Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee

Definition and meaning

The Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee is a legal document that allows a beneficiary to renounce their rights and interests in a trust. This form is essential when a beneficiary chooses not to accept their benefits from a trust for personal or financial reasons. By executing this disclaimer, the beneficiary expresses their decision to forfeit any claim to the trust’s assets or income.

Key components of the form

This form consists of several crucial sections:

- Identifying Information: This includes the names and addresses of the trustee and trustor, as well as the name of the trust.

- Statement of Disclaimer: The beneficiary's formal statement indicating their renunciation of rights under the trust.

- Witnessing: Signatures from both the beneficiary and the trustee are required, acknowledging the disclaimer.

Each component serves to clarify the intentions of the beneficiary while ensuring proper legal procedures are followed.

How to complete a form

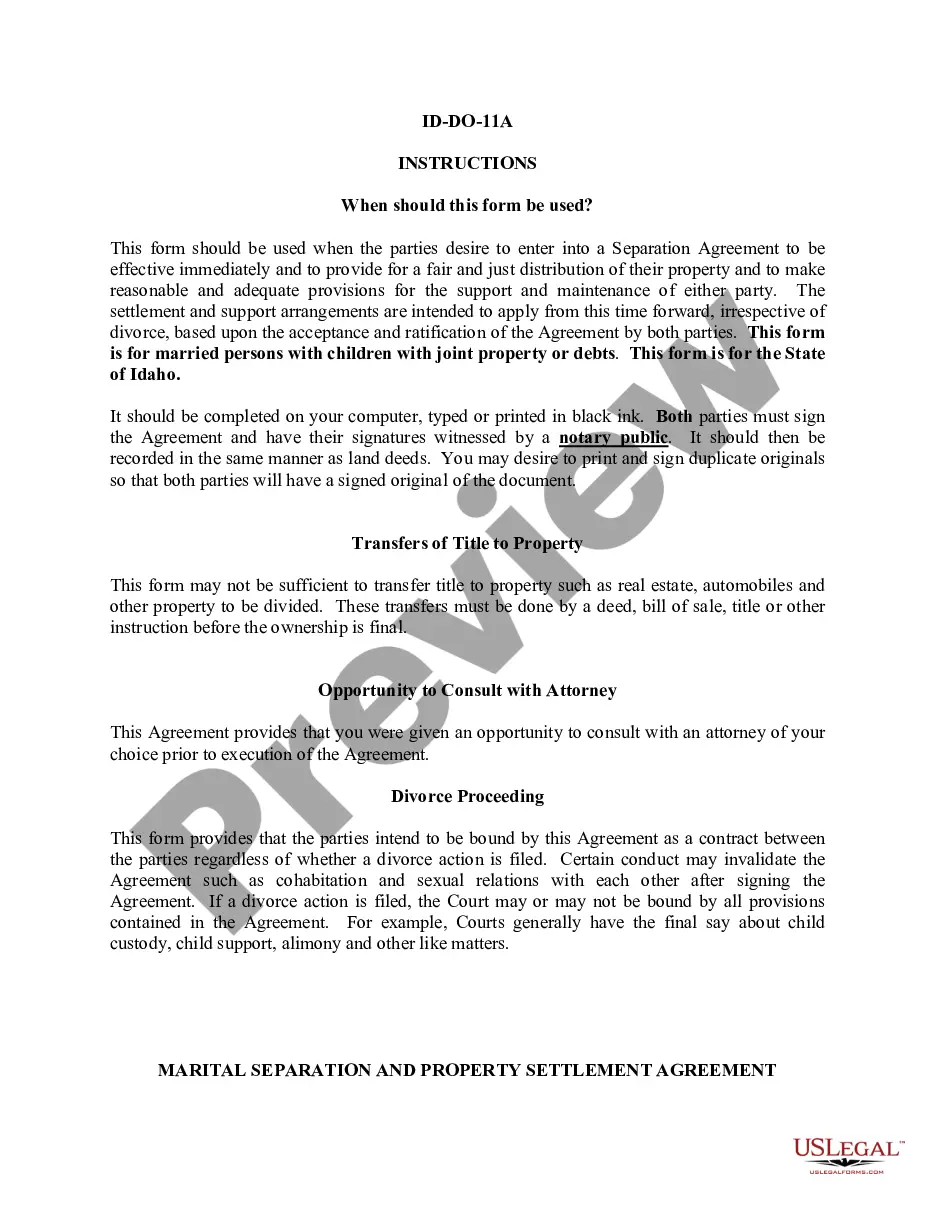

Completing the Disclaimer by Beneficiary form requires careful attention to detail. Here’s a step-by-step guide:

- Begin by filling in the names and addresses of the trustee and trustor at the top of the form.

- State the name of the trust and the date it was created.

- In the disclaimer section, clearly describe your interest under the trust (for example, income or specific assets).

- Sign the document in the presence of a witness.

- Finally, the trustee should acknowledge receipt and acceptance of the disclaimer by signing the form.

Ensure all information is accurate and complete to avoid any complications.

Who should use this form

This form is primarily for beneficiaries of a trust who decide not to accept their inheritance or any rights associated with it. Common users include:

- Beneficiaries aiming to tax minimize their estate.

- Individuals wishing to pass their inheritance to other beneficiaries.

- Persons looking to avoid potential debt liabilities associated with the inherited property.

If you find yourself in a situation where accepting the benefits may not be in your best interest, consider this form.

Common mistakes to avoid when using this form

When completing the Disclaimer by Beneficiary form, being aware of common pitfalls is crucial:

- Incomplete Information: Ensure all sections are filled out completely, including names, addresses, and details of the trust.

- Incorrect Signatures: Both the beneficiary and trustee must sign the document; forgotten signatures can invalidate it.

- Not Having Witnesses: Witnessing is often required; ensure the signatures are made in front of the appropriate parties.

Taking the time to review your form can prevent potential legal issues in the future.

What to expect during notarization or witnessing

When notarizing or witnessing the Disclaimer by Beneficiary form, here’s what to anticipate:

- The beneficiary must present a government-issued ID to verify their identity.

- The witness or notary will ensure that the beneficiary understands the document they are signing.

- All parties involved will sign the form in the presence of the notary or witness.

This process enhances the document's credibility and can be critical if the disclaimer is ever challenged.

Form popularity

FAQ

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property. Do not accept any benefit from the property you're disclaiming.

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property. Do not accept any benefit from the property you're disclaiming.

Any disclaimer of an interest in a trust by a trust beneficiary must be made to the trustee of that trust. For a disclaimer to be valid, it must be supported by some evidence that the beneficiary is disclaiming their interest. Silence or otherwise passive behaviour will not suffice.

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor,

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property. Do not accept any benefit from the property you're disclaiming.

Specifically, the IRS requires that: You make your disclaimer in writing.You disclaim the assets within nine months of the death of the person you inherited them from. (Note: There's an exception for minor beneficiaries; they have until nine months after they reach the age of majority to disclaim.)

A qualified disclaimer is a part of the U.S. tax code that allows estate assets to pass to a beneficiary without being subject to income tax. Legally, the disclaimer portrays the transfer of assets as if the intended beneficiary never actually received them.

No, a disclaimer does not need to be notarized.To get the most legal protection out of your disclaimers, display them in accessible places for users to see, such as linking to the disclaimer page in the website footer, and including it in the terms and conditions.