Escrow Check Receipt Form

What is this form?

The Escrow Check Receipt Form is a legal document used to acknowledge the receipt of a check that is held in escrow. This form outlines the details of the check, including the amount and the parties involved, and ensures that the funds are used according to specific written instructions. It serves to protect both the buyer and seller in a transaction by providing a clear record of the escrow arrangement, differing from other receipt forms by emphasizing the conditions under which the funds will be released.

What’s included in this form

- Escrow number: A unique identifier for tracking the escrow agreement.

- Date received: The date when the check was accepted into escrow.

- Name of drawer: The individual or entity that issued the check.

- Check details: Information about the bank and amount of the check.

- Instructions for fund use: Specifications on how the funds are to be handled according to the terms of the escrow agreement.

- Signature of the escrow agent: Verification of receipt by the responsible party managing the escrow.

When to use this form

This form is commonly used in real estate transactions, business partnerships, and other agreements where funds are held until certain conditions are met. For example, it is appropriate when a buyer deposits a down payment that will be released to the seller only after inspections are satisfactorily completed. This form ensures every party has a clear understanding of the conditions governing the escrow funds.

Who needs this form

This form is intended for:

- Buyers and sellers in real estate transactions.

- Individuals or businesses entering escrow agreements.

- Escrow agents or representatives managing funds held in escrow.

- Anyone needing a formal acknowledgment of received funds for safekeeping until conditions are fulfilled.

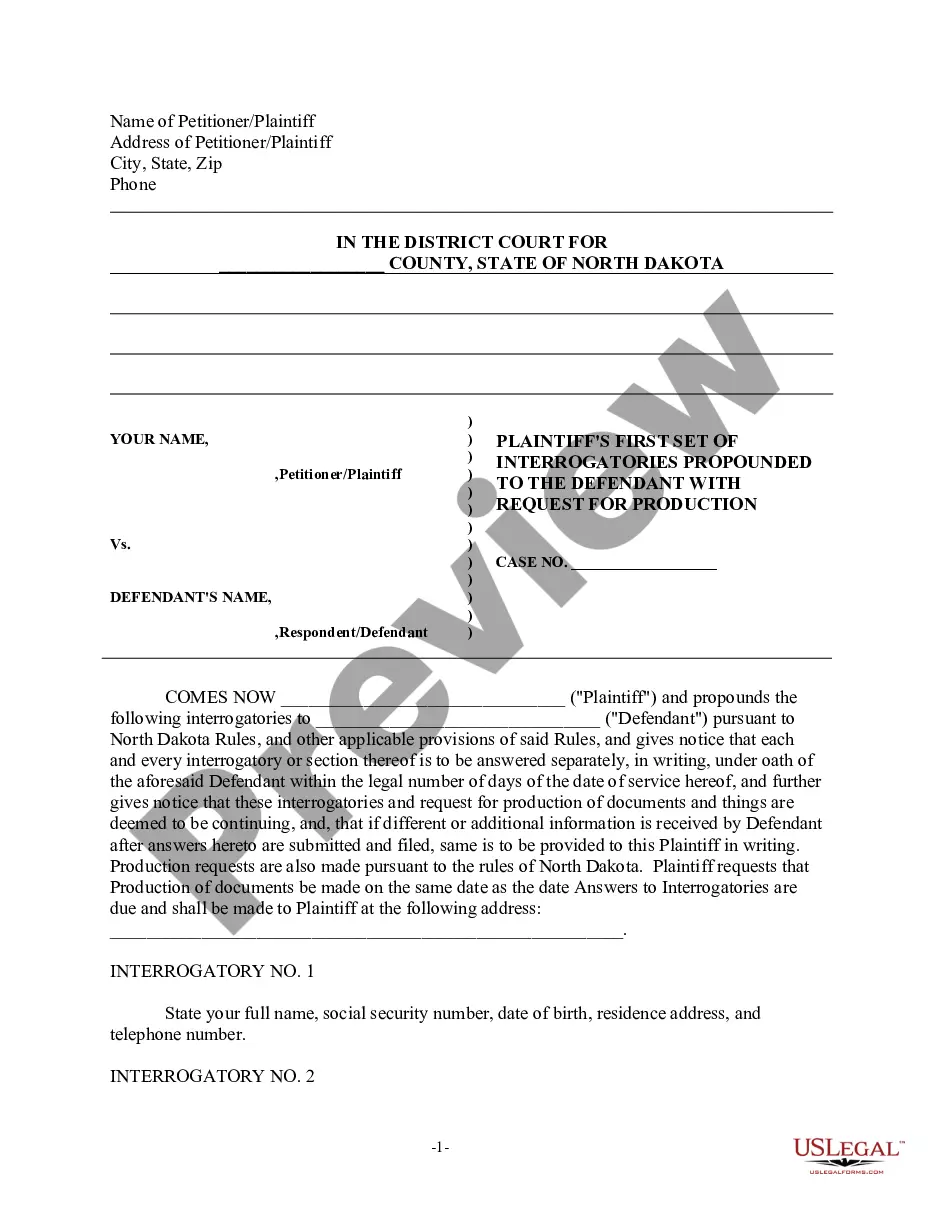

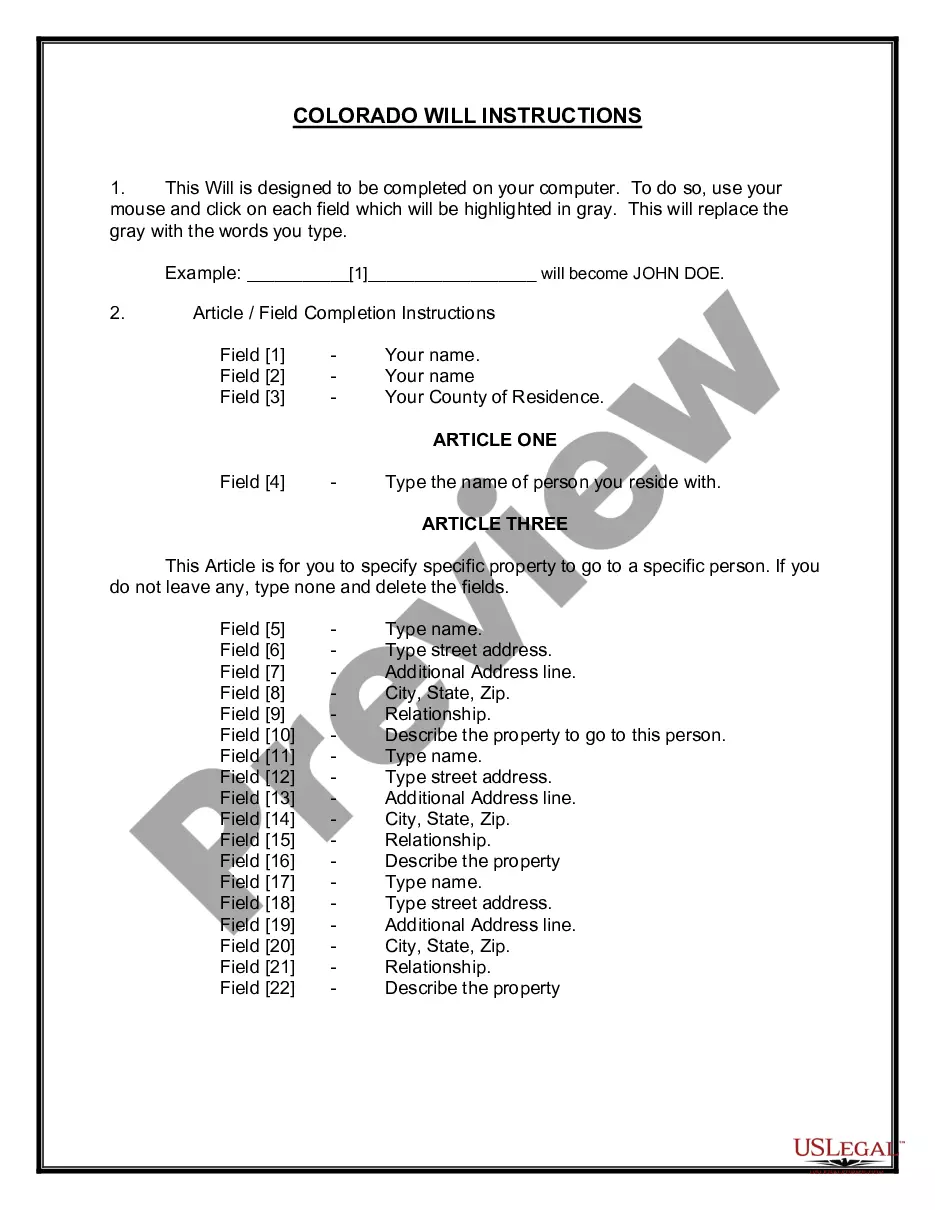

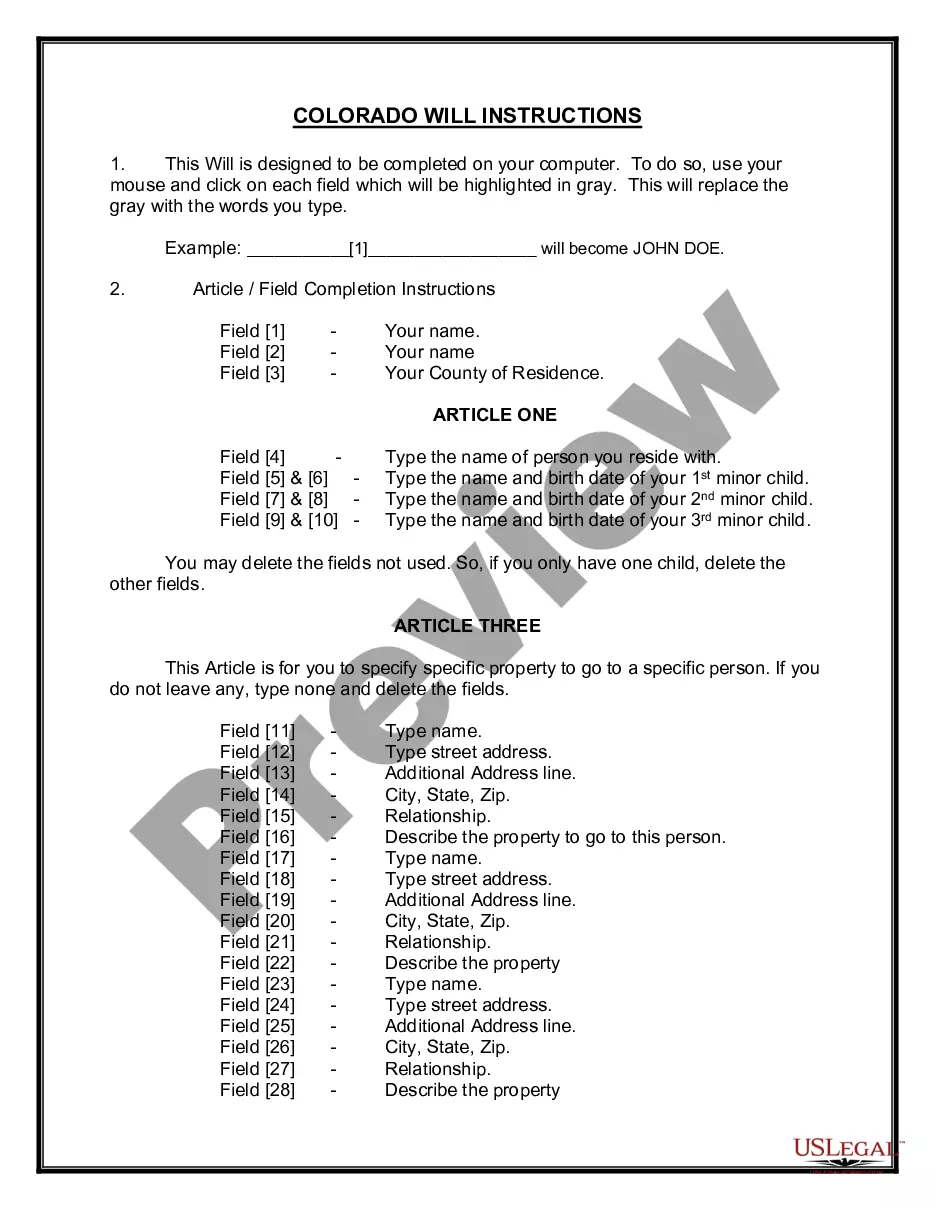

Completing this form step by step

- Identify the escrow number and enter it at the top of the form.

- Fill in the date the payment is received.

- Enter the name of the drawer (the person or business that issued the check).

- Specify the check amount and the name of the bank on which the check is drawn.

- Document the purpose or conditions for which the funds are to be used.

- Have the escrow agent sign and date the form, confirming receipt of the check.

Is notarization required?

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to accurately fill in the check amount can lead to disputes.

- Not specifying the intended use of funds may create confusion later.

- Omitting signatures or dates can render the form invalid.

- Forgetting to report any changes in the escrow instructions after the form is completed.

Why use this form online

- Convenience of instant download, allowing for immediate use.

- Editability makes it easy to customize the form to fit individual needs.

- Reliable templates drafted by licensed attorneys ensure legal compliance.

- Access to integrated online notarization for added security and validity.

Quick recap

- The Escrow Check Receipt Form protects both parties in a transaction by clearly documenting the receipt of funds held in escrow.

- Complete the form accurately to ensure all parties understand the terms of the escrow agreement.

- This form is suitable for various types of transactions, including real estate and business agreements.

Looking for another form?

Form popularity

FAQ

The earnest money deposit receipt is given to a buyer of real estate after entering into a purchase agreement with a seller. The deposit slip is given to the buyer after funds have been received which binds the parties into the agreement.

It's a binding agreement between the party who makes the promise and the one to whom the promise is made. Written documents are held in escrow until the underlying agreement is accomplished.Any written document executed in accordance with all the necessary legal formalities may be put into escrow.

An escrow receipt is a bank statement which guarantees that an option writer has the underlying security available for delivery, should the need arise.

Provide personal information: Write your name and your account number on the deposit slip. Fill in additional details: Write in the date and any branch information, if required. List the cash amount of your deposit: This is the total amount of currency (bills and coins) that you have for the deposit.

Find out the name of the title company and make the check payable to that particular title company. Put the property address in the memo line. Write a new check for every offer.

The trend today is for the title company and/or escrow officer to issue the deposit receipt. This is generally issued after the buyer's earnest money deposit has been deposited into the title or escrow company's bank account. It will often contain the following information: Name of title company.

The deposit should be payable to a reputable third party, such as a well-known real estate brokerage, escrow company, title company, or legal firm (never give the deposit directly to the seller). Buyers should verify the funds will be held in an escrow account and always obtain a receipt.

In financial transactions, the term "in escrow" indicates a temporary condition of an item, such as money or property, that has been transferred to a third party."In escrow" is a type of legal holding account for items, which can't be released until predetermined conditions are satisfied.