Idaho Acknowledgment by Individual - Short Form

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

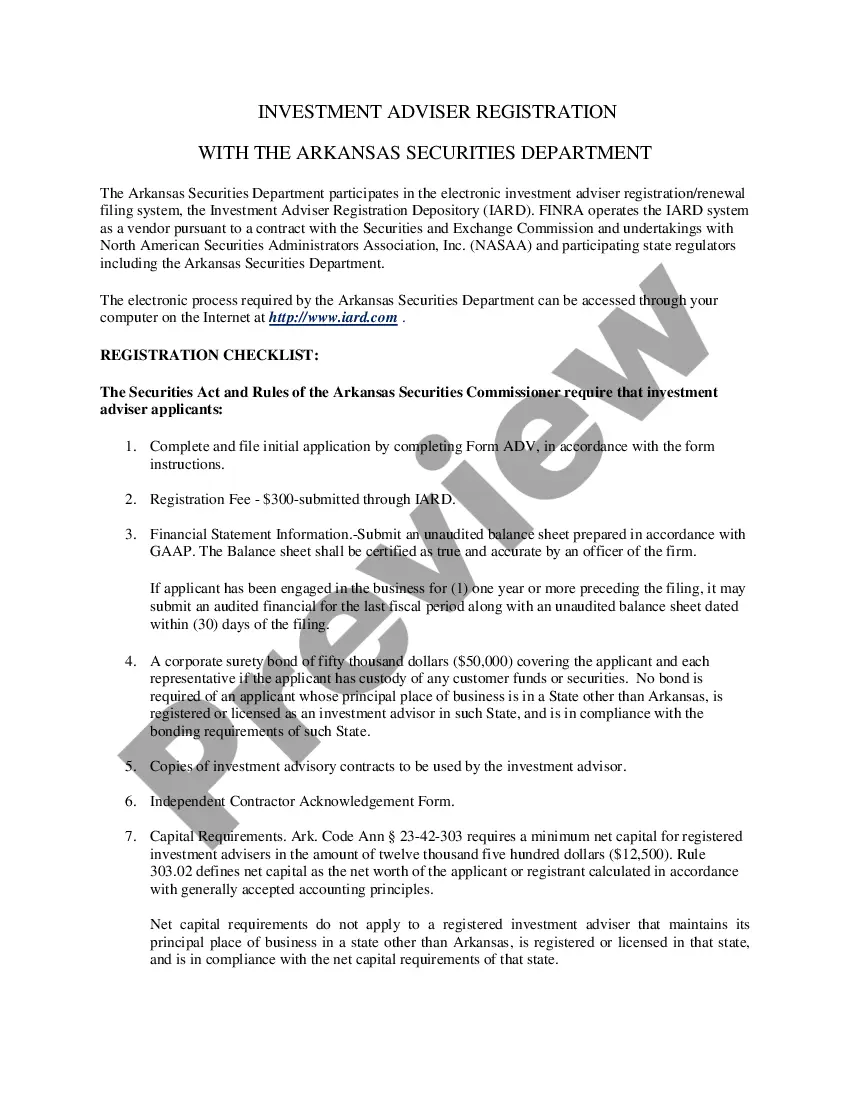

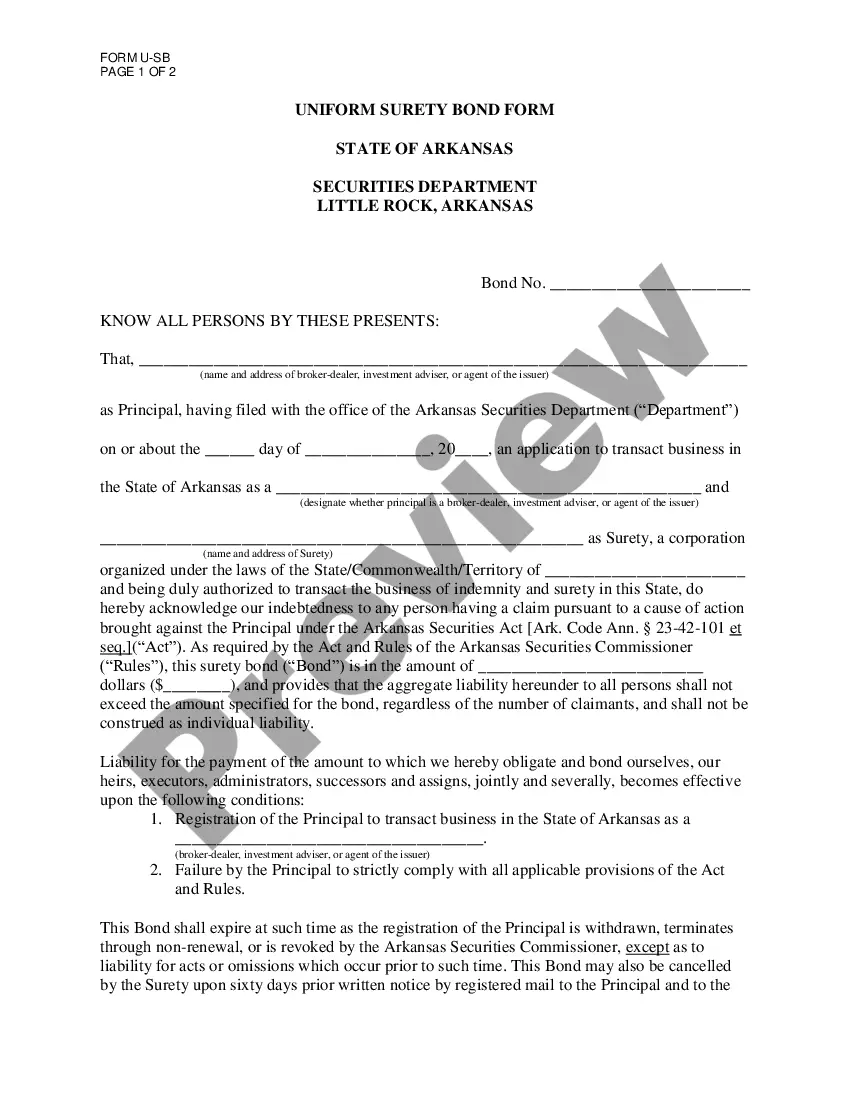

How to fill out Idaho Acknowledgment By Individual - Short Form?

Searching for Idaho Acknowledgment by Individual – Short Form documents and completing them can be quite a challenge.

To conserve time, expenses, and effort, utilize US Legal Forms and discover the suitable template specifically for your state in just a few clicks.

Our lawyers prepare all papers, so you only need to complete them.

Choose your plan on the pricing page and create your account. Choose whether to pay by card or PayPal. Save the document in your preferred format. Now you can print the Idaho Acknowledgment by Individual – Short Form template or complete it using any online editor. Don’t worry about making errors as your sample can be used, sent, and printed as many times as you like. Explore US Legal Forms and gain access to approximately 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's webpage to save the document.

- Your downloaded copies are stored in My documents and are accessible at any time for future use.

- If you haven’t subscribed yet, you must register.

- Check out our comprehensive instructions on how to obtain your Idaho Acknowledgment by Individual – Short Form template in a few minutes.

- To get a valid form, verify its applicability for your state.

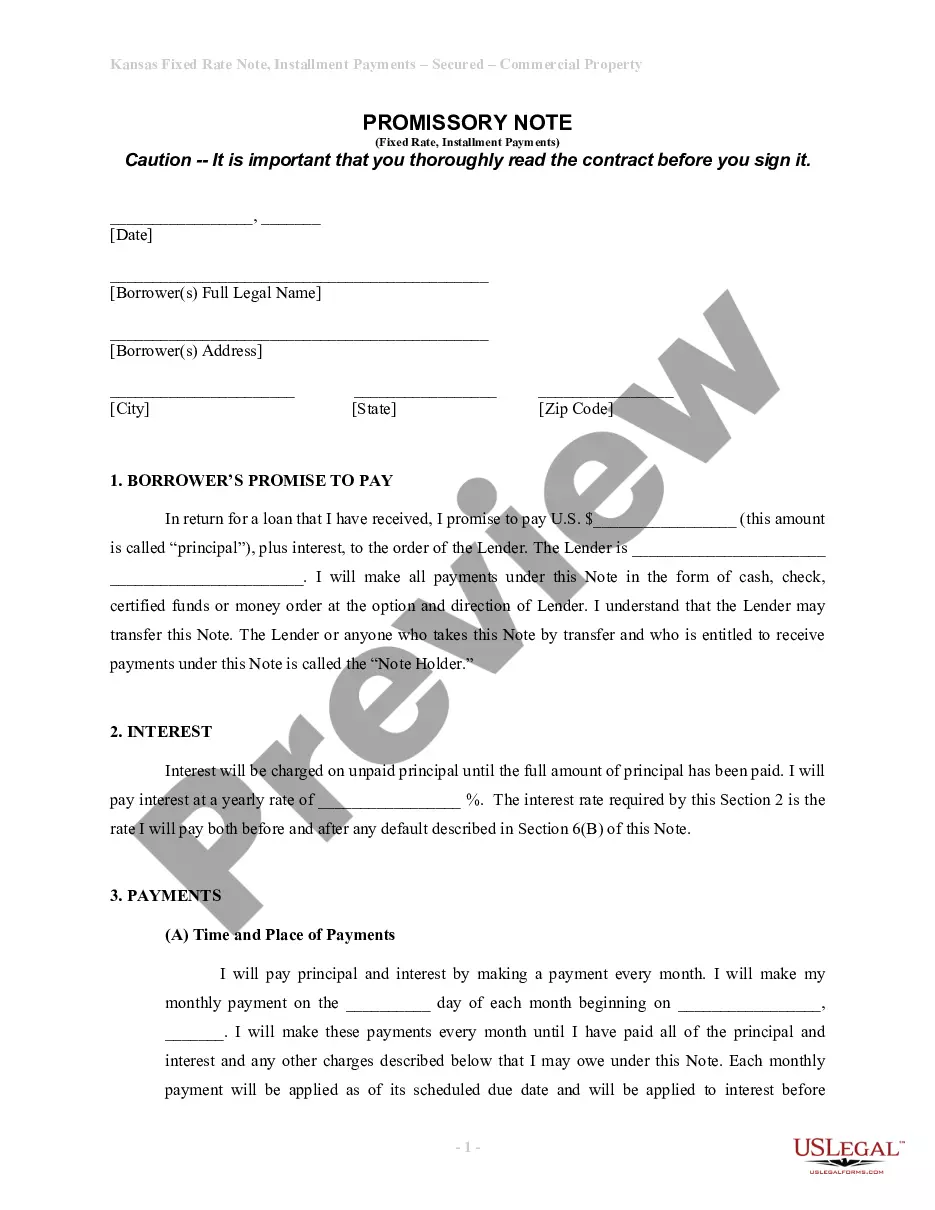

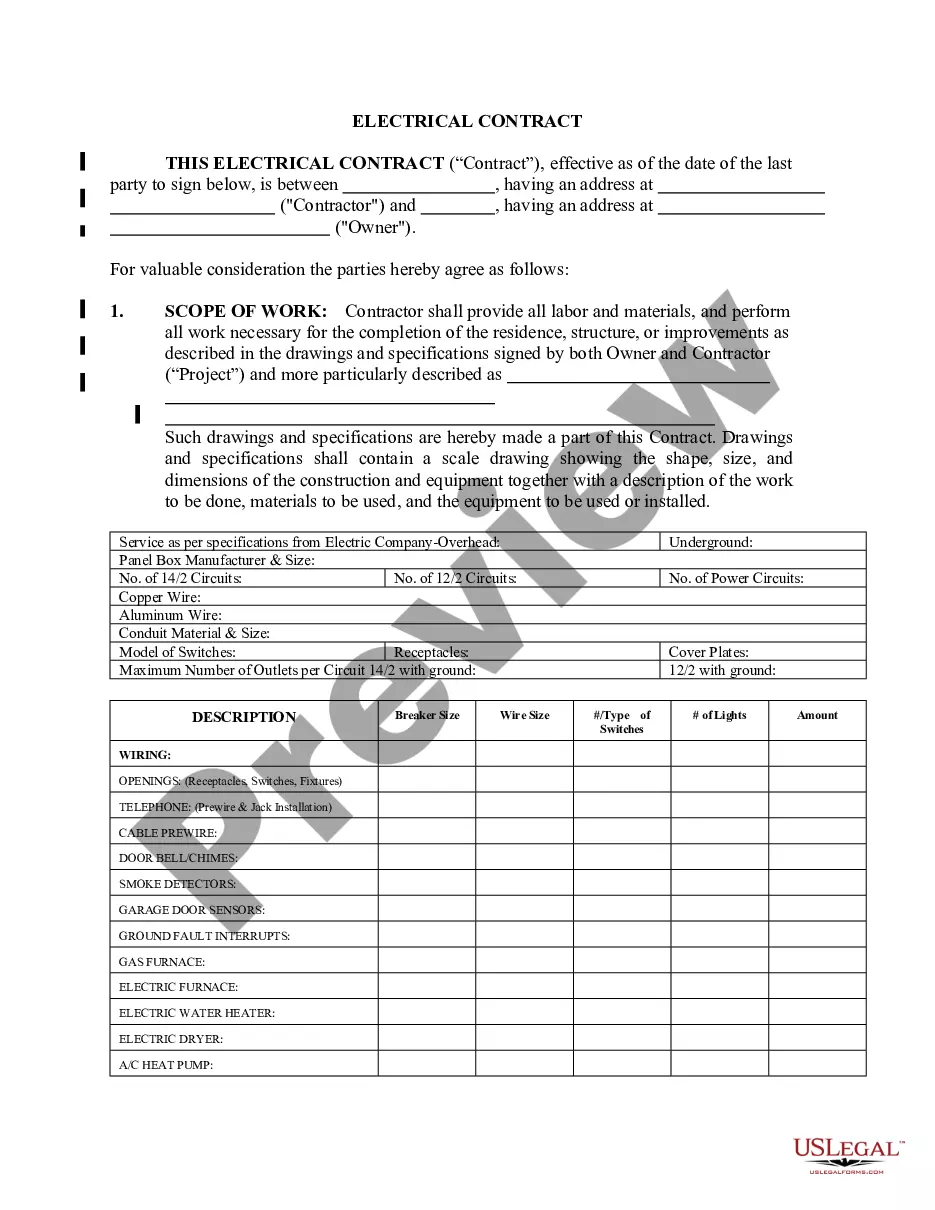

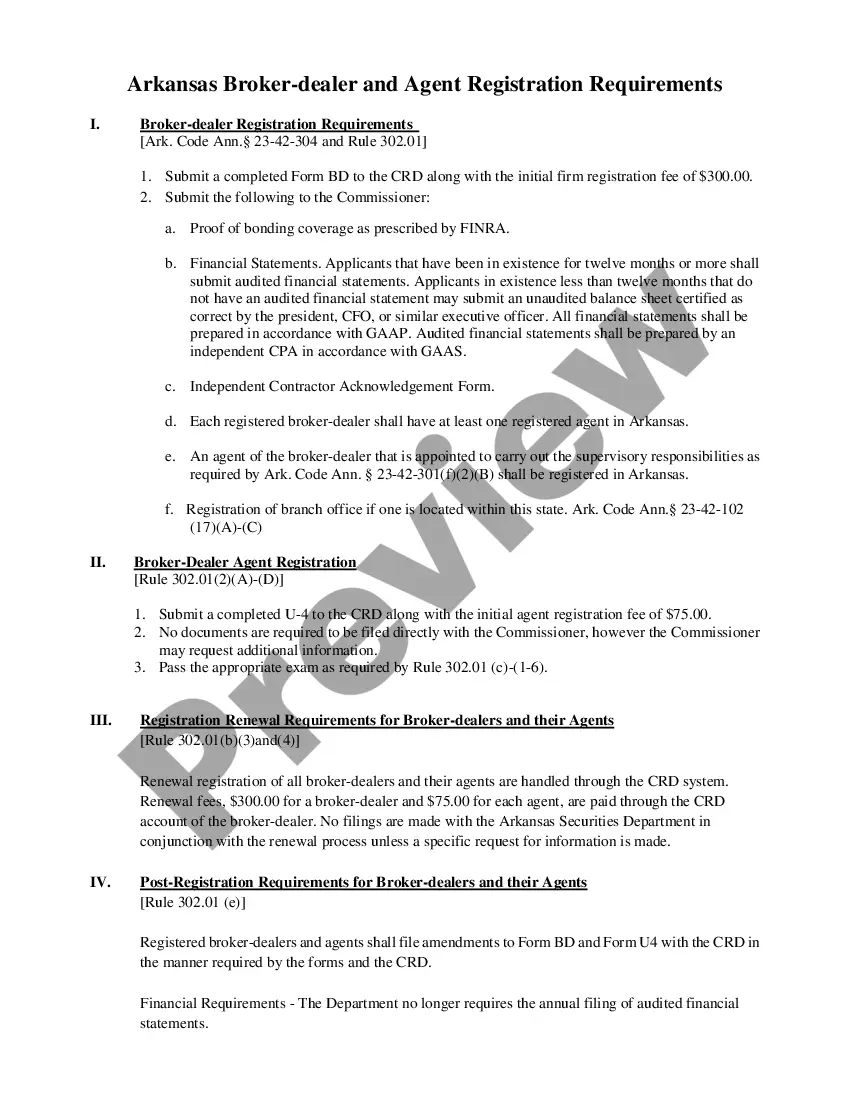

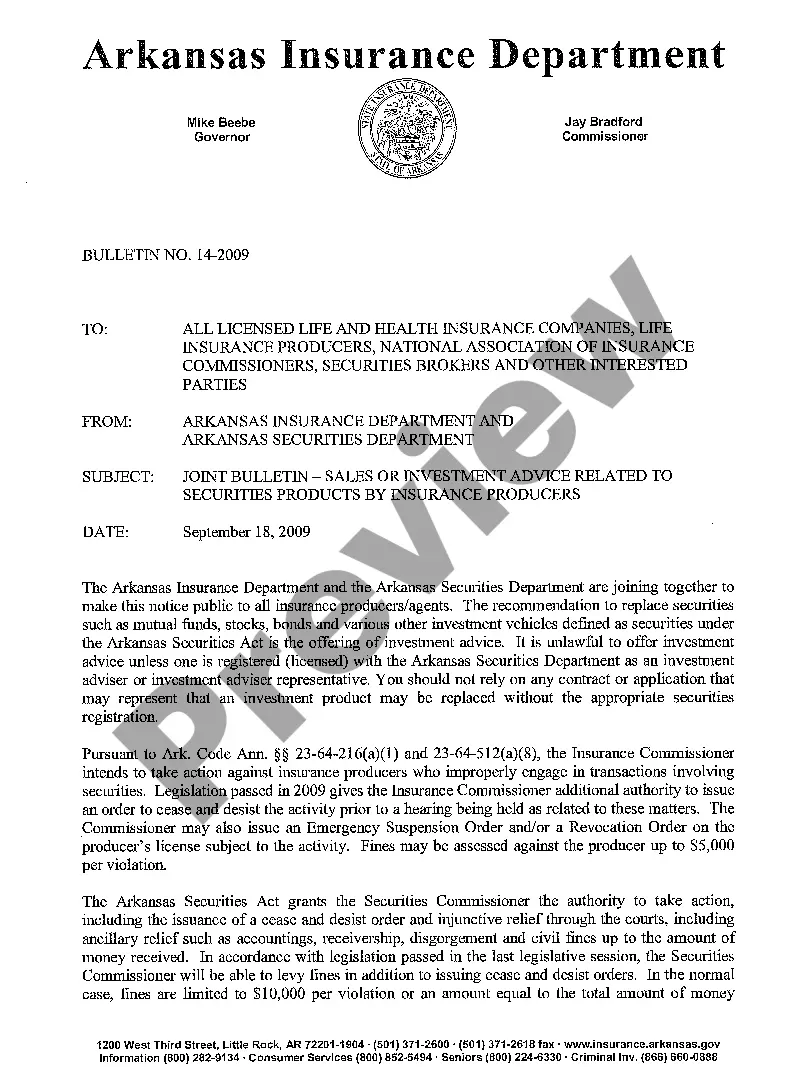

- Examine the sample using the Preview feature (if available).

- If there’s a description, review it to understand the specifics.

- Click on the Buy Now button if you found what you need.

Form popularity

FAQ

File your Idaho and Federal tax returns online with TurboTax in minutes.We last updated Idaho FORM 39NR (NONRESIDENT/PART-YEAR RESIDENT) in January 2021 from the Idaho State Tax Commission. This form is for income earned in tax year 2020, with tax returns due in April 2021.

Step 1: Require Personal Appearance. Step 2: Check Over The Document. Step 3: Carefully Identify The Signer. Step 4: Record Your Journal Entry. Step 5: Complete The Notarial Certificate. A Last Note: Never Give Advice.

The notarization process is typically simple. You present a document to a notary public and sign it in their presence. After that, the notary officially notarizes the document using an official stamp, writes in the date, and adds their own signature.

Use an appropriate heading. You can write the letter in any format you choose but make certain to mention an appropriate heading. Insert a case caption. Add the address. Give details about the affiant. Include your name. Leave a space for the signature of the notary public.

When you see (here insert the name and character of the officer) next to a blank as shown below, it means you should insert Your name, Notary Public in the blank.

In such cases, you should refuse to notarize, citing the blank space as a reason. Remember that you may only complete information in the notarial certificate wording. Any blanks in the main text must be completed by the signer or another individual authorized to do so before the notarization may proceed.

A notary public shall provide and keep an official seal, which shall clearly show, when embossed, stamped, impressed or affixed to a document, the name of the notary, the State Seal, the words "Notary Public," and the name of the county wherein the bond and oath of office are filed, and the date the notary public's

The appropriate verbal wording for an oath for a jurat is as follows: Do you solemnly swear that the statements in this document are true to the best of your knowledge and belief, so help you God?