Employment Application for Sole Trader

Description

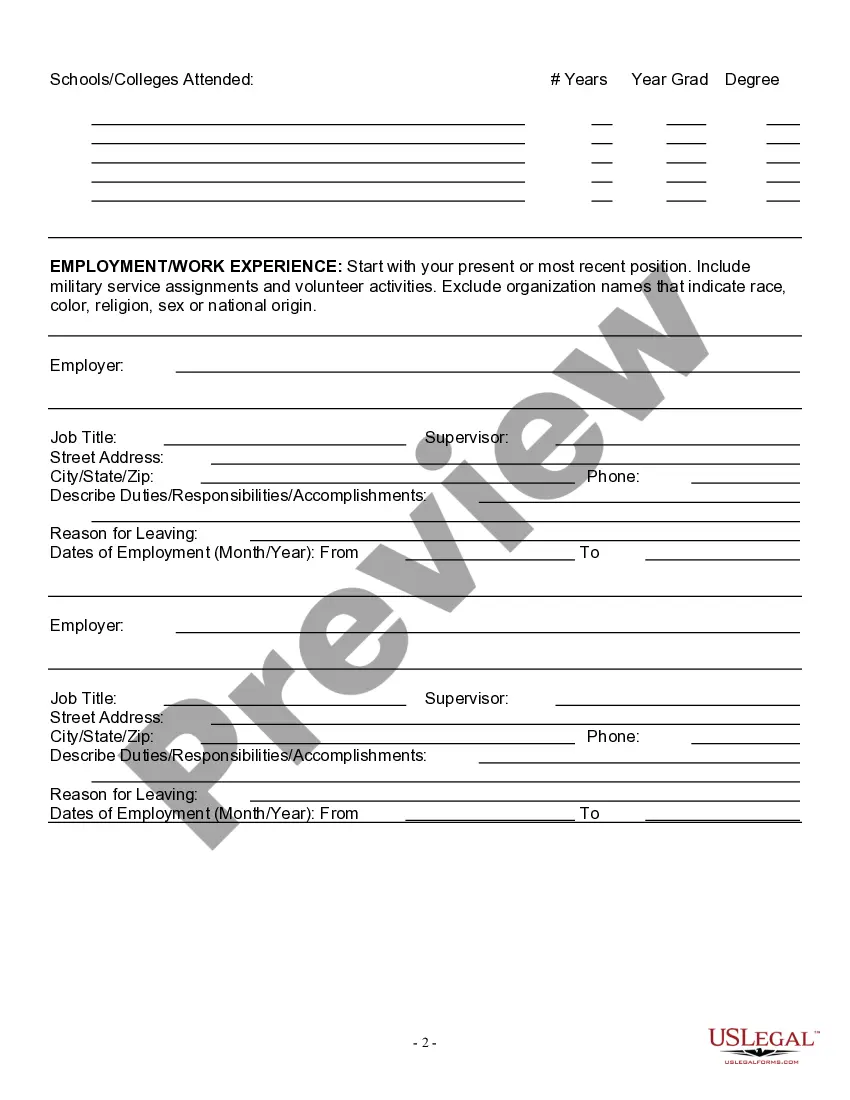

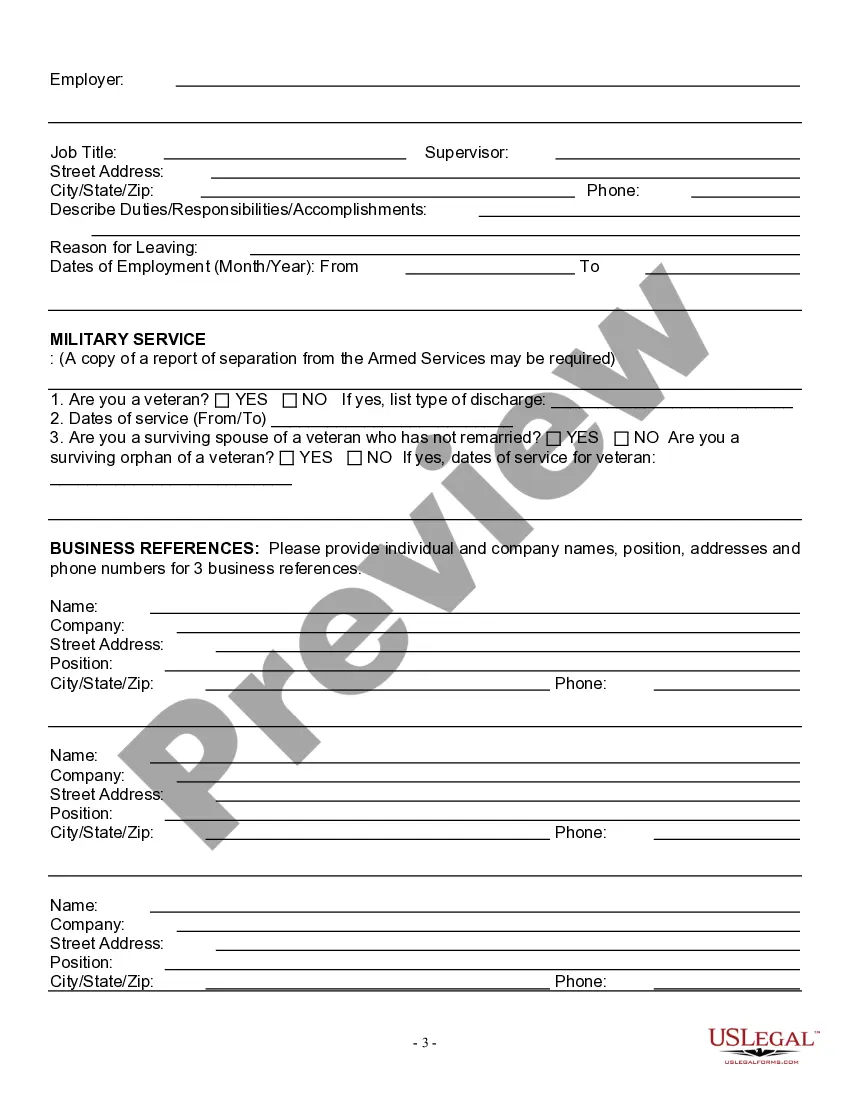

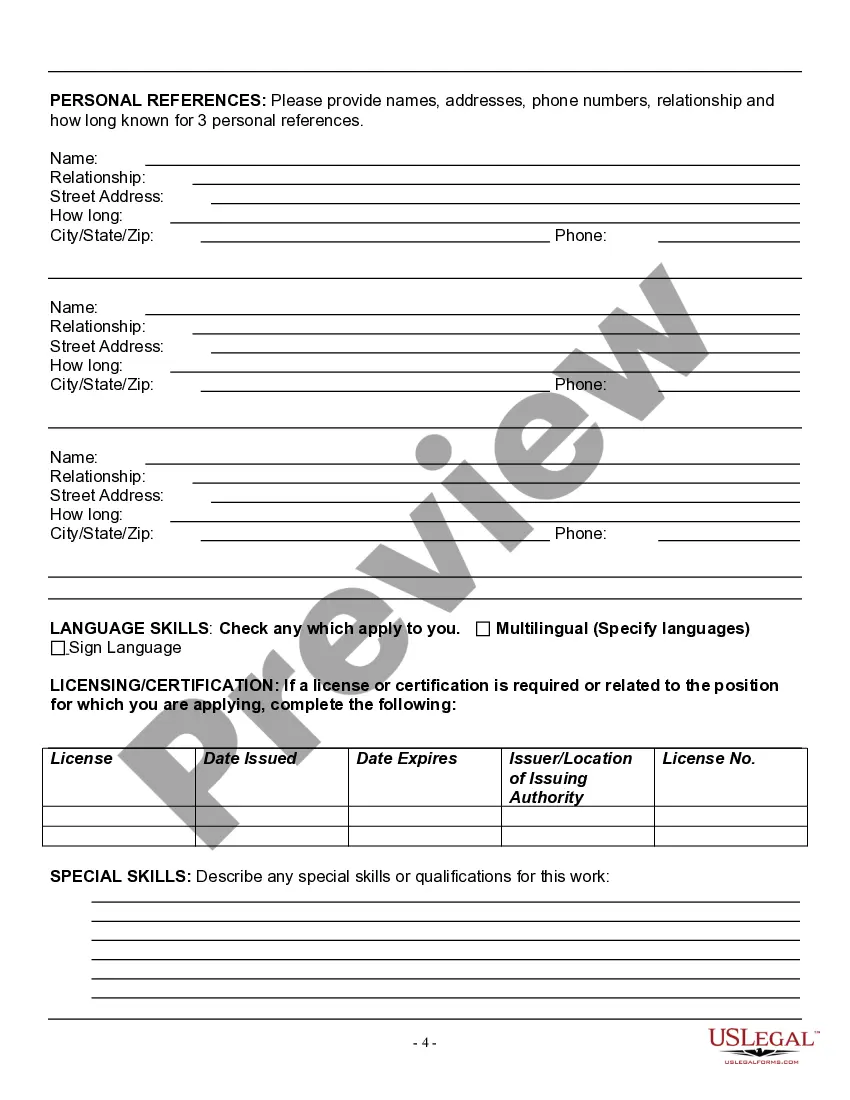

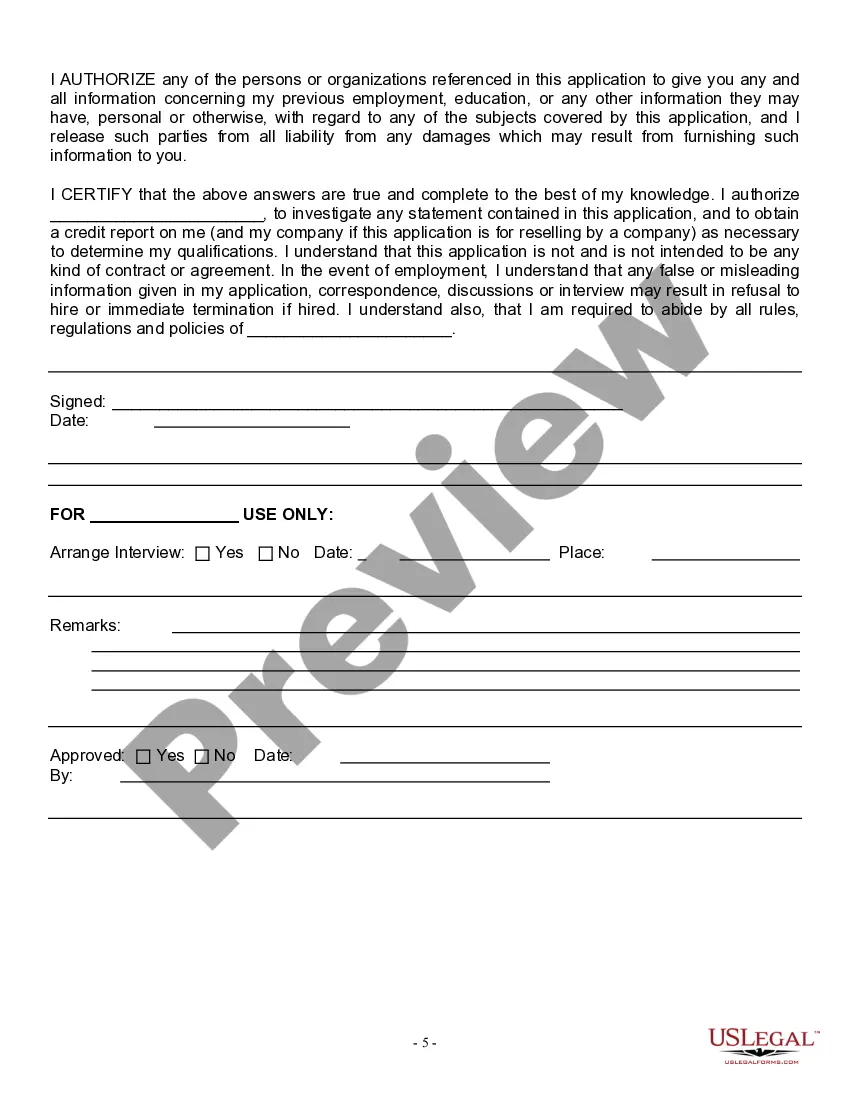

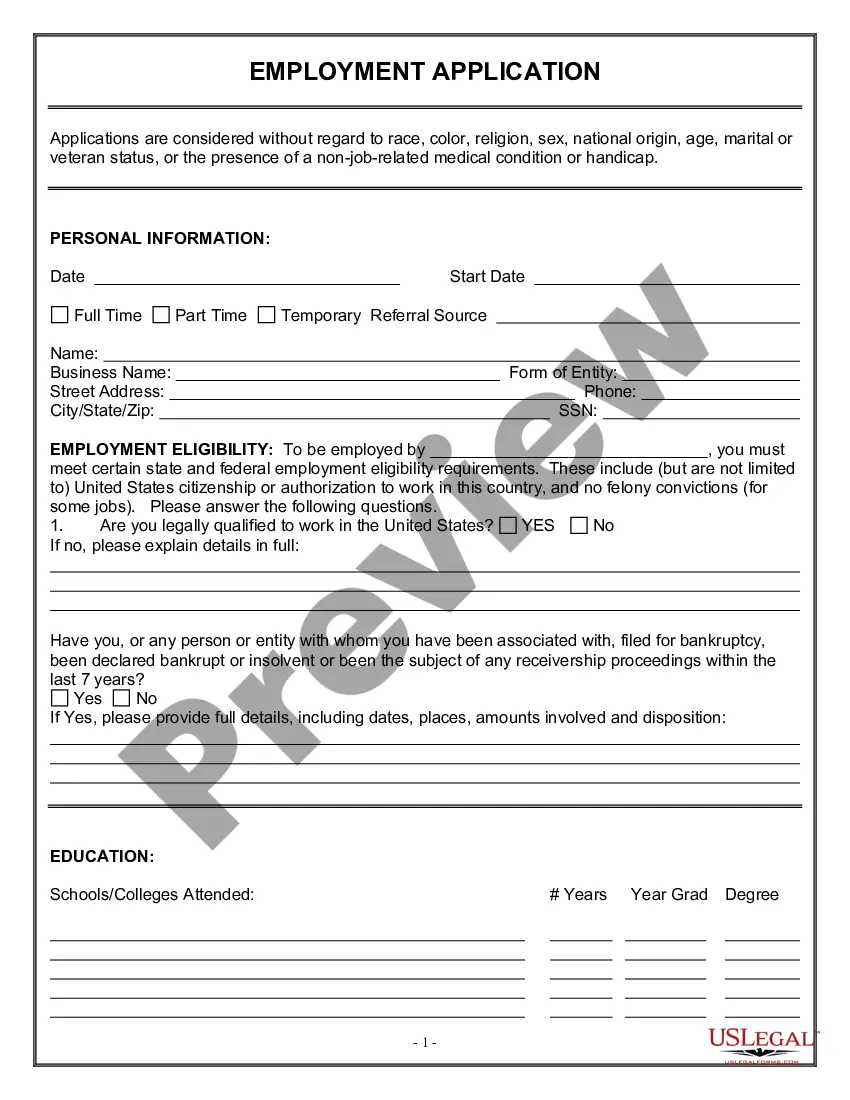

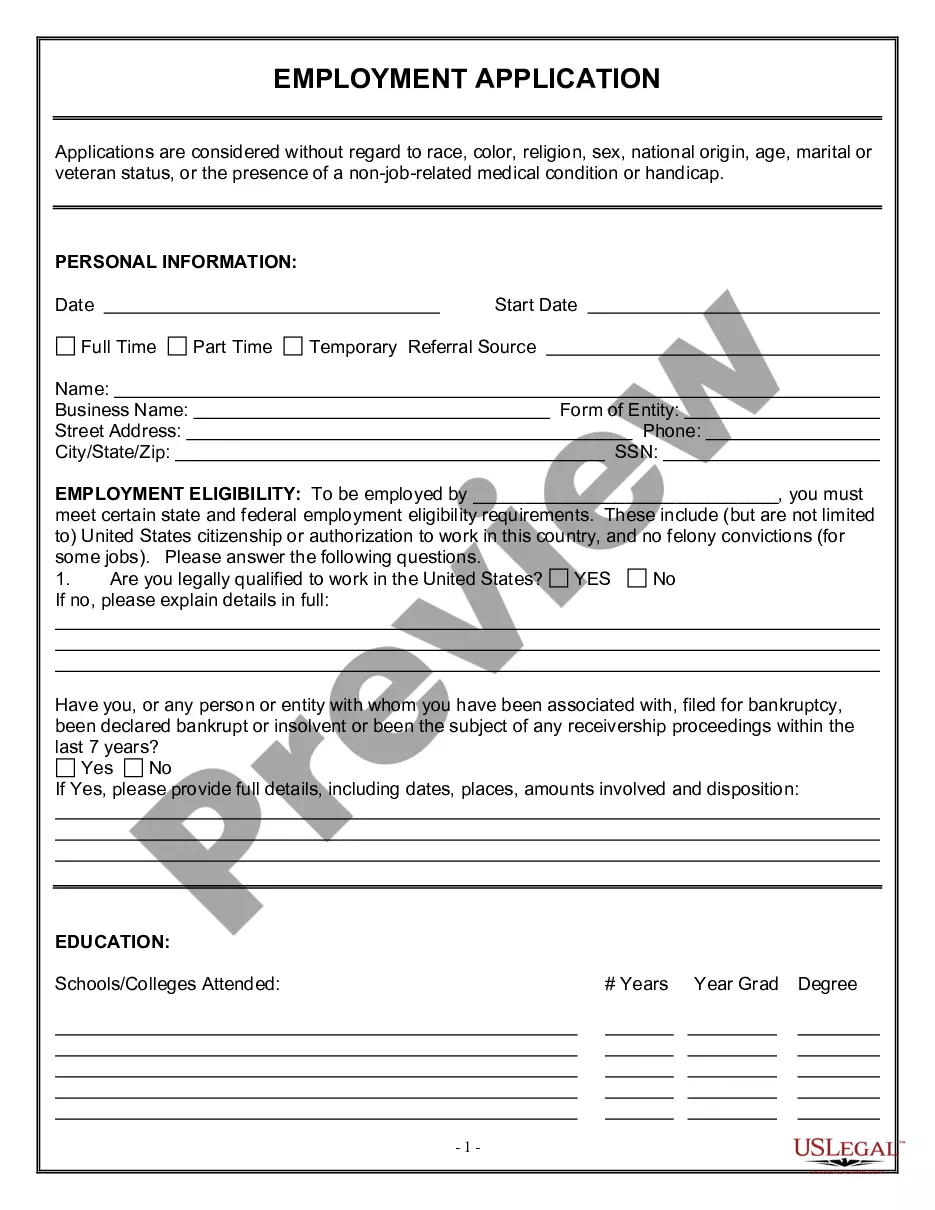

How to fill out Employment Application For Sole Trader?

Use US Legal Forms to get a printable Employment Application for Sole Trader. Our court-admissible forms are drafted and regularly updated by professional attorneys. Our’s is the most extensive Forms catalogue online and provides reasonably priced and accurate samples for consumers and lawyers, and SMBs. The documents are categorized into state-based categories and many of them can be previewed prior to being downloaded.

To download samples, customers must have a subscription and to log in to their account. Click Download next to any form you want and find it in My Forms.

For individuals who don’t have a subscription, follow the following guidelines to easily find and download Employment Application for Sole Trader:

- Check to ensure that you get the proper form in relation to the state it is needed in.

- Review the form by looking through the description and using the Preview feature.

- Click Buy Now if it is the document you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it multiple times.

- Make use of the Search engine if you want to get another document template.

US Legal Forms offers a large number of legal and tax templates and packages for business and personal needs, including Employment Application for Sole Trader. More than three million users already have used our platform successfully. Select your subscription plan and obtain high-quality documents within a few clicks.

Form popularity

FAQ

You can hire 1099 workers for specific projects, but you can't control when or how they complete their jobs. You're not responsible for covering their Medicare and Social Security taxes, and you won't provide them with the same benefits as you would for a W2 worker.

Those eligible for PUA also will receive an additional $300/week through the end of the extension period unlike CARES Act I, which added $600/week in federal stimulus payments. Finally, the new stimulus bill provides independent contractors with paid sick and paid family leave benefits through March 14, 2021.

Get an EIN. Consider Changing Your Business Structure. Register with the State Labor Department. Explore Insurance Options. Set Up Your Tax Withdrawals and Payroll. Get Employment Forms Ready. Consult an Attorney to Comply With Employment Laws.

A sole proprietorship can use independent contractors for the term of the contract without any further obligation. If the sole proprietor no longer needs the independent contractor, the sole proprietor is under no obligation to extend the contract. This also allows a sole proprietor to try out potential employees.

The good news is that you can employ people and remain a sole trader. There's no need to set up a limited company if you don't want to. While sole traders operate the business on their own, that doesn't mean they have to work alone.

The good news is that you can employ people and remain a sole trader. There's no need to set up a limited company if you don't want to. While sole traders operate the business on their own, that doesn't mean they have to work alone.

Like other small business owners, sole proprietors do have the ability to hire employees. As per the IRS, any time a sole proprietor hires an employee other than an independent contractor, the sole proprietorship will need to obtain an Employer Identification Number (EIN).

As a sole proprietor, you don't pay yourself a salary and you cannot deduct your salary as a business expense. Technically, your pay is the profit (sales minus expenses) the business makes at the end of the year. You can hire other employees and pay them a salary. You just can't pay yourself that way.

The owner of a sole proprietorship is subject to self-employment taxes, and will report Federal income as an individual on Form 1040.on wages paid to employees, and will file Forms 940 (FUTA Tax return) and 941 (Quarterly Return for Income and FICA taxes) for amounts withheld.