Texas Self-Employed Excavation Service Contract

Description

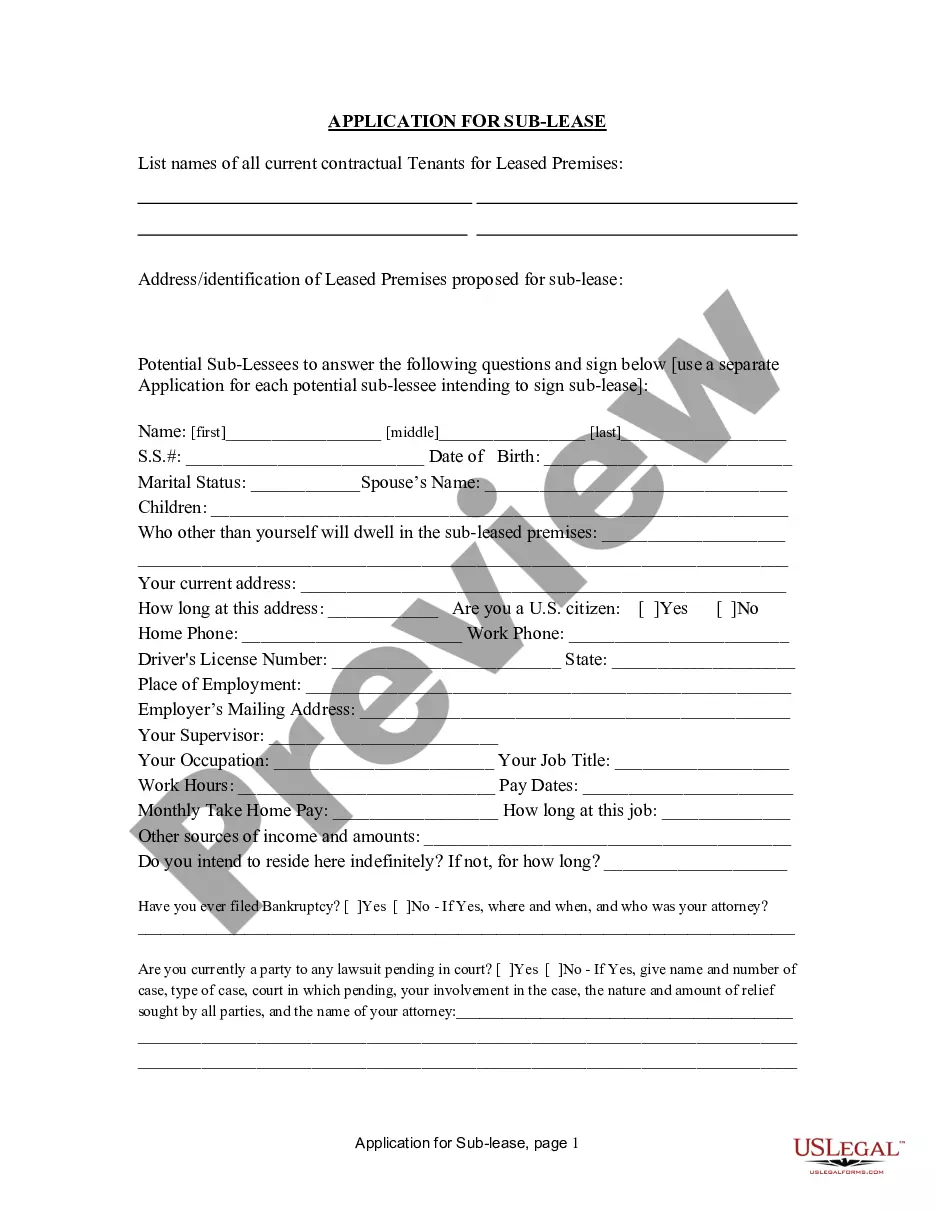

How to fill out Self-Employed Excavation Service Contract?

If you desire to finalize, acquire, or create legal document templates, utilize US Legal Forms, the largest assortment of legal documents, accessible online.

Take advantage of the site’s straightforward and convenient search to find the documents you require.

Numerous templates for commercial and personal purposes are categorized by groups and states, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Choose your preferred pricing plan and enter your information to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finish the transaction. Step 6. Select the format of the legal document and download it to your device. Step 7. Complete, review, and print or sign the Texas Self-Employed Excavation Service Contract.

Each legal document template you obtain is yours permanently. You have access to every form you saved in your account. Visit the My documents section and choose a form to print or download again. Complete and acquire, and print the Texas Self-Employed Excavation Service Contract with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to acquire the Texas Self-Employed Excavation Service Contract with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Obtain button to receive the Texas Self-Employed Excavation Service Contract.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your specific city/state.

- Step 2. Use the Review option to examine the form’s details. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other types from the legal document format.

Form popularity

FAQ

Yes, having a contract is crucial when you work as an independent contractor. A Texas Self-Employed Excavation Service Contract lays out the terms of your agreement, helping to protect your rights and clarify expectations. This contract not only serves as a legal document but also fosters trust and professionalism between you and your clients.

To be classified as an independent contractor, you must demonstrate control over how you perform your work and manage your business. This includes having a Texas Self-Employed Excavation Service Contract that specifies your responsibilities and payment terms. It's also important to operate independently, without being subject to the employer's control over your work methods.

Setting up as an independent contractor starts with creating a solid business plan. You will need a Texas Self-Employed Excavation Service Contract to detail your service offerings and payment terms. Additionally, register your business, open a separate bank account for transactions, and familiarize yourself with tax obligations to ensure a smooth operation.

Establishing yourself as an independent contractor involves defining your services and setting up a business structure. You should draft a Texas Self-Employed Excavation Service Contract that outlines your terms and services. Moreover, consider obtaining any necessary licenses and permits required for your excavation services in Texas to reinforce your professional status.

To prove your status as an independent contractor, you should maintain clear documentation of your work agreements and payment records. Having a Texas Self-Employed Excavation Service Contract can serve as vital evidence of your independent status. Additionally, keep track of your invoices and tax filings, which should reflect your self-employed income.

The terms self-employed and independent contractor can often be used interchangeably, but there are nuances. A self-employed individual manages their own business, while an independent contractor provides services under a contract without being an employee. When discussing a Texas Self-Employed Excavation Service Contract, it's essential to understand these distinctions for clarity in your agreements.

The new federal rule for independent contractors revises how workers are classified, focusing on their level of independence from the employer. It is essential for businesses and contractors to understand this rule to ensure compliance and protect their rights. When drafting a Texas Self-Employed Excavation Service Contract, consider this rule to ensure the agreement aligns with federal guidelines.

In Texas, a subcontractor generally needs a contract to file a lien against a property. Without a formal agreement, the subcontractor may face challenges in claiming payment. To avoid such issues, it is advisable to establish a clear Texas Self-Employed Excavation Service Contract that outlines all necessary terms, ensuring that all parties understand their rights.

An independent contractor agreement in Texas is a legal document that outlines the terms and conditions between a contractor and a client. This agreement typically includes payment terms, project scope, and deadlines. Utilizing a well-structured Texas Self-Employed Excavation Service Contract ensures clarity and protects both parties involved in the excavation project.

Independent contractors in Texas do not have a set limit on the number of hours they can work. Unlike employees, they have the flexibility to determine their own schedules and workloads. This aspect can be beneficial for those entering a Texas Self-Employed Excavation Service Contract, allowing them to manage their time effectively while fulfilling project demands.