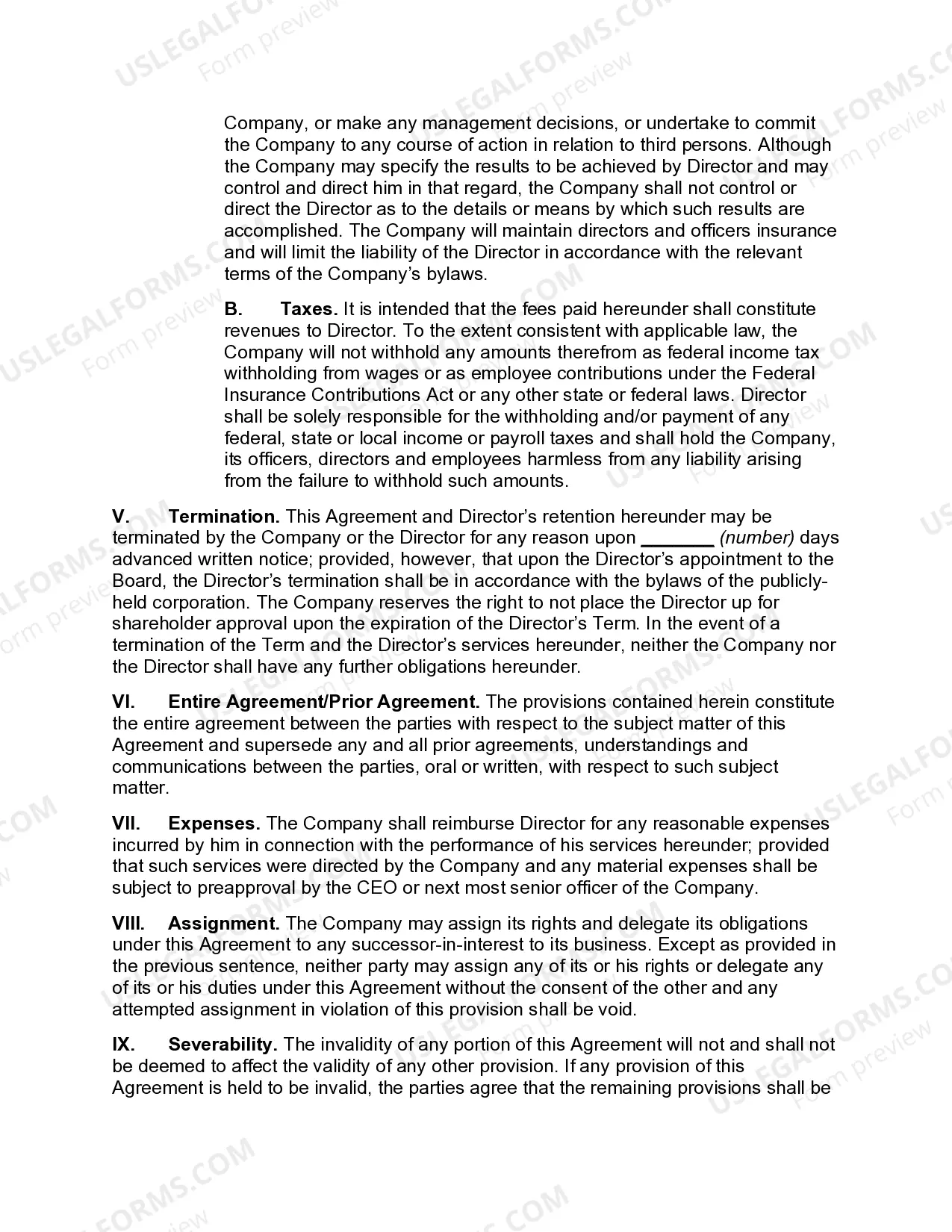

- Termination: Outlines conditions under which the agreement can be terminated.

- Governing Law: Indicates which state laws govern the agreement.

When this form is needed

This form is essential for companies looking to formalize their arrangement with a board member regarding compensation and duties. It is particularly useful during the recruitment of new directors or when establishing clear financial expectations for existing board members, ensuring compliance and clarity in governance.

Who needs this form

- Corporations seeking to establish a formal agreement with their board directors.

- Newly appointed directors who need clarity on their compensation and duties.

- Legal advisors preparing agreements for corporate governance.

- Companies that require a written memorandum for compliance with legal obligations.

How to prepare this document

- Identify the parties involved: Fill in the names of the corporation and director.

- Specify the term: Enter the effective date and duration of the director's service.

- Outline the compensation: Detail the fees and additional compensation for meetings and committees.

- Include termination conditions: State how either party can end the agreement with notice.

- Finalize signatures: Ensure both the company officer and the director sign the agreement.

Is notarization required?

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to specify the term of service, leading to ambiguity.

- Omitting details about compensation structures and fees.

- Not providing adequate notice periods for termination.

- Neglecting to sign the agreement, making it unenforceable.

Advantages of online completion

- Convenience: Access and complete the form from anywhere at any time.

- Editability: Easily fill out and customize the template to fit specific needs.

- Reliability: Utilize forms drafted by licensed attorneys, ensuring legal accuracy.

Looking for another form?

Form popularity

FAQ

A board of directors agreement is an agreement that outlines the roles and responsibilities of the members of the board of directors of a company and secures membership of a new board member. The agreement isn't a legal document, but it does assert a new member's commitment to the organization.

Directors Fees means the annual fees paid by an Employer, including retainer fees and meetings fees, as compensation for serving on a board of directors of an Employer.

Directors' Remuneration (also referred to as Directors' Compensation or Directors' Fees) refers to any and all amounts paid to directors of a company in exchange for their service to the company. Remuneration can include cash compensation, stock compensation, bonuses, gifts, and fringe benefits.

A director's service agreement is very similar to an employment contract. Both will often include the responsibilities that the director should carry out and the rules under which they should operate.

Directors fees are payments made to your company director, or the person performing the duties of the company director, to cover travelling costs, costs associated with attending meetings, and other expenses incurred in the position.

Directors Fees means the annual fees paid by an Employer, including retainer fees and meetings fees, as compensation for serving on a board of directors of an Employer.

Director Payments means, with respect to any Director, the compensation payable in the form of the annual retainer, committee fees or other cash compensation.

If you are a corporate director, the fees you are paid for your services are not considered employee wages or executive salaries. They are categorized as self-employment income by the IRS. To prevent confusion, your director's fees should be paid separately from your employee wages.