An heirship affidavit is used to state the heirs of a deceased person. It is commonly used to establish ownership of personal and real property. It may be recorded in official land records, if necessary. Example of use: Person A dies without a will, leaves a son and no estate is opened. When the son sells the land, the son obtains an heirship affidavit to record with the deed. The person executing the affidavit should normally not be an heir of the deceased, or other person interested in the estate. The affidavit of heirship must also be signed by a notary public.

Affidavit of Heirship, Next of Kin or Descent - Heirship Affidavit Made By Someone Well-Acquainted with Decedent - Decedent having Spouse and Children at Death

Description

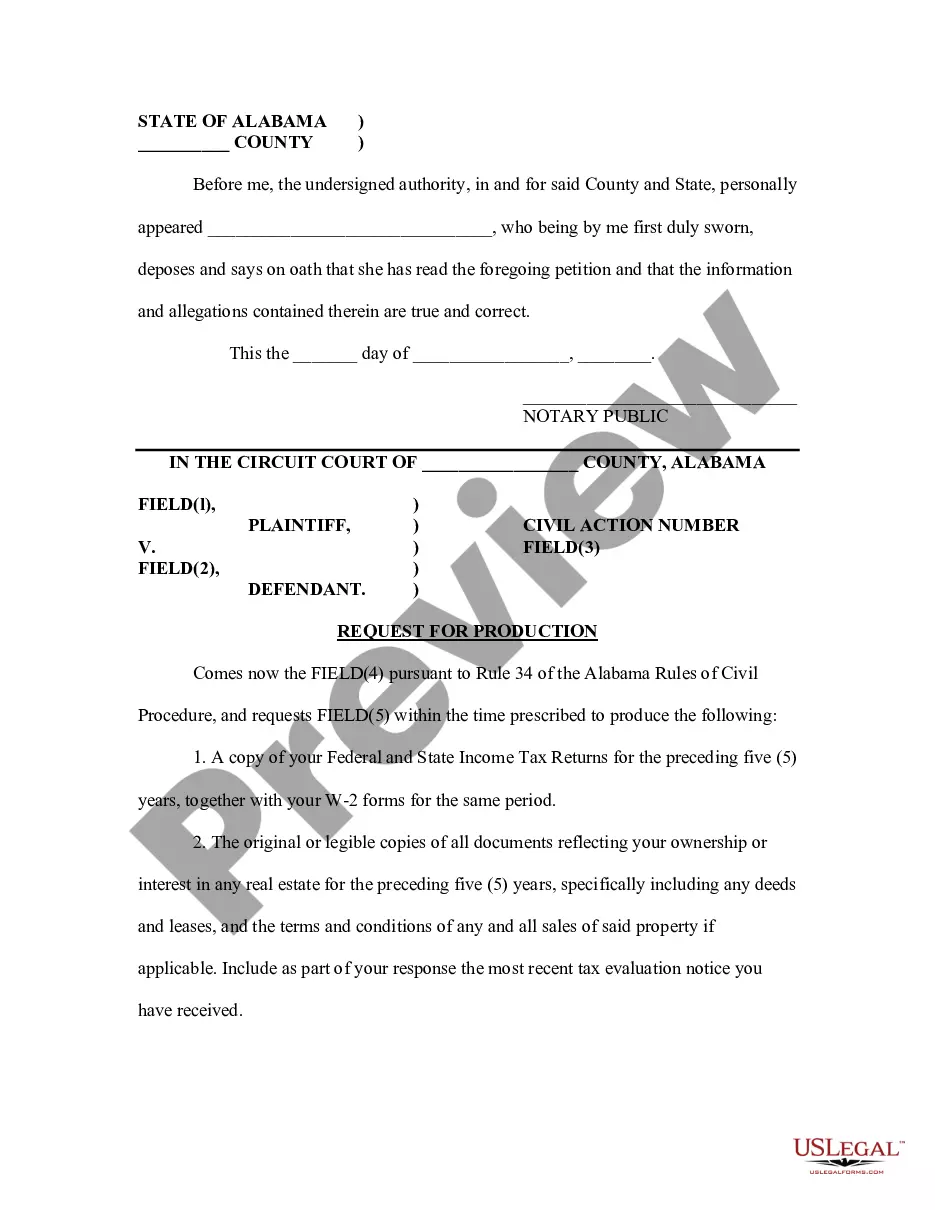

How to fill out Affidavit Of Heirship, Next Of Kin Or Descent - Heirship Affidavit Made By Someone Well-Acquainted With Decedent - Decedent Having Spouse And Children At Death?

Aren't you tired of choosing from countless samples each time you need to create a Affidavit of Heirship, Next of Kin or Descent - Heirship Affidavit Made By Someone Well-Acquainted with Decedent - Decedent having Spouse and Children at Death? US Legal Forms eliminates the wasted time millions of American people spend exploring the internet for perfect tax and legal forms. Our professional team of lawyers is constantly upgrading the state-specific Forms catalogue, so that it always has the right documents for your situation.

If you’re a US Legal Forms subscriber, just log in to your account and click on the Download button. After that, the form are available in the My Forms tab.

Visitors who don't have a subscription should complete simple actions before having the ability to get access to their Affidavit of Heirship, Next of Kin or Descent - Heirship Affidavit Made By Someone Well-Acquainted with Decedent - Decedent having Spouse and Children at Death:

- Utilize the Preview function and read the form description (if available) to be sure that it’s the appropriate document for what you’re looking for.

- Pay attention to the validity of the sample, meaning make sure it's the appropriate example for the state and situation.

- Use the Search field at the top of the page if you want to look for another file.

- Click Buy Now and choose an ideal pricing plan.

- Create an account and pay for the services using a credit card or a PayPal.

- Get your document in a convenient format to complete, create a hard copy, and sign the document.

When you’ve followed the step-by-step recommendations above, you'll always have the capacity to sign in and download whatever file you need for whatever state you want it in. With US Legal Forms, completing Affidavit of Heirship, Next of Kin or Descent - Heirship Affidavit Made By Someone Well-Acquainted with Decedent - Decedent having Spouse and Children at Death templates or any other legal documents is not difficult. Get started now, and don't forget to double-check your examples with certified lawyers!

Form popularity

FAQ

The price of the Affidavit of Heirship is $500. This price includes the attorneys' fees to prepare the Affidavit of Heirship and the cost to record in the real property records. You can save $75 if you record the Affidavit of Heirship yourself.

Does an affidavit of heirship need to be recorded in Texas? Yes, after the affidavit is signed and executed, it must be filed with the county deed records where the decedent's real property is located.

Affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 days of the transfer.

An affidavit of heirship must be filed with the real property records in the county where the land is located. Call the county clerk and ask how much their filing fees are. The filing fees vary from county to county.

An affidavit of heirship must be filed with the real property records in the county where the land is located. Call the county clerk and ask how much their filing fees are. The filing fees vary from county to county.

An affidavit of heirship should be signed by two disinterested witnesses. To qualify as a disinterested witness, one must be knowledgeable about the deceased and his or her family history, but cannot benefit financially from the estate.

1. This form should be completed by someone other than an Heir. This person should be someone who is familiar with the family history of the deceased (decedent), and who will obtain no benefit from the Estate. The person who fills out the form is referred to as the AFFIANT.

Step 1 At the top, write in the name of the decedent. Step 2 Under Section 1, write in the date of birth, the date of death, the residential address of decedent. Step 3 In Section 2, check the box that describes you as the person filling out the affidavit.

Harris County Civil Courthouse. 201 Caroline, Suite 800. (713) 274-8585.